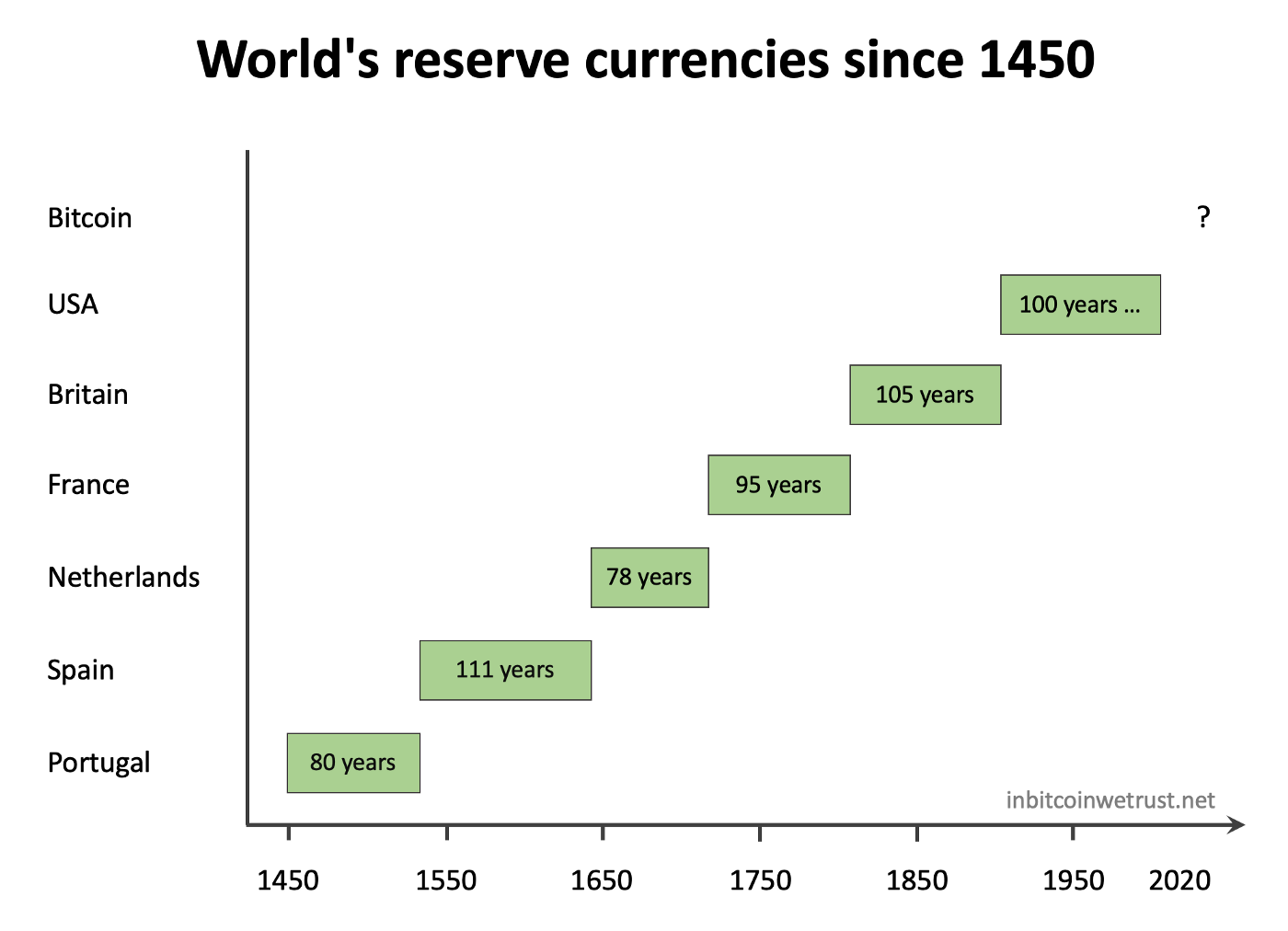

Could Bitcoin Become the World’s Reserve Currency of the Future? Impact on Price and Global Financial Systems

Could Bitcoin Become the World’s: Bitcoin has undergone a remarkable transformation in recent years. Once a niche product for tech enthusiasts and speculators, it has evolved into a global asset class recognized by institutional investors, corporations, and even some governments. However, the question of whether Bitcoin can truly become the world’s reserve currency is complex and depends on Trump’s Shift on Bitcoin Implications for 2024 on factors far beyond mere market adoption.

