Bitcoin Surges to $102,000 Multiple Altcoins See Price Explosion!

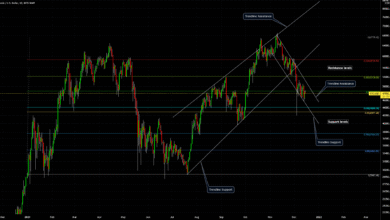

Bitcoin Surges to $102,000: The cryptocurrency market is ablaze as Bitcoin reaches an astonishing milestone, surging to $102,000. This landmark achievement has sent ripples through the market, with several altcoins also experiencing unprecedented price explosions. Can I Use Bitcoin for Everyday Purchases? Investors and enthusiasts alike are rejoicing as the market showcases its resilience and potential for growth.

Bitcoin Hits $102,000: What’s Driving the Rally?

Bitcoin, often referred to as digital gold, has once again proven its dominance in the cryptocurrency space. The recent surge can be attributed to a combination of factors:

- Institutional Investment: Institutional players, including hedge funds and publicly traded companies, have significantly increased their Bitcoin holdings, signaling long-term confidence in the asset.

- Macroeconomic Trends: Amid global economic uncertainty and inflation concerns, Bitcoin’s appeal as a hedge against traditional financial systems has grown.

- Increased Adoption: Countries and corporations adopting Bitcoin for transactions and reserves have boosted its credibility and demand.

- Scarcity Effect: With the limited supply of 21 million Bitcoins, growing demand naturally pushes prices higher.

Altcoins Riding the Wave

As Bitcoin’s price reaches new heights, many altcoins have followed suit, with some experiencing even more dramatic gains. Leading the charge are:

As Bitcoin’s price reaches new heights, many altcoins have followed suit, with some experiencing even more dramatic gains. Leading the charge are:

- Ethereum (ETH): Ethereum’s transition to a proof-of-stake model and its growing role in decentralized finance (DeFi) and NFTs have made it a favorite among investors. Its price has surged alongside Bitcoin’s rally.

- Solana (SOL): Known for its high transaction speeds and low fees, Solana continues to attract developers and projects, fueling its price growth.

- Cardano (ADA): With ongoing network upgrades and partnerships, Cardano remains a strong contender in the blockchain space.

- Polygon (MATIC): As a layer-2 scaling solution for Ethereum, Polygon’s utility in DeFi and dApps has propelled its value.

What This Means for Investors

The latest market movements have reignited interest in cryptocurrencies as a high-reward investment opportunity. However, with great potential comes significant risk. Here are some key considerations for investors:

- Volatility: Cryptocurrency prices can change rapidly, leading to substantial gains or losses in short periods.

- Diversification: While Bitcoin remains a stronghold, diversifying into promising altcoins can balance risk and reward.

- Research: Thoroughly understanding the projects and their use cases is essential before investing.

- Timing: Markets often experience corrections after major surges, so entering at the right time is crucial.

The Future of Cryptocurrencies

As Bitcoin sets new records, the broader cryptocurrency market is poised for further innovation and adoption. Blockchain technology continues to revolutionize industries, and cryptocurrencies are increasingly seen as a viable alternative to traditional financial systems.

Conclusion

For now, the excitement surrounding Bitcoin’s rise to $102,000 and the altcoin rally serves as a reminder of the market’s transformative potential. Whether you’re a seasoned investor or a newcomer, this is an exhilarating moment in the world of digital assets. The journey ahead promises to be just as dynamic and unpredictable as the market itself.

[sp_easyaccordion id=”5170″]