Bitcoin Price Enterprise Solution 3 Revolutionary Benefits

The bitcoin price enterprise solution landscape has transformed dramatically as corporations increasingly integrate cryptocurrency into their treasury management strategies. Modern businesses require sophisticated tools that go beyond basic price tracking to provide comprehensive financial insights and automated reporting capabilities. Enterprise bitcoin solutions have emerged as game-changing technologies that address the complex needs of corporate finance teams managing digital asset portfolios.

Today’s bitcoin price tracking solutions offer far more than simple market data feeds. They provide real-time analytics, automated compliance reporting, and advanced risk management features specifically designed for enterprise blockchain implementations. Companies like MicroStrategy, Tesla, and numerous other Fortune 500 organizations have discovered that traditional financial tools cannot adequately handle the unique requirements of corporate bitcoin holdings and transaction management.

The evolution of cryptocurrency enterprise solutions has created unprecedented opportunities for businesses to optimize their digital asset strategies. These platforms integrate seamlessly with existing financial systems while providing the specialized functionality required for bitcoin treasury management. From automated crypto accounting to sophisticated blockchain analytics, modern enterprise solutions address every aspect of corporate cryptocurrency operations.

The revolutionary benefits of bitcoin price enterprise solutions is crucial for CFOs, treasury managers, and financial executives considering digital asset integration. These platforms not only streamline operations but also provide the transparency, security, and compliance features necessary for institutional-grade cryptocurrency management. The following analysis explores three fundamental advantages that make these solutions indispensable for forward-thinking enterprises.

As regulatory frameworks continue to evolve and bitcoin adoption accelerates across industries, companies implementing robust enterprise crypto solutions gain significant competitive advantages. These tools transform how organizations monitor, manage, and maximize the value of their digital asset investments while ensuring full compliance with financial reporting standards.

