Next Crypto Bull Run Predicted by JP Morgan?

Next Crypto Bull Run. Since its inception, Bitcoin (BTC) has come to dominate the cryptocurrency industry, and it continues to exert the most significant influence on the overall market performance. In addition, the influence has become much more significant since the introduction of Bitcoin exchange-traded funds, often known as ETFs. These exchange-traded funds contributed to Bitcoin’s ascent to the all-time high of $73,750.07 and factored toward the subsequent decline to $54,000.

On the other hand, things are about to change since the well-known banking and financial services organization, known as JP Morgan, has anticipated the Next Crypto Bull Run that would occur. The projection appears to be in the process of evolving as a result of the growing number of optimistic sentiments and the decreasing amount of selling pressure.

JP Morgan Claims August Is The Month For Crypto

J.P. Morgan recently released a study explaining the new evaluations and the crypto liquidation difficulties that will be resolved by the end of the month. This may encourage the market to recover by August, causing the price of Bitcoin and the cryptocurrency market to experience a considerable increase.

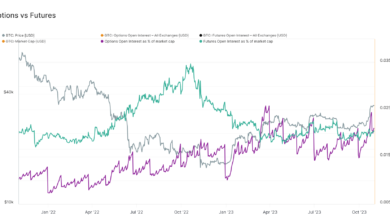

The report included the company’s discussion of the change to the year-to-date crypto flow, which was reduced from the earlier estimate of $12 billion to $8 billion. After analyzing Bitcoin’s relative value to its production cost or even the price of gold, the earlier estimation was replaced with skepticism. Last but not least, the reduction in the reserve held by the exchange is another factor that plays a key role in the methodology behind the new valuation.

According to Nikolaos Panigirtzoglou, an analyst and strategist at JP Morgan, the decrease in the anticipated net flow is mostly due to the decrease in bitcoin reserves across exchanges over the past month. This new calculation has been formed due to the net flow of $14 billion in cryptocurrency money, $5.7 billion from cryptocurrency venture capitalists, and $5 billion from CME charges. As a result of the transition from exchange wallets to exchange-traded funds (ETFs), the total accounts for the 17 billion dollars that were added to the account.

The drop in BTC Liquidation can be attributed to several factors, including the transfer of the token by the Mt. Gox exchange, the intensive selling of the token by the German government, and others. After the effects of these causes have passed, the market may experience an increase.

Is Next Crypto Bull Run Next?

The influence of fear of missing out (FOMO) may increase the price of Bitcoin if the market recovers in the following month and the selling pressure decreases. Since reaching its all-time high in March, the value of Bitcoin has been steadily falling, and it is time for a significant comeback. According to CryptoQuant, the movement of the current chart signals that a further downward trend is occurring, and it is currently at a pivot point.

On the other hand, whales have been aggressively purchasing Bitcoin tokens, which indicates growing demand. The decline in value is the primary factor for this rise in demand; nevertheless, the net flow rates of Bitcoin exchange-traded funds are also playing a significant part in this phenomenon.

Predicting the bull run is becoming increasingly difficult due to the lack of clarity surrounding Bitcoin and market behavior. However, it is expected to take place after the Bitcoin halving, and JP Morgan’s forecast on the market rebound in the next month may make things clearer shortly.