BTC Price Prediction 2026 Altcoin With 8,000% ROI

BTC price prediction signals a pullback as Uniswap surges and a top altcoin for 2026 posts 8,000% ROI. Explore market trends and future outlook.

Cryptocurrency market has once again entered a critical phase. Investors are closely watching charts, macroeconomic signals, and on-chain data as volatility intensifies. The latest BTC price prediction suggests that Bitcoin may be approaching a short-term pullback after an extended rally. At the same time, Uniswap surges on renewed decentralized finance momentum, while a rising contender for the title of best altcoin to invest in 2026 has captured headlines with an astonishing 8,000% return on investment.

In today’s evolving crypto landscape, capital rotates quickly between assets. Bitcoin often sets the tone for the broader market, but altcoins can outperform dramatically during specific cycles. As we analyze the current BTC price prediction, we’ll also explore why Uniswap is gaining strength and how one emerging altcoin could shape portfolios heading into 2026.

Understanding these trends is essential for traders, long-term investors, and anyone seeking exposure to digital assets. From technical analysis to market sentiment, and from decentralized exchange growth to high-growth altcoins, this in-depth article will provide clarity and insight into where the market may be heading next.

BTC Price Prediction: Is a Pullback Inevitable?

The latest BTC price prediction revolves around one key question: has Bitcoin overheated in the short term? After a strong upward trend driven by institutional demand, ETF inflows, and improving macro sentiment, Bitcoin appears to be testing major resistance levels.

Technical Indicators Signal Cooling Momentum

Technical analysts examining the BTC price prediction point to overbought conditions on the Relative Strength Index (RSI). Historically, when Bitcoin reaches these elevated levels, a short-term correction often follows. Moving averages also suggest that BTC may need to retest support zones before resuming its long-term bullish structure. This doesn’t necessarily indicate a market reversal. Instead, many traders interpret the current BTC price prediction as a healthy consolidation phase. Pullbacks allow new buyers to enter at lower levels and provide sustainability to the broader uptrend.

On-Chain Data and Market Sentiment

On-chain metrics provide further insight into the evolving BTC price prediction. Exchange inflows have slightly increased, which can indicate profit-taking behavior. Meanwhile, long-term holders remain relatively inactive, suggesting confidence in Bitcoin’s future valuation. Market sentiment remains cautiously optimistic. While short-term traders anticipate volatility, institutional participants continue accumulating BTC as a hedge against inflation and economic uncertainty. This dynamic supports the idea that any potential pullback could be temporary rather than structural.

Bitcoin’s Macro Outlook Heading Into 2026

While short-term BTC price prediction models highlight possible retracements, the long-term thesis for Bitcoin remains intact. Several macro factors could drive price appreciation through 2026.

Institutional Adoption Expands

Institutional adoption has fundamentally changed Bitcoin’s market structure. Pension funds, hedge funds, and corporations are allocating capital to BTC, reinforcing its role as digital gold. This structural demand significantly influences long-term BTC price prediction scenarios. As regulatory clarity improves globally, more traditional investors may enter the space. This capital inflow strengthens Bitcoin’s position at the center of the crypto ecosystem.

Supply Dynamics and Halving Cycles

Bitcoin’s programmed scarcity continues to play a major role in every BTC price prediction analysis. With a fixed supply cap of 21 million coins and periodic halving events reducing mining rewards, supply shocks historically precede bull markets. As we approach 2026, reduced issuance combined with sustained demand could create favorable conditions for renewed upward momentum after any short-term pullback.

Uniswap Surges: DeFi Momentum Returns

While Bitcoin consolidates, Uniswap surges on the back of renewed interest in decentralized finance. As one of the largest decentralized exchanges (DEXs), Uniswap benefits from increased trading volume during volatile periods.

Why Uniswap Is Gaining Strength

The recent movement where Uniswap surges can be attributed to growing liquidity across decentralized platforms. As traders rotate out of Bitcoin during pullbacks, many turn to altcoins and DeFi tokens for higher yield opportunities. Uniswap’s protocol revenue, governance upgrades, and cross-chain expansion have enhanced its value proposition. Investors now see Uniswap not just as a DEX token but as a core infrastructure asset within Web3 finance.

The Broader DeFi Revival

The fact that Uniswap surges may also signal a broader revival in decentralized finance. Total Value Locked (TVL) across DeFi platforms has begun climbing again, indicating renewed investor confidence. When Bitcoin consolidates, capital often flows into high-beta assets. Uniswap’s strength suggests that investors anticipate continued activity in decentralized trading, lending, and yield generation platforms.

