Bitcoin Price Plunges Why BTC Fell Below $100,000

Bitcoin price plunges below $100,000 as market fears surge. Discover the real reasons behind BTC’s sudden crash and what it means for investors.

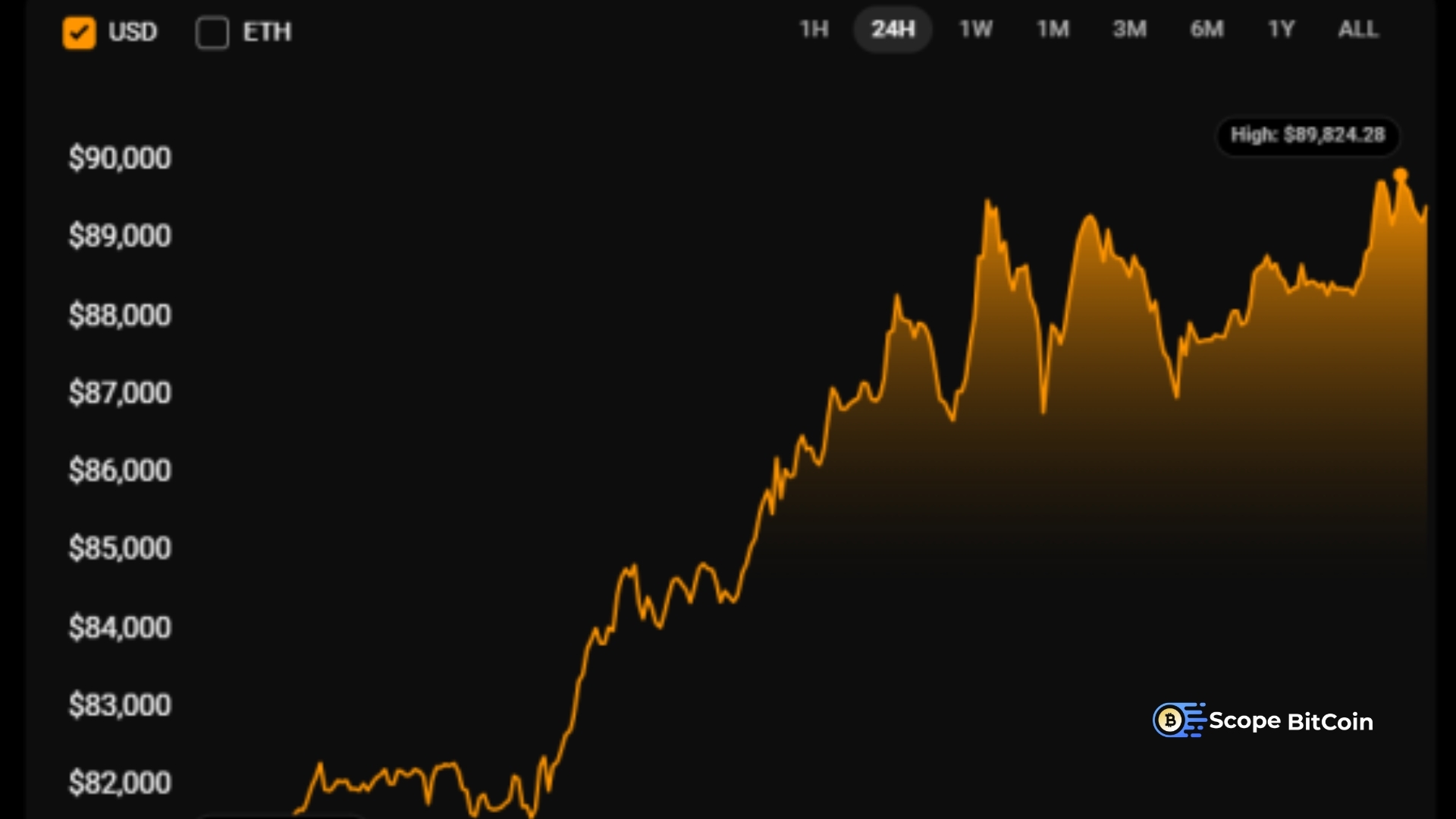

The cryptocurrency market has once again entered a turbulent phase, and at the center of the storm is Bitcoin. The Bitcoin price plunging below $100,000 shocked investors worldwide, reigniting debates about market bubbles, institutional sentiment, macroeconomic pressure, and the long-term sustainability of digital assets. What appeared to be a strong bullish cycle has unexpectedly taken a sharp downward turn, leaving both seasoned traders and new investors questioning the triggers behind this sudden drop.

