Bitcoin’s Future at the UNGA Why It Matters Now

Bitcoin has outgrown its origins as a cypherpunk experiment. It is now a geopolitical subject that surfaces in cabinet rooms, at central bank roundtables, and—most notably in recent years—around the United Nations General Assembly (UNGA). During UNGA weeks, heads of state and ministers converge on New York to discuss war and peace, development and technology, and increasingly, the question of how open, borderless digital money will intersect with national priorities. That is where the phrase “Bitcoin for the future” resonates: not as a slogan for speculators, but as a shorthand for the financial inclusion, sovereignty, and innovation debates nations bring to the world’s largest diplomatic stage.

This evolution has not been accidental. When El Salvador made Bitcoin legal tender in 2021, the country’s president, Nayib Bukele, placed the asset on the front pages of global media and, by extension, on the agendas of world forums. His UN appearances—and the global discussion surrounding them—turned Bitcoin adoption into a test case for the developing world, even as international institutions urged caution. In parallel, side events during UNGA weeks have showcased Bitcoin circular economies, indicating that grassroots usage is part of the broader policy conversation taking shape in New York each September.

Yet the UN system’s own organs have, at times, urged a measured approach to cryptocurrencies, stressing consumer protection, macro-prudential risk, and the need for coherent regulation. The divergence between innovation narratives and institutional caution is precisely why UNGA week has become such a potent lens: it is where Bitcoin’s promise meets the realities of governance, development, and law.

The UN General Assembly: Why it’s become a Bitcoin bellwether

A forum where national experiments meet multilateral scrutiny

The UNGA’s general debate gives every member state a microphone. Countries that are piloting Bitcoin policy or considering digital asset frameworks can place these issues within broader narratives—sovereignty, development, or modernisation. The UN’s own portal underscores this unique structure: a week where leaders set out priorities and signal policy trajectories, often generating downstream work for agencies and negotiators. When Bitcoin enters these speeches, side events, or bilateral meetings, it hints at where the global conversation might move next.

El Salvador’s spotlight effect

El Salvador’s decision to adopt Bitcoin as legal tender stands as a watershed moment and the anchor point for its visibility at global summits. The move—passed by the Legislative Assembly in June 2021—reframed the digital currency’s role from investment asset to national payments instrument, a change that continues to shape discussions at forums like the UN. Whether applauded as bold or criticised as risky, the policy ensured that whenever El Salvador’s delegation appears at UNGA, Bitcoin follows close behind in journalists’ and diplomats’ questions.

In 2021, Bukele’s UN appearance coincided with El Salvador’s early roll-out period, and coverage captured the global attention this generated. Even when Bitcoin was not the explicit centrepiece of a speech, the broader policy pivot—and its implications for development, remittances, and financial access—remained top of mind for observers parsing UNGA narratives. That early media framing, showing Bukele addressing the Assembly amid the launch, helped cement Bitcoin as a subject worthy of summit-level scrutiny.

Side events and circular economies during UNGA week

UNGA week is more than speeches. It’s a constellation of policy convenings and private sector forums that orbit the main debate. In recent seasons, sessions focused on Bitcoin circular economies have highlighted how bottom-up adoption—local merchants, community wallets, remittance corridors—can complement high-level policy. These gatherings have brought founders and operators into dialogue with policymakers who are iterating on financial inclusion agendas. The net effect: Bitcoin usage stories move from conference halls into the diplomatic bloodstream.

“Bitcoin for the future”: What governments and agencies actually mean

From speculative asset to strategic infrastructure

When officials cast Bitcoin as “for the future,” they are typically talking about resilience and optionality. For some countries, the argument is that an open, non-sovereign settlement rail can function as infrastructure—a neutral network that citizens and businesses can rely on even when correspondent banking is expensive or brittle. El Salvador’s experiment is the canonical case, and it continues to evolve as the government refines what “legal tender” looks like in practice and in law.

Inclusion, remittances, and the Global South agenda

Another reason Bitcoin features around the UNGA is the Global South development lens. Nations with large diasporas and remittance inflows see potential in lowering costs and expanding access. Pakistan-focused commentary during UNGA80 framed digital assets less as speculation and more as a survival tool for financial inclusion—an example of how countries are attempting to recast crypto in development terms on a world stage that listens for precisely these narratives. While such positioning is aspirational and still unfolding, its emergence during UNGA underscores how Bitcoin policy is being debated within multilateral development frames.