1. Real-Time Market Intelligence and Advanced Analytics

Comprehensive Price Monitoring Capabilities

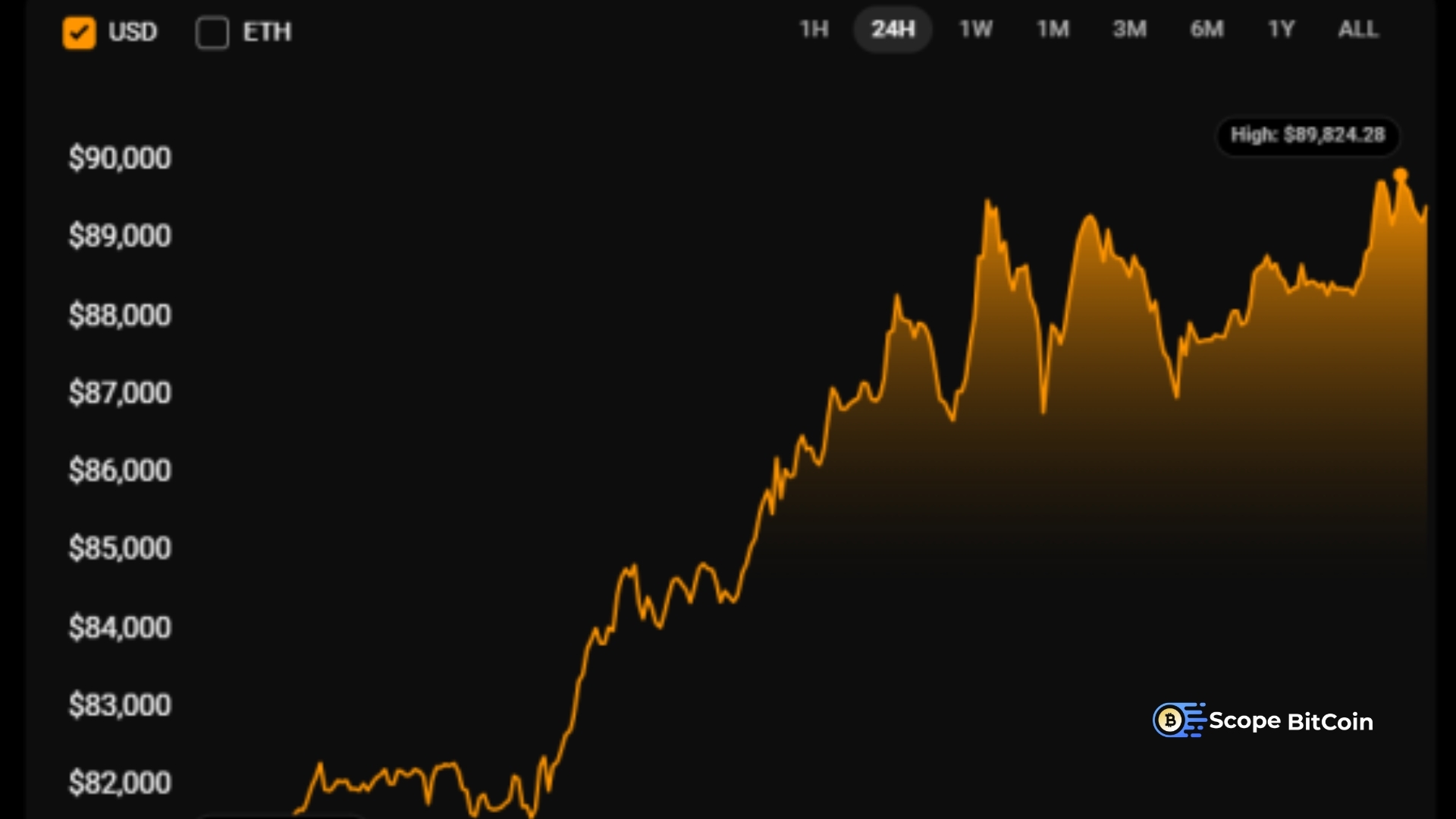

Bitcoin price enterprise solutions provide sophisticated real-time monitoring that extends far beyond basic price feeds. These platforms aggregate data from multiple exchanges, providing weighted average pricing that reflects true market conditions. Enterprise bitcoin platforms typically integrate with 50+ exchanges globally, ensuring comprehensive market coverage and eliminating the pricing discrepancies that can impact large-scale corporate transactions.

The cryptocurrency price tracking functionality includes advanced features such as volume-weighted average price (VWAP) calculations, time-weighted pricing models, and historical volatility analysis. This level of detail enables corporate treasury teams to make informed decisions about bitcoin trading activities and portfolio rebalancing strategies.

Predictive Analytics and Market Forecasting

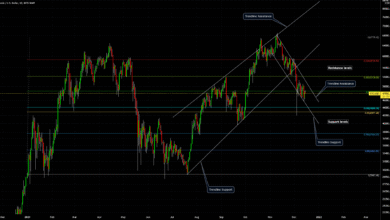

Modern bitcoin enterprise solutions incorporate machine learning algorithms that analyze market patterns, trading volumes, and external factors influencing cryptocurrency prices. These predictive analytics tools help corporations anticipate market movements and optimize their digital asset acquisition strategies. Blockchain analytics platforms can process millions of data points to identify trends that might not be apparent through traditional analysis methods.

The forecasting capabilities extend beyond simple price predictions to include correlation analysis with traditional markets, regulatory impact assessments, and macroeconomic factor integration. This comprehensive approach to crypto market analysis enables enterprises to develop more sophisticated bitcoin investment strategies.

Multi-Currency Portfolio Management

Enterprise cryptocurrency platforms support comprehensive portfolio management across multiple digital assets. While bitcoin often represents the primary holding, these solutions accommodate diverse cryptocurrency portfolios, including Ethereum, stablecoins, and other institutional-grade digital assets. The multi-currency functionality provides consolidated reporting and cross-asset correlation analysis essential for sophisticated crypto treasury management.

