Cardano Price Prediction 2030 Expert Analysis & Forecast

The cryptocurrency market has witnessed unprecedented growth over the past decade, with various digital assets capturing investors’ attention worldwide. Among these promising blockchain projects, Cardano (ADA) stands out as a third-generation blockchain platform that has garnered significant interest from both retail and institutional investors. As we look toward the future, many investors are eager to understand the potential trajectory of Cardano price prediction 2030 and what factors might influence its long-term value proposition.

Cardano, founded by Ethereum co-founder Charles Hoskinson, represents a scientifically-driven approach to blockchain development. Unlike many cryptocurrency projects that rush to market, Cardano has built its foundation on peer-reviewed academic research and evidence-based methodologies. This methodical approach to development has positioned ADA as a potential leader in the next generation of blockchain technology, making Cardano price prediction 2030 a topic of considerable interest among cryptocurrency enthusiasts and professional investors alike.

The blockchain industry is experiencing rapid evolution, with decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contract platforms driving unprecedented innovation. As these sectors continue to mature, the long-term potential of established platforms like Cardano becomes crucial for making informed investment decisions. This comprehensive analysis examines various factors that could influence ADA price predictions over the next decade, providing valuable insights for those considering long-term cryptocurrency investments.

Cardano’s Foundation and Technology

The Scientific Approach to Blockchain Development

Cardano’s unique positioning in the cryptocurrency ecosystem stems from its commitment to scientific rigor and academic research. Unlike many blockchain projects that prioritize rapid deployment, Cardano’s development team has consistently emphasized the importance of peer-reviewed research and formal verification methods. This approach has resulted in a more robust and sustainable blockchain infrastructure that could significantly impact Cardano price prediction 2030 scenarios.

The platform’s Ouroboros consensus mechanism represents a breakthrough in proof-of-stake technology, offering enhanced security while maintaining energy efficiency. This innovative approach to consensus has attracted attention from environmental advocates and institutional investors who prioritize sustainable blockchain solutions. As global awareness of environmental concerns continues to grow, Cardano’s eco-friendly approach could become a significant competitive advantage influencing future ADA cryptocurrency valuations.

Smart Contract Capabilities and DeFi Integration

The implementation of smart contract functionality through the Alonzo upgrade marked a pivotal moment in Cardano’s evolution. This development enabled the platform to compete directly with established smart contract platforms like Ethereum, opening new possibilities for decentralized applications (dApps) and DeFi protocols. The expansion of Cardano’s ecosystem through smart contracts could play a crucial role in determining Cardano price prediction 2030 outcomes.

DeFi integration on Cardano has shown promising growth, with various protocols launching innovative financial products and services. The platform’s ability to handle complex financial applications while maintaining low transaction fees and high security standards positions it favorably for future adoption. As the DeFi sector continues to mature, Cardano’s role in this ecosystem could significantly influence long-term ADA price predictions.

Market Analysis and Current Trends

Historical Price Performance and Pattern Recognition

Analyzing Cardano’s historical price movements provides valuable insights into potential future trends that could affect Cardano price prediction 2030 scenarios. Since its inception, ADA has demonstrated both significant growth periods and market corrections, reflecting the volatile nature of the cryptocurrency market. These patterns helps investors develop realistic expectations for long-term price trajectories.

The cryptocurrency market cycles have historically shown correlation between Bitcoin’s performance and altcoin movements, including ADA. However, as the market matures, individual projects are beginning to establish more independent price discovery mechanisms based on their unique value propositions and adoption metrics. This evolution could lead to more accurate Cardano price predictions based on fundamental analysis rather than purely speculative trading patterns.

Institutional Adoption and Market Sentiment

Institutional cryptocurrency adoption has accelerated significantly in recent years, with major corporations and financial institutions recognizing digital assets as legitimate investment vehicles. Cardano’s emphasis on regulatory compliance and academic rigor makes it an attractive option for institutional investors seeking exposure to blockchain technology while maintaining risk management standards.

The growing institutional interest in ADA reflects confidence in the platform’s long-term viability and technological superiority. As more institutions allocate resources to cryptocurrency investments, the demand for established platforms like Cardano could increase substantially, potentially driving positive Cardano price prediction 2030 outcomes.

Technical Factors Influencing Long-Term Price Predictions

Scalability Solutions and Network Upgrades

Cardano’s scalability roadmap includes several planned upgrades designed to increase transaction throughput and reduce fees. The Hydra scaling solution represents one of the most anticipated developments, promising to enable thousands of transactions per second while maintaining the network’s security and decentralization properties. These technical improvements could significantly impact ADA price predictions by enhancing the platform’s utility and competitive position.