The regulatory counterpoint: UN-linked cautions

Balanced against those ambitions are UN trade and development bodies, emphasising risk management. UNCTAD reports have repeatedly urged countries to address consumer protection, capital flow monitoring, and systemic risk, especially given the rapid growth of cryptocurrency usage post-COVID. This tension—innovation versus oversight—tends to surface during UNGA week: a public forum where both the promise and pitfalls of Bitcoin are presented to the same global audience.

Case study: El Salvador’s evolving Bitcoin policy as seen through the UN lens

The adoption that changed the conversation

El Salvador’s 2021 law made Bitcoin legal tender alongside the U.S. dollar, and the world took notice. The move became a reference point cited by journalists covering UNGA, and by policymakers dissecting what “legal tender” means in a digital context. The law’s enactment proved that national-level Bitcoin policy was not merely hypothetical. It could pass, be implemented, and feed into a country’s development narrative—especially in venues like the UN, where national experiments are either praised as pioneering or critiqued as risky.

Adjustments, IMF dynamics, and legal fine-tuning

As with any first-of-its-kind law, El Salvador has iterated. Media and financial outlets report on legal refinements and IMF program conditions shaping the contours of the policy—clarifying the status of Bitcoin while maintaining elements of its legal tender role. The effect on UNGA-week discourse is tangible: the story is no longer simply “one country adopted Bitcoin,” but “one country is integrating a Bitcoin strategy into broader economic management, debt negotiations, and institutional engagement.” That richer, more nuanced narrative is exactly the kind of complexity diplomatic forums are built to examine.

Signal to peer nations

Other countries study El Salvador’s example when crafting their own digital asset strategies. By the time UNGA week arrives, ministers and central bank officials have fresh questions: What did El Salvador learn about merchant acceptance? How did volatility affect fiscal communications? Did remittance channels meaningfully improve? That curiosity, expressed in bilateral meetings and panel discussions, keeps Bitcoin in the UNGA orbit—less as a headline-grabbing novelty and more as a policy case study with lessons to extract.

What the UNGA context reveals about Bitcoin’s trajectory

Bitcoin as a development conversation, not justa market story

Financial headlines tend to frame Bitcoin in terms of price action and investment flows. UNGA reframes it as a development instrument—a tool that might lower payment friction, improve access to savings, and serve as a resilient settlement layer for cross-border commerce. That is why side events on Bitcoin circular economies and national speeches referencing digital inclusion sit comfortably alongside debates on climate adaptation and debt relief: they are all dimensions of building future-ready economies.

The rise of the pragmatic middle ground

The multilateral setting also encourages pragmatism. Even nations enthusiastic about Bitcoin accept that clear rules, consumer protections, and macro risk buffers are necessary. Meanwhile, agencies that stress caution acknowledge that innovation will not pause. The result is a middle-ground conversation: experiment with guardrails, measure outcomes, adjust. UNCTAD’s analyses exemplify how the system is pushing toward practical governance frameworks—an approach that aligns with how countries present their plans during UNGA.

Narrative power: Why words at UNGA move markets and policy

The UNGA pulpit confers narrative power. A head of state endorsing Bitcoin-driven inclusion at the UN is not the same as a tweet; it signals to ministries, regulators, and international lenders that a digital money agenda may shape budget priorities, legislative calendars, and cross-agency coordination. Conversely, a cautious line from a UN body can stiffen the spines of regulators preparing to draft stricter rules. That interplay between vision and veto, revealed in New York each year, is a critical barometer for Bitcoin’s future in public policy.

Thematic pillars shaping “Bitcoin for the future” at UNGA

Financial inclusion and remittances

For nations with significant remittance flows, Bitcoin promises cheaper, faster transfers. The argument runs that open networks and Lightning-enabled payments could keep more money in families’ pockets, thereby advancing SDG-aligned outcomes. El Salvador’s policy drew attention precisely because it attempted to formalise such channels at the national scale, inviting peers to assess whether similar benefits could hold in their contexts. Sceptics point out that user experience, education, and volatility are non-trivial hurdles—points frequently emphasised by UNCTAD and other UN-linked analysts.

