Bitcoin Rallies on U.S.-China Trade Deal Inflation Eases

Bitcoin rally, taking centre stage, is Bitcoin Price, whose price rocketed beyond the $100,000 mark and inspired investor expectations of a new all-time high above $109,000. Two significant macroeconomic events—the announcement of a historic U.S.-China trade deal and indications that U.S. inflation may be cooling—have set the stage for this comeback and helped risk assets, including cryptocurrency.

Bitcoin Rallies on Trade Deal

One of the primary drivers behind the latest Bitcoin rally is the newly announced trade agreement between the United States and China. After months of negotiations, the two economic giants reached a deal to reduce tariffs and improve bilateral trade relations. While this agreement does not eliminate all trade barriers, it represents a critical de-escalation of long-standing tensions that have unsettled global markets.

Investors have responded positively to the development, viewing it as a sign of potential stability in international commerce. This optimism has extended to the crypto market, where Bitcoin often benefits from geopolitical clarity. As global equity markets climbed in response to the news, digital assets followed suit, with Bitcoin gaining more than 4.5% in a single day to break through the $101,000 mark—a level not seen since early 2025.

Other major cryptocurrencies mirrored Bitcoin’s rise. Ethereum surged over 14% to $2,050, while altcoins like Solana and XRP posted moderate gains. The broader rally reinforces the narrative that crypto assets are increasingly seen as legitimate components of a diversified investment portfolio, especially during periods of economic transition.

Inflation Eases Outlook

Fueling the movement, current U.S. inflation figures have come in below projections. With a meager 0.2% month-over-month rise, the April Consumer Price Index (CPI) raised the annual inflation rate to 2.8%. With an annual rate of 3.1%, the core CPI, which separates out volatile food and energy prices, also climbed by 0.2%.

These numbers imply that inflation is slowing down following a protracted period of high prices starting in the wake of the COVID-19 epidemic and aggravated by worldwide supply chain interruptions. Less inflation usually translates to fewer expectations for interest rate increases, which supports speculative and growth-oriented assets.

Analysts point out that the Federal Reserve might adopt a more dovish monetary posture in the subsequent quarters should inflation keep falling. Reduced interest rates help lower the opportunity cost of owning non-yielding assets like Bitcoin, stimulating demand from institutional and ordinary investors.

Institutional Bitcoin Surge

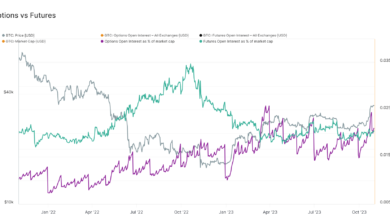

The increase in institutional investment, primarily through spot Bitcoin ETFs, is another strong tailwind influencing Bitcoin’s price movement. These funds, approved in early 2024, have opened the floodgates for capital flows from prominent asset managers, pension funds, and hedge funds formerly lacking simple access to cryptocurrency.

With over $39 billion in inflows thus far, spot Bitcoin ETFS highlight the increasing demand among institutions to gain exposure to the asset class. Citing ETF adoption, more general macro support, and enhanced mainstream integration, Standard Chartered analysts recently estimated that Bitcoin would reach as high as $500,000 by the end of President Trump’s current term.

A possible sign of Bitcoin’s rising role as a “digital gold” hedge in uncertain times is that its correlation to conventional assets has also somewhat dropped.

Bitcoin Bull Surge

Bitcoin is positioned to approach its previous all-time high of well over $109,000 as momentum from macroeconomic improvements and robust investor demand builds. After months of sluggish price movement, investor mood has turned sharply positive while technical indicators reflect optimistic trends.

Bitcoin was valued at about $103,848 as of May 12, 2025, having peaked near $105,000 intraday. The next significant resistance level is $109,000; a successful break could open the path for additional price discovery ground exploration.

Still, some prudence is justified. Future economic data, including jobless numbers and retail sales, could affect market mood. Any surprising geopolitical event could also lead to volatility. For now, though, declining inflation, better trade connections, and rising institutional involvement seem to be building the ideal storm for Bitcoin enthusiasts.