Bitcoin Shrugs Off Tariffs, Nears $68,000

Bitcoin has a habit of doing the opposite of what dramatic headlines suggest it “should” do. When the news cycle turns loud

Bitcoin has a habit of doing the opposite of what dramatic headlines suggest it “should” do. When the news cycle turns loud—especially around trade policy—many traders expect an instant wave of panic selling. Tariffs, after all, can reshape inflation expectations, corporate margins, supply chains, and consumer prices. They can also jolt traditional markets into a risk-off posture, pushing investors toward cash, short-term bonds, or other defensive trades. Yet the crypto market isn’t a mirror image of equities, and Bitcoin often trades to its own rhythm. That’s why the latest narrative—Bitcoin shrugs off Trump’s new tariffs—has been so compelling: rather than collapsing, Bitcoin has held firm and edged toward $68,000, while altcoins have led a modest bounce across the broader market.

To understand why this matters, it helps to look at what tariff headlines represent to investors. Tariffs can signal renewed economic friction and policy unpredictability. Markets price uncertainty fast, and when the policy path seems unclear, volatility can rise across multiple asset classes. But Bitcoin’s response has been notably contained. The coin’s stability near $68,000 suggests that traders are currently weighting other factors more heavily than trade-policy noise: liquidity conditions, expectations around interest rates, and the internal structure of the crypto market itself—leverage, derivatives positioning, and spot demand.

The second half of the story is just as important. As Bitcoin steadies, higher-risk assets typically wake up. That dynamic is playing out again: altcoins lead modest bounce in a way that feels cautious rather than euphoric. This is not a runaway rally where everything explodes higher at once. It’s a selective bid—an early rotation that often appears when traders believe the worst near-term downside is paused and the market can breathe. In this deep-dive, we’ll unpack why Bitcoin shrugs off Trump’s new tariffs, why $68,000 is a meaningful level, what it means that altcoins are driving the rebound, and how traders can think about the next phase without getting trapped by hype or fear.

Why tariff headlines usually shake markets and why Bitcoin stayed resilient

Tariffs are more than politics; they are a macroeconomic lever. When governments raise tariffs, import costs can climb. Companies either absorb those costs, cutting margins, or pass them along, raising prices. Either route can influence inflation trends, consumer behavior, and central-bank decisions. That’s why markets tend to react: tariffs can change the path of growth and inflation at the same time.

Bitcoin’s resilience in the face of tariff headlines can feel counterintuitive if you assume crypto behaves like stocks. But Bitcoin has distinct features that change the reaction function. It trades globally, continuously, and is often driven by a mix of macro sentiment and crypto-native mechanics. That means a scary headline can cause an initial wobble, but the follow-through depends on positioning, liquidity, and whether investors interpret the news as altering monetary conditions.

A key reason Bitcoin shrugs off Trump’s new tariffs is that crypto markets have become skilled at separating “headline heat” from “liquidity reality.” If tariffs are expected to tighten conditions—by keeping inflation sticky and rates higher—Bitcoin can struggle. If tariffs are seen as political theater with uncertain enforcement, the market may shrug and refocus on what’s actually moving flows: spot demand, ETF flows, derivatives funding, and the broader appetite for risk.

Market structure matters more than headlines

When traders talk about Bitcoin shrugging off a macro shock, they’re often describing market structure. If leverage is excessive—too many traders long with borrowed money—any negative headline can trigger liquidations. That creates a waterfall effect: forced selling pushes price down, which triggers more forced selling.

But if leverage is moderate, spot buying can absorb selling pressure. In that environment, Bitcoin can dip briefly and then stabilize. The result looks like resilience: the price holds, volatility cools, and the market returns to its prior range. This is crucial for understanding why Bitcoin can appear “unbothered.” The headline may be intense, but if the market is not positioned for disaster, the price reaction can be surprisingly muted.

Bitcoin’s hedge narrative resurfaces during policy conflict

Another reason Bitcoin shrugs off Trump’s new tariffs is narrative. During periods of political conflict or policy uncertainty, some investors lean into Bitcoin’s framing as a store of value, a non-sovereign asset, or a form of digital gold. Not everyone agrees with those labels, but markets don’t require universal belief—only enough participants trading the story for it to influence price. Tariffs also highlight geopolitical and trade fragmentation. In a world where policy shifts can arrive abruptly, a globally traded asset with a fixed supply narrative can attract incremental demand.

Why $68,000 is a big deal for Bitcoin

Bitcoin approaching $68,000 isn’t just a random number on a chart. Round-number zones act as psychological magnets. Traders cluster orders around them, analysts reference them repeatedly, and the market tends to test them multiple times. When Bitcoin nears $68,000, the question isn’t only “Will it go higher?” It’s “Will it hold this level, reject it, or consolidate around it?”