Portfolio optimization features include automatic rebalancing based on predefined parameters, risk-adjusted return calculations, and performance attribution analysis. These capabilities transform how enterprises approach cryptocurrency portfolio management and strategic asset allocation decisions.

2. Automated Compliance and Financial Reporting

Regulatory Compliance Automation

Bitcoin price enterprise solutions address one of the most challenging aspects of corporate cryptocurrency adoption: regulatory compliance. These platforms automatically generate reports required by various regulatory bodies, including the SEC, IRS, and international financial authorities. Crypto compliance features include automated transaction categorization, gain/loss calculations, and audit trail maintenance.

The compliance automation extends to blockchain transaction monitoring, ensuring all bitcoin movements are properly documented and reported. Advanced cryptocurrency accounting modules handle complex scenarios such as hard forks, airdrops, and staking rewards, automatically calculating tax implications and maintaining detailed records for audit purposes.

Integration with Traditional Accounting Systems

Modern enterprise blockchain solutions seamlessly integrate with existing ERP systems, accounting platforms, and financial reporting tools. This integration eliminates the manual data entry that traditionally creates bottlenecks in crypto accounting processes. Bitcoin treasury data flows directly into general ledger systems, enabling real-time financial statement updates and eliminating reconciliation errors.

The integration capabilities include API connections to popular accounting platforms like SAP, Oracle, and QuickBooks Enterprise. Cryptocurrency enterprise solutions can also generate standardized journal entries, supporting both GAAP and IFRS accounting standards for digital asset reporting.

Audit Trail and Documentation Management

Bitcoin price enterprise solutions maintain comprehensive audit trails that satisfy institutional and regulatory requirements. Every transaction, price update, and system action is logged with timestamps, user identifications, and supporting documentation. This level of detail ensures crypto audit readiness and supports internal control frameworks required for publicly traded companies.

The documentation management features include automated report generation, customizable dashboards for different stakeholder groups, and export capabilities for external auditors. Blockchain audit trails provide immutable records of all cryptocurrency activities, enhancing transparency and accountability in corporate bitcoin management.

3. Risk Management and Security Enhancement

Advanced Security Infrastructure

Enterprise bitcoin solutions implement institutional-grade security measures that protect cryptocurrency assets and sensitive financial data. Multi-signature wallet integration, hardware security module (HSM) support, and advanced encryption protocols ensure bitcoin holdings remain secure against both external threats and internal risks. Crypto security features include role-based access controls, transaction approval workflows, and segregation of duties protocols.

The security infrastructure extends to data protection, with encrypted communication channels, secure API endpoints, and comprehensive backup systems. Enterprise cryptocurrency platforms undergo regular security audits and penetration testing to maintain the highest standards required for institutional digital asset management.

Risk Assessment and Mitigation Tools

Bitcoin price enterprise solutions incorporate sophisticated risk management tools that quantify and monitor various types of cryptocurrency risks. Value-at-risk (VaR) calculations, stress testing scenarios, and correlation analysis help corporations understand their exposure levels and potential losses under different market conditions. Crypto risk management features include automated alerts for significant price movements, concentration risk monitoring, and exposure limit enforcement.

The risk mitigation tools support hedging strategies through integration with derivatives platforms and traditional financial instruments. Enterprise blockchain solutions can automatically execute risk management protocols, such as stop-loss orders or portfolio rebalancing, based on predefined risk parameters and corporate policies.

Operational Risk Controls

Bitcoin enterprise solutions implement comprehensive operational risk controls that address the unique challenges of cryptocurrency management. These include transaction verification protocols, multi-level approval processes, and automated compliance checks that prevent unauthorized or non-compliant bitcoin transactions. Crypto operational risk controls extend to vendor management, ensuring third-party service providers meet institutional security and compliance standards.

The operational controls include disaster recovery capabilities, business continuity planning, and redundant system architectures that ensure the continuous availability of bitcoin price data and trading capabilities. Enterprise crypto platforms maintain 99.9% uptime guarantees and provide multiple data center locations for enhanced resilience.

