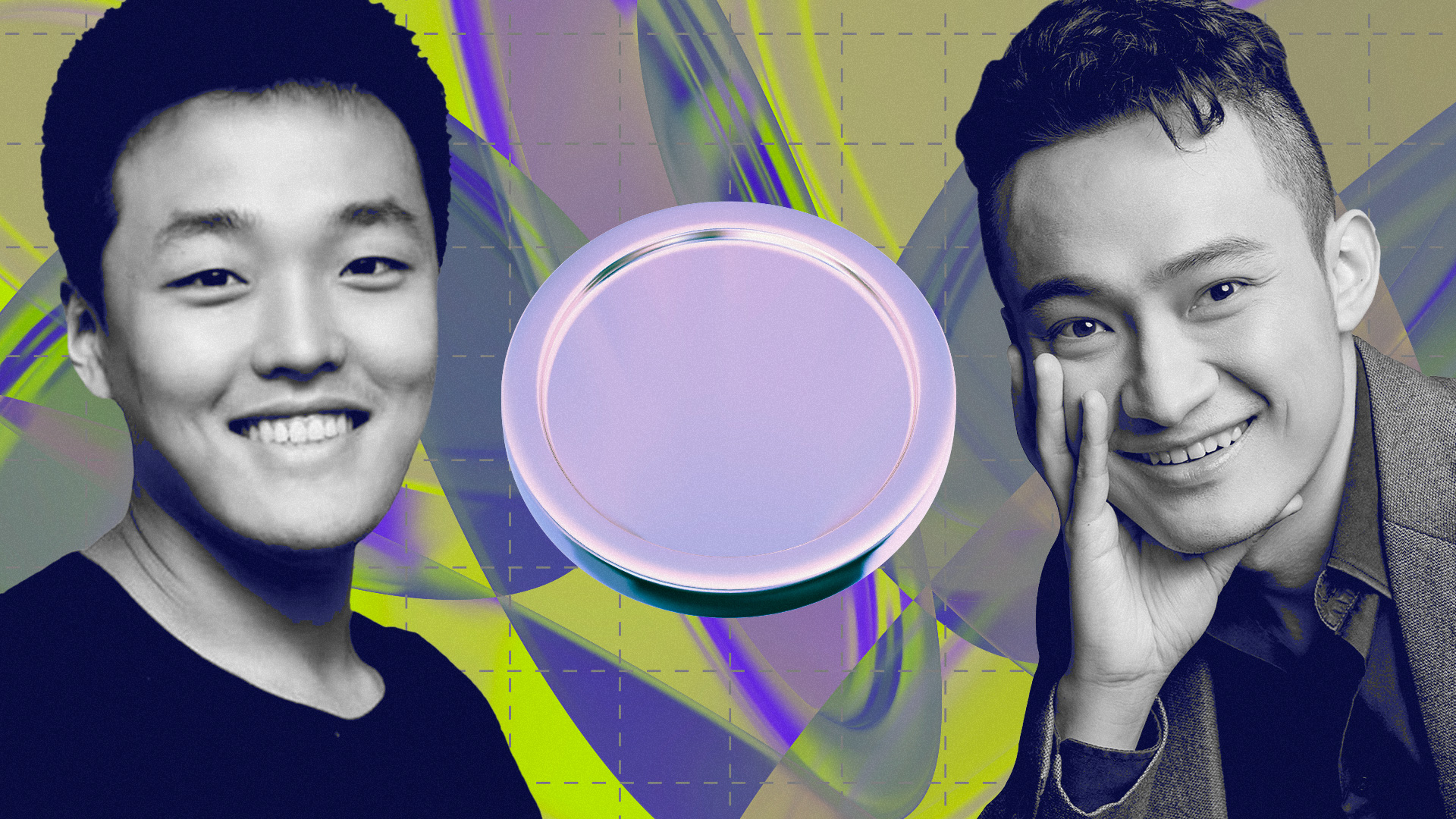

Justin Sun Explores MicroStrategy-Like Strategy to Boost Tron ($TRX) Purchases and Price

Justin Sun Explores MicroStrategy: Justin Sun, the founder of Tron (TRX) and a prominent figure in the cryptocurrency world, has expressed interest in adopting a MicroStrategy-inspired approach to bolster TRX’s adoption and market value. MicroStrategy, led by Michael Saylor, is well-known for its aggressive Bitcoin acquisition strategy, which has significantly influenced Bitcoin’s prominence in the corporate world. Could this strategy bring similar success to Tron? Binance co-founder CZ indirectly denies help for WazirX Let’s dive into Sun’s potential plan and its implications for TRX.

