Cryptocurrency Investment: Pinnacle of Crypto Market Indicators

In recent years, cryptocurrency trading has become increasingly popular and established a distinct market segment. Most Bitcoin and cryptocurrency investors retain their holdings for extended periods, hoping to witness their investments increase passively. A growing number of investors, though, are devoting time and energy to the hope of turning a profit trading cryptocurrencies. Any good trader should strive to remove emotions from trading. Familiarity with the various instruments and their proper use might benefit a trader’s confidence, expertise, and ability to avoid mistakes and maximize investment value.

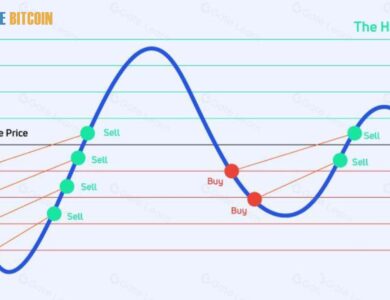

Because it gives traders a leg up, studying crypto’s technical analysis is just as vital as researching. The macroeconomic market and promising businesses. In technical analysis, indicators based on previous price data are used to analyze chart patterns and make forecasts. Technical analysis uses asset volume or price calculations to forecast prices, spot market trends, and detect reversal warning signs. No single indicator can confirm market trends or detect reversals. To maximize your indicators, use a combination or, better yet, a select subset and combine them without overwhelming your charts.

Traders have all the tools they need to customize their trading experience. No indicator will necessarily yield better results, so traders must choose based on personal preference. Below, we’ll review some of the most significant crypto research and investment tools. This is not an exhaustive list of available materials. Traders’ capacity to understand the endless potential of additional technical analysis tools increases with experience. A trading strategy builder and cryptocurrency investment guide are available here. Scopebitcoin post will examine the significant crypto indications and signals and how crypto traders use them.

Good Indicators for Crypto

As a rule of thumb, indicators are statistical data that shed light on the state of the market and potential monetary and economic developments. In technical analysis, technical indicators significantly predict when a cryptocurrency’s price or trend will change. To forecast how a cryptocurrency’s value will rise or fall, technical analysts look at its historical trading activity and price fluctuations.

In contrast to fundamental analysis, which examines patterns in price history, technical analysis examines a company’s financials. The indicators an investor should use will depend on whether they want to use a day, scalp, or swing trading strategy. Moving averages, MACD, and the RSI are prevalent technical analysis indicators in conventional and cryptocurrency markets. Crypto FOMO indicators, cryptocurrency social media indicators, and the Crypto Fear and Greed Index are more market-specific indicators.

Moving Average (MA)

Moving average technical indicators rank high among the many simple tools available to technical analysts. They represent the mean value of an item throughout a given time frame. Depending on their direction, they show whether an asset is rising upwards (bullish) or downwards (bearish).

Cryptocurrency Investment

They give input after the price change and follow the trend, which is why they are also known as lagging indicators. Exponential and simple moving averages are the most common patterns employed in crypto and the most popular. The simple moving average (SMA) is helpful for long-term traders since it identifies trends that do not shift direction fast.

However, short-term traders would do better with the exponential moving average (EMA) because it rapidly captures price movements and gives recent price data a lot of weight. Moving averages can be used on any timescale. Most often, though, they are 200-, 50-, and 20-period moving averages. They give traders a sense of the asset’s overall trend depending on the dataset’s selected period.

The 200-period SMA

A cryptocurrency’s 200-day simple moving average (SMA) is its average closing price over the last 200 trading days. It is calculated by summing all of the asset’s closing prices and dividing the sum by 200. For those looking to trade for the long haul, this is a fantastic tool for spotting up and down trends and support and resistance levels. By convention, a bullish trend is indicated when an asset’s price is above. The 200-day moving average, while a negative trend is shown when the price is below.

The 50-period SMA

Technical traders in the cryptocurrency market often employ this indicator. Knowing where support is is helpful for deciding whether to take a position when the market is going up or down. A standard level of support for cryptocurrencies is their 50-day moving average, which is the average price investors have paid for them over the last ten trading weeks (or 2.5 months).

Within the 200-period and 50-period SMA, you can find Death and Golden Crosses. A Death Cross could signal the impending onset of a bear market, which occurs when the 50 SMA crosses the 200 SMA in a downward direction. However, a Golden Cross, in which the 50 SMA is moving from a downtrend to an uptrend, may suggest that a bullish market is on the horizon.

The 20-period SMA

Due to its shorter time frame, day traders benefit more from the 20-period simple moving average. It averages the prices of all 20 daily candles and determines the average worth of a cryptocurrency. Identifying the buildup’s bottom before the breakout helps traders respond more quickly to market price swings and trade breakouts. On the other hand, such temporary shifts might be signs of bull or bear traps.