This level matters because Bitcoin often behaves like it is negotiating with liquidity. If there is heavy selling interest near $68,000, price can stall. If buy-side demand is strong, Bitcoin can push through, forcing sellers to chase higher or exit. Either way, $68,000 becomes a pivot that affects sentiment and how capital rotates into the rest of the crypto market. When Bitcoin holds a key level, it creates a sense of stability. That stability encourages traders to take calculated risk in altcoins, which is one reason altcoins lead modest bounce as Bitcoin steadies near $68,000.

Psychological levels and liquidity zones

There’s a practical reason why psychological levels matter: many strategies are automated. Some traders place buy orders just below key levels and sell orders just above them. Others set stops at obvious points. As price approaches a level like $68,000, the density of orders increases, which can create sudden bursts of volatility. If Bitcoin breaks above and holds, it can trigger short covering and fresh momentum buying. If it fails, it can prompt profit-taking and a return to lower support. This tug-of-war is why Bitcoin hovering near $68,000 can feel like a tense pause before the next move.

What holding near $68,000 signals to the market

When Bitcoin stays firm near a major level after a headline shock—like new tariffs—it signals strength. Not necessarily “bull market confirmed,” but strength in the sense that sellers could not seize control. That’s why the phrase Bitcoin shrugs off Trump’s new tariffs resonates: it implies that the market absorbed fear and moved on. This can improve confidence. And confidence is the fuel that powers rotation—especially into altcoins.

Bitcoin shrugs off Trump’s new tariffs: the real drivers behind the move

It’s tempting to attribute Bitcoin’s stability to a single factor. In reality, multiple forces are working together. When we say Bitcoin shrugs off Trump’s new tariffs, we’re describing a market that is prioritizing certain inputs over others.

Liquidity and the macro backdrop

Bitcoin tends to perform best when liquidity is expanding and worst when liquidity is tightening. Liquidity is influenced by interest rates, credit conditions, and the availability of capital for speculation. Tariffs can influence inflation, which can influence rates, which can influence liquidity—but that’s a chain reaction that takes time. In the short term, traders may not treat tariffs as an immediate liquidity event. If the market believes monetary conditions won’t change quickly, Bitcoin can remain stable. This is why Bitcoin can trade calmly even as the news cycle feels chaotic. Macro effects often arrive gradually, while markets react instantly only when they expect immediate policy shifts.

Derivatives positioning and funding dynamics

A huge portion of Bitcoin’s short-term movement comes from derivatives: perpetual futures, options, and leveraged positions. If funding rates are elevated, it suggests the market is crowded long. If funding is neutral or subdued, it suggests less leverage. When a headline hits, the market’s response depends on whether leverage needs to be flushed. If not, Bitcoin can hold steady. That’s part of what “shrugs off” can mean in a trading context: the market didn’t have an overextended position that needed to unwind violently.

