The Significance of Crypto Exit Strategies

Crypto Exit Strategies Having a clear crypto exit strategy is essential in the volatile world of cryptocurrency trading. Without a clear plan for selling your digital assets amid the unpredictable cryptocurrency marketplaces, you put your investments in danger of sudden declines in value. In this article from Cryptopolitan, we’ll look at why you need an exit strategy for your cryptocurrency portfolio and the dangers of moving forward without one. Moreover, it provides a synopsis of the essential takeaways from the subsequent parts.

Considering the specifics of the cryptocurrency market, this article will walk you through the steps of developing an exit strategy that works for your portfolio. Remember that information is power when venturing into the crypto sector and that knowing how to exit a trade can be the difference between making and losing a ton of money.

Crypto Exit Strategies

A well-thought-out plan for selling one’s holdings in digital assets, especially cryptocurrencies, on the financial markets is known as a crypto exit strategy. Investors can use it as a roadmap to help them decide when and how to cash out their cryptocurrency holdings. To protect capital in the wildly unpredictable and unpredictable cryptocurrency market, this approach is more than simply a collection of guidelines; it’s an essential instrument.

Setting price targets, utilizing stop and limit orders, and determining why you invested are all parts of an effective crypto exit strategy. It offers a systematic approach for investors to mitigate losses during market downturns and exploit profitable trends.

Crypto exit strategies are crucial in the cryptocurrency sector, to put it simply. Determining how you will sell your digital assets, avoiding decisions based on emotions, and being aware of the dangers of hoarding them are all part of this process. These insights equip investors with the knowledge and resources to navigate the cryptocurrency market confidently and prudently.

Why Investors Need an Exit Strategy

Not having a plan B in place can be disastrous when dealing with cryptocurrency. Without a well-defined sales strategy, investors risk succumbing to their emotions, frequently fueled by FOMO or unreasonable greed. Consider the following scenario: an investor buys bitcoin and watches its value increase by 20% but decides against selling because they believe others will make even more money by holding on.

Have an exit strategy to avoid making rash decisions based on emotions. This strategy safeguards investments from irrational decisions by requiring investors to make reasonable decisions according to established criteria. Without this plan, investors risk being swept away by the market’s ups and downs, which can result in substantial losses.

Pitfalls of Holding onto Cryptocurrencies Indefinitely

Investors who adopt the “HODL” (short for “Hold On for Dear Life”) strategy typically keep their cryptocurrency holdings for long periods without a specific plan for selling them. This method has advantages, but despite how laid-back it seems, it also has drawbacks. If you hoard cryptocurrency forever, you risk missing out on price spike profits.

For example, investors too attached to their holdings or too optimistic about the coin’s future may miss a 20% price increase. However, the same investment may lose much money in a market crash, putting investors in a tough spot.

Common Crypto Exit Strategies

Investors can easily navigate the cryptocurrency market using this section’s standard crypto exit methods. Staking, limit orders, price targets, and portfolio diversification are all strategies for managing risk and optimizing returns, but they all work differently. Investors should ensure that their strategies align with their financial objectives and level of comfort with risk.

Investors should also ensure their investment plans align with their unique financial objectives. They should set specific goals, like paying for school or getting a new automobile, and adjust their approach appropriately.

