Bitcoin Nears $110K Resistance Amid Institutional Growth

As its price approaches a crucial resistance level of $110,000, Bitcoin is once more under public focus. As of mid-May 2025, Bitcoin is currently trading at $102,000; a mix of positive macroeconomic signs, rising institutional acceptance, and a maturing regulatory framework drives its increasing momentum. These elements coming together are preparing the ground for what

Institutional Adoption Drives Bitcoin

The foundation of Bitcoin’s Market dynamics has progressively become institutional investors. The scene has been drastically altered by the increasing number of institutions in the bitcoin field, which offer not only capital but also legitimacy and stability. This effort is led by MicroStrategy, the commercial intelligence tool run by Bitcoin advocate Michael Saylor. In May 2025, MicroStrategy acquired 13,390 BTC for $1.34 billion, bringing their total to 568,840 BTC. With a $59 billion market value, MicroStrategy holds the most Bitcoin.

This isn’t an isolated incident. Frequently referred to as the “Asian MicroStrategy,” Japanese company Metaplanet recently increased its Bitcoin holdings to 2,101 BTC with intentions to reach 10,000 BTC by year’s end. These acquisitions indicate a more general institutional plan to use Bitcoin as a long-term reserve asset, therefore indicating continuous trust in its appreciation potential rather than just speculation.

Apart from small businesses, big financial institutions are becoming aware of Bitcoin via recently approved spot Bitcoin ETFs. These investment vehicles greatly increase the availability of Bitcoin by letting conventional investors join the market without handling wallets or exchanges. For a few months after its introduction, BlackRock’s spot ETF, for instance, has accumulated assets under management valued at over $10 billion.

Strategic Bitcoin Adoption

A seismic shift in the regulatory narrative has also contributed to Bitcoin’s rise. In a landmark move in early 2025, the U.S. government established the Strategic Bitcoin Reserve via executive order under President Donald Trump. The initiative designates Bitcoin as a national reserve asset and signals its increasing role in financial and geopolitical strategy.

The endorsement of Bitcoin at the highest levels of government brings with it a wave of trust and credibility. Other governments are now evaluating similar strategies, particularly in nations looking to diversify away from fiat-based reserves or hedge against inflationary risks. Regulatory clarity in the U.S. and across Europe has further emboldened both institutional and retail investors, who now perceive the crypto landscape as more secure and sustainable.

