Bitcoin price today dips to $66K before CPI

Bitcoin price today slides toward $66K, eyeing a 4th weekly loss. All eyes on US CPI as traders brace for fresh crypto volatility.

Bitcoin price today is under renewed pressure as the world’s largest cryptocurrency edges closer to the $66,000 mark, raising concerns about a potential fourth consecutive weekly loss. After weeks of choppy price action, traders are navigating a tense macro environment dominated by inflation data, Federal Reserve policy expectations, and shifting risk appetite across global markets.

The current pullback in Bitcoin price today reflects a broader recalibration happening across financial markets. With the upcoming US Consumer Price Index (CPI) report looming, investors are reducing risk exposure and reassessing positions. The inflation reading could play a decisive role in determining the near-term trajectory of not just equities and bonds, but also the highly sensitive cryptocurrency market.

As Bitcoin price today hovers near key support levels, volatility is rising. The market is at a crossroads: either the $66K zone becomes a launchpad for recovery, or it opens the door for deeper downside. Understanding the forces behind this dip is essential for traders and long-term investors alike.

Why Bitcoin price today is slipping toward $66K

Bitcoin price today is reacting to a combination of macroeconomic caution and technical weakness. In recent sessions, sellers have gained the upper hand as traders de-risk ahead of the highly anticipated CPI report. Inflation data has become one of the most important catalysts for risk assets, and Bitcoin is no exception.

When inflation expectations rise, markets begin pricing in tighter monetary policy. Higher interest rates and elevated Treasury yields typically reduce appetite for speculative assets. As a result, Bitcoin price today has faced steady pressure, especially as traders anticipate potential surprises in the inflation data.

At the same time, price structure plays a role. Bitcoin price today has struggled to reclaim recent highs, forming a pattern of lower highs and weakening momentum. This technical setup often attracts short-term traders looking to capitalize on downside continuation.

Set for a 4th straight weekly loss: What it means

If Bitcoin price today closes the week in negative territory, it would mark a fourth consecutive weekly loss. While weekly streaks do not guarantee further declines, they can significantly impact sentiment. Extended losing streaks tend to shake confidence among retail traders and can trigger portfolio rebalancing among institutional participants. Weekly chart trends are widely monitored in the crypto space, and repeated red candles can signal short-term trend deterioration.

However, history shows that prolonged downside streaks in Bitcoin price today sometimes precede strong rebounds. Crypto markets are known for sharp reversals, especially when bearish positioning becomes overcrowded. The key question now is whether macro data will provide the catalyst for a turnaround or reinforce the bearish trend.

US CPI on tap: Why inflation data matters for Bitcoin price today

The upcoming US CPI release is the central event driving caution in Bitcoin price today. CPI measures changes in consumer prices and is one of the Federal Reserve’s primary gauges of inflation. Inflation data directly influences interest rate expectations. If CPI comes in hotter than expected, markets may push back expectations for rate cuts or even price in further tightening. Conversely, cooler inflation could revive hopes of a more accommodative policy stance. Bitcoin price today tends to respond quickly to shifts in rate expectations, as these affect liquidity conditions and overall risk sentiment. When financial conditions tighten, capital often flows away from volatile assets like cryptocurrencies.

The connection between CPI and crypto volatility

Bitcoin trades 24/7, but traditional financial markets often dictate the tone during major economic releases. Around CPI announcements, volatility in Bitcoin price today can spike sharply within minutes. This happens because traders rapidly adjust their positions based on how the inflation data alters the outlook for the Federal Reserve. Yields on government bonds and the US dollar frequently move first, and crypto markets follow. Pre-CPI positioning can also create exaggerated moves. Traders often reduce leverage ahead of major reports, which can temporarily weigh on Bitcoin price today even before the data is released.

Inflation, interest rates, and liquidity

The broader relationship between inflation and Bitcoin price today revolves around liquidity. When central banks keep rates high to combat inflation, borrowing costs increase and liquidity tightens. Reduced liquidity can dampen enthusiasm for speculative investments. On the other hand, signs that inflation is cooling can improve liquidity expectations. A softer CPI reading may support the narrative that monetary conditions could ease, potentially benefiting Bitcoin price today.

Technical outlook: Key levels around $66K

Bitcoin price today is approaching an important technical zone around $66,000. Psychological price levels often serve as magnets for trading activity. Round numbers attract attention, concentrate stop orders, and influence options positioning. If Bitcoin price today holds above this level, buyers may attempt to build a base for a rebound. A successful defense of support could encourage dip-buying and short covering. However, a decisive breakdown below $66K could accelerate selling pressure. Technical traders would then look toward the next significant support zones, potentially increasing short-term volatility.

