Senate Banking to Launch First Crypto Subcommittee: Major Crypto Milestone!

Banking to Launch First Crypto: The world of cryptocurrency is abuzz with the latest announcement from Capitol Hill: the Senate Banking Committee is set to establish its first-ever subcommittee dedicated to cryptocurrency and blockchain technology. This move marks a pivotal moment for the rapidly evolving crypto space, signaling increased regulatory Bitcoin exchanges ranked by Trustpilot rating attention and a growing recognition of the sector’s importance.

What Does This Mean?

The creation of a dedicated crypto subcommittee represents a significant step forward in the United States’ approach to digital assets. For years, the crypto industry has operated in a regulatory gray area, with oversight split among various agencies and inconsistent state-level regulations. This new subcommittee aims to provide a centralized forum for discussing and shaping policy related to cryptocurrency and blockchain technology.

By focusing on the nuances of the crypto ecosystem, the subcommittee is expected to:

- Streamline Regulatory Efforts: Address the fragmented nature of crypto regulation by fostering collaboration between federal agencies and lawmakers.

- Enhance Consumer Protections: Develop frameworks to safeguard investors and consumers from fraud and market manipulation.

- Promote Innovation: Encourage the growth of blockchain and Banking to Launch First Crypto crypto technologies while ensuring compliance with existing laws.

Why Now?

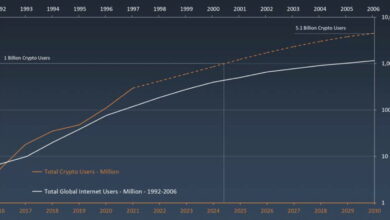

The timing of this development is no coincidence. The cryptocurrency market has grown exponentially in recent years, with a market capitalization exceeding $1 trillion. High-profile collapses, such as the FTX debacle, and the increasing adoption of digital currencies by institutional investors and governments alike have underscored the need for comprehensive oversight.

The timing of this development is no coincidence. The cryptocurrency market has grown exponentially in recent years, with a market capitalization exceeding $1 trillion. High-profile collapses, such as the FTX debacle, and the increasing adoption of digital currencies by institutional investors and governments alike have underscored the need for comprehensive oversight.

Additionally, the global race for crypto dominance has heated up, with countries like China and the European Union making significant strides in adopting blockchain technology and digital currencies. The United States is keen to maintain its position as a leader in financial innovation, and this subcommittee is a clear signal of its intent.

Key Areas of Focus

While the full agenda of the subcommittee is yet to be outlined, experts predict it will Banking to Launch First Crypto tackle several pressing issues:

- Stablecoins: Establishing clear guidelines for the issuance and use of stablecoins, which have become a cornerstone of the crypto economy.

- Central Bank Digital Currencies (CBDCs): Exploring the feasibility and implications of a U.S. digital dollar.

- Taxation: Clarifying tax reporting requirements for crypto transactions.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Strengthening measures to combat illicit activities.

- Investor Education: Promoting awareness and understanding of the risks and opportunities in the crypto space.

Industry Reactions

The announcement has been met with mixed reactions from the crypto community. Advocates see it as a necessary step toward legitimizing the industry and fostering innovation. “This is a huge milestone,” said a spokesperson from a leading blockchain association. “It shows that policymakers are beginning to understand the transformative potential of blockchain technology.”

However, skeptics worry that increased regulation could stifle innovation and impose burdensome compliance costs on startups. “We hope the subcommittee will strike a balance between regulation and innovation,” noted a prominent crypto entrepreneur.

What’s Next?

The Senate Banking Committee is expected to finalize the details of the subcommittee in the coming months, including its leadership and specific objectives. Stakeholders from across the crypto ecosystem are likely to play a crucial role in shaping the subcommittee’s agenda through consultations and public hearings.

Conclusion

The establishment of the first crypto-focused subcommittee Banking to Launch First Crypto by the Senate Banking Committee is a landmark moment for the cryptocurrency industry. It reflects the growing maturity of the sector and its integration into mainstream financial systems. While challenges lie ahead, this move has the potential to provide much-needed clarity and stability, paving the way for Banking to Launch First Crypto sustainable growth and innovation in the crypto space.

[sp_easyaccordion id=”5609″]