Bitcoin Price Prediction Rainbow Bands vs Stock-to-Flow Models

Long a mystery to traders, analysts, and investors alike, Bitcoin is the most widely used cryptocurrency worldwide. Bitcoin’s worth is still a subject of wonder with its erratic price swings, startling surges, and explosive collapses.

Two predictive models—the Rainbow Bands and the Stock-to-Flow (S2F) model—have emerged as likely markers of Bitcoin’s price path as we gaze ahead. With many believing that Bitcoin may hit $275,000 by 2026, these models seek to forecast the Price of Bitcoin going forward. Can these models, though, really predict the direction of Bitcoin? Allow me to examine more closely.

Bitcoin Rainbow Bands Explained

With each “band” denoting a different price range, the Rainbow Bands model provides a colorful chart outlining Bitcoin’s price over time. Designed by pseudonymous trader Tomas in 2019, the chart shows Bitcoin’s past price fluctuations and possible future values using logarithmic development. The color-coded bands illustrate price volatility from blue (undervaluation) to red (overvaluation).

The Rainbow Bands model’s central tenet is that over time, Bitcoin’s price often shows a predictable pattern of growth and contraction. With the hope that the price will ultimately return to the “mean” or average price level, the bands help to graphically show when Bitcoin might be in a “buy zone” or an “overbought zone.”

The simplicity and clarity of the RaiBitcoin Price Prediction Rainbow Bands vs Stock-to-Flow Modelsnbow Bands chart have been commended for helping traders and investors to find possible buying or selling opportunities. The Rainbow Bands are not perfect, just as any forecasting model is. Although they offer a general picture of historical trends, they ignore the outside elements that might drastically change the course of Bitcoin, such as government policies, scientific developments, or significant economic events.

Bitcoin Price Forecast

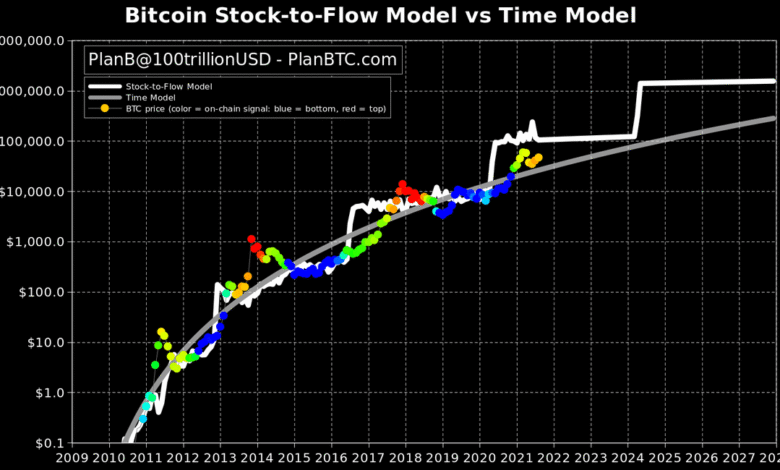

Another often-used approach to forecasting Bitcoin’s future price is the Stock-to-Flow (S2F) model, which is based on the asset’s scarcity. In 2019, a pseudonymous analyst going by “Planb” helped popularise this concept. The Stock-to-Flow model contrasts the current Bitcoin “stock” with the rate of mining fresh Bitcoins, or “flow.” According to the model, an asset gets more value the rarer it is, particularly when the supply of new units declines over time.

The S2F model for Bitcoin operates by noting that the entire supply of the coin is limited to 21 million units. Bitcoin’s finite supply and events of halving, which lower the block reward for miners about every four years, cause the coin to become ever rarer over time. According to the S2F model, the value of Bitcoin will rise as its supply declines, therefore fostering a price appreciation grounded on scarcity.

Depending on how supply and demand dynamics play out, one of the most often discussed forecasts from the S2F model is that Bitcoin might reach anywhere from $100,000 to $288,000 per coin by 2024 or 2025. Some Bitcoins might reach $275,000 by 2026. Despite market fluctuations, the model accurately predicted Bitcoin’s price during its big bull runs in 2020 and 2021.

Bitcoin Price Influencers

Although tools like Rainbow Bands and S2F provide insightful analysis of Bitcoin’s possible price swings, their foundation is previous data and trends rather than future events. As a highly volatile and speculative asset, Bitcoin is vulnerable to a range of outside events that might fundamentally influence its price path. These elements comprise macroeconomic movements, including inflation or interest rate fluctuations, technological developments, including the creation of Bitcoin Layer 2 solutions, including the Lightning Network, and legislative changes.

For example, regulatory issues in China significantly influenced the price of Bitcoin in 2021 and resulted in a substantial sell-off. Conversely, institutional investors’ rising acceptance of Bitcoin, including MicroStrategy, Tesla, and several hedge funds, helped propel prices to fresh all-time highs. Likewise, Bitcoin’s reputation as an inflation hedge—especially in uncertain economic times—has added to its attraction to institutional and ordinary investors.

Although Rainbow Bands and S2F are helpful models for analysing Bitcoin’s price behaviour, they cannot explain these always-shifting outside variables. Predicting a specific price point like $275,000 by 2026 remains hypothetical; hence, investors should be wary of depending on these estimates.

Final thoughts

All things considered, Stock-to-Flow and Rainbow Bands provide interesting analysis of Bitcoin’s price path. Based on past trends and ongoing scarcity, some analysts think 202 Bitcoin might hit the $275,000 threshold. Bitcoin’s future will probably rely on several elements, including technical advancements, market mood, and legislative actions.

Based on these estimates, the price prediction of $275K by 2026 is most likely realistic; yet, it is not assured. Investors should be wary before basing judgments on prediction models and consider many other elements. In the volatile realm of Crypto, the only certainty is ambiguity.