Sovereignty and monetary optionality

Some leaders frame Bitcoin as an instrument of sovereignty—a way to diversify settlement options and lessen reliance on external financial intermediaries. This perspective surfaces at UNGA in conversations about south-south trade, sanctions exposure, and the costs of correspondent banking. Even where officials stop short of adoption, they increasingly discuss Bitcoin alongside CBDCs and instant payment rails as part of a broader monetary optionality strategy.

Regulation, risk, and the rule of law

UN-linked reports emphasise regulatory coherence. Without clear consumer protections and AML/CFT controls, Bitcoin markets can be vulnerable to abuse, and households can be exposed to losses. The balance many states seek—especially as they present their development agendas in New York—is to harness innovation without stoking instability. That is why frameworks, sandboxes, and phased pilots dominate the policy language around Bitcoin’s future at UNGA side events and press briefings.

The UNGA80 (2025) moment: Signals and subtext

A widening cast of actors

At UNGA80, the cast of actors engaging with the Bitcoin conversation broadened. Coverage and commentary highlighted attempts by Global South voices to reposition digital assets as part of inclusion and modernisation agendas, moving beyond the trope of “crypto speculation.” That reframing—whether in formal remarks, bilateral meetings, or media interviews—suggests the Bitcoin policy debate is maturing.

Lessons from El Salvador’s ongoing journey

In 2025, El Salvador’s relationship with Bitcoin continued to evolve under the watchful eye of international lenders and markets. Reporting noted both the government’s strategic reserve posture and program commitments with the IMF, reflecting an attempt to synchronise Bitcoin ambitions with macro-economic stewardship. For diplomats and observers in New York, that synchronisation—innovation tempered by conditions and clarifications—offered a textured case study.

Civil society, startups, and the circular economy layer

Meanwhile, entrepreneurs and NGOs used UNGA week to showcase Bitcoin circular economy pilots—merchant acceptance, community savings circles, and local energy-backed mining initiatives—arguing that these bottom-up stories help translate high-level policy into lived benefits. This civil society layer matters: it makes Bitcoin’s future more than rhetoric by demonstrating usage patterns that can inform lawmaking and regulation.

What policymakers should take from the UNGA Bitcoin discourse?

Start with real use-cases, not pricing.e

Speeches that resonate, emphasise use-cases—remittances, micro-commerce, treasury diversification within defined risk bands—rather than price charts. The UNGA format rewards that approach because it connects Bitcoin to development outcomes and public welfare, not just markets. Countries considering their own strategies can use the UNGA week to articulate problem statements and how open monetary networks might help solve them.

Pair experimentation with safeguards

The UN-linked literature is clear: experimentation must be paired with consumer protection, disclosure standards, and macroprudential oversight. Policymakers can carry this message credibly at UNGA if they show concrete safeguards—licensing thresholds, proof-of-reserves norms for custodians, or tiered KYC regimes for low-risk wallets—while still welcoming innovation. That balance reduces political risk and strengthens public trust.

Connect national pilots to multilateral dialogues.

UNGA is a staging ground for multilateral coordination. Countries can use it to request technical assistance, share data from pilots, and align with partners on cross-border standards. Doing so elevates national Bitcoin strategies from isolated experiments to contributing elements in a broader global architecture—precisely the kind of cooperation the UN system is designedto catalyse.

Media narratives and why they matter for adoption

The “first mover” effect

Global media chronicled El Salvador’s pioneering status, and those headlines reverberated through UNGA coverage. First movers shape the frame through which diplomats and development professionals view Bitcoin: as a governance challenge, an inclusion opportunity, or both. Even when policies are adjusted later, the initial narrative can set expectations for peers who are still deciding whether to explore Bitcoin integration.

From hype to habitat

A second narrative shift is unfolding: from hype to habitat. Coverage of Bitcoin circular economies during UNGA weeks moves the story from speculative cycles to real-world usage. When entrepreneurs describe merchants accepting Lightning payments or communities saving in Bitcoin to avoid local currency erosion, it reframes the asset as part of an emergent financial habitat rather than a passing craze. That is the kind of narrative credibility policymakers look for when defending experiments at home.

