Inflation-Linked Tax Increases to Begin in 2025, Announces Government

Inflation-Linked Tax Increases: Inflation-linked taxation establishes a system where taxes automatically adjust to the rate of inflation. As a result, tax burdens change in tandem with price fluctuations. This system enhances the stability of the tax framework and provides Technical Analysis of Ethereum (ETH) greater predictability for taxpayers. Particularly during periods of high inflation.

Deputy Prime Minister Zsolt Semjén submitted his latest proposal to parliament on Tuesday. According to the draft law, from 2025. Excise taxes on alcoholic beverages, tobacco products, and fuels will increase in line with inflation. Additionally, vehicle tax and registration tax will also rise.

Excise Taxes to Increase

According to a bill submitted by Deputy Prime Minister Dr. Zsolt Semjén, several taxes and fees will automatically rise (or decrease) from 2025. Bank360 reports that, in addition to excise taxes on alcoholic beverages, tobacco products, and fuels. Taxes affecting motorists will also increase.

For the first time, inflation will influence vehicle-related taxes and fees. Starting in January, the registration tax, vehicle tax, and transfer fees will rise. By 2026, the company car tax will also be adjusted accordingly.

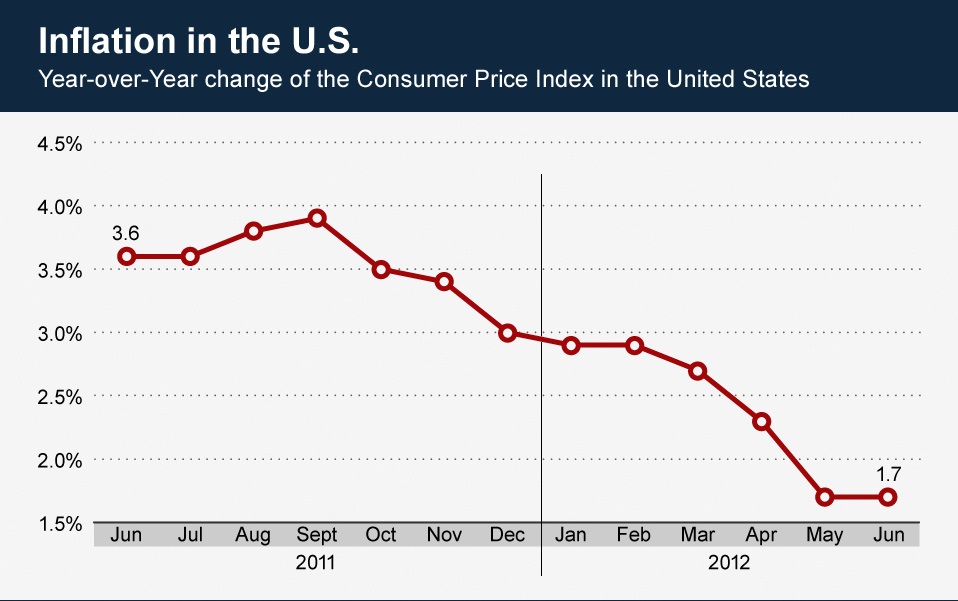

From 2025, the rates of the affected taxes will be adjusted based on the consumer price index, or inflation, compared to the same period of the previous year. In July 2024, inflation was reported at 4.1% by the Central Statistical Office (KSH). This means inflation-linked taxes will initially rise by this percentage. The National Tax and Customs Administration (NAV) will publish the exact tax rates by October 31.

Implementation of Inflation-Linked Taxation

The core concept of inflation-linked taxation is that tax rates, tax-free income thresholds, and other tax brackets automatically adjust in line with the rate of inflation. This approach can apply to personal income tax, corporate tax, and consumption taxes.

The core concept of inflation-linked taxation is that tax rates, tax-free income thresholds, and other tax brackets automatically adjust in line with the rate of inflation. This approach can apply to personal income tax, corporate tax, and consumption taxes.

Such inflation-linked mechanisms are utilized in many countries, particularly in economies where inflation is high or shows significant fluctuations. In Latin America, these systems are common due to historically high inflation, necessitating adjustments to tax brackets to preserve purchasing power Coinbase Wallet Offers 4.7% APY on USDC.

In the United States, certain tax-free thresholds in the personal income tax system are indexed to inflation, such as the standard deduction and various tax credits. Israel and Turkey also employ inflation-linked taxes, particularly for income taxation.

Criticism

Inflation-linked taxation has a mixed reputation, balancing advantages with significant societal criticisms. Its benefits include mitigating the impact of inflation and ensuring automatic adjustments. By aligning taxes with inflation, taxpayers avoid an automatic increase in real tax burdens due to rising prices, helping preserve purchasing power.

However, inflation indexing in consumption taxes can result in substantial cost increases. For instance, excise taxes on fuel or basic commodities could rise, disproportionately burdening lower-income households, and making it harder for them to afford essential goods.

Some analysts argue that such systems may inadvertently fuel an inflationary spiral, leading to further price increases. Additionally, automatic adjustments can reduce the transparency of the tax system, especially if changes are poorly communicated. The resulting uncertainty may foster distrust among taxpayers.

Conclusion

Inflation-linked taxation presents a double-edged sword. While it offers a mechanism to protect purchasing power and ensure tax fairness during periods of inflation, it also risks creating additional financial burdens, particularly for vulnerable populations Scope Bitcoin – Secure Your Wealth with Bitcoin. Effective implementation requires careful consideration of its broader economic impact and robust communication to maintain public trust. Striking a balance between fiscal stability and social equity is essential to ensure that such a system achieves its intended benefits without exacerbating economic disparities.

[sp_easyaccordion id=”4792″]