Bitcoin as a Global Reserve Currency

The concept of Bitcoin as a reserve currency isn’t new. Proponents argue that it has the potential to challenge the traditional financial system, which has relied on fiat currencies like the US dollar as the global benchmark for decades. But can Bitcoin realistically achieve this status?

Technological Advantages of Bitcoin

One of Bitcoin’s key advantages is its decentralization. Unlike traditional fiat currencies, Bitcoin is not controlled by a central bank, making it less susceptible to political manipulation. This independence could appeal to countries seeking protection from inflation or external control over their national currencies.

Bitcoin also offers high levels of transparency and security, with all transactions permanently recorded on the blockchain. These attributes make it attractive for international payments and as a long-term store of value.

Challenges for Bitcoin as a Reserve Currency

Despite its strengths, Bitcoin faces significant challenges in becoming the world’s reserve currency. A major issue is its high price volatility. While traditional reserve currencies like the US dollar are relatively stable, Bitcoin’s value fluctuates dramatically, making it a difficult choice for countries and institutions to rely on as a reserve asset.

Scalability is another problem. Bitcoin’s blockchain has struggled with transaction bottlenecks and high fees, which limit its usability on a large scale. Addressing these issues through innovations like the Lightning Network, which enables faster and cheaper payments, would be crucial for Bitcoin’s adoption as a global reserve currency.

Political and Regulatory Barriers

The adoption of Bitcoin as a reserve currency would likely face political resistance. Many governments and central banks view cryptocurrencies as a threat to their control over monetary policy. Establishing a global reserve currency based on Bitcoin would require a radical restructuring of the international financial system, likely encountering significant opposition.

What Would Happen to Bitcoin’s Price if It Became a Reserve Currency?

If Bitcoin were to become a global reserve currency, its price would likely experience a massive surge. Demand for Bitcoin as a store of value and a medium of exchange would skyrocket worldwide. Given Bitcoin’s limited supply of 21 million coins, this increased demand could lead to significant scarcity and drive prices higher.

If Bitcoin were to become a global reserve currency, its price would likely experience a massive surge. Demand for Bitcoin as a store of value and a medium of exchange would skyrocket worldwide. Given Bitcoin’s limited supply of 21 million coins, this increased demand could lead to significant scarcity and drive prices higher.

Long-Term Price Stability

One potential outcome would be a stabilization of Bitcoin’s price. As Bitcoin becomes established as a reserve currency and is used regularly in international transactions, the market might become less volatile. This stabilization would depend on the efficiency of supporting infrastructure and widespread adoption.

Inflationary vs. Deflationary Scenarios

A Bitcoin standard could combat inflation because its supply is capped and cannot be arbitrarily increased by central banks. Over time, this could lead to a deflationary economy, where Bitcoin’s value steadily increases. For countries and businesses holding Bitcoin as a reserve, this might mean consistent value appreciation.

However, excessive demand for Bitcoin could overheat the market, potentially leading to price bubbles similar to those seen in Bitcoin’s early years. Such volatility might hinder its broad acceptance as a reserve currency.

Conclusion

While the prospect of Bitcoin becoming the world’s reserve currency remains uncertain, it is not entirely out of reach. Bitcoin’s technological advantages make it a compelling alternative to traditional currencies. However, challenges such as scalability, volatility, and political acceptance are significant hurdles.

If Bitcoin manages to overcome these obstacles, its price could surge dramatically, supported by the need for a robust infrastructure and global consensus. Whether Bitcoin can achieve the desired stability and become the cornerstone of the global financial system remains to be seen.

[sp_easyaccordion id=”4887″]