Grid Trading in Crypto A Complete Guide By Scopebitcoin

There are many opportunities for traders to profit from price fluctuations in the cryptocurrency market. What advantages traders have in one situation can also be their undoing in another. Because the market is open around the clock in an unpredictable setting, traders often fail to strike the ideal moment for their trades. However, the advent of crypto trading bots has significantly mitigated these unfavorable trading circumstances. Many traders have found great success using grid trading bots in particular. But first, what is grid trading, and how can it benefit you?

Crypto traders can supplement their trading arsenal with grid trading tactics, which are more prevalent in the foreign currency markets. In this comprehensive tutorial, learn the ins and outs of grid trading and how to implement a winning strategy.

What is Grid Trading?

Traders can automate grid trading using incremental orders below and above a predetermined price level. This quantitative trading strategy aims to make money in the unpredictable cryptocurrency market. An effective grid trading method involves executing automated orders through grid trading bots.

Within these parameters, the bots will automatically place orders. This generates a trading grid of orders for all possible market fluctuations. If an asset’s price is expected to fluctuate within a specific range, then traders can profit from the ups and downs of that range.

How Does Grid Trading Work?

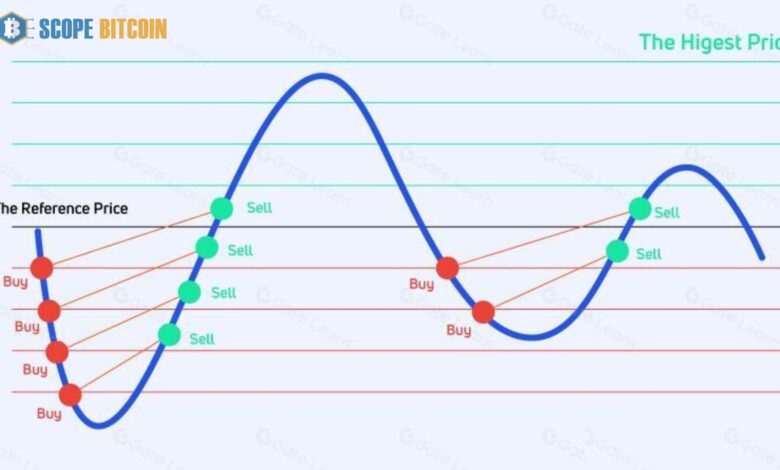

Any trader’s first step is to set up trading range parameters on a cryptocurrency exchange. They will purchase and sell at the maximum and minimum prices. In grid trading, orders are pre-calculated to maximize profit for each trade within the specified grid structure’s price ranges.

The price levels are shown like gridlines on a grid, which is the area where these trades are plotted. Remember that the spacing between gridlines is usually fixed. The next step is for the trader to establish a ceiling and floor for the price at which no sell orders will be executed. At levels higher than the purchase orders, there are matching sell orders.

Ethereum is a good example to consider. The minimum amount to place a purchase order is $500. A price of $2,000 for ETH would allow you to place orders at $1,500, $1,000, and $500. The sale orders would also be executed similarly but with a $500 increment “above” the current price. Based on these characteristics, the bot would execute these buy and sell orders automatically.

Constructing a Trading Grid

In plotting your approach on a chart, you will see that the grid starts to manifest itself. Consider the steps that are listed below to design a trading grid successfully.

Determine starting price

This step is crucial because one cannot design a grid without establishing a baseline. By this point, your familiarity with the price action should have increased, and you should be able to identify the range in which the asset is trading.

Choose the interval

You must decide the “pip” intervals you will utilize to implement your approach. “Pips” refers to increments, such as every one hundred dollars for either the price below or above. It is, therefore, possible for you to start by choosing ten pips as an example. This means your buy orders will remain at $190, $180, and so on, even if the asset price is $200.When stop-loss orders are set up, positions are automatically sold at a specified price once a particular loss level has occurred. Because of this, losses are reduced while profits are increased.

