Index Funds Explained Benefits, Risks, and Market Impact

Index Funds Market Impact: Investors must navigate many options and lingo. Having said that, index funds are quickly becoming a favorite due to their ease of use and high rate of return. What are index funds? How do they operate? What effect might they have on conventional financial markets and cryptocurrency markets? We’ll find out in this post.

What are Index Funds?

Investing in an index fund means your money will grow with a predetermined market index, such as the S&P 500 or the FTSE 100. These indices are like snapshots of the market as a whole; they usually include a variety of bond and equity holdings.

How Do Index Funds Work?

Index funds can only make money if their holdings are highly correlated with the underlying index in weight and composition. For example, an S&P 500 index fund would invest in each of the 500 companies that comprise the S&P 500 index, using a weighting methodology determined by market capitalization.

Benefits of Index Funds

Diversification: Index funds provide rapid diversification due to their diversified holdings across many assets. This lessens the effect of the performance of any one stock on the portfolio as a whole by spreading risk across several industries and firms.

Lower costs: Because index funds do not need their managers to buy and sell securities constantly, they usually have lower expense ratios than actively managed funds. In the long run, this might mean cheaper fees for investors.

Consistent performance: Instead of trying to outdo their underlying index, index funds try to keep up with it. Although this won’t put them ahead of the market, it won’t put them far behind. Investors should expect steady gains from a high-quality index fund over the long run.

Ease of investing: Index funds are easy to buy and sell, making them suitable for novice and experienced investors. They can be purchased through brokerage accounts, retirement accounts, and other investment platforms.

Disadvantages of Index Funds

Low flexibility: Index funds can provide more consistent performance, but they are unsuitable for short—and mid-term investors who might want to respond quickly to market movements.

Moderate returns: Investing in an index fund, which holds thousands of different assets, typically results in moderate returns that are consistent over time. Although more diversification can make an investment more secure, it also lowers the odds of seeing a substantial return on investment each year.

Tracking error: While index funds aim to track the performance of their underlying index closely, slight discrepancies may affect the fund’s performance.

Impact on Financial Markets

Index funds have had a significant impact on traditional financial markets in several ways:

Increased market efficiency: By tracking well-established market indexes, index funds help promote market efficiency by reflecting the collective wisdom of millions of investors. This can lead to more accurate securities pricing and better capital allocation.

Lower trading costs: Index funds tend to have lower turnover rates than actively managed funds, resulting in lower trading costs and reduced market volatility.

Corporate governance: Index funds have a lot of clout regarding corporate governance issues because of their vast holdings in the firms they invest in. That way, shareholder interests can be considered when making decisions about things like board makeup and executive salary.

Impact on Cryptocurrency Markets

While index funds are more commonly associated with traditional financial markets, they can also make an impact on cryptocurrency markets:

Diversification in cryptocurrency investments: Investors can spread their risk over various digital assets via cryptocurrency index funds, rather than relying on any one cryptocurrency in particular. The extreme volatility of the bitcoin market makes this a potentially advantageous strategy.

Lower entry barriers: Investing in cryptocurrency index funds allows people to diversify their holdings in the market without having to buy individual currencies. Due to this reduced entry barrier, the cryptocurrency market may see an influx of more mainstream investors.

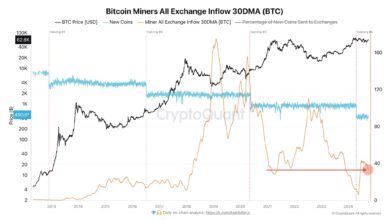

Increased market stability: If more institutional investors start investing in index funds, the bitcoin market may experience less price volatility and more market stability. As a result, more institutional investors may feel compelled to invest in the cryptocurrency market.

Closing Thoughts

Investing in an index fund is a low-effort, high-reward strategy for getting exposure to many markets or asset classes, whether it’s the established financial markets or the new cryptocurrency markets. Index funds can level the playing field for investing and improve market stability and efficiency. Index funds will probably stay popular for a long time because investors want low-cost, diversified solutions.