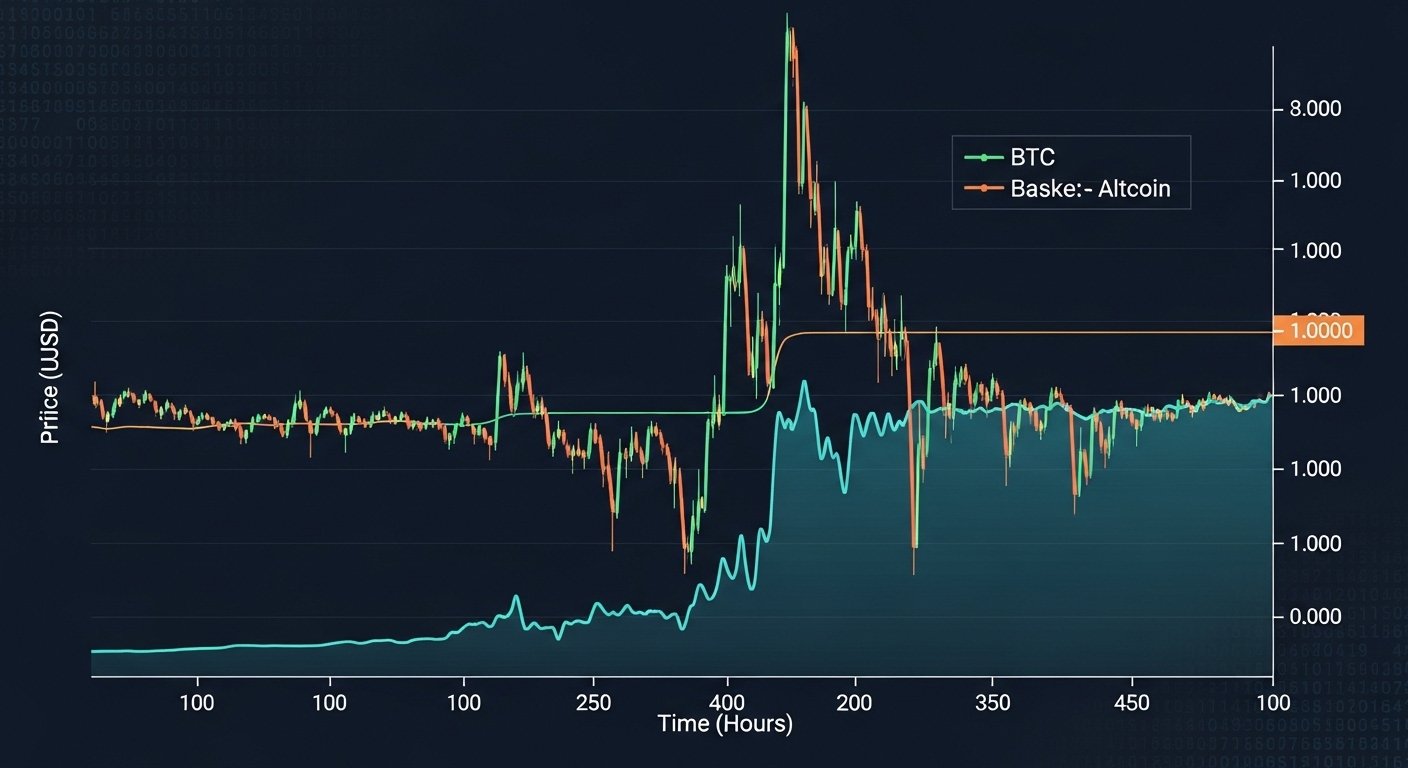

Bitcoin dominance and capital rotation

Another crucial concept is Bitcoin dominance, which measures Bitcoin’s share of total crypto market capitalization. When Bitcoin dominance rises, capital tends to stay concentrated in Bitcoin. When dominance falls, capital spreads into altcoins. A scenario where Bitcoin stabilizes near $68,000 and altcoins lead modest bounce often corresponds with a slight easing of Bitcoin dominance—traders feel safe enough to explore higher-beta opportunities. This is not guaranteed to continue, but it’s a recognizable rhythm in crypto cycles.

Altcoins lead modest bounce: why higher beta is winning

Altcoins are the market’s “risk dial.” When sentiment improves, they often respond faster than Bitcoin. When sentiment worsens, they often drop faster too. That’s why altcoins lead modest bounce is both exciting and cautionary: it suggests risk appetite is returning, but it also implies fragility if conditions shift. The most important point is that this is described as a modest bounce, not a full-blown altcoin season. In a modest bounce, gains are selective and driven by rotation rather than mania. Traders often focus on larger, more liquid altcoins first before moving into smaller assets.

Ethereum’s role in early rebounds

Ethereum often acts as the bridge between Bitcoin and the altcoin universe. When Bitcoin steadies, Ethereum tends to attract flows if traders believe risk appetite is improving. A healthy market often shows Ethereum participating alongside Bitcoin rather than lagging dramatically. When Ethereum and other large-cap altcoins start to outperform while Bitcoin holds its ground, it can create a feedback loop: traders see strength, confidence improves, and more capital rotates into altcoins.

Sector narratives and ecosystem strength

Altcoins don’t move as a single unit. They often rally in clusters based on narratives: Layer 2 scaling, DeFi, AI tokens, real-world assets, or gaming. During a modest bounce, one or two narratives can lead while others stay quiet.

Why altcoins can outperform when Bitcoin is stable

Bitcoin’s stability near $68,000 creates a “base camp” feeling. Traders become less worried about a sudden market crash and more willing to pursue returns. Since altcoins have higher upside potential in short bursts, they attract speculative flows. But this works only as long as Bitcoin remains stable. If Bitcoin breaks down, altcoins usually suffer more.

How Trump’s new tariffs could still influence Bitcoin and altcoins

Even if Bitcoin shrugs off Trump’s new tariffs today, tariffs can matter tomorrow. The market often reacts in stages. The first stage is the headline reaction. The second stage is the economic data reaction: if tariffs affect inflation or growth, the data will reflect it over time. The third stage is the central-bank reaction: policy makers respond to the data, which changes liquidity conditions.

Inflation risk and rate expectations

Tariffs can contribute to inflation by raising the cost of imported goods. If inflation becomes more persistent, central banks may be slower to cut rates. Higher rates can tighten financial conditions, which can pressure risk assets, including crypto. This channel is subtle but powerful. Bitcoin’s short-term resilience does not guarantee immunity if macro conditions tighten.