Capital Rotation: From Bitcoin to High-Growth Altcoins

Crypto markets operate in cycles. Historically, when the BTC price prediction indicates short-term stagnation or pullback, altcoins often experience explosive growth phases. This rotation is driven by risk appetite. Bitcoin acts as a relatively stable anchor within crypto, while smaller-cap tokens offer outsized upside potential. As traders seek higher returns, liquidity shifts into promising projects with innovative use cases.

Best Altcoin to Invest in 2026 Surges With 8,000% ROI

Amid Bitcoin’s consolidation and as Uniswap surges, one emerging project has captured attention as the best altcoin to invest in 2026. Delivering an eye-catching 8,000% ROI during its growth phase, this altcoin reflects how early-stage crypto investments can outperform even established giants.

What Drives Explosive Altcoin Growth?

Several factors typically define the best altcoin to invest in 2026: First, strong utility. Projects offering scalable blockchain solutions, AI integration, or decentralized infrastructure often attract sustained adoption.

Second, tokenomics. Scarcity models, staking incentives, and burn mechanisms can amplify price appreciation.

Third, community momentum. Crypto markets thrive on network effects, and engaged communities fuel visibility and demand. The altcoin delivering 8,000% ROI appears to combine these elements effectively, positioning itself for continued relevance through 2026.

Innovation and Market Positioning

Unlike speculative tokens without real-world application, the best altcoin to invest in 2026 often focuses on solving critical blockchain limitations. Whether through faster transaction speeds, interoperability, or real-world asset tokenization, innovation plays a key role. This particular altcoin’s growth trajectory suggests it has captured a niche within the evolving Web3 ecosystem. As institutions explore blockchain integration, scalable and efficient platforms may dominate future narratives.

Risk Management in a Volatile Market

While the BTC price prediction highlights potential pullbacks and altcoins show impressive ROI, risk management remains essential. Cryptocurrency markets are inherently volatile. An 8,000% surge can be followed by significant corrections. Diversification across Bitcoin, established DeFi tokens like Uniswap, and carefully researched altcoins may reduce exposure to extreme swings. Investors should also monitor macroeconomic factors such as interest rates, regulatory announcements, and global liquidity conditions, as these variables significantly impact digital assets.