The Basho era of Cardano’s development focuses on optimization and scaling, addressing the growing demand for blockchain infrastructure that can support mass adoption. As these upgrades are implemented, the improved performance metrics could attract more developers and users to the platform, potentially influencing positive Cardano price prediction 2030 scenarios.

Governance and Community Participation

Cardano’s governance model empowers ADA holders to participate in network decisions through a democratic voting process. This approach to decentralized governance ensures that the platform evolves according to community needs and preferences, potentially leading to more sustainable long-term growth. The strength of Cardano’s governance system could play a crucial role in determining future ADA cryptocurrency valuations.

Project Catalyst, Cardano’s innovation funding mechanism, demonstrates the platform’s commitment to fostering ecosystem development through community-driven initiatives. This approach to funding and development could accelerate the growth of applications and services built on Cardano, potentially contributing to positive Cardano price prediction 2030 outcomes.

Global Adoption and Partnership Strategies

Geographic Expansion and Developing Markets

Cardano’s focus on emerging markets represents a strategic approach to achieving global adoption. The platform’s partnerships with various African governments and educational institutions demonstrate its commitment to providing blockchain solutions for underserved populations. This geographic expansion strategy could create new demand sources for ADA tokens and influence long-term price predictions.

Financial inclusion initiatives powered by Cardano technology have the potential to onboard millions of new users to the cryptocurrency ecosystem. As these projects mature and demonstrate real-world impact, they could contribute significantly to Cardano price prediction 2030 scenarios by establishing sustainable use cases for the platform.

Strategic Partnerships and Enterprise Adoption

The development of enterprise partnerships continues to be a key focus for Cardano’s growth strategy. Collaborations with academic institutions, government agencies, and private corporations provide validation for the platform’s technology while creating new revenue streams and use cases. These partnerships could play a significant role in shaping ADA price predictions over the coming years.

Supply chain applications and identity management solutions built on Cardano demonstrate the platform’s versatility beyond traditional cryptocurrency use cases. As these enterprise applications gain traction, they could contribute to increased demand for ADA tokens and support positive Cardano price prediction 2030 projections.

Regulatory Environment and Compliance Considerations

Global Cryptocurrency Regulation Trends

The evolving regulatory landscape for cryptocurrencies presents both opportunities and challenges for platforms like Cardano. The platform’s proactive approach to regulatory compliance positions it favorably as governments worldwide develop frameworks for digital asset oversight. This regulatory readiness could be a significant factor in Cardano price prediction 2030 scenarios.

Central Bank Digital Currency (CBDC) development by various governments could impact the broader cryptocurrency market. However, Cardano’s focus on interoperability and compliance may allow it to coexist with or even support CBDC implementations, potentially maintaining its relevance in evolving regulatory environments.

Compliance Features and Risk Management

Cardano’s built-in compliance features include identity management capabilities and transaction monitoring tools that align with regulatory requirements. These features make the platform attractive to institutions and governments that require blockchain solutions meeting specific compliance standards. The availability of such features could contribute to positive ADA price predictions as regulatory clarity increases globally.

Price Prediction Models and Analysis Methodologies

Technical Analysis Approaches

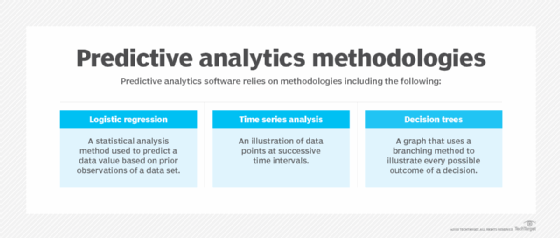

Technical analysis of Cardano’s price movements involves examining historical data patterns, support and resistance levels, and market indicators to forecast future price directions. While technical analysis provides valuable short-term insights, Cardano price prediction 2030 requires consideration of fundamental factors and long-term trends that extend beyond traditional chart analysis.

Moving averages, trend lines, and momentum indicators can provide guidance on potential price directions, but long-term predictions must also account for technological developments, market adoption, and macroeconomic factors that could influence ADA cryptocurrency valuations over the next decade.

Fundamental Analysis and Valuation Models

Fundamental analysis of Cardano involves evaluating the platform’s intrinsic value based on its technology, adoption metrics, and competitive position. This approach to ADA price predictions considers factors such as network usage, developer activity, partnership announcements, and technological milestones that could drive long-term value appreciation.

