FDIC Exposed: Documents Reveal Crypto Industry Exclusion from the U.S. Banking System

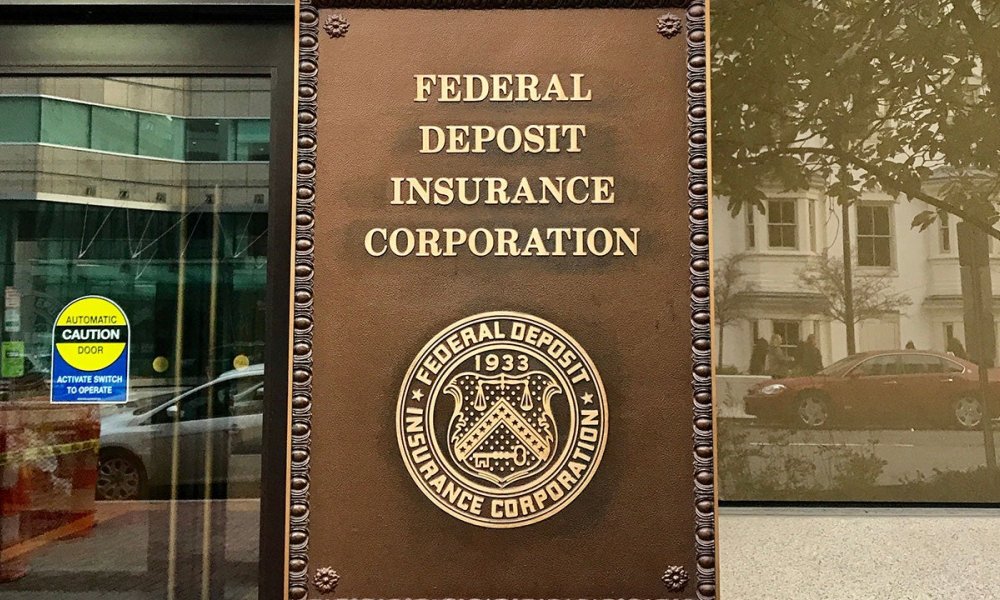

Documents Reveal Crypto Industry: The intersection of cryptocurrency and traditional banking has long been a contentious space, marked by innovation on one side and regulatory skepticism on the other. Recent revelations, however, have brought the issue into sharper focus. Documents uncovered through investigative efforts suggest that the. Federal Deposit Insurance Corporation (FDIC) may have actively contributed to the exclusion. Of the cryptocurrency industry from the U.S. banking system.

This revelation has sparked heated debates, raising concerns about regulatory overreach, innovation suppression, and the long-term implications for the U.S.’s role in the global financial system.

The Controversial Role of the FDIC

The FDIC, tasked with maintaining stability in the U.S. banking sector and protecting depositors, has been accused of overstepping its mandate. Internal documents allegedly indicate that the FDIC, either directly or indirectly, discouraged banks from offering services to crypto-related businesses.

Key allegations include:

- Pressuring Banks to Deny Services: Crypto companies have reported sudden closures of accounts or unexplained denials of service from banks, potentially due to FDIC guidance.

- Risk Overstatements: Critics argue that the FDIC exaggerated the risks associated with the cryptocurrency industry, deterring financial institutions from engaging with the sector.

- Selective Enforcement: While fostering innovation is a stated goal of U.S. financial policy, the FDIC’s alleged actions seem counterproductive, selectively targeting an emerging industry.

Impact on the Crypto Industry

The exclusion of crypto companies from banking services has far-reaching consequences for the industry:

The exclusion of crypto companies from banking services has far-reaching consequences for the industry:

- Operational Challenges

Without access to banking infrastructure, many crypto firms struggle to manage payroll, facilitate transactions, or ensure liquidity. This creates a bottleneck for innovation and scalability. - Reduced Trust and Legitimacy

Banking relationships are crucial for any business to gain credibility. By cutting off these ties, the FDIC’s actions could undermine public trust in the crypto industry. - Shift to Offshore Solutions

Companies denied banking services in the U.S. are increasingly turning to foreign jurisdictions, potentially weakening the country’s influence in the global crypto market.

Why Does This Matter?

The alleged exclusion of crypto companies from the U.S. banking system raises several red flags:

- Regulatory Overreach: If true, these actions suggest a misuse of regulatory authority, undermining the principles of fair competition and innovation.

- Economic Implications: The crypto industry contributes significantly to economic growth and job creation. Suppressing its growth could hamper the U.S.’s ability to remain a leader in financial innovation.

- Global Competitiveness: While the U.S. grapples with regulatory hurdles, other nations, like Singapore and Switzerland. Are positioning themselves as crypto-friendly hubs, potentially luring talent and investment away.

The FDIC’s Defense

The FDIC has denied allegations of systemic discrimination against the crypto industry, asserting that its role is to mitigate risks and ensure the stability of the financial system. In its defense, the FDIC points to the volatility and speculative nature of many cryptocurrencies, Documents Reveal Crypto Industry as well as high-profile failures like FTX, as justification for its cautious approach.

However, critics argue that these concerns should be addressed through clear and consistent regulation, not by effectively blacklisting an entire industry.

What’s Next for the Crypto Industry?

The fallout from these revelations is likely to intensify calls for regulatory clarity in the U.S. cryptocurrency space. Several key developments could shape the future:

- Congressional Oversight: Lawmakers may increase scrutiny of the FDIC’s actions, demanding transparency and accountability.

- Industry Advocacy: Crypto businesses and advocacy groups are likely to ramp up efforts to engage with policymakers and push back against perceived discrimination.

- Shift to Alternative Banking Solutions: In response to challenges with traditional banks, the industry may accelerate the Documents Reveal Crypto Industry development of decentralized finance (DeFi) solutions and crypto-native banking infrastructure.

Conclusion

The alleged actions of the FDIC highlight a broader struggle over the future of finance in the United States. Regulation is essential to ensure stability and protect consumers. It must strike a balance that fosters innovation and competition. In the cryptocurrency industry. These revelations underscore the urgent need for clear, fair, and forward-thinking policies. The outcome of this debate will not only shape the trajectory of crypto but also determine whether. The U.S. maintains its leadership in the rapidly evolving global financial landscape.

[sp_easyaccordion id=”5058″]