As the Bitcoin market crashes, analysts have pointed to a combination of factors—ranging from regulatory crackdowns and liquidity shortages to miner capitulation, derivatives unwinding, and fears of a global risk-off environment. While volatility is not new to the crypto market, the pace and magnitude of this decline underscore deeper systemic shifts that must be examined carefully.This article breaks down every major driver behind the sudden plunge, providing an in-depth and easy-to-understand analysis of the situation.

We look at global economic trends, internal market mechanics, investor sentiment, and the broader implications for the future of Bitcoin. Whether you are a long-term holder or a short-term trader, understanding why Bitcoin dropped below $100,000 is crucial for making informed decisions moving forward.

The Global Economic Backdrop Behind Bitcoin’s Steep Decline

Rising Interest Rates and Liquidity Crunch

The macroeconomic environment has played a major role in Bitcoin’s recent troubles. When central banks worldwide tighten monetary policy, speculative assets like Bitcoin tend to suffer first. Higher interest rates reduce the money supply, compress liquidity, and push investors toward safer assets such as bonds or cash equivalents. This shift has created intense selling pressure across cryptocurrencies.

In previous cycles, Bitcoin was often hailed as a hedge against inflation—digital gold that would thrive in a tighter economy. But as more institutional players entered the market, Bitcoin began behaving more like a high-risk tech stock than a hedge. This correlation means that whenever liquidity dries up, Bitcoin prices react violently.

Strengthening US Dollar and Risk-Off Behavior

Another major driver behind the plunge is the sudden strengthening of the US dollar. Historically, a powerful dollar is bearish for Bitcoin because it reduces the incentive for global investors to seek alternative stores of value. As risk-off sentiment spreads across financial markets, Bitcoin is among the first assets to experience panic selling. Institutional investors, hedge funds, and arbitrage desks have aggressively reduced their exposure to cryptocurrencies, reallocating capital to stabilize portfolios. This chain reaction has amplified downward pressure, forcing the Bitcoin price to decline sharply.

Regulatory Crackdowns Ignite Market Fear

Aggressive Enforcement Actions Against Exchanges

One of the strongest catalysts behind the crash is ongoing global regulatory pressure. Governments and financial watchdogs in the US, Europe, and Asia have intensified their scrutiny of major crypto exchanges, citing concerns about money laundering, market manipulation, and unregistered securities offerings. Recent enforcement actions—ranging from multi-billion-dollar fines to operational shutdowns—have triggered massive outflows from centralized exchanges. As liquidity dries up, volatility increases and panic spreads, feeding into the downward spiral.

Tighter Rules on Stablecoins and On-Ramp Services

Stablecoins play a crucial role in maintaining liquidity in the crypto ecosystem. Stricter regulations on stablecoin issuers, reserve audits, and redemption processes have made it harder for traders to move funds quickly. This bottleneck has contributed to a widespread liquidity crunch, further pushing Bitcoin below the $100,000 mark. In addition, restrictions on on-ramps—platforms that convert fiat to crypto—have slowed down new capital inflows, weakening Bitcoin’s demand structure.

Internal Market Dynamics Accelerating the BTC Crash

Miner Capitulation and Hashrate Decline

Another important factor behind the plunge is miner capitulation. Mining becomes unprofitable when prices fall dramatically, and weaker miners often shut down operations or sell their Bitcoin reserves to cover expenses. This large-scale sell-off increases downward pressure on the price. A decline in hashrate indicates reduced network security and confidence. Investors closely monitor this metric, and a sudden drop often triggers fear-driven selling.

Overleveraged Positions Wiped Out by Liquidations

The crypto derivatives market plays a decisive role in short-term price movements. Over the past months, billions of dollars in leveraged long positions accumulated on major exchanges. When Bitcoin broke key support levels, these positions were liquidated automatically, resulting in a cascade of forced selling. The liquidation of leveraged positions can create flash crashes that drag prices lower than expected. This is one of the reasons why the Bitcoin price plunge seemed so sudden and dramatic.

Market Makers Reducing Liquidity

Market makers help stabilize prices by providing continuous buy and sell orders. When volatility spikes, many market makers pull back to avoid excessive risk. Their absence creates wide spreads and abrupt price swings, making the crash even worse.