Momentum indicators and market structure

Momentum indicators have shown signs of cooling in recent sessions. Bitcoin price today has struggled to generate sustained upside momentum, with rallies fading quickly. This pattern suggests cautious participation and lingering uncertainty.

Market structure also reflects a period of consolidation turning fragile. Lower highs combined with repeated tests of support increase the risk of breakdowns if macro catalysts disappoint.

Broader macro backdrop influencing Bitcoin price today

Bitcoin does not operate in isolation. The broader macro environment is shaping Bitcoin price today in significant ways. Global investors are navigating concerns about persistent inflation, the timing of potential rate cuts, and the strength of the US economy. When uncertainty rises, markets often shift into defensive mode. Risk-sensitive assets, including cryptocurrencies, tend to feel the impact first. The US dollar and Treasury yields are particularly influential. A stronger dollar can weigh on Bitcoin price today, as it reduces demand for alternative stores of value. Similarly, rising yields can make traditional fixed-income investments more attractive relative to non-yielding assets like Bitcoin.

Is Bitcoin a risk asset or a hedge?

The behavior of Bitcoin price today continues to spark debate about its role in portfolios. In some periods, Bitcoin behaves like a digital gold or inflation hedge. In others, it trades similarly to high-growth technology stocks. In the short term, Bitcoin price today is often driven by liquidity and speculative flows. Around macro events like CPI, it tends to align with broader risk sentiment. This risk-asset behavior explains why inflation data can have such an immediate effect. Longer term, however, Bitcoin’s fixed supply and decentralized nature underpin its appeal as a hedge against monetary debasement. The tension between these narratives contributes to its volatility.

Derivatives, leverage, and amplified moves

Another important factor behind Bitcoin price today is the structure of the derivatives market. Futures and options allow traders to use leverage, which can magnify both gains and losses. When price approaches key levels like $66K, liquidations can accelerate movements. If heavily leveraged long positions are forced to close, selling pressure intensifies. Conversely, sharp rebounds can trigger short squeezes. This dynamic explains why Bitcoin price today can swing dramatically in response to relatively modest news developments.

Potential scenarios after CPI

The direction of Bitcoin price today after CPI largely depends on how the data compares to expectations. If inflation surprises to the upside, markets may anticipate tighter policy for longer. In that scenario, Bitcoin price today could face additional downside pressure as yields rise and risk appetite weakens. If CPI comes in softer than forecast, optimism around rate cuts could boost sentiment. Bitcoin price today might reclaim higher levels quickly as traders reposition for improved liquidity conditions. An in-line reading could produce choppy, two-way trading. Without a clear macro signal, Bitcoin price today may remain range-bound until the next catalyst emerges.