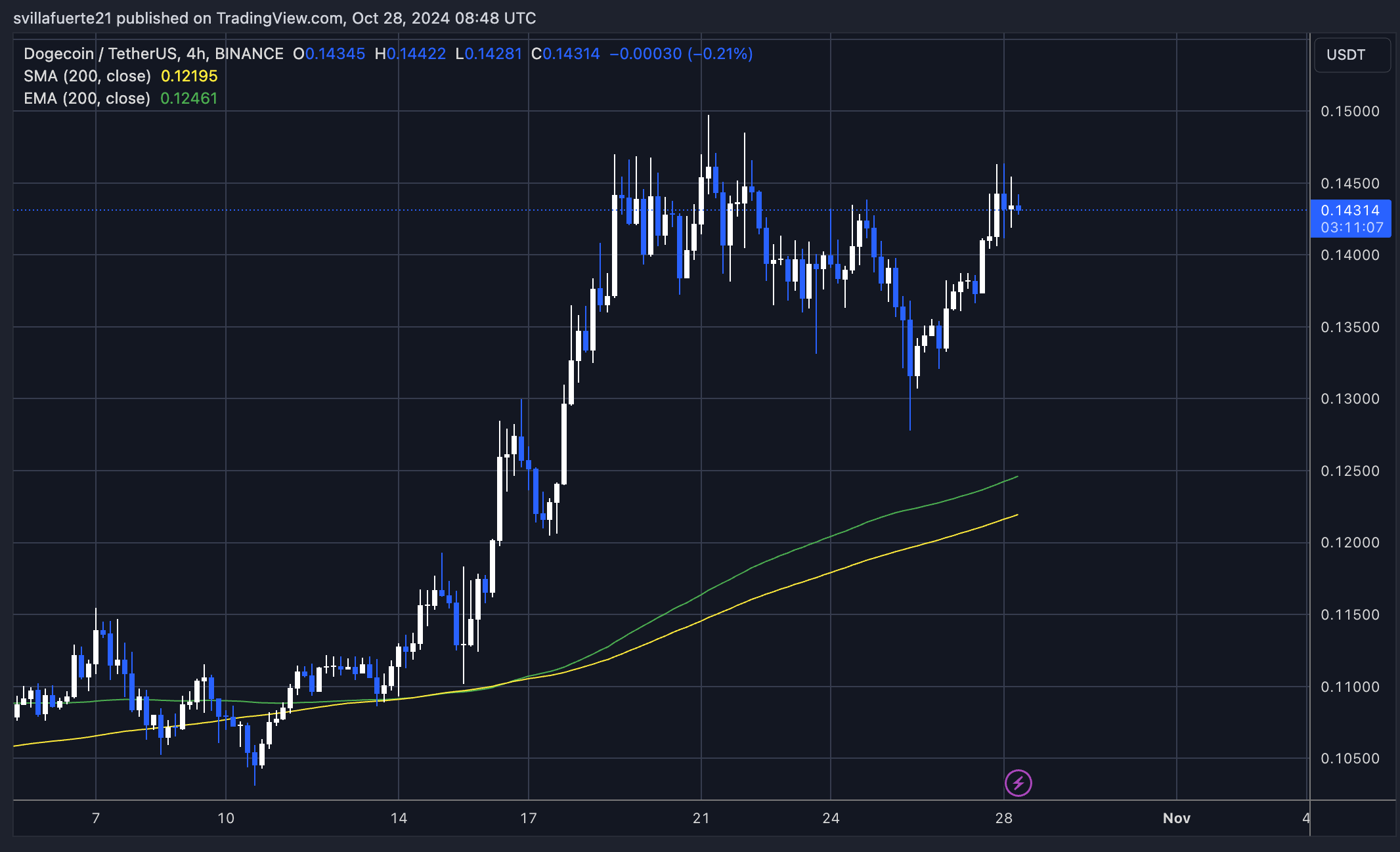

Bitcoin Breakout Looms

The mechanics of Bitcoin’s supply help to justify the optimistic view. Based on on-chain data, BTC is consistently leaving centralized exchanges, suggesting that holders are shifting their coins to cold storage, maybe in expectation of better values. Concurrent with this rise in stablecoin inflows, it points to a build-up of buying power that is ready for rapid application should a price breakout occur.

Technically, Bitcoin is currently grouping inside the area of $100,000 to $103,000. The next crucial obstacle is at $110,000, a psychologically important figure that also fits Fibonacci extension values obtained from past market cycles. A successful breach of this level might cause a fast phase of price discovery, whereby analysts project new all-time highs, maybe reaching $125,000 or more in the near term.

Still, prudence is advised. Should Bitcoin fall short of convincingly breaking $110,000, a retracement toward $93,000 is likely. While trader mood is positive, momentum indicators are high but beginning to indicate divergence; traditionally, local peaks correspond with these levels.

Bitcoin’s Macroeconomic Support

Bitcoin’s upward trajectory is further supported by macroeconomic conditions that favor alternative assets. In recent weeks, U.S. inflation data came in below expectations, raising hopes of imminent interest rate cuts by the Federal Reserve. Lower interest rates tend to weaken the U.S. dollar and encourage risk-on investing, both of which are favorable to Bitcoin.

In parallel, easing global trade tensions, especially between the U.S. and China, has led to improved market sentiment. Investors are once again seeking high-growth opportunities, and Bitcoin—with its finite supply and decentralized nature—is seen as a hedge not just against inflation but also against systemic financial risk.

Bitcoin’s Pivotal Moment

As Bitcoin edges closer to the $110,000 threshold, it finds itself at a pivotal moment in its evolution. A decisive move above this level would not only mark a technical breakout but would also symbolize Bitcoin’s graduation into the realm of globally recognized store-of-value assets. The growing role of institutions, favorable regulatory shifts, and macroeconomic tailwinds all suggest that Bitcoin’s best days may still lie ahead.

This period may very well be remembered as a turning point, when Bitcoin transitioned from an emerging digital asset to a foundational pillar of modern finance. For investors and institutions alike, the coming weeks will be critical in determining whether Bitcoin consolidates its gains or redefines its ceiling entirely.

Final thoughts

Emphasizing important elements such as institutional adoption, legislative changes, and macroeconomic conditions, the paper offers a thorough summary of Bitcoin’s present market dynamics and future prospects. With businesses like MicroStrategy and Metaplanet raising their holdings, indicating a change from speculative interest to long-term investment strategy, institutional participation in Bitcoin has grown to be a key influence. The launch of Bitcoin ETFs strengthens this even further since it increases the availability of Bitcoin for conventional investors.

Under the Trump administration, the creation of the U.S. Strategic Bitcoin Reserve marks a historic event that lends credibility and indicates Bitcoin’s increasing influence in the economy. This helps to further establish Bitcoin’s legitimacy as a valid asset class in combination with a favorable legal environment. Technically, Bitcoin is at a critical resistance level; $110,000 is a relevant benchmark.