Old Bitcoin Whales Move Tokens After Surge

On-chain data shows that the dormant Bitcoin whales have returned alive and are making moves following the cryptocurrency’s latest price surge.

Old Bitcoin Whales Have Just Made Several Transactions

As explained by CryptoQuant community analyst Maartunn in a new post on X, several transfers involving old cryptocurrency tokens occurred during the past day.

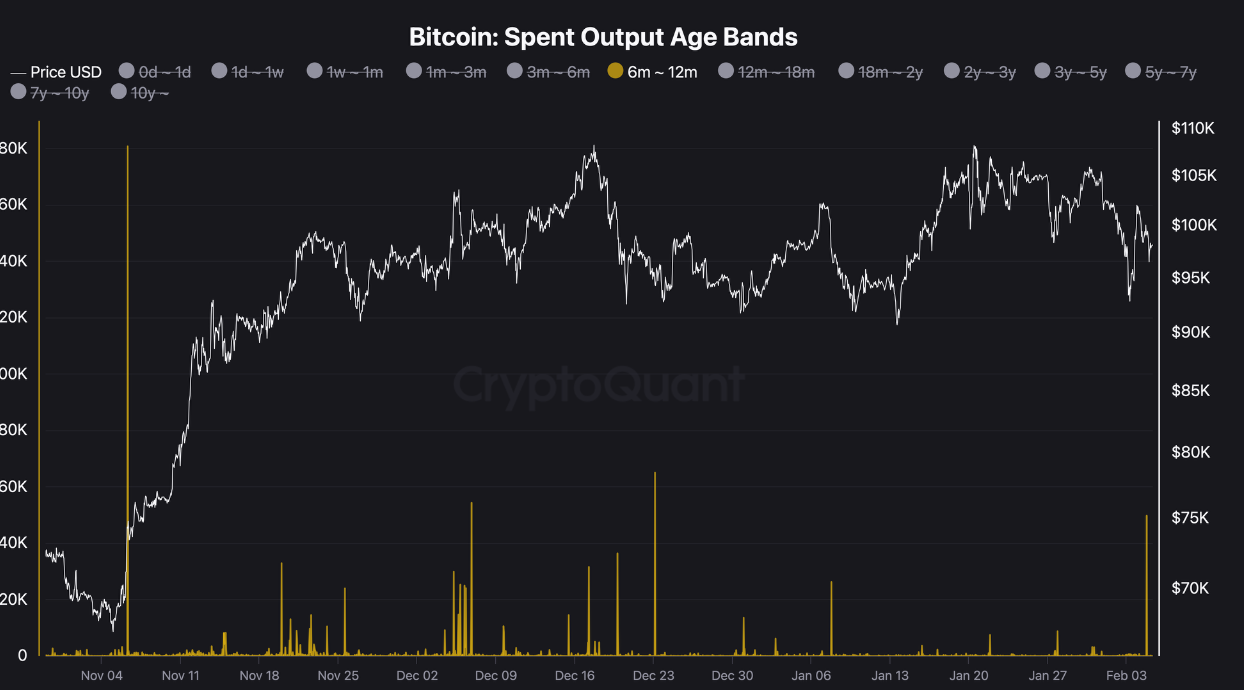

The on-chain indicator of relevance here is the “Spent Output Age Bands,” which tracks the transaction activity of the various Bitcoin ‘age bands.’ An age band defines a time-range inside which the coins contained by it were last moved on the network.

For example, the 6-to 12-month band includes the tokens last involved in a transaction between six and twelve months ago. If the owners of these coins included them in a move, the Spent Output Age Bands would spike for the band.