The caution chorus

Finally, sober assessments from UN bodies and other institutions provide a counter-melody. They remind audiences that consumer harm, capital flight, and regulatory arbitrage are real risks. Responsible media coverage incorporates these warnings, ensuring that enthusiasm for Bitcoin’s future is tempered with an informed assessment of tradeoffs. In UNGA settings, that balance is a feature, not a bug—it produces better policy.

The road ahead: What “Bitcoin for the future” could look like by UNGA85

Interoperable rails, plural money

In five years, expect more pluralistic payment stacks. Bitcoin will likely sit alongside domestic instant rails and, in some jurisdictions, CBDCs. Interoperability standards and cross-border settlement protocols will be key, and UNGA will remain a venue for airing lessons learned. The countries that do well will treat Bitcoin as a component of national payments resilience, not a silver bullet.

Regulation that moves from reactive to risk-based

We should also see a shift from reactive bans and moratoria to risk-based regulation—tiered rules for wallets, clearer categories for service providers, and international cooperation on enforcement. UNGA-adjacent conversations can accelerate that convergence by giving ministers and supervisors a shared set of terms and targets. Bitcoin’s maturation will track with this regulatory evolution.

Data-rich pilots and public dashboards

Lastly, expect more data transparency. Governments will publish pilot dashboards—merchant acceptance, transaction volumes, remittance cost changes—to move the Bitcoin policy debate from rhetoric to evidence. UN agencies and development banks can help by funding measurement frameworks, giving diplomats better tools to compare notes each September in New York.

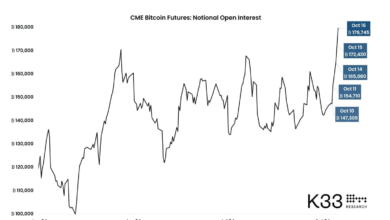

Also Read: Bitcoin Futures Open Interest Hits $80 Billion: Institutional Growth.

Conclusion

“Bitcoin for the future” is not a maximalist boast; it is a policy hypothesis unfolding in plain sight. The UN General Assembly has become one of the few venues where this hypothesis is publicly contested by presidents, ministers, UN officials, entrepreneurs, and civil society. El Salvador’s path first pulled the topic into the spotlight, UNGA side events gave it a lived texture through circular economies, and UN trade and development bodies supplied the cautions and frameworks that make better experiments possible.

However countries choose to proceed, one thing is clear: Bitcoin is now part of the global policy conversation about development, sovereignty, and the digital economy. That makes UNGA not just a stage for speeches, but a laboratory for the future of money.

FAQs

Q: Did any head of state explicitly endorse Bitcoin at the UN General Assembly?

El Salvador’s decision to adopt Bitcoin as legal tender made President Nayib Bukele the de facto political face of national-level adoption, and his UN appearances amplified the conversation—even when the currency wasn’t the sole theme of his speeches. The policy move itself ensured Bitcoin would be discussed around the UNGA.

Q: What role do UN agencies play in shaping Bitcoin policy debates?

Bodies linked to the UN system, such as UNCTAD, publish analyses that emphasise consumer protection, capital controls, and macro-prudential safeguards. Their work often becomes reference material for ministers and regulators speaking or meeting during UNGA week.

Q: Are there Bitcoin-focused events during UNGA week?

Yes. UNGA week attracts a dense calendar of side events. In recent seasons, sessions highlighting Bitcoin circular economies—use in remittances, local commerce, and community savings—have given policymakers concrete case studies to consider alongside formal speeches.

Q: How has El Salvador’s Bitcoin policy changed since 2021?

The core experiment remains, but there have been legal and programmatic adjustments to clarify Bitcoin’s role and align with international financing arrangements. Reporting in 2025 pointed to ongoing management of a strategic reserve within IMF program constraints, reflecting a more nuanced, institutionalised approach than in the first year.

Q: Why does UNGA matter for Bitcoin’s future?

UNGA gives every nation a platform and concentrates multilateral attention on development and governance. That makes it a natural arena to test, challenge, and refine Bitcoin narratives—from inclusion to regulation—before they become domestic policy. The visibility and credibility of the forum help accelerate learning and coordination.