MACD

Many cryptocurrency traders rely on the moving average convergence divergence indicator (MACD), an oscillator, as a basic momentum indicator for buying or selling. As the two underlying moving averages move further apart, the MACD diverges, and as they move closer together, it converges.

How is the MACD indicator used?

As a trend-following momentum indicator, it will provide signals on both a trend and momentum—that is, the propensity for rising asset values to continue rising and falling prices to continue falling. It is intended to highlight shifts in a cryptocurrency’s price trend’s intensity, direction, momentum, and length. The difference between an exponential moving average’s shorter and longer periods is the MACD indicator. In Cryptocurrency Investment, the 12- and 26-period EMAs are typically considered. The MACD line, the outcome of those computations, might provide intriguing buy or sell indications.

It is a good idea to buy if the MACD is above zero since it is positive and shows an upward (bullish) momentum. It is bearish and negative if it is less than zero, indicating that now would be a good time to sell. Traders can also determine how strong the current trend is by examining the MACD chart. For instance, if the MACD indicates lower highs but the chart displays higher highs, there is a strong likelihood that the markets will soon enter a downtrend as the price is rising, but the momentum is falling.

RSI

Technical traders can use the RSI and MACD to study asset price charts and find patterns that suggest when to purchase or sell cryptocurrency. Another technical analysis momentum indicator is the relative strength indicator, which uses recent price changes to assess a cryptocurrency’s strength or weakness and identify overbought or oversold levels in an asset. Additionally, the indicator can identify divergences and alert traders to potential trend reversals.

The RSI is assessed on a scale from 0 to 100, with high and low levels at 70% and 30%, respectively. It is most commonly utilized over 14 days. Generally, levels over 70 are considered overbought with corresponding recommendations to buy or sell, and below 30 are considered oversold. Additionally, the RSI can be regarded as bearish when it crosses below the 70% level and bullish when it crosses above the 30% level. Long-term investors may choose a 21- or even 30-period RSI, while short-term traders may employ a 5- or 7-period RSI.

Bollinger Bands

Bollinger bands, named for the technical trader who created them, are a technical indication of the price and volatility of a cryptocurrency asset over time. They comprise three primary parts: an upper band, typically two standard deviations from the SMA, and a lower band. The simple moving average is usually the 20-period SMA. A standard deviation determines the difference between a set of values or prices and the average value or price.

Do Technical Indicators Work for Crypto?

Technical analysis tools, like those mentioned here, can help traditional market traders estimate asset prices based on previous data. Cryptocurrency forecasts are more complex to analyze because the business is new and lacks market data. Due to cryptocurrency market volatility, predictions have often proved wrong.

However, cryptocurrency volatility makes some indicators more useful. On-balance volume is a good momentum signal for price breakouts. It can also track funds from important market participants or institutional investors. It analyzes a cryptocurrency’s trade volume across days, weeks, and months and measures cryptocurrency buying and selling pressure.

Price momentum rises as the OBV rises because more buyers are willing to buy the asset at the trade price. A decreasing OBV signals intense selling pressure, often near all-time highs, giving traders a chance to profit. This usually indicates market pessimism.

Cryptocurrency Social Media Indicators

In the bitcoin domain, different indicators are considered, especially given millennials’ strong social media involvement and the success of online marketing with Cryptocurrency Investment. These indicators aid cryptocurrencies with smaller market capitalizations because a well-known influencer or celebrity supporting the project can cause significant price movements. Understanding how younger traders express market attitudes, pricing, and trading volume is crucial. Search traffic and social media activity can predict price changes.

Bitcoin dominance

Bitcoin dominance is defined as the ratio of Bitcoin’s market capitalization to its overall market capitalization. They determine the market value of a Cryptocurrency Investment. Because numerous lesser-cap coins track changes in Bitcoin’s price, the dominance of Bitcoin affects the entire market. It calculates the market capitalization of Bitcoin in comparison to the whole of the market. An “alt season,” or altcoin bull market, is probably on the horizon if the market’s capitalization is rising and Bitcoin’s dominance is declining.

The Bitcoin hash rate is a helpful indicator of the network’s health, even though it cannot be regarded as an exact one per se. The quantity of processing power Bitcoin miners produce to produce new blocks and handle new transactions is known as the hash rate. Bitcoin hash rates are expressed in hashes per second (h/s).

Because it guarantees that the network is always safe and that investors can rely on it, it has historically exhibited some correlation with the price. However, it should not be viewed as an exact signal for predicting prices.