Investor Sentiment Turns Bearish Amid Uncertainty

Fear Index Reaches Extreme Levels

Sentiment indicators, especially the Crypto Fear and Greed Index, have dropped to extreme fear territory. Negative headlines, panic-driven social media sentiment, and massive red candles in the charts have scared many retail investors into selling Bitcoin at a loss. Bearish sentiment tends to snowball quickly—once panic sets in, even neutral news can trigger further decline.

Institutional Outflows Hit Record Highs

Institutional interest was once the driving force behind Bitcoin’s surge above previous all-time highs. But as yields rise and regulatory uncertainty intensifies, institutions have begun pulling funds from crypto-focused ETFs and investment products. Large-scale outflows not only reduce market confidence but also increase selling pressure, deepening Bitcoin’s fall below $100,000.

Technological and Network Factors Contributing to the Slowdown

High Transaction Fees and Network Clustering

In recent months, Bitcoin’s transaction fees have risen significantly due to network congestion. High fees discourage everyday usage, making Bitcoin less attractive for new users and reducing transaction volume. A congested network can trigger doubts about scalability, causing investors to look toward alternative blockchains or stablecoins instead.

Competition From Layer-1 and Layer-2 Solutions

While Bitcoin remains the dominant player in the crypto market, competition from faster, cheaper, and more flexible networks has intensified. Layer-2 solutions and rival blockchains offering low transaction fees, smart contract support, and high throughput have captured market attention. This shift has led some investors to diversify away from Bitcoin, potentially contributing to the selling pressure.

Psychological Anchors and Market Expectations

The $100,000 Level as a Psychological Barrier

The $100,000 mark has long been considered a psychological milestone in the crypto world. Many investors believed that once Bitcoin reached this level, it would quickly surge to even higher prices. When Bitcoin dipped below this symbolic threshold, it triggered widespread panic and doubt. Psychological anchors play a huge role in speculative markets, and breaking a major support zone can amplify fear and uncertainty.

Profit-Taking and Whale Movements

Large Bitcoin holders, often referred to as whales, can influence market movement significantly. Recent on-chain data suggests massive transfers from whale wallets to exchanges, indicating potential profit-taking. When whales sell, retail investors often panic and follow suit, accelerating the decline.

Also Read: Bitcoin Miner Exchange Inflows Surge Affecting BTC Price

Broader Implications of Bitcoin Falling Below $100,000

Impact on Altcoins and the Entire Crypto Market

Bitcoin acts as a bellwether for the crypto ecosystem. When its price plunges, altcoins typically suffer more severe losses. As capital exits the market, liquidity in smaller tokens dries up, causing steep declines across the board.

This chain reaction can lead to temporary shutdowns of projects, reduced developer funding, and lower innovation activity.

Long-Term Holders Maintain Confidence

Despite the panic, many long-term holders remain optimistic. Historically, Bitcoin has gone through several major crashes—each followed by stronger recoveries and new all-time highs. Long-term investors view the current decline as an opportunity to accumulate more BTC at discounted prices. This resilient belief in Bitcoin’s long-term value strengthens the foundation for future market rebounds.

What Comes Next for Bitcoin

Conclusion

The Bitcoin price plunge below $100,000 marks a significant moment in the current market cycle. While dramatic and unsettling, this decline is driven by a combination of predictable factors: tightening monetary policy, regulatory pressure, liquidity crises, miner capitulation, derivatives liquidations, and widespread fear across global markets. Bitcoin’s volatility is not new, but understanding the forces behind it is essential for making smart investment decisions.

History has shown that Bitcoin often emerges stronger from downturns. As the market stabilizes and new opportunities arise, long-term investors may once again see Bitcoin reclaim its momentum. For now, the focus should be on staying informed, understanding the market dynamics, and avoiding emotionally driven decisions.

FAQs

Q: Why did Bitcoin drop below $100,000 so suddenly?

Because multiple factors—including regulatory crackdowns, rising interest rates, and leveraged liquidations—hit the market simultaneously, accelerating the sell-off.

Q: Will Bitcoin recover from this price crash?

Historically, Bitcoin has recovered from every major crash. Recovery depends on liquidity returning, stable regulations, and improving macroeconomic conditions.

Q: Is this a good time to buy Bitcoin?

It depends on your risk tolerance and investment timeline. Some see corrections as buying opportunities, while others prefer to wait for stabilization.

Q: Did miner capitulation play a role in the crash?

Yes. When mining becomes unprofitable, miners sell large amounts of Bitcoin, increasing selling pressure and dragging down the price.

Q: Are institutional investors leaving the crypto market?

Some institutions are reducing exposure due to regulatory uncertainty and high interest rates, contributing to short-term downward pressure.