Explaining the Sudden Decline in Bitcoin Price Below $61k

Bitcoin Price Below $61k. The recent downturn in Bitcoin’s price, dropping to $61,000, has prompted concerns within the cryptocurrency market. Investors and analysts are scrutinizing the factors contributing to this decline and assessing the potential for further decreases. This period of heightened volatility underscores the dynamic nature of digital asset markets, where a combination of technical indicators, market sentiment, and broader economic factors influences price movements.

Factors Contributing to Bitcoin’s Decline

Investors appear to be avoiding risk and playing it safe as of late, according to market sentiment. Not only have these factors impacted the price of Bitcoin, but they have also lowered confidence in the cryptocurrency sector as a whole. The recent decline in Bitcoin’s price can be attributed to the following main factors:

Technical Resistance and Market Sentiment

Bitcoin’s fall below $62,000 has sounded the technical sirens for traders, who are keeping a close eye on the crucial support level close to $61,500. Technical indicators that could indicate a trend reversal have been pointed out by analysts like 10X Research’s Markus Thielen: a possible double top formation in Bitcoin’s chart.

When investors respond to breaches of significant support levels, such patterns usually cause selling pressure to intensify. The cautious mood has been shaped by this technical analysis, which has affected market dynamics and pushed the price of Bitcoin closer to $60,000.

Federal Reserve Interest Rate Speculation

The recent performance of Bitcoin has also been affected by the uncertainty surrounding the interest rate policy of the Federal Reserve. Bitcoin Price Below $61k: Due to ongoing worries over inflation, traders are wary of possible interest rate hikes. Market mood is highly dependent on the Federal Reserve’s forthcoming decisions, which are, in turn, affected by economic data such as the PCE price index. Increased volatility and downward pressure on Bitcoin’s price are both caused by speculative assets, such as cryptocurrencies, which are especially vulnerable to fluctuations in interest rate expectations.

Outflows from U.S. Spot Bitcoin ETFs

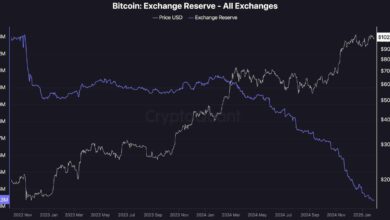

A change in investor opinion toward digital assets is indicated by the substantial $545 million outflow from U.S. Spot Bitcoin ETFs. Due to regulatory and market uncertainty, institutional investors are rebalancing their holdings in Bitcoin-related financial products. The selling pressure in the cryptocurrency market has been intensified by this fund movement, which shows how institutional investor activity can affect short-term price swings.

Inflation and Economic Indicators

The excessive inflation rates relative to the Federal Reserve’s targets continue to be a worry, even though recent CPI figures indicate a minor decrease in inflation. Asset valuations in the financial markets, particularly cryptocurrency markets, are affected by market expectations on the Federal Reserve’s monetary policy stance in response to high inflation levels. Much of the recent price volatility in Bitcoin has been caused by the interaction between inflation patterns, central bank policies, and other economic indicators. These factors influence investor mood.

Current Bitcoin Market Conditions and Future Outlook

The price of Bitcoin has dropped 4.83% in the past 24 hours, trading at $61,269.90, on a trading volume of $21.5 billion. A market capitalization of around $1.2 trillion indicates that this cryptocurrency is undeniably a significant participant in the realm of digital assets. Despite the global recession, Bitcoin’s open interest has grown by 0.59%, bringing its present worth to $19.1 billion.

Bitcoin Price Below $61k: Prior research by market analysts indicated that, due to impending macroeconomic events and options expirations, the price could fall to $57,000 by the end of the month. Anticipated events that are likely to increase market volatility include essential data releases and pronouncements by the Federal Reserve.

With more than 105,000 Bitcoin options set to expire on June 28, traders will be keeping a careful eye on the $57,000 strike price in particular. As traders react to changing market conditions, this concentration might cause selling pressure in the cryptocurrency market to increase.

As a result of a myriad of technical indicators, economic variables, and investor mood, the price of Bitcoin has fallen below $62,000 as of late. Investors should be on the lookout for any market-moving events in the following weeks and be attentive in the face of persistent volatility.