Bitcoin’s Institutional Adoption and Price Surge: $111,000

Long the subject of great conjecture, Bitcoin (BTC) is the first and most well-known Cryptocurrency Market available worldwide. Though erratic, the digital asset has shown an amazing increase over time, which many analysts believe may cause Bitcoin to approach fresh all-time highs.

According to one of the more hopeful estimates, Bitcoin might climb to $111,000. Unilabs, which lately opened a Bitcoin fund with $30 million in assets under management (AUM), emphasizes simultaneously Bitcoin’s growing institutional acceptance. The elements causing Bitcoin’s possible price spike, the function of institutional investments, and the relevance of Unilabs’ Bitcoin fund are investigated in this paper.

Bitcoin’s Price Surge: Institutional Adoption and Future Projections

Much debate among the bitcoin community has centered on whether or not Bitcoin will reach $111,000. Currently selling between $30,000 and $40,000, Bitcoin is a far cry from its all-time high of about $69,000 in 2021. Still, a number of elements point to Bitcoin’s price likely breaking over its latest high and maybe rising to $111,000 in the next months or years.

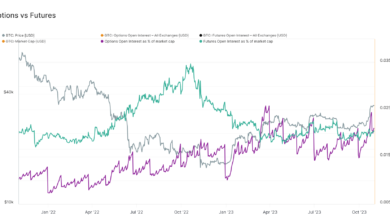

Institutional adoption is among the most important elements driving Bitcoin’s increasing price. More financial institutions, hedge funds, and publicly traded firms have begun to see Bitcoin not only as a speculative asset but also as a real store of value during the past few years. Significant businesses such as Tesla, MicroStrategy, and Square have massively invested in Bitcoin, hence increasing market liquidity and public confidence in the commodity.

For a number of reasons—its distributed character, limited quantity of 21 million coins, and ability to fight inflation—instinctive institutions find attraction in Bitcoin. Bitcoin’s demand increases as more colleges join the market, therefore driving its price as well.

Impact of Regulatory Clarity on Bitcoin’s Market Adoption

More regulatory certainty helps to favorably affect the price path of bitcoin. Lack of worldwide regulations in the past meant that cryptocurrencies, including Bitcoin, were quite unknown. Many institutional investors paused before making investments in digital assets due to this uncertainty. Nonetheless, institutional players are more ready to interact with the market as nations such as the United States, Canada, and several European countries implement clearer legislative policies.

For instance, the acceptance of Bitcoin futures ETFs in the United States has opened a more controlled and easily available investing path for conventional investors. This action has been crucial in validating Bitcoin and might result in more general acceptance, thus influencing its price.

Bitcoin’s Supply Limits and Halving

Given its natural scarcity, Bitcoin has been compared to “digital gold.” The total quantity of the bitcoin is limited to 21 million coins; hence, knowing why Bitcoin has such great increasing price potential depends on knowing this fixed supply. The restricted supply of Bitcoin as demand rises—especially from institutional players—may drive its price higher.

Furthermore, every four years the halving cycle of Bitcoin lowers the mining earnings by half. This incident slows the flow of fresh Bitcoin, so limiting supply even further. Historically, the price of Bitcoin has skyrocketed following halving occurrences since lowered supply in line with rising demand generates upward price pressure. 2024 is likely to be the next halving; many experts think this will drive Bitcoin toward unprecedented highs.

Unilabs Launches Bitcoin Fund

Unilabs, an asset management company, has opened a Bitcoin fund with $30 million in assets under management (AUM), therefore highlighting the rising institutional acceptance of Bitcoin. This fund gives qualified investors access to Bitcoin without personally buying and handling the coin.

Unilabs’s choice to join the Bitcoin market with a committed fund shows that big investors are growing at ease with cryptocurrencies. Unilabs is giving a controlled environment for investors to get Bitcoin exposure by creating a Bitcoin fund, therefore avoiding the complications of direct cryptocurrency transactions, including wallet and private key management. The $30 million AUM of the fund reveals notable institutional faith in the long-term future of Bitcoin.

The establishment of the fund follows a larger pattern whereby asset management companies are progressively offering investing solutions with an eye toward cryptocurrencies. The liquidity of the market improves as more institutions include Bitcoin and other cryptocurrencies in their portfolios, therefore laying a strong basis for the price increase of Bitcoin.

Institutional Interest Boosts Bitcoin Adoption

The success of Unilabs’ Bitcoin fund reflects institutional investors’ increasing curiosity about digital assets. Seeing Bitcoin as a hedge against inflation and an asset with great growth potential, many conventional investment companies are today adding it into their diverse portfolios. The demand for Bitcoin, which is probably going to drive its price higher, is further driven by the money inflow from institutional investors.

Moreover, institutional Bitcoin investing has a knock-on impact, motivating ordinary investors to match behavior. As institutional investors keep joining the market, they set off a chain reaction that results in more acceptance and use of Bitcoin, therefore increasing the value of the currency.

Factors Influencing Bitcoin’s Potential Rise to $111,000

Although the Bitcoin Price might definitely hit $111,000, exact timing is challenging. The price of Bitcoin will be influenced by elements including the world economic situation, ongoing institutional investment expansion, legislative changes, and technological breakthroughs in the crypto industry.

Having said that, the historical performance of Bitcoin, the approaching halving cycle, and the growing number of institutional players joining the market combine to create a price rise to $111,000 feasible. Though with the volatility usual of the crypto market, analysts believe the price of Bitcoin will keep rising. Thus, even if short-term swings are unavoidable, the long-term future of Bitcoin seems bright.

Final thoughts

Strong institutional acceptance, growing legal clarity, and Bitcoin’s natural scarcity help to support its possible new all-time high of $111,000. Furthermore, with its $30 million AUM, the recent introduction of Unilabs’ Bitcoin fund emphasizes the mounting institutional trust in Bitcoin as a respectable asset class.

Bitcoin’s price is probably going to experience further increasing momentum as institutional capital keeps pouring into the market, making the $111,000 price estimate more realistic. Although there are still hazards, the long-term future of Bitcoin is clearly bright, and it might very well exceed past price highs in the next years.