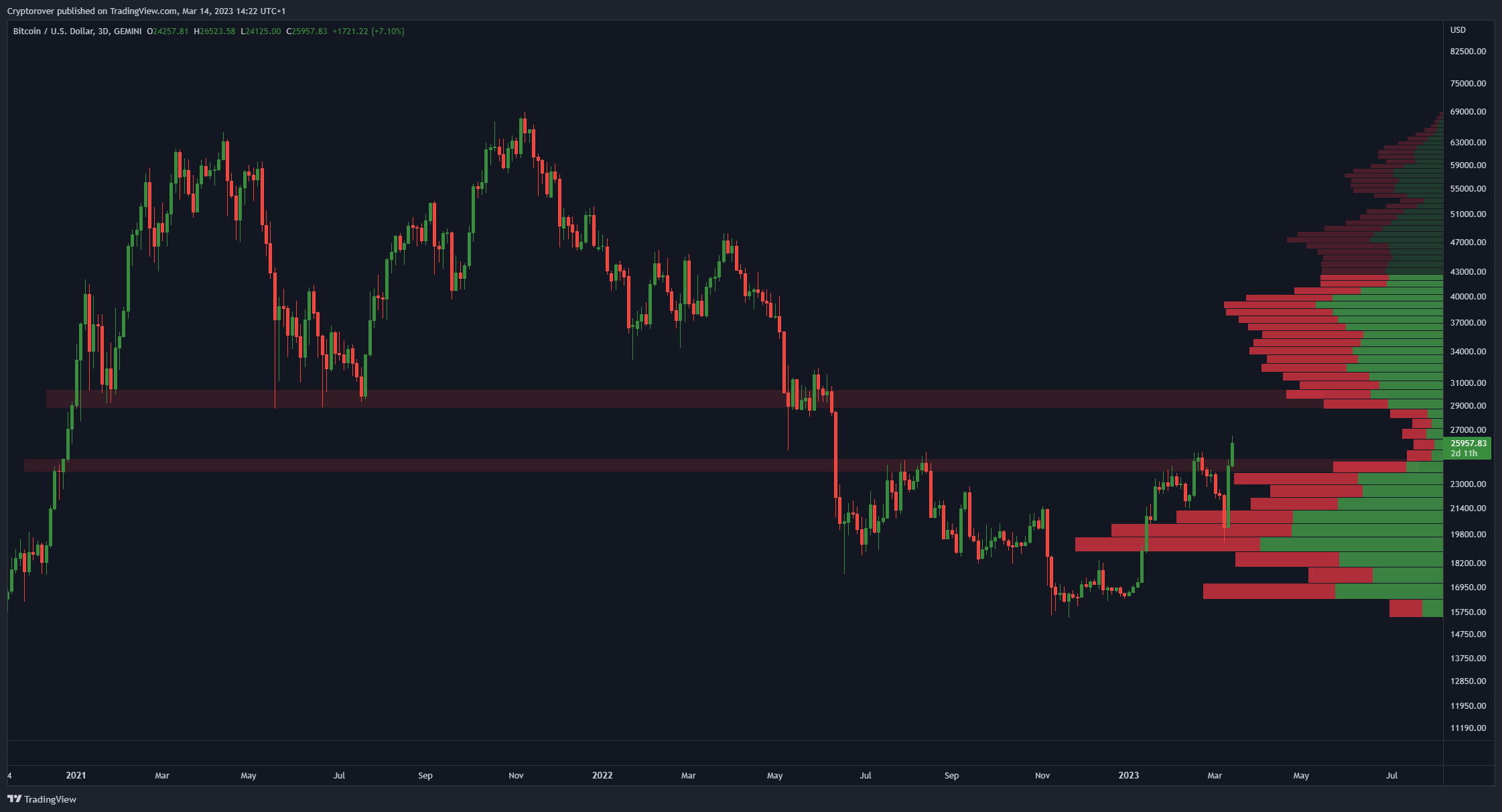

Now, here is the chart shared by the analyst that shows the latest trend in the indicator for the 7 years to 10 years and 10+ years age bands:

As the above graph shows, the Spent Output Age Bands have registered a few spikes from each age band in the last 24 hours. This means that previously dormant coins have been brought out of the freezer for at least seven years.

Given that the transactions followed the cryptocurrency’s recovery back above $90,000, it’s possible that these old whales made them to take profits. If so, it could be a bearish sign for the asset, considering how long these coins were dormant.

Something to note, though, is that when tokens age more than seven years, they are more likely to have reached their age by being lost rather than being HODLED. Coins are said to be ‘lost’ when the keys associated with the wallet are misplaced.

Thus, it’s possible that the investors who have made these transactions in the past day only recently rediscovered the keys attached to the addresses. If they were genuinely holding by their own volition thus far, deciding to sell now would suggest these diamond hands don’t believe Bitcoin would get much higher.

A cohort that’s more likely to contain willful HODLers is the 5 years to 7 years one, and it turns out coins falling in this age band have also seen significant movement in the last 24 hours.

BTC Price

It would seem that the decision to sell from the dormant whales may not have been such a bad one as Bitcoin has already erased most of its gains from the rally, with its price falling back to $87,500.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. The information provided in this article does not constitute financial, investment, or trading advice. Every investment and trading move involves risk, especially for cryptocurrencies given their volatility. We strongly advise our readers to conduct their research when deciding.

Final Thoughts

Bitcoin’s price corrected and dropped back to about $87,500 after these whales moved, partially wiping out the rally’s gains. The question of whether this drop was a natural market correction or an indication of an approaching slump is brought up by these latent whales’ choice to sell. Understanding the behavior of long-term Bitcoin investors is crucial for gauging market mood, and this article offers insightful information on that subject. The study is speculative, though, particularly given that there are many possible causes for the activity, including profit-taking or the finding of misplaced wallets.

Furthermore, even while whale activity can significantly affect market prices, it’s crucial to take into account the larger market trends, continuous adoption, and outside variables that affect the price of Bitcoin. In the end, it appears that some Bitcoin owners may be cashing out, while others may continue to hold in anticipation of future price increases. As stated in the disclaimer, the price of Bitcoin is unpredictable and volatile, which emphasizes the importance of exercising caution while making any investment.