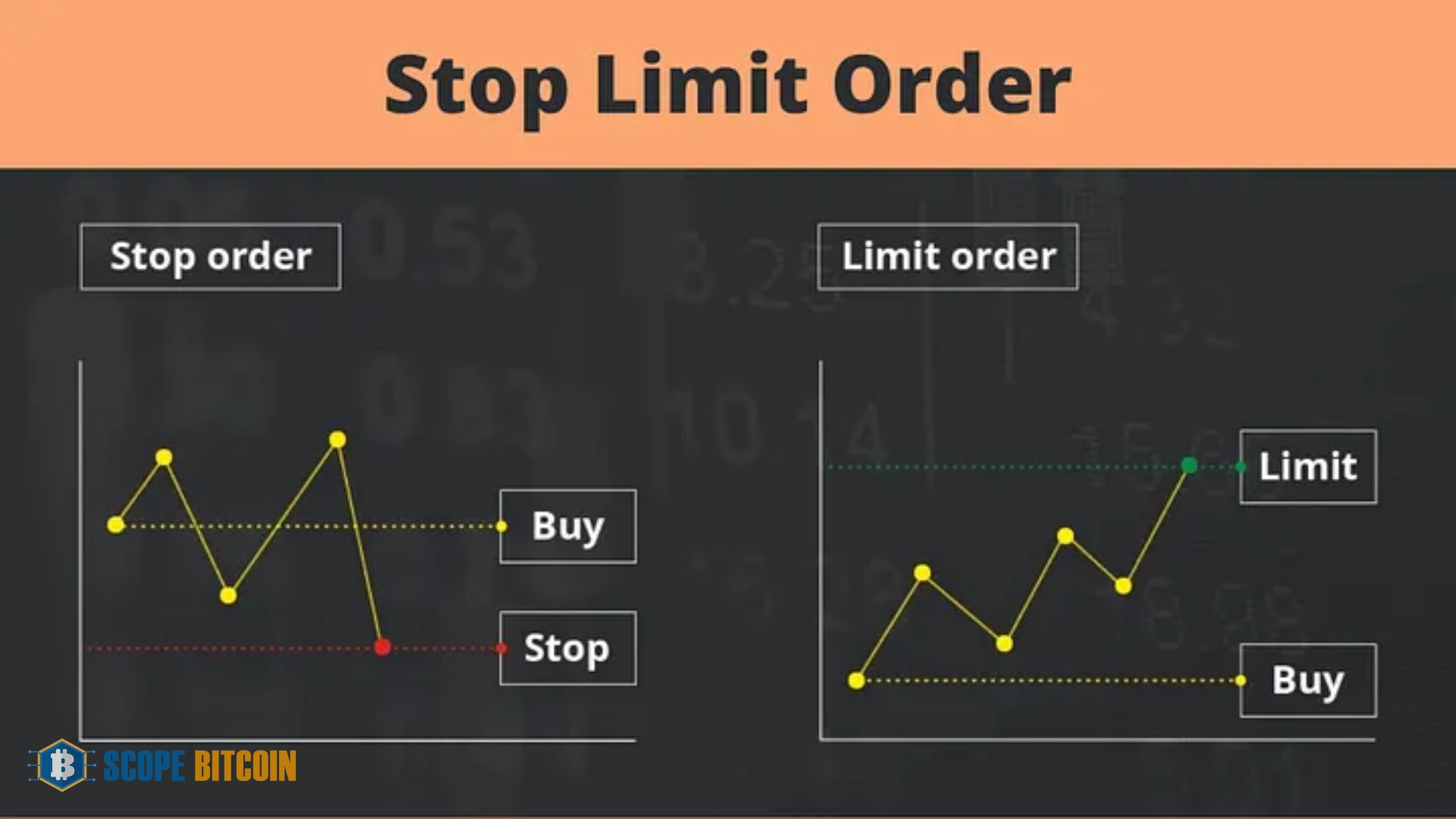

Limit/Stop Orders

A critical tool for crypto investors is the ability to set limit orders. These orders let you buy or sell your assets at specific price points. So, if you purchased $100 worth of Bitcoin at $25,000 and want to limit your losses, you can put a limit on selling at $20,000. This way, when the price hits $20,000, your order will be executed automatically without you having to monitor the market constantly. On the other hand, stopping orders prevents further losses in a declining market. If you set a specific price, your assets will be sold automatically if the market price drops to that level. The advantage of these orders is that they can execute trades even when you’re not actively monitoring the market.

Price Targets

An essential aspect of any crypto exit plan is the establishment of concrete price objectives. Investors should set their goals and decide at what prices they intend to sell their cryptocurrency holdings before plunging into the market. This method protects against substantial losses.

