Bitcoin moved $34 million after 11 years

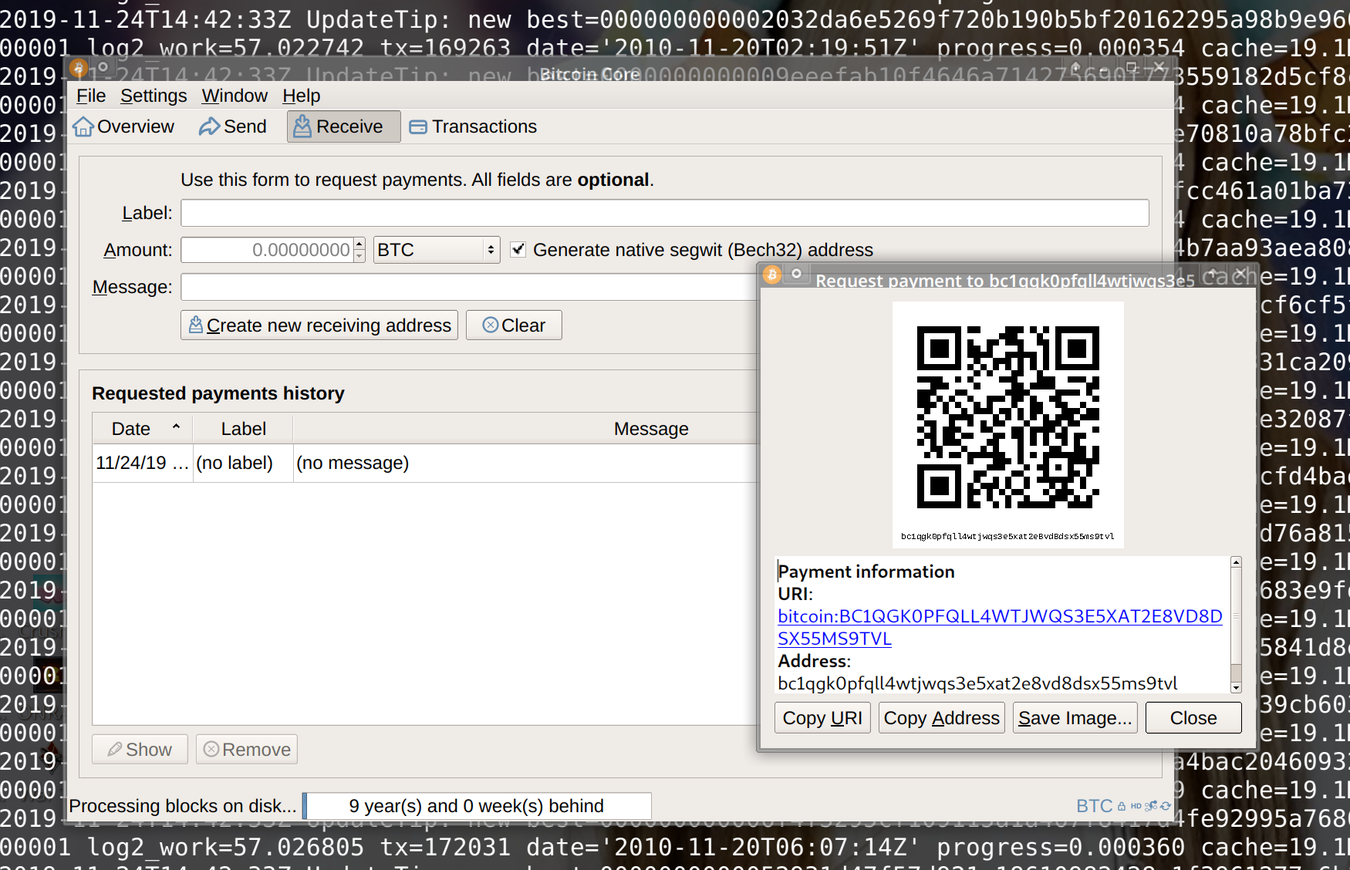

Bitcoin moved $34 million: In the ever-evolving world of cryptocurrency, certain events can send shockwaves through the market. One such event recently occurred when a dormant Bitcoin wallet, untouched for over 11 years, suddenly sprang to life. This “whale” wallet, which had been inactive since 2013, moved a staggering $34 million worth of Bitcoin, sparking speculation and curiosity 3 Significant Events in 2024 That Promoted Crypto Adoption among crypto enthusiasts, traders, and analysts alike.

What is a Bitcoin Whale?

In the cryptocurrency world, a “whale” refers to a person or entity that holds a significant amount of a particular cryptocurrency. In this case, the Bitcoin whale is someone who possesses a large amount of Bitcoin—often enough to influence market trends. Bitcoin whales are often cautious and strategic with their holdings, making moves only when the time feels right.

The Significance of the Move

The fact that this particular Bitcoin wallet remained dormant for over a decade is particularly intriguing. The wallet in question held approximately 4,700 Bitcoins, which at the time of the transaction were worth around $34 million. This substantial amount was transferred to a different wallet, reigniting questions about the intentions behind such a move.

