Bitcoin Surges Above $93,000 Amid US-China Trade Optimism

Bitcoin surged unexpectedly and rose above $93,000 for the first time, marking a pivotal moment in the Cryptocurrency Market. Investor confidence in U.S.-China trade negotiations and former President Donald Trump’s comments has boosted investor sentiment and altered market dynamics. Many people wonder: What’s behind this unusual price surge, and how is it related to geopolitics as Bitcoin sets records?

Bitcoin’s Rising Momentum

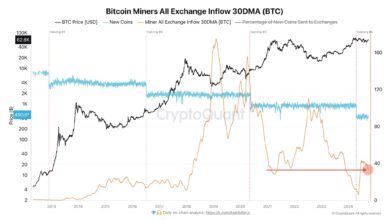

Both conventional financial markets and the Bitcoin surge community have taken note of Bitcoin’s climb to nearly $93,000. Having already witnessed notable increases over the past year, Bitcoin has now taken centre stage for investors seeking alternative assets in an uncertain economic environment. Although there have been erratic price swings under this new record, it has remained strong despite concerns about inflation, interest rates, and the global economic situation.

Many people attribute Bitcoin’s surge to several factors, including institutional acceptance and growing interest from ordinary investors. However, this most recent spike is related to a shift in investor mindset, brought about by the changing geopolitical environment, particularly in US-China relations.

Trump Trade Bitcoin

Market confidence has been much enhanced by recent remarks made by former President Donald Trump on U.S.-China trade negotiations. Trump showed hope for the prospect of an agreement that could help the two largest economies in the world ease their tariffs. His comments have generated buzz in industries ranging from technology to commodities to cryptocurrencies.

The apparent reduction in geopolitical concerns and the possibility of an economic recovery have inspired investors to view Bitcoin as a hedge against conventional market risks, especially in times of uncertainty, inflationary worries, and fiat currency instability. Bitcoin’s decentralised character and limited supply make it an appealing alternative. Bitcoin and other cryptocurrencies have become increasingly popular as safe-haven investments, as global markets look forward to a more seamless future. This scenario reminds me of times past when shifting global political tensions and economic policies drove the price of Bitcoin up.

Tariffs Inflation Bitcoin

Although not all investors recognise the apparent link between tariffs and Bitcoin’s value, trade policies, inflation, and digital asset prices are interconnected. In recent years, U.S. and Chinese tariffs on each other’s goods have raised manufacturing costs, consumer prices, and economic instability. These factors fueled inflationary fears, threatening the stability of the monetary system.

However, cryptocurrencies like Bitcoin are deemed inflation-resistant due to their 21 million coin supply. Bitcoin may have hedging value as inflationary pressures increase in conventional markets. The reduction of US-China tensions has stabilised global business and supply chains, which could lower inflationary pressures and boost Bitcoin’s investment appeal.

Trump’s comments on a potential trade war boost Bitcoin prices and increase global economic optimism. Before being sceptical of digital assets, investors are now more eager to diversify their portfolios with cryptocurrencies, driving the boom.

Bitcoin’s Institutional Adoption

Not only are geopolitical events responsible for Bitcoin’s current price explosion. However, with firms, investment money, and even governments expressing growing interest in blockchain technology and digital currencies, the larger Bitcoin market has seen notable institutional adoption recently. While nations like El Salvador have formally adopted Bitcoin as a legal tender, major financial companies, including PayPal, Square, and Fidelity, have integrated it into their systems.

The validity of Bitcoin as a mainstream investment grows in line with institutional demand. Large companies entering the market have provided further evidence for the long-term value proposition of digital assets. Together with the increase in retail involvement, these institutions have played a crucial role in driving the adoption of Inditcoin to unprecedented levels.

Moreover, the growing interest in distributed finance (DeFi) and the larger cryptocurrency ecosystem support Bitcoin’s rising position as a substitute asset class. Many investors are reconsidering their portfolios and exploring digital currencies, as they continue to outperform conventional assets.

Final thoughts

Although the current surge in Bitcoin is remarkable, analysts disagree on whether the coin can keep this momentum. Some analysts contend that, given the geopolitical environment remains positive and inflationary worries persist, Bitcoin may continue to rise higher. Others warn of potential corrections, noting Bitcoin’s inherent volatility and the likelihood of government actions aimed at dampening market enthusiasm.

One thing is certain, though: Bitcoin Surges has once more demonstrated its ability to transcend constraints and capture the imagination of people worldwide. The function of digital assets in the global financial system is growing in importance as they continually push new limits. Unquestionably, Bitcoin is on the radar of investors, governments, and institutions, both now and in the future. Whether the $93,000 level will be a fleeting peak or the beginning of a new phase in the coin’s growth remains unknown.

Bitcoin’s rise above $93,000 is due to Trump’s optimistic comments on U.S.-China trade relations, institutional acceptance, and rising inflation. It will be intriguing to see how Bitcoin interacts with the changing global economy and whether it can maintain its upward path despite potential challenges.