Bitcoin Price Support Resistance Levels Complete Trading Guide 2025

Bitcoin price support resistance levels are crucial for any cryptocurrency trader looking to maximize profits and minimize losses in the volatile digital asset market. These fundamental technical analysis concepts serve as the backbone of successful Bitcoin trading strategies, helping traders identify optimal entry and exit points while managing risk effectively.

Support and resistance levels represent psychological price points where Bitcoin’s price action tends to pause, reverse, or consolidate. Support levels act as a floor where buying pressure typically emerges, preventing further price declines. Resistance levels function as a ceiling where selling pressure intensifies, limiting upward price movement. By mastering these bitcoin price support resistance levels, traders can make more informed decisions and improve their overall trading performance in the dynamic cryptocurrency landscape.

Understanding Bitcoin Support and Resistance Fundamentals

What Are Bitcoin Price Support Resistance Levels

Bitcoin price support resistance levels are specific price points on a chart where the cryptocurrency has historically shown strong buying or selling pressure. These levels form when Bitcoin’s price repeatedly bounces off certain prices, creating identifiable patterns that technical analysts use to predict future price movements.

Support levels develop when Bitcoin’s price falls to a certain point and then rebounds due to increased buying interest. This creates a “floor” that the price struggles to break below. Conversely, resistance levels form when Bitcoin’s price rises to a specific point and then retreats due to selling pressure, establishing a “ceiling” that limits upward movement.

These levels are not arbitrary numbers but represent real market psychology and collective trader behavior. When Bitcoin approaches a known support level, many traders anticipate a bounce and place buy orders, creating actual buying pressure that can fulfill the prediction. Similarly, resistance levels attract sellers who remember previous rejections at those prices.

The Psychology Behind Support and Resistance

The effectiveness of bitcoin price support resistance levels stems from human psychology and market memory. Traders remember significant price levels where Bitcoin previously reversed direction, creating a self-fulfilling prophecy effect. When Bitcoin approaches these memorable levels, traders act based on past experiences, reinforcing the strength of these zones.

Market participants who missed buying opportunities at previous support levels often wait for another chance to enter at similar prices. This accumulated demand creates genuine buying pressure when Bitcoin retests support levels. Similarly, traders who missed selling opportunities at resistance levels may be eager to exit their positions when Bitcoin returns to those highs.

Identifying Key Bitcoin Support and Resistance Levels

Historical Price Analysis

The most reliable bitcoin price support resistance levels emerge from significant historical price action. Major swing highs and lows that occurred during high-volume trading sessions often become important future levels. These historical levels gain more significance when they coincide with psychological price points, such as round numbers like $20,000, $30,000, or $50,000.

Previous all-time highs frequently become strong resistance levels until broken, after which they can transform into support levels. Bitcoin’s price history shows numerous examples of former resistance becoming support, demonstrating the dynamic nature of these levels.

Volume-Confirmed Levels

Volume plays a crucial role in validating bitcoin price support resistance levels. Levels that formed during high-volume trading sessions tend to be more reliable than those created during low-volume periods. When Bitcoin bounces off a support level with significant volume.

It indicates strong conviction among buyers and increases the probability that the level will hold in future tests. Similarly, resistance levels that rejected Bitcoin’s price with high volume demonstrate substantial selling pressure and are more likely to act as barriers in subsequent attempts to break higher.

Moving Average Support and Resistance

Dynamic bitcoin price support resistance levels can be identified using moving averages. The 20-day, 50-day, and 200-day moving averages often act as support during uptrends and resistance during downtrends. These moving levels adapt to current market conditions and provide flexible reference points for traders.

The 200-day moving average, in particular, has historically served as a significant long-term support and resistance level for Bitcoin. When Bitcoin trades above this average, it often acts as support during pullbacks. Conversely, when Bitcoin trades below the 200-day moving average, it frequently serves as resistance during rallies.

