Bitcoin Price USD Prediction Latest Insights and Trends

Bitcoin, the oldest and with the greatest renown among cryptocurrencies, has had quite a developing trend since it was created in 2009. It has experienced extreme price swings but remains a fundamental part of the crypto market. By 2024, many investors, analysts, and crypto enthusiasts will be interested in the Bitcoin price forecast in USD. Bitcoin’s mechanism of breaking new records or catching bullet downgrades makes it even more important to study its price and the prognoses for its gliding or bouncing back. The likely mushrooms or vines that can affect Bitcoin’s price trajectory. The forthcoming months and years must be carried out.

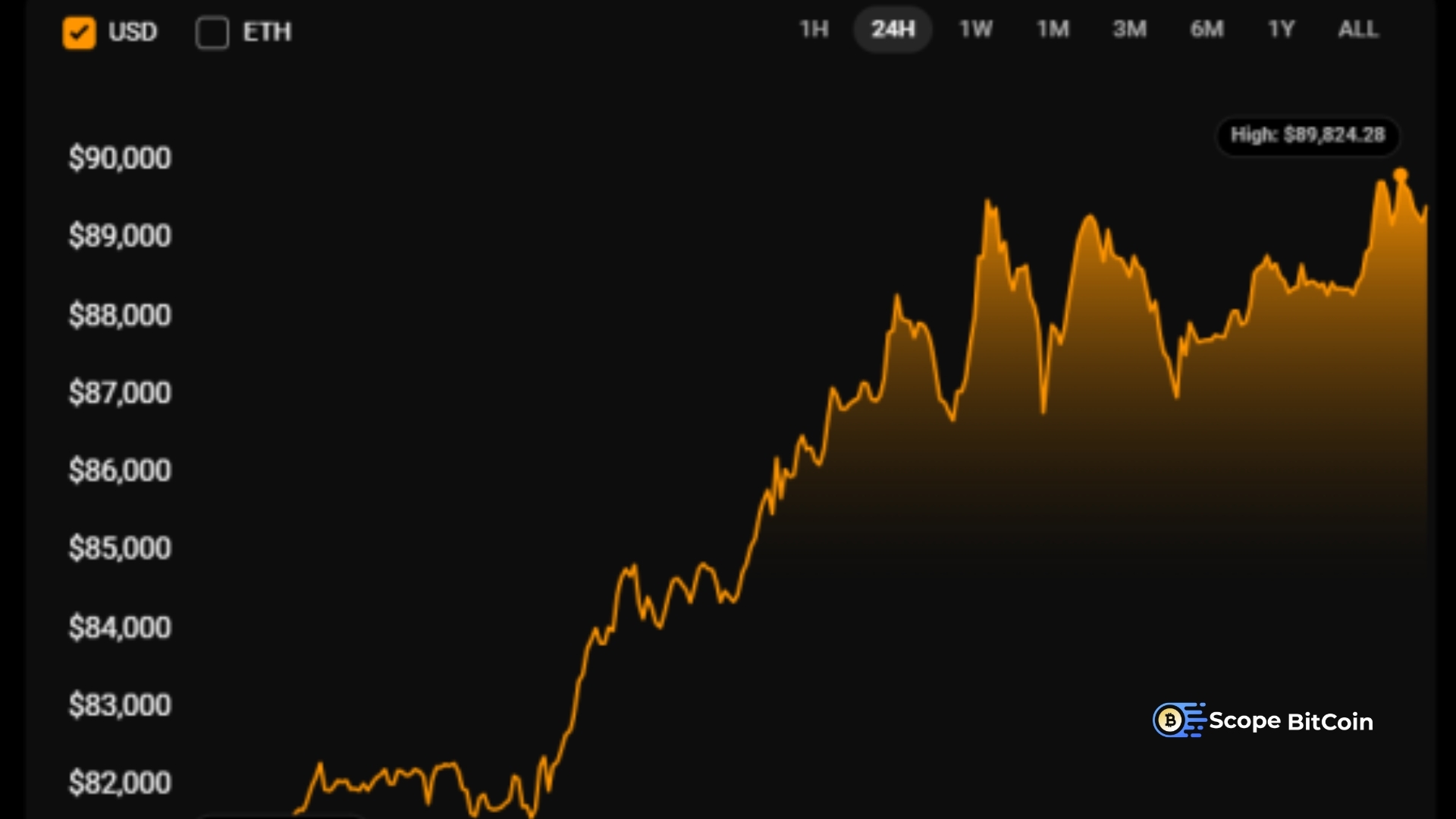

Current Bitcoin Price Trends in 2024

Bitcoin’s price prognosis, as of November 2024, indicates some ups and downs in the future. The predictions postulate that the price may oscillate between $64,246 and $94,480, with an average of about $75,584 by November 2024, approximately 13.93% lower than the previous peaks. The fluctuation of prices is expected to occur throughout December, with the rate remaining in the same range. According to some sources, Bitcoin will likely follow a slowly upward path in 2025 and the future, with prices over $100,000 in 2026. Nonetheless, these projections have been peers about such influences as market trends, legislative changes, and technological growth.

Bitcoin Price USD Prediction for the Near Term

Predicting Bitcoin’s short-term price is difficult due to the cryptocurrency’s high volatility. Yet, many analysts have predicted possible movements by applying some critical indicators.

$40,000 to USD 45,000: In the near term, Bitcoin could test the $40,000 to USD 45,000 range. This would represent a return to pre-2024 levels and a consolidation period. The price could increase if Bitcoin continues gaining mainstream acceptance and institutional investment. Key developments, like more Bitcoin ETFs (Exchange-Traded Funds) becoming available, could drive prices toward this level. Additionally, any bullish market sentiment, driven by global economic concerns or growing demand for cryptocurrencies, could push Bitcoin closer to USD 45,000.

$30,000 to USD 35,000: Another possibility is Bitcoin continuing to trade within the $30,000 to USD 35,000 range in the short term. This is where it has found some stability, and if the market sentiment remains mixed or uncertain, future prices could hover in this range for the remainder of 2024. Bitcoin’s stability during this period might attract new investors. Who were previously hesitant to enter the market during periods of heightened volatility.