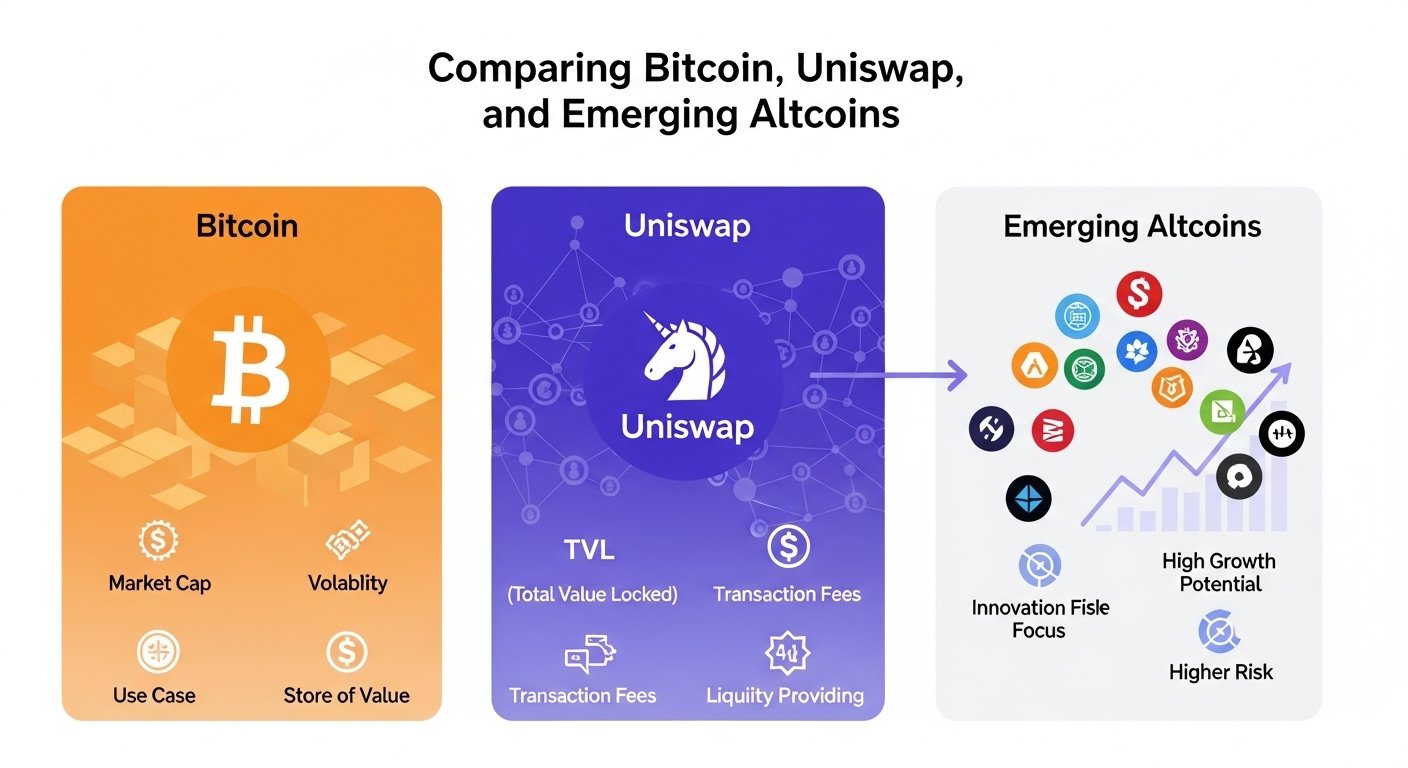

Comparing Bitcoin, Uniswap, and Emerging Altcoins

To understand the broader market dynamic, it’s useful to compare these three segments. Bitcoin represents stability and long-term store-of-value potential. The ongoing BTC price prediction debate revolves around timing and cyclical corrections rather than existential threats. Uniswap represents decentralized infrastructure growth. When Uniswap surges, it often reflects rising trading activity and broader DeFi adoption. Emerging altcoins represent asymmetric opportunity. The best altcoin to invest in 2026 could deliver exponential returns, but it carries higher volatility and risk. Together, these assets form a layered strategy for crypto investors navigating 2026.

Market Outlook for 2026: What to Expect

Looking ahead, the crypto market may become increasingly segmented. Bitcoin could solidify its role as a macro hedge asset. DeFi tokens like Uniswap may anchor decentralized finance expansion. Meanwhile, innovative altcoins could redefine industries through blockchain integration. The evolving BTC price prediction suggests that short-term volatility should not overshadow long-term growth potential. As regulatory clarity improves and institutional participation increases, the market could enter a more mature phase. However, volatility will remain part of the equation. Strategic accumulation during pullbacks and disciplined profit-taking during surges may define successful investment approaches.

Conclusion

The latest BTC price prediction indicates a possible short-term pullback as Bitcoin consolidates after strong gains. Rather than signaling weakness, this phase may represent a healthy reset within a broader bullish cycle. At the same time, as Uniswap surges, the resurgence of decentralized finance highlights renewed investor appetite for innovative blockchain applications. Meanwhile, the emergence of a project labeled the best altcoin to invest in 2026, boasting an 8,000% ROI, underscores the explosive potential within the altcoin sector.

Navigating this landscape requires balance. Bitcoin offers foundational strength, Uniswap represents DeFi momentum, and emerging altcoins provide high-risk, high-reward opportunities. Investors who remain informed, diversified, and strategic may be best positioned to capitalize on the evolving crypto narrative heading into 2026.

FAQs

Q: What does the latest BTC price prediction suggest?

The latest BTC price prediction indicates a potential short-term pullback due to overbought technical conditions, but the long-term outlook remains bullish.

Q: Why is Uniswap surging right now?

Uniswap surges as decentralized finance activity increases, trading volumes rise, and investor confidence returns to DeFi platforms.

Q: Is Bitcoin still a good long-term investment?

Many analysts believe Bitcoin remains a strong long-term investment due to institutional adoption, limited supply, and its position as digital gold.

Q: What makes an altcoin the best altcoin to invest in 2026?

The best altcoin to invest in 2026 typically demonstrates strong utility, innovative technology, solid tokenomics, and growing community adoption.

Q: How can investors manage risk in crypto markets?

Investors can manage risk by diversifying portfolios, conducting thorough research, monitoring market trends, and avoiding emotional trading decisions.