Technical Indicators for Support and Resistance Analysis

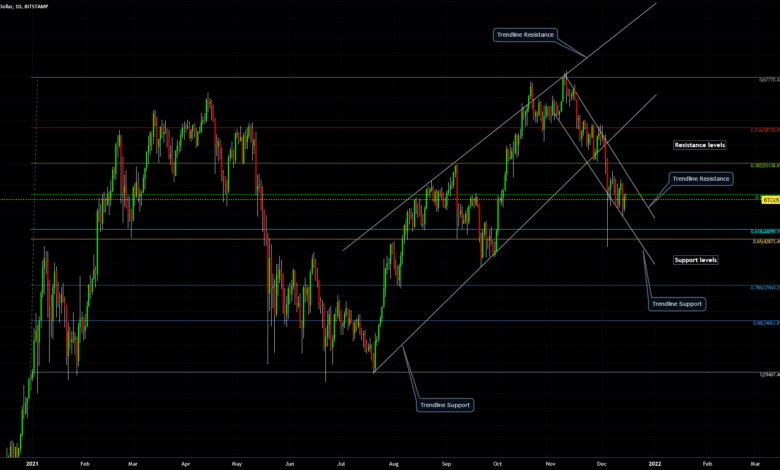

Fibonacci Retracement Levels

Fibonacci retracement levels provide mathematically derived bitcoin price support resistance levels based on key ratios found in nature and mathematics. The most important Fibonacci levels for Bitcoin analysis are 38.2%, 50%, and 61.8% retracements of significant price moves.

These levels often coincide with natural support and resistance areas, providing additional confirmation for trading decisions. When Bitcoin retraces to a Fibonacci level that aligns with historical support or resistance, the combination creates a stronger, more reliable trading zone.

Pivot Points and Floor Trader Levels

Pivot point analysis generates multiple bitcoin price support resistance levels based on the previous period’s high, low, and closing prices. These calculations produce a central pivot point along with multiple support (S1, S2, S3) and resistance (R1, R2, R3) levels.

Professional traders often use these levels as reference points for intraday trading, as they provide objective price targets and risk management levels. The central pivot point frequently acts as a key support or resistance level depending on Bitcoin’s position relative to this price.

Bollinger Bands and Price Channels

Bollinger Bands create dynamic bitcoin price support resistance levels that adjust based on Bitcoin’s volatility. The upper band often acts as resistance during normal market conditions, while the lower band provides support. When Bitcoin touches or breaches these bands, it can signal potential reversal opportunities.

Price channels, whether ascending, descending, or horizontal, create clear support and resistance boundaries. Bitcoin’s price tends to respect these channel lines, bouncing between the upper resistance and lower support levels until a significant breakout occurs.

Trading Strategies Using Bitcoin Support and Resistance

Bounce Trading Strategy

The bounce strategy involves buying Bitcoin at established support levels and selling at resistance levels. This approach works best in range-bound markets where Bitcoin consistently respects bitcoin price support resistance levels without breaking through them.

Successful bounce trading requires patience and strict risk management. Traders should wait for confirmation signals, such as reversal candlestick patterns or momentum divergences, before entering positions at support or resistance levels.

Breakout Trading Strategy

Breakout trading focuses on identifying when Bitcoin breaks through established bitcoin price support resistance levels with strong momentum and volume. These breakouts often lead to significant price movements as the break through a key level triggers stop-losses and attracts new buyers or sellers.

Effective breakout trading requires distinguishing between genuine breakouts and false breakouts (fakeouts). True breakouts typically occur with increased volume and are followed by sustained price movement in the breakout direction.

Range Trading Strategy

Range trading exploits Bitcoin’s tendency to trade between established bitcoin price support resistance levels for extended periods. This strategy involves buying near support levels and selling near resistance levels while the range remains intact. Range traders must remain vigilant for signs that Bitcoin might break out of the established range, as continued range trading during a breakout can result in significant losses.

Risk Management with Support and Resistance Levels

Setting Stop-Loss Orders

Bitcoin price support resistance levels provide logical placement points for stop-loss orders. When buying at support, traders typically place stop-losses slightly below the support level to limit losses if the level fails to hold. Similarly, when selling at resistance, stop-losses are often placed just above the resistance level.

The distance between entry points and stop-loss levels helps determine position sizing and overall risk per trade. Tighter stop-losses based on strong support and resistance levels allow for larger position sizes while maintaining consistent risk management.

Position Sizing Strategies

The strength and reliability of bitcoin price support resistance levels should influence position sizing decisions. Stronger levels supported by multiple confirmations (volume, historical significance, moving averages) may justify larger position sizes, while weaker levels warrant smaller positions. Traders should also consider the distance to the next major support or resistance level when determining position sizes, as this affects the potential reward-to-risk ratio of each trade.

Common Mistakes When Trading Support and Resistance

Failing to Confirm Levels

One of the most common mistakes is trading bitcoin price support resistance levels without proper confirmation. Entering positions immediately upon reaching a support or resistance level without waiting for confirmation signals often results in premature entries and unnecessary losses.

Confirmation can come from various sources: reversal candlestick patterns, momentum divergences, volume spikes, or multiple-timeframe analysis. Waiting for confirmation reduces the likelihood of falling victim to false signals.