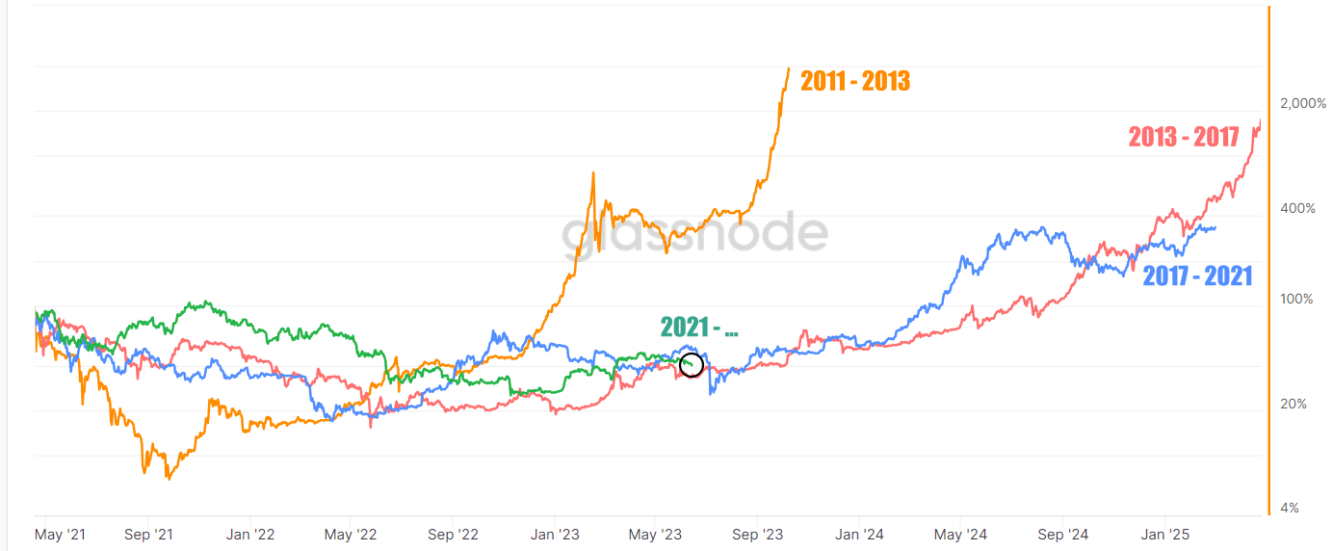

It’s important to note that the Bitcoin in this wallet was mined in the early days of the cryptocurrency’s existence, meaning it was acquired at a fraction of the current price. For context, Bitcoin’s value has skyrocketed since 2013, and this early miner likely paid only a few dollars per Bitcoin.

What Does This Mean for the Market?

The movement of such a large amount of Bitcoin after more than a decade of inactivity has sparked a number of theories. Some believe it could signal the return of an early adopter looking to cash in on their long-term investment. Others worry that the move could cause a sudden fluctuation in Bitcoin’s price, as whales have the power to influence market dynamics.

There’s also speculation that the transfer might be a sign of growing institutional interest in Bitcoin. If a significant holder like this one decides to liquidate or reallocate their assets, it could suggest that larger players are preparing for a major shift in the market. On the other hand, some analysts think it could be a sign of a more secure future for Bitcoin, as older holders move their coins to new wallets for safekeeping, further securing the network.

The Psychology of Bitcoin Whales

Bitcoin whales are known to be highly strategic, often making moves that are well-calculated to maximize profit or mitigate risk. This recent transaction may not be a random occurrence; rather, it could be part of a larger strategy. The fact that this particular whale waited 11 years before taking action suggests that they may have been waiting for the right market conditions to make their move.

Bitcoin whales are known to be highly strategic, often making moves that are well-calculated to maximize profit or mitigate risk. This recent transaction may not be a random occurrence; rather, it could be part of a larger strategy. The fact that this particular whale waited 11 years before taking action suggests that they may have been waiting for the right market conditions to make their move.

There’s also the element of timing. Bitcoin’s price has been relatively stable in recent months, and it’s possible that the whale felt it was the right time to either sell or transfer their holdings. With the crypto market still volatile and unpredictable, some believe this could be the start of a trend, with more dormant wallets becoming active as holders look to capitalize on Bitcoin’s current value.

What Happens Next?

While the market’s reaction to this event is still unfolding, it’s clear that the movement of such a large sum of Bitcoin will be closely monitored by traders, analysts, and investors. Bitcoin whales, due to their significant holdings, have the ability to influence price movements, and this recent transfer may set the stage for future volatility.

For now, the world watches as the cryptocurrency market reacts to this dormant whale stirring. Whether it’s the beginning of a new trend or a one-off event remains to be seen. But one thing is certain: the movement of 4,700 Bitcoins after 11 years of dormancy is a significant reminder of the unpredictable nature of the cryptocurrency space.

Conclusