In What Ways Could the Price of Bitcoin Fall?

Price of Bitcoin Fall. The price of Bitcoin (BTC) has fallen by 9.5% in the past three days, from $64,000 at the beginning of the week after rising to that high. From a peak of $63,223 on July 2 to an intra-day low of $56,709 on July 4, the price of Bitcoin declined precipitously, according to the data.

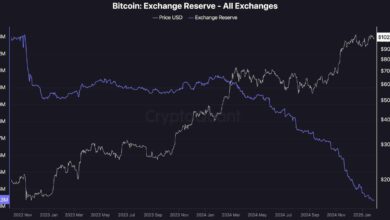

There has been a 32% decline in the daily trading volume of Bitcoin and an 18% decline in its price over the past 30 days. However, a quick rebound from these losses is unlikely because multiple indicators point to a more profound drop.

Analysts Set $50,000 Target for Bitcoin

Bitcoin’s continuous downward trend is true to what analysts at 10x Research predict could be the lower objective for BTC pricing. They warn that this dramatic decline may be the beginning, with Bitcoin potentially dropping to $50,000.

Breaking the psychological threshold at $60,000 toward $50,000 represents a dramatic shift in market sentiment, which 10x Research attributes to buy flows drying up “while sell flows are accelerating.” Markus Thielen, an analyst at 10x Research, argues that the downward spiral was predicted: “Our data from early June already hinted at an overbought market ripe for correction.”

Price of Bitcoin Fall: On June 24, Thielen shared the graphic anticipating Bitcoin’s break out of its consolidation zone and slide toward $50,000, citing the potential fulfillment of a double-top pattern. An adorable-top pattern emerges when the price hits two comparable peaks with a short dip in between, keeping support above the standard line known as the “neckline.” This pattern often resolves when the price breaks below the neckline, perhaps decreasing by an amount equal to the distance between the peaks and the neckline.

“As we’ve observed over the past three months, range trading is a complex phase, often marked by several false breakouts,” Thielen noted, adding: “Topping formations have historically left the average retail investor vulnerable, with many altcoins experiencing significant drops.” In contrast to Thielen, Michael Van de Poppe, founder of MN Capital, has a significantly higher objective for Bitcoin on the downside. Van de Poppe expects Bitcoin will break below the May 1 low at $56,000 to collect the demand-side liquidity resting under it before sliding to $52,809.

Bitcoin Price Loses Key Support Level at $58,000

With a decline from $60,145 at the opening to an intraday low of $56,709, Bitcoin (BTC) lost support from the 200-day exponential moving average (EMA), which it had occupied for over a decade. In his analysis of the most recent price movement, prominent trader Skew pointed out that Bitcoin’s price had fallen below its 200-day MA for the first time in ten months. When this article was published, the 200-day exponential moving average was $58,246 higher than the current price.

If Bitcoin were to lose the 200-day exponential moving average (EMA), it would be exposing itself to much greater dangers. According to research compiled byon-chain data aggregator IntoTheBlock, Bitcoin will likely continue declining. Bitcoin encounters stronger upward resistance than downward support, according to the In/Out of the Money Around Price (IOMAP) chart below. Around 747,140 addresses have already purchased 264,360 BTC, which might be a support level above $50,000. It appears that Bitcoin’s potential decline may be limited at this point.

Bitcoin Bear Flag Targets Below $50,000

According to technical analysis, a bearish continuation setup known as a classic bear flag pattern has formed in Bitcoin’s price action. This pattern develops when the market consolidates inside an up-sloping range after a steep price decrease.

In most cases, a bear flag will disappear whenever prices fall below the lower trendline and the height of the prior downturn. This means that the lowest price goal for Bitcoin is $49,200, which was last reached on February 12th. The 29 level on Bitcoin’s daily relative strength indicator also indicates that it is oversold. Because of this, the current sell-off is more intense, and Bitcoin’s odds of reaching the bear flag target are higher.