Bitcoin’s Journey to $100K Fink and Trump’s Bold Predictions

Bitcoin price $100K For investors, IT buffs, and financial professionals alike, the Bitcoin price has long been a subject of obsession. Being the first distributed cryptocurrency in the world, it has seen doubt, instability, and even direct hatred. Still, Bitcoin has shown amazing fortitude and expansion in these difficulties.

Following BlackRock CEO Larry Fink’s audacious forecast, the theory that Bitcoin could reach a price of $100,000 has recently gained popularity. The odd support of this aim by none other than former U.S. President Donald Trump adds mystery to this prediction. His validation of Fink’s forecast has created waves in the financial industry, leaving many wondering whether Bitcoin is headed toward the sought-after $100K level.

Larry Fink’s Bitcoin Transformation

Originally among Bitcoin price $100K most strident detractors, Larry Fink has been a major player in the finance industry for decades. As BlackRock’s CEO, the biggest asset manager in the world, Fink’s opinions on Bitcoin have great weight. He was wary about the volatility of Bitcoin and its possible safety value. However, Fink made a significant change in 2021, realizing Bitcoin might develop as a “store of value.” This marked a dramatic shift from his previous position and indicated increasing acceptance of cryptocurrencies by reputable financial organizations.

One daring prediction made by Fink was that Bitcoin would one day be worth $100,000. He said a Bitcoin price of $100k might upset established financial systems because of its distributed character and limited availability. Though still hypothetical, this forecast was not made in a vacuum. It reflected the growing curiosity in cryptocurrencies from institutional investors, including MicroStrategy, Tesla, and Square, who had started to see Bitcoin not only as a speculative asset but also as a valid store of wealth.

Fink’s comments have considerably more weight when Bitcoin attracted traction among institutional participants. BlackRock started looking at methods to provide investment products linked to Bitcoin and cryptocurrencies, confirming the possibility of cryptocurrency becoming a mainstay of conventional finance.

Trump Backs Bitcoin

Donald Trump’s public support of Fink’s $100,000 estimate was what caught people’s attention in recent weeks. Previously dubious about Bitcoin, Trump even referred to it as a “scam” in past interviews, shocking many by supporting the theory that the price of Bitcoin might reach the $100,000 level.

Trump’s remarks during an interview concerning the future of Bitcoin and whether he believed it could reach such a high price revealed that, in a rare moment of agreement with a financial industry executive such as Fink, Trump said that Bitcoin was becoming increasingly credible and would appreciably increase in value. Given Trump’s past impact on business and politics, his support gave Fink’s forecast more legitimacy.

Although Trump’s views often cause controversy, his acknowledgement of Bitcoin’s potential reminded us of the rising acceptance of cryptocurrencies in the world economy. The former president’s remarks underlined how Bitcoin has evolved from a niche asset to a topic of discussion among the highest levels of authority, in the corporate sector, and on the political scene.

Bitcoin Price Surge

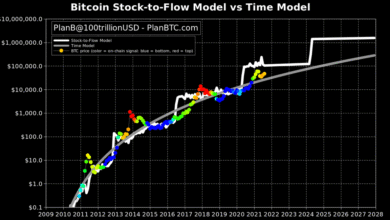

Though Bitcoin’s price is somewhat erratic and influenced by multiple global and technical events, several elements might propel it to $100K or above.

Institutional adoption is one important determinant. The resulting demand surge might greatly raise the price if major institutional players, such as hedge funds, asset managers, or even sovereign wealth funds, begin more extensively investing in Bitcoin. Further price swings as more capital enters the market could result from accepting ETFs (exchange-traded funds) in significant markets, making Bitcoin more available to retail and institutional investors.

Global economic considerations are also rather important. As a hedge against conventional fiat currencies, Bitcoin could appeal more during great inflation or devaluation. Should central banks keep printing money, Bitcoin would draw more investors seeking a fixed-supply asset free from the same inflationary pressures as fiat currencies. Bitcoin has already been a popular substitute store of value and medium of trade in some nations experiencing hyperinflation or unstable currencies; this trend may spread worldwide.

Final thoughts

This essay offers a perceptive analysis of Bitcoin’s expanding importance in the financial scene, particularly from the points of view of powerful people like BlackRock CEO Larry Fink and former President Donald Trump. The change in attitude toward Bitcoin, particularly among well-known people, points to its growing popularity inside the mainstream financial scene.

Especially notable is Larry Fink’s shift of opinion on Bitcoin. Originally a skeptic, Fink now sees Bitcoin as a possible “store of value,” which fits its rising acceptance by institutional investors. Not only from BlackRock’s perspective but also from a larger trend of institutional interest in cryptocurrencies, his audacious forecast that Bitcoin may finally hit $100,000 has weight. Bitcoin is now considered a substitute for conventional financial instruments rather than only a speculative asset. BlackRock’s research into investment products connected to Bitcoin and cryptocurrencies also points to this change.