Key Features Comparison: Enterprise vs. Standard Bitcoin Solutions

Scalability and Performance

Bitcoin price enterprise solutions are designed to handle institutional-scale operations with high-frequency data processing, large transaction volumes, and complex reporting requirements. While standard cryptocurrency platforms may struggle with enterprise demands, dedicated enterprise bitcoin solutions provide the scalability necessary for Fortune 500 crypto treasury operations.

Customization and Integration

Enterprise blockchain platforms offer extensive customization options and integration capabilities that standard solutions cannot match. Custom reporting modules, API development support, and tailored user interfaces ensure Bitcoin enterprise solutions align perfectly with corporate workflows and existing systems.

Support and Service Levels

Cryptocurrency enterprise solutions provide dedicated account management, 24/7 technical support, and professional services teams that assist with implementation, training, and ongoing optimization. This level of support is essential for corporations managing significant bitcoin positions and complex digital asset strategies.

Implementation Best Practices for Bitcoin Price Enterprise Solutions

Strategic Planning and Requirements Analysis

Successful bitcoin price enterprise solution implementation begins with comprehensive requirements analysis and strategic planning. Organizations must evaluate their current crypto infrastructure, identify integration points, and establish clear objectives for cryptocurrency management capabilities. Enterprise bitcoin implementations require cross-functional collaboration between IT, finance, treasury, and legal teams.

Phased Deployment Approach

Bitcoin enterprise solution deployment should follow a phased approach that minimizes operational disruption while maximizing learning opportunities. Initial phases typically focus on crypto price tracking and basic reporting, gradually expanding to include advanced analytics, blockchain integration, and automated compliance features.

Training and Change Management

Enterprise cryptocurrency solutions require comprehensive training programs that address both technical and operational aspects of bitcoin management. Change management strategies should prepare teams for new workflows, updated procedures, and enhanced reporting requirements associated with crypto enterprise platforms.

Future Trends in Bitcoin Price Enterprise Solutions

Artificial Intelligence Integration

The next generation of bitcoin price enterprise solutions will incorporate advanced AI capabilities for predictive analytics, automated trading strategies, and intelligent risk management. Machine learning algorithms will enhance cryptocurrency price forecasting accuracy and optimize bitcoin portfolio performance through continuous learning and adaptation.

Blockchain Interoperability

Future enterprise blockchain solutions will provide seamless interoperability across multiple blockchain networks, enabling comprehensive cryptocurrency management beyond Bitcoin. Cross-chain analytics, unified reporting, and multi-protocol security will become standard features in advanced crypto enterprise platforms.

Regulatory Technology (RegTech) Evolution

Bitcoin enterprise solutions will increasingly incorporate sophisticated RegTech capabilities that automatically adapt to changing regulatory requirements. Automated compliance monitoring, regulatory change management, and dynamic reporting frameworks will ensure cryptocurrency operations remain compliant across multiple jurisdictions.

Also Read: Essential Bitcoin Price Monitoring System 3 Game Changers

Conclusion

Bitcoin price enterprise solutions represent a transformative technology that addresses the complex needs of corporations, integrating cryptocurrency into their financial operations. The three revolutionary benefits – real-time market intelligence with advanced analytics, automated compliance and financial reporting, and comprehensive risk management with security enhancement – provide compelling reasons for enterprises to adopt these sophisticated platforms.

These solutions eliminate operational bottlenecks, reduce compliance costs, enhance security, and provide the institutional-grade functionality required for successful corporate bitcoin adoption. As cryptocurrency continues gaining mainstream acceptance and regulatory frameworks mature, bitcoin enterprise solutions will become essential tools for competitive advantage in the digital economy.

Organizations implementing these platforms today position themselves to capitalize on the ongoing blockchain revolution while maintaining the highest standards of financial management, regulatory compliance, and operational excellence that institutional stakeholders demand.