What is MicroStrategy’s Approach?

MicroStrategy made headlines by leveraging corporate funds and even taking on debt to purchase massive amounts of Bitcoin. This bold strategy not only strengthened Bitcoin’s standing as a store of value but also positioned MicroStrategy as a leader in crypto-driven corporate innovation. The approach involved:

- Strategic, large-scale cryptocurrency purchases.

- Long-term holding to reduce market liquidity.

- A clear message to the market about Bitcoin’s institutional potential.

Justin Sun’s Vision for Tron

Justin Sun has always been vocal about his ambitions for Tron, a blockchain platform designed for decentralized applications (DApps) and smart contracts. Drawing inspiration from MicroStrategy’s success, Sun is exploring a similar path to increase the utility and price of TRX, Tron’s native token.

Justin Sun has always been vocal about his ambitions for Tron, a blockchain platform designed for decentralized applications (DApps) and smart contracts. Drawing inspiration from MicroStrategy’s success, Sun is exploring a similar path to increase the utility and price of TRX, Tron’s native token.

Key Components of Sun’s Potential Strategy

- Increased TRX Acquisition:

Sun might consider purchasing significant amounts of TRX, either personally or through Tron’s foundation, to reduce supply and drive demand. - Strengthening Utility:

Unlike Bitcoin, which is often viewed as a store of value, TRX serves as the backbone for decentralized applications. Sun could focus on expanding Tron’s ecosystem to boost TRX usage. - Institutional Engagement:

By promoting TRX to institutions and investors, Sun could align with the growing trend of mainstream adoption of cryptocurrencies. - Marketing and Partnerships:

Sun’s flair for marketing and partnerships could complement this strategy. High-profile endorsements, collaborations, or new use cases could elevate Tron’s market presence.

Potential Benefits of This Approach

- Market Confidence:

Large-scale acquisitions and long-term commitment to TRX can instill confidence in investors, potentially driving price appreciation. - Ecosystem Growth:

Increased attention and liquidity can attract developers and users to the Tron blockchain, further solidifying its position in the crypto space. - Competitive Advantage:

With several blockchains vying for dominance, Sun’s proactive strategy could differentiate Tron from competitors like Ethereum and Binance Smart Chain.

Challenges and Risks

- Volatility:

TRX’s price may become more volatile if large purchases create significant market movements. - Skepticism:

Critics may question whether such a strategy is sustainable, especially if it relies on aggressive acquisitions without clear use-case expansion. - Regulatory Scrutiny:

As regulatory bodies increase oversight on crypto-related activities, Sun’s strategy may face hurdles, particularly if large-scale purchases raise concerns.

The Broader Impact on TRX

If executed successfully, this strategy could elevate TRX’s status in the cryptocurrency market, making it a key player alongside Bitcoin and Ethereum. By reducing market liquidity and promoting utility within the Tron ecosystem, Sun could create a scenario where demand outpaces supply, leading to a price surge.

Moreover, the strategy could inspire other blockchain projects to adopt similar approaches, potentially reshaping how cryptocurrencies are managed and valued.

Conclusion

Justin Sun’s exploration of a MicroStrategy-like approach underscores his ambition to position Tron as a leader in the cryptocurrency market. By combining aggressive TRX acquisition with strategic ecosystem development, Sun aims to not only increase the price of TRX but also expand its relevance in the blockchain space.

As the crypto world watches closely, Sun’s moves could set a precedent for other altcoin projects seeking innovative ways to enhance adoption and market impact. Whether this strategy leads to sustained growth for Tron remains to be seen, but one thing is certain: Justin Sun is not afraid to think big.

[sp_easyaccordion id=”5051″]