To illustrate, investors who believe in Bitcoin’s long-term prospects and anticipate a $100,000 price objective can establish $80,000 and $90,000 as intermediate price targets. This way, they can lock in profits while reducing their exposure to the possibility of an abrupt market collapse.

The Step-by-Step Method (Dollar-Cost-Averaging-Out)

Dollar-cost averaging (DCA) or the Step-by-Step Method is a wise investment strategy. The strategy entails investing a set amount regularly, irrespective of market circumstances. This approach reduces vulnerability to the unpredictable nature of cryptocurrency markets.

Crypto Exit Strategies: For DCA-Out to work, investors must sell a certain amount of their assets at specific prices. This method allows investors to take advantage of profit-taking chances without getting greedy or selling too late. Investors often hold on to 5-10% of their assets for long periods, reflecting their belief in a project or their long-term perspective.

Initial Investment Return

As a precaution, it’s wise to keep returns relative to the capital put in. Investors sell assets equal to the initial money as a precaution against loss. This ensures that clients will never lose more than they initially invested, regardless of how the market performs. Investors can play with their wins by continuing to trade with profits while minimizing their overall risk exposure. This strategy aims to achieve greater earnings while carefully investing one’s money.

HODL’ing

The term “HODL’ing,” which means “Hold On for Dear Life,” is an investing strategy in which people purchase cryptocurrency to hold onto them for a long time. Without a strategy to get out of the investment, this strategy is predicated on the hope that the value of the cryptocurrency would rise sharply over time.

Despite its passive nature, hoDLing has certain drawbacks. Because the technique requires investors to wait long periods to realize substantial profits, investors risk missing out on opportunities to profit from price increases.

Staking

Staking is a way to earn money from your cryptocurrency holdings. It is most commonly used in proof-of-stake networks, where users verify transactions by adding new blocks to the blockchain and receive additional coins as a reward. Anyone can join in by becoming a validator or by entrusting others with their money to do so.

When cryptocurrency prices are low during a bear market, staking becomes much more effective. The longer assets remain staked, the higher the interest collected, and the more profits can be compounded by reinvesting these earnings. However, interest rates that are too high could indicate unsustainable practices, so investors should oversee the market.

Portfolio Management

The best way to spread out potential losses in a bitcoin portfolio is to diversify. Investors can diversify their portfolios among several projects, from well-established cryptocurrencies to smaller ones with promise, allowing them to balance risk and return.

If you can, avoid low-ranked coins because they are more likely to experience price changes and volatility. Established coins’ stability and predictability come from their capacity to weather numerous market cycles.

Stablecoins

Stablecoins allow investors to diversify their cryptocurrency holdings into a more solid digital currency that may generate interest even in down markets. You won’t have to worry about losing money if you hold these coins because their value doesn’t fluctuate.

Extremely high interest rates could be risky and unsustainable, so investors should consider whether or not the rates given by platforms can be sustained. Since a daily commitment equals a daily risk exposure, they should also consider how long their investments in staking contracts will last.

Conclusion

Knowledge, planning, and investment will serve you well in the bitcoin industry. A thorough study is essential before entering the cryptocurrency industry. Understanding the dynamics, possible hazards, and rewards is the first step toward a prosperous investing journey. Limit and stop orders, which define explicit price goals, provide automated protection against significant losses.

Although it’s a passive approach, HODL’ing is something long-term believers should consider. Understanding market cycles helps you know when to purchase and sell. Staking can give you revenue on your assets, but you must time it and watch interest rates. Stablecoins with earnings can provide a continuous income stream even in low markets as part of a diversified portfolio. Your cryptocurrency ventures will have more meaning if your investment tactics align with your financial goals.

But the crypto world is constantly changing. Being adaptable is crucial in today’s fast-paced market. To succeed in an ever-changing climate, you must stay updated on industry trends and adjust your strategies.