Bitcoin Volatility in 2025 Key Drivers & Future Outlook

With its fast price swings and significant presence in the larger digital asset market, Bitcoin Volatility, the first and most powerful Cryptocurrency Market available worldwide, nevertheless attracts interest everywhere. Following a recent downturn below $77,000, Bitcoin is selling for almost $84,000 as of April 2025.

Though the causes of this volatility in Bitcoin are growing more complicated, it is not new for the currency. The leading causes of Bitcoin’s recent price swings will be discussed in this paper, together with an analysis of the trends guiding its future.

Bitcoin Volatility Surges

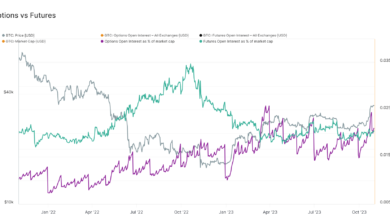

Early 2025’s volatility of Bitcoin has been shaped by macroeconomic events, investment behavior, and changing global policies combined. Bitcoin had significant rallies and extreme declines in the year’s first quarter. Prices fell by more than 10% in early April following an all-time high in March, then rebounded again. Much of this was related to political uncertainty following the U.S. presidential contest and growing worries about a worldwide recession.

Fascinatingly, researchers noted that although significant, this latest decline was less extreme than past years’ equivalent price adjustments. Given rising institutional investor and hedge fund engagement, the Bitcoin investors’ base could grow more mature and strong.

Another oddity this year is the somewhat high volatility on Tuesdays. The average realized volatility on Tuesdays in the past month has been 82%, which is significantly higher than on other days of the week, according to data. Analysts think this could result from institutional structured trading activity, which sometimes moves significantly early in the week following weekend news.

Key Drivers of Bitcoin Price Volatility in 2025

Several main factors drive the price swings of Bitcoin in 2025:

Market Sentiment Shifts

The shape of risk appetite is strongly influenced by economic uncertainty. All asset classes—including cryptocurrencies—are impacted by worries about a weakening global economy, changing interest rates, and geopolitical concerns. Particularly, the U.S. Federal Reserve’s choices on interest rates, which affect market liquidity, and central bank policies are under great observation by investors.

Crypto Policy Impact

Still, a significant component of Bitcoin’s volatility is regulation. Policy changes connected to cryptocurrencies in the United States, the European Union, and Asia are generating market waves. Although regulatory clarity should finally help to stabilize prices, investors are wary of the present uncertainty and continuous enforcement activities.

Recent regulatory operations against Crypto Market and wallet providers in various countries, for instance, have scared the market and momentarily lowered prices. Still, some confidence has been restored by the continuous need for better crypto rules, particularly concerning Bitcoin ETFs.

Institutional Bitcoin Involvement

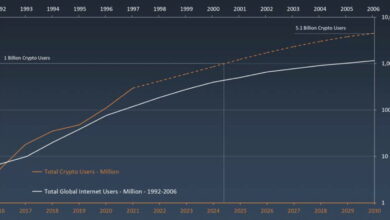

The increasing participation of institutional investors has been among the most notable positive patterns. The acceptance of numerous spot Bitcoin ETFs in early 2025 has allowed more conventional investors access to Bitcoin. Demand for these items has surged, which has helped to cause price swings.

Moreover, institutions are actively helping to shape market behavior. Many are using long-term plans, which could help to gradually lower significant short-term volatility.

Bitcoin’s Outlook in 2025

The future of Bitcoin in 2025 still looks somewhat cautiously hopeful. Many analysts think Bitcoin can reach fresh highs this year, with some projecting objectives between $150,000 and $200,000 by year-end. Scheduled for mid-2025, the Bitcoin halving is among the most awaited occurrences. Usually occurring every four years, this event lowers the block reward for miners and slows the rate of new Bitcoin entering circulation—historically, a powerful driver of price rises.

The increasing creativity in the fundamental technology of Bitcoin adds still another positive element. With new layer-2 Bitcoin advancements like the Stacks Nakamoto update, scalability is being improved, and faster, less expensive transactions are made possible. This increases the usability of Bitcoin for distributed apps and smart contracts, so perhaps extending its value and use.

Still, hazards exist. The crypto market is still somewhat fresh and quite sensitive to news. Still capable of causing significant sell-offs are technical flaws, macroeconomic shocks, and sudden legislative changes.

Final thoughts

The volatility of Bitcoin reflects changing character rather than an indication of weakness. It presents possibilities and difficulties as it moves from a speculative asset to a more developed segment of the financial system. The price swings in 2025 mirror a continuous struggle between macroeconomic uncertainty, institutional interest, and regulatory changes.

Although volatility will probably always be a feature of Bitcoin’s narrative for the foreseeable future, the long-term future seems bright for investors who recognize the dangers and are ready to negotiate them. As use rises, infrastructure improves, and more legislative clarity is on the horizon, Bitcoin might enter a new period when it becomes digital gold and a basic foundation of the financial terrain.