With-the-trend or against-the-trend

It is possible that determining this can be difficult if you are not aware of what to look for. “Trading with the trend” refers to charting your orders toward the asset’s price trend. As a result, you would place purchase orders at $510, $520, and so on if the price was $500 with ten pips per contract. This method calls for an exit while things are going well to ensure that earnings are locked in. On the other hand, when you trade “against the trend,” you are actively taking positions that are in the opposite direction of the trend. This frequently leads to taking advantage of corrections and retracements in the market structure.

Pros and Cons of Grid Trading

Grid trading can be helpful when prices move in a sideways market or inside a specified range. Assets tend to fluctuate within a narrow range over a lengthy time, which is why. Although this sort of trading offers traders many advantages, such as the ability to customize their trading experience and increased exchange liquidity, there are still a few things to keep in mind. Let’s go over the benefits and drawbacks of the situation below.

Pros

- Low entry point: The bots allow traders to enter positions at levels they cannot manually enter in any other circumstance. This is frequently the case because, to obtain those cheaper entry points, one must ensure that they are constantly monitoring the price activity. Additionally, this is effective for the reverse impact, achieving maximum selling points.

- High automation: Logical reasoning underpins the trading approach utilized in this sort of trading. This makes it simple for bots to carry out the activities they have been taught, even if those tasks are unconnected to the market’s feelings and trends. In other words, this results in high degrees of automation that provide efficient performance.

- Enhanced risk management: You have the power to actively configure the settings of a bot, which can have a significant impact on the prizes and income you receive. This, in turn, provides you with increased control and reduces the degree of loss that can be incurred from extremely speculative trades.

- Removes emotions from trading: When it comes to cryptocurrency investments, mainly trading, emotions such as wrath, fear, and greed are driving elements that might be difficult to ignore. Because the process is mechanized and conducted through logic and rules, trading bots reduce the emotional attachment associated with the transaction.

Cons

- Long waiting for larger timeframes: If the timing windows are extensive, you must hold for weeks or longer. The profits will gradually decrease as a result of this. Having patience is essential in this situation.

- The system fails if the market is too directional. For this approach to be successful, there must be consistent pullbacks in the market where it is being implemented. Because losses cannot be averaged, this market trajectory will only work against you going forward.

- Constant monitoring: A trading bot is not being utilized because of this. The price action is something that a trader needs to be aware of, but because the market is open around the clock, it is nearly impossible for them to do so. There is no way around that this will result in traders missing out on significant timed orders.

Grid Trading Bots

Bots have been present in the trading markets for a considerable time. Understanding how to use them in the Bitcoin market, which is open twenty-four hours a day, is also a good idea. In their most basic form, grid trading bots are nothing more than trading codes or algorithms that automate the entire grid experience. To take a break from the screen, traders design bots to execute orders at predetermined interval prices, allowing them to stop trading.

The advantages include the ability to make judgments more quickly and rationally, customize trades, and the possibility of continuing to make gains even when the market is calm. Binance, for instance, possesses both internal trading bots and grid bots in its ecosystem. In fact, of all exchanges that enable bots, Binance ranks first in terms of the number of trading bots it has. It uses real-time data with pre-set indicators and rules to generate lucrative trading signals. One can be used for margin trading, while others can be used for futures trading. You can select any option that meets your trading requirements.

Effective Grid Trading Strategy

Grid trading has been demonstrated to offer significant advantages to traders in the foreign exchange and cryptocurrency markets. Although certain risks may be involved, the benefits unquestionably exceed the drawbacks, as with every investment. An effective entrance strategy, well-defined risk management, and strategic position sizing are the primary factors determining whether these tactics will accomplish their goals.

You can choose entry methods by looking at other trading indicators or the overall price pattern in the chart. Both of these factors can be used. Risk management includes establishing “stop losses” and “take profit” levels to safeguard earnings and limit losses. Determine the size of each transaction and the number of trades placed in each grid to manage your finances effectively. In conclusion, you may significantly improve your odds of success by methodically planning your trade orders and utilizing grid trading bots. This will allow you to increase your chances of achievement.