Investor sentiment and psychology

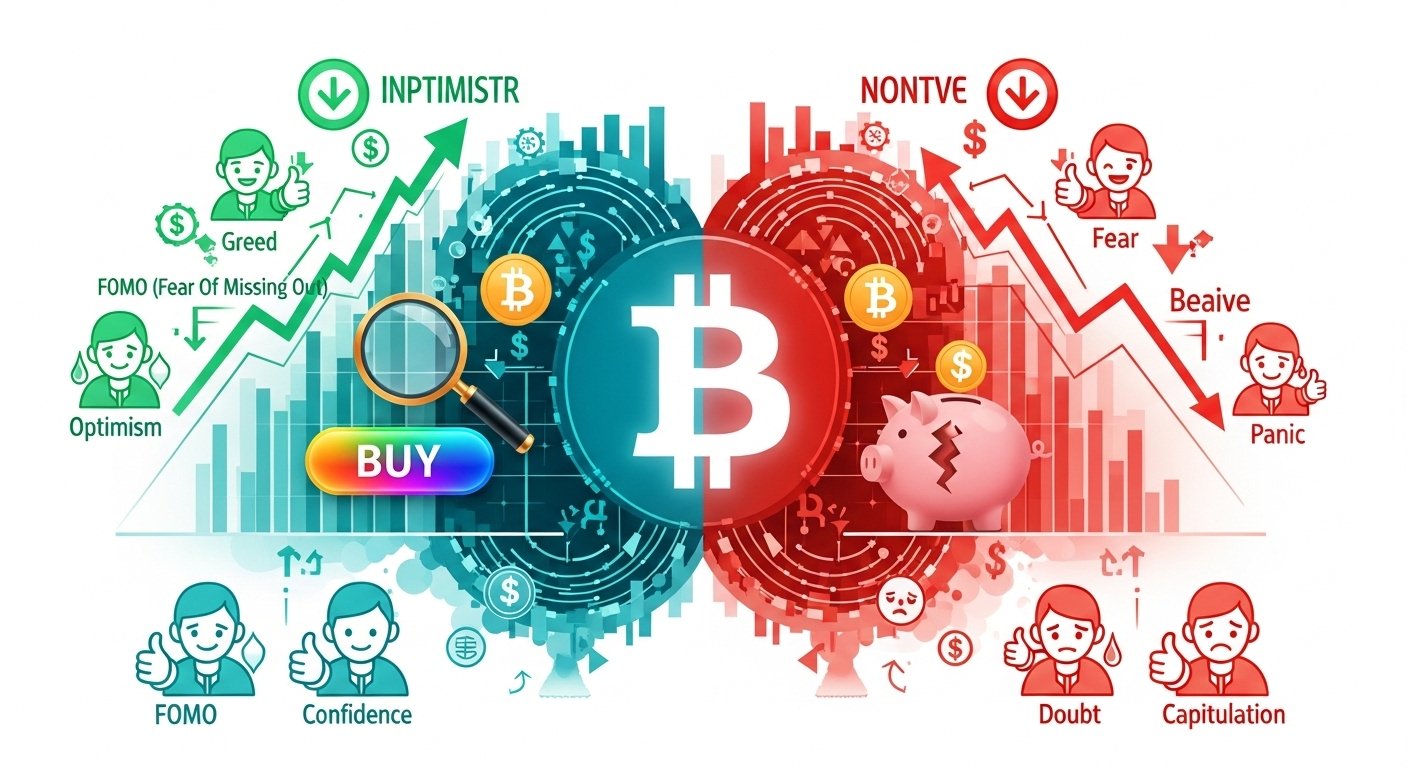

Market psychology plays a powerful role in shaping Bitcoin price today. Fear of further losses can cause traders to exit prematurely, while optimism about potential rebounds can fuel sudden rallies. Sentiment indicators often swing rapidly in crypto markets. Social media chatter, funding rates, and trading volumes can shift within hours. As Bitcoin price today approaches significant support, emotional decision-making tends to increase. Maintaining discipline during volatile periods is critical. Understanding that macro events like CPI can create temporary dislocations helps investors avoid overreacting to short-term noise.

Long-term perspective amid short-term volatility

While Bitcoin price today is focused on immediate macro risks, long-term investors often zoom out. Bitcoin has historically experienced multiple drawdowns exceeding 20% within broader bull cycles. Short-term dips, including moves toward $66K, do not necessarily invalidate long-term theses centered on adoption, scarcity, and network growth. However, they do highlight the importance of risk management. For many participants, periods of macro-driven volatility provide opportunities to reassess allocations rather than panic.

Conclusion

Bitcoin price today dipping toward $66K underscores the fragile balance between technical pressure and macro uncertainty. With a potential fourth straight weekly loss on the line and US CPI data imminent, traders are bracing for heightened volatility. Inflation figures will likely shape expectations for Federal Reserve policy, liquidity conditions, and overall risk appetite. Whether Bitcoin price today stabilizes or extends its decline will depend largely on how markets interpret the upcoming data. In the meantime, the $66K zone remains a critical battleground. As always in crypto markets, flexibility, risk awareness, and a clear understanding of macro drivers are essential for navigating the next move.

FAQs

Q: Why is Bitcoin price today falling toward $66K?

Bitcoin price today is under pressure due to cautious positioning ahead of US CPI data, weakening technical momentum, and broader macro uncertainty affecting risk assets.

Q: What does a fourth straight weekly loss indicate?

A fourth weekly loss suggests sustained short-term bearish momentum, which can impact investor sentiment and increase volatility, though reversals are always possible in crypto markets.

Q: How does US CPI affect Bitcoin price today?

US CPI influences interest rate expectations. Higher inflation can lead to tighter monetary policy, which often weighs on Bitcoin price today, while cooler inflation can support risk assets.

Q: Could Bitcoin rebound after CPI?

Yes. If CPI data comes in softer than expected, improved sentiment and liquidity expectations could trigger a rebound in Bitcoin price today.

Q: Is $66K a critical support level?

Yes, $66K is viewed as an important psychological and technical support area. A strong hold could encourage buyers, while a breakdown might accelerate selling pressure.

Also More: Bitcoin price today near $67K as CPI looms