Bitcoin Breaks $97,000 Institutional Surge and Geopolitical Factors

As hope about developments in U.S.-China trade negotiations rises, the Bitcoin price surge has increased beyond the $97,000 mark and set a new all-time high. This evolution has given global financial markets new hope, and cryptocurrencies—especially Bitcoin—are once more front and center as investors search for strong substitutes in an uncertain economic environment.

Bitcoin Gains Momentum

Many have read the breakthrough in U.S.-China trade negotiations as evidence of possible world economic stability. Months of conflict between the two biggest economies in the world have cast a shadow over financial markets. Now, investors are gravitating further into risk assets as both sides apparently agree on the structure for a multi-phase agreement.

Long regarded as a counterpoint to geopolitical concerns and economic uncertainty, Bitcoin has been a big winner. Just 24 hours after the revelation, the bitcoin rose more than 7% and first exceeded the crucial $97,000 threshold. Although stock markets also responded favorably, the extent of Bitcoin’s increase emphasizes the increasing acceptance of digital assets as a component of conventional investing methods.

Analysts said the news from Washington and Beijing offered the “perfect macro backdrop” for Bitcoin’s next step up. “Whenever we see indications of lowered global risk, investors feel more confident investing money into assets like Bitcoin,” said a Galaxy Digital senior crypto strategist. “It’s seen more as a required component of a diversified portfolio and less as a fringe asset.”

Institutional Bitcoin Surge

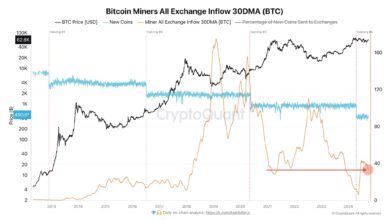

Apart from geopolitical tailwinds, rising institutional acceptance keeps driving the momentum of Bitcoin. Recent weeks have seen major companies, including MicroStrategy and BlackRock, augment their holdings. Particularly, MicroStrategy revealed the purchase of about 7,600 BTC in early February at an average price of slightly over $97,000, therefore raising its overall holdings to almost 190,000 BTC.

For corporate treasurers and retail investors, this kind of institutional buying makes a strong statement: Bitcoin is strategic rather than speculative. Publicly traded firms, pension funds, and hedge funds are starting to view Bitcoin as a basic holding instead of a wild experiment.

Furthermore, the increase in institutional investment is helping to normalize Bitcoin’s historically erratic price behavior. Though still providing asymmetric upside potential, Bitcoin is progressively reflecting the behavior of conventional assets with more liquidity and higher support levels.

Bitcoin Macroeconomic Drivers

Apart from institutional action and geopolitical events, macroeconomic factors have been quite important in the rise of Bitcoin. For the crypto markets, the Federal Reserve’s cautious approach to interest rates has been interpreted as favorable. Although inflation is still higher than the Fed’s long-term aim, the central bank has lately indicated it would stop more rate increases or even consider cuts should economic development slow down.

Lower interest rates usually help alternative assets, including cryptocurrency, by depreciating the dollar and boosting liquidity. For Bitcoin, which many see as a digital kind of gold—limited, dispersed, and deflationary by design—this atmosphere is especially ideal.

Moreover, continuous worries about long-term inflation keep Bitcoin interesting as a hedge. The case for keeping Bitcoin as a store of value is becoming legitimate as governments worldwide run huge deficits and central banks extend their balance sheets.

Bitcoin Bullish Surge

Technically, Bitcoin’s surge had been gathering positive momentum for weeks, supported at the $90,000 mark and driving rising trade volume. Driven by both news-driven attitude and automated trading techniques, buy-side pressure grew as it neared the $97,000 barrier.

Furthermore, the market mood is quite favorable. Indicating a persistent need for risk, the Fear & Greed Index for crypto markets—which measures investor emotions—has remained in the “extreme greedy” area for several days. Reminiscent of the bull run in late 2020 and early 2021, social media chatter and search trends also imply that retail interest is once more rising.

Final thoughts

Despite the euphoria, analysts warn that investors should remain cautious. Regulatory risks remain a looming factor, particularly in the United States, where the Securities and Exchange Commission (SEC) is still weighing how to classify and oversee various crypto assets.

Although volatility is lower than in past years, it is still part of the crypto market’s DNA. A sudden shift in macroeconomic policy, a breakdown in trade talks, or a harsh regulatory crackdown could quickly reverse gains. As always, prudent risk management remains essential.

Still, Bitcoin’s outlook appears stronger than ever. Its rise past $97,000 is more than just a headline—it’s a sign of growing maturity, wider adoption, and deeper integration into the global financial system.

As global dynamics shift and investors seek resilient, non-sovereign stores of value, Bitcoin’s relevance continues to grow. Whether this marks the beginning of a sustained climb beyond six figures remains to be seen, but the momentum—and the conviction behind it—is clearly building.