Network value to transactions (NVT) ratios and other blockchain-specific metrics provide insights into whether current ADA valuations are justified by network activity. These fundamental analysis tools help establish realistic baselines for Cardano price prediction 2030 scenarios.

Risk Assessment and Market Volatility Factors

Cryptocurrency Market Risks

Market volatility remains a significant factor in any Cardano price prediction 2030 analysis. The cryptocurrency market’s inherent volatility can lead to substantial price swings that may not reflect underlying fundamental value. These volatility patterns is crucial for developing realistic expectations about long-term price trajectories.

Competition from other blockchain platforms represents an ongoing risk factor that could impact Cardano’s market share and token valuation. As the blockchain space becomes increasingly competitive, platforms must continuously innovate and demonstrate unique value propositions to maintain their market positions.

Technology and Development Risks

Development delays and technical challenges could impact Cardano’s roadmap execution and influence ADA price predictions. While the platform’s scientific approach reduces certain risks, the complexity of blockchain development means that unforeseen challenges could affect timeline and feature delivery.

Security vulnerabilities and smart contract risks represent ongoing concerns for all blockchain platforms, including Cardano. The platform’s formal verification approach helps mitigate these risks, but the potential for security issues remains a consideration in long-term price prediction models.

Expert Predictions and Market Sentiment

Industry Expert Opinions

Cryptocurrency analysts and industry experts have offered various perspectives on Cardano price prediction 2030 scenarios. These predictions range from conservative estimates based on current adoption trends to optimistic projections assuming significant technological and market breakthroughs. The reasoning behind different expert opinions helps investors form their own conclusions about ADA’s long-term potential.

Institutional research reports from major financial firms provide additional insights into professional assessments of Cardano’s investment potential. These reports often consider regulatory developments, technology adoption curves, and competitive analysis when developing ADA price predictions.

Community Sentiment and Social Metrics

Social media sentiment and community engagement metrics provide valuable insights into market perception of Cardano’s prospects. Strong community support and active developer engagement often correlate with positive long-term price performance, making these factors relevant to Cardano price prediction 2030 analysis.

GitHub activity, social media mentions, and community forum discussions offer quantitative measures of interest and development activity that could influence future ADA valuations. These social metrics complement traditional financial analysis in developing comprehensive price prediction models.

Investment Strategies and Risk Management

Long-Term Investment Considerations

Developing appropriate investment strategies for ADA requires careful consideration of risk tolerance, investment timeline, and market outlook. Long-term investors interested in Cardano price prediction 2030 scenarios should consider dollar-cost averaging and portfolio diversification strategies to manage volatility risks.

Position sizing and risk management become particularly important when investing in volatile assets like cryptocurrencies. Establishing clear investment goals and exit strategies helps investors navigate the emotional challenges of cryptocurrency investing while maintaining focus on long-term objectives.

Portfolio Diversification Strategies

Cryptocurrency portfolio diversification should extend beyond individual token selection to include various blockchain platforms, use cases, and market segments. While Cardano may represent a significant holding for believers in its technology, prudent risk management suggests maintaining exposure to other promising projects and traditional assets.

Asset allocation models that incorporate cryptocurrencies like ADA should consider correlation patterns with traditional financial markets and adjust exposure levels based on overall portfolio risk profiles and investment objectives.

Also Read: Polkadot Price DOT Price Live Charts and Marketcap

Conclusion

Cardano price prediction 2030 represents a complex analytical challenge that requires consideration of multiple factors ranging from technological developments to market adoption trends. The platform’s scientific approach to blockchain development. Combined with its focus on sustainability and regulatory compliance, positions it favorably for long-term success in an evolving cryptocurrency landscape.

While ADA price predictions remain inherently uncertain due to market volatility and technological risks. Cardano’s strong fundamentals and growing ecosystem provide reasons for cautious optimism about its long-term prospects. The platform’s emphasis on academic research, peer review, and formal verification creates a solid foundation for sustained growth and adoption.

Investors considering Cardano as a long-term investment should carefully evaluate their risk tolerance and investment objectives. While staying informed about platform developments and market trends. The cryptocurrency market’s evolution over the next decade will likely present. Both opportunities and challenges that could significantly impact ADA cryptocurrency valuations.

As the blockchain industry continues to mature. Platforms like Cardano that demonstrate technological innovation, regulatory compliance, and sustainable. Development practices may be best positioned to capture long-term value. However, investors should approach Cardano price prediction 2030 scenarios with appropriate caution and maintain. Diversified investment portfolios to manage inherent market risks.