$25,000 to USD 28,000: On the downside, Bitcoin could drop to the $25,000 to USD 28,000 range if broader financial markets experience significant downturns. A drop in investor interest, adverse regulatory news, or a stronger U.S. dollar could weigh heavily on Bitcoin’s price. However, such a price drop could present a buying opportunity for long-term investors who believe in Bitcoin’s future potential.

Long-Term Bitcoin Price Predictions

Long-term Bitcoin price predictions are more speculative because market conditions are uncertain. Still, many analysts forecast that Bitcoin’s value will increase significantly in the next five to ten years because of past trends and cryptocurrency growth.

$100,000 to USD 150,000: A standard long-term price prediction for Bitcoin places its value between $100,000 and USD 150,000. As Bitcoin’s supply continues to dwindle due to halving events, demand may outstrip supply, driving up the price. This estimate assumes continued adoption by institutions, more positive regulatory developments, and Bitcoin becoming an integral part of the global financial ecosystem.

$250,000 to USD 500,000: Some more bullish predictions suggest that Bitcoin could eventually reach $250,000 to USD 500,000, especially. The cryptocurrency gains global adoption and becomes a viable alternative to traditional fiat currencies. In this scenario, Bitcoin could become a dominant global asset driven by increasing demand and limited supply.

USD 1,000,000 and Beyond The most optimistic forecasts suggest that Bitcoin could eventually reach USD 1,000,000 per coin. Bitcoin might become a global reserve currency or standard payment method under a decentralized, non-sovereign financial system. This possibility is still hypothetical and depends on many aspects, including regulatory developments and Bitcoin’s scaling ability.

In Summary

The future price of Bitcoin can be highly ambiguous. However, there are strongly suggested indications that it will still play a crucial role in the monetary system for many years. In the short term perspective, Bitcoin’s value might fluctuate between $30,000 and $45,000 U.S.D., based on the market consensus and the economic climate. Long-term forecasts differ significantly. However, some analysts predict levels above USD 100,000 as institutional enrollment continues and the supply of Bitcoin stays unaltered.

Factors like market demand, regulatory changes, and macroeconomic conditions will determine the price of Bitcoin and the overall development of the cryptocurrency sector. Bitcoin’s volatile nature might be risky, but its capability to deliver significant long-term returns remains a drive that attracts investors and market players worldwide.

[sp_easyaccordion id=”4548″]