Dollar strength and global liquidity

Trade conflict can influence currency markets. In some scenarios, uncertainty can strengthen the U.S. dollar, which can reduce global liquidity in dollar terms. A stronger dollar has sometimes coincided with tighter conditions for risk assets. Bitcoin is global, but liquidity is often dollar-centered. That’s why the tariff narrative matters indirectly: it can affect currency flows that shape risk appetite.

Volatility spikes hit altcoins first

If tariff developments escalate abruptly, the market can shift from calm to panic. In those moments, altcoins often fall first because they are thinner and more speculative. That’s the trade-off embedded in altcoins lead modest bounce: upside comes with higher vulnerability. Bitcoin can sometimes act as the “least risky” crypto asset, but altcoins are more exposed to sudden sentiment shifts.

What to watch next: key signals for traders and investors

Bitcoin near $68,000 is a crossroads. The market can push higher, stall and consolidate, or drift lower into another choppy range. The outcome will depend on both macro signals and crypto-native mechanics.

Acceptance above resistance versus rejection into range

The market’s next step often hinges on whether Bitcoin can hold above key levels after testing them. If Bitcoin climbs above resistance and stays there, it can trigger momentum buying and strengthen sentiment. If Bitcoin repeatedly fails and retreats, it can reinforce choppy conditions where rallies are brief. In that environment, altcoin bounces tend to be shorter and more selective.

Spot demand and long-term holder behavior

Spot demand is a quieter force than leverage, but it’s more durable. When spot buyers step in during dips, Bitcoin stabilizes. When spot demand fades, derivatives can dominate, increasing volatility. Long-term holders also shape the market. If long-term holders remain confident, selling pressure is limited. If they begin distributing, rallies can struggle.

Risk appetite and market breadth across altcoins

A modest bounce can evolve into a stronger move if breadth expands. Watch whether multiple categories of altcoins participate or whether only a small cluster rallies. Broader participation often signals healthier demand. At the same time, a bounce fueled purely by hype can reverse quickly. Sustainable rebounds tend to show gradual strengthening rather than sudden vertical spikes.

Narrative alignment: tariffs, inflation, and liquidity

Ultimately, the tariff story matters most when it aligns with inflation and liquidity narratives. If tariffs appear to keep inflation elevated and rates high, that can cap risk appetite. If tariffs remain more political than economically disruptive, crypto may continue focusing on internal drivers. This is why Bitcoin can “shrug off” tariffs now but still remain sensitive later.

Conclusion

Bitcoin’s ability to hold steady and approach $68,000 while headlines swirl about Trump’s new tariffs highlights a central truth about crypto markets: price responds to liquidity, positioning, and narrative weight more than to headline intensity alone. In the current environment, Bitcoin shrugs off Trump’s new tariffs because traders appear to view the immediate impact as limited, while broader drivers—market structure, risk appetite, and macro expectations—remain the primary forces shaping price.

At the same time, the market’s rotation into higher-beta assets explains why altcoins lead modest bounce. This isn’t a euphoric surge; it’s a cautious rebound built on Bitcoin stability. If Bitcoin continues to hold near $68,000 and volatility remains contained, the altcoin bounce may broaden. If macro conditions tighten or tariff uncertainty escalates into real economic pressure, the rebound could fade—altcoins first, Bitcoin later. For now, the market is sending a clear message: Bitcoin is resilient, and traders are testing risk again—but they are doing it carefully, one level at a time.

FAQs

Q: Why does Bitcoin shrug off Trump’s new tariffs instead of dropping?

Bitcoin can remain stable during tariff news when traders believe the immediate liquidity impact is limited. If leverage is not overly crowded and spot demand holds, Bitcoin can absorb headline shocks without major downside.

Q: Why is $68,000 important for Bitcoin?

$68,000 is a psychological and liquidity-heavy zone where orders cluster. Bitcoin often reacts at these levels, either consolidating, rejecting, or breaking through in a way that influences sentiment across the crypto market.

Q: Why do altcoins lead modest bounce when Bitcoin is steady?

Altcoins have higher beta, meaning they can move more aggressively when risk appetite improves. When Bitcoin stabilizes, traders often rotate into altcoins seeking higher returns, which can lead to a modest bounce.

Q: Could tariffs still hurt Bitcoin later even if it’s fine now?

Yes. Tariffs can influence inflation and growth over time, potentially affecting interest-rate expectations and liquidity. If tariffs contribute to tighter financial conditions, that can pressure Bitcoin and altcoins.

Q: What are the best signals to watch next?

Watch Bitcoin’s behavior around key levels like $68,000, changes in volatility, spot demand during dips, and whether market breadth expands across altcoins. A broader, steadier participation often signals a healthier rebound.

Also Read: Bitcoin May Need $55K Ki Young Ju Recovery Signal