Ignoring Market Context

Trading bitcoin price support resistance levels without considering the broader market context can lead to poor results. Support and resistance levels that work well in trending markets may behave differently during high-volatility periods or major news events. Traders should always consider the overall trend, market sentiment, and external factors that might affect Bitcoin’s price action when making trading decisions based on support and resistance levels.

Over-reliance on Single Levels

Depending too heavily on individual bitcoin price support resistance levels without considering multiple timeframes or confluence factors increases trading risk. The most reliable trading opportunities often occur when multiple support or resistance factors align at similar price levels. Successful traders combine horizontal support and resistance with trend lines, moving averages, Fibonacci levels, and other technical indicators to create high-probability trading zones.

Advanced Support and Resistance Concepts

Multiple Timeframe Analysis

Analyzing bitcoin price support resistance levels across multiple timeframes provides a more comprehensive view of market structure. A level that appears as minor support on a 1-hour chart might represent major resistance on a daily chart, significantly affecting its reliability. The general rule suggests that higher timeframe levels take precedence over lower timeframe levels. A daily resistance level typically overrides an hourly support level when they conflict.

Dynamic vs. Static Levels

Bitcoin price support resistance levels can be categorized as either static (horizontal) or dynamic (sloped). Static levels remain at fixed prices and are based on historical highs and lows. Dynamic levels, such as trend lines and moving averages, change over time and adapt to current market conditions. Both types of levels have their strengths and applications. Static levels provide clear, objective price targets, while dynamic levels better reflect evolving market sentiment and trends.

Support and Resistance Zone Trading

Rather than viewing bitcoin price support resistance levels as exact prices, experienced traders often think in terms of zones or areas. This approach acknowledges that exact price levels may not hold precisely due to market inefficiencies, slippage, or gap openings. Zone trading involves identifying price ranges where support or resistance is likely to emerge, allowing for more flexible entry and exit strategies while maintaining the core concepts of support and resistance analysis.

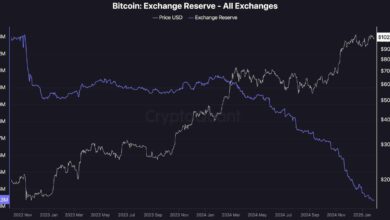

Market Psychology and Sentiment Indicators

Fear and Greed Index Impact

The Bitcoin Fear and Greed Index significantly influences how bitcoin price support resistance levels. During extreme fear periods, support levels may be more likely to break as panicked sellers overwhelm buyers.

Conversely, during extreme greed phases, resistance levels might be more easily breached as FOMO (fear of missing out) drives aggressive buying. Understanding market sentiment helps traders adjust their expectations for how Bitcoin might behave at key support and resistance levels, leading to more realistic trading strategies.

News and Event Impact

Major news events and developments in the cryptocurrency space can cause Bitcoin to break through established bitcoin price support resistance levels with unusual force. Regulatory announcements, institutional adoption news, or technical developments can override technical analysis temporarily. Successful traders remain aware of the news calendar and adjust their reliance on support and resistance levels during periods of high-impact news flow.

Tools and Platforms for Analysis

Recommended Charting Platforms

Several professional charting platforms excel at identifying and analyzing bitcoin price support resistance levels. TradingView offers comprehensive tools for drawing support and resistance levels, along with automated pivot point calculations and Fibonacci tools. Other popular platforms include Coinigy, CryptoCompare, and exchange-native charting tools from Coinbase Pro, Binance, and Kraken. Each platform offers unique features that can enhance support and resistance analysis.

Automated Detection Tools

Some advanced trading platforms and indicators automatically identify bitcoin price support resistance levels based on historical price action and volume data. These tools can save time and help identify levels that might be missed through manual analysis. However, automated tools should supplement, not replace, manual analysis and market understanding. The most effective approach combines automated detection with human judgment and market context.

Also Read: Bitcoin Price Target Next Month Expert Analysis and Predictions for September 2025

Conclusion

Mastering bitcoin price support resistance levels is essential for successful cryptocurrency trading. These fundamental technical analysis concepts provide the framework for identifying high-probability trading opportunities while managing risk effectively. By understanding how to identify, analyze, and trade these levels, you can significantly improve your Bitcoin trading results.

Remember that support and resistance analysis works best when combined with proper risk management, multiple timeframe analysis, and awareness of market context. No single approach guarantees success, but a thorough understanding of bitcoin price support resistance levels provides a solid foundation for profitable trading.

Start implementing these concepts in your Bitcoin trading strategy today, and begin identifying the key support and resistance levels that will guide your next trading decisions. With practice and patience, these levels will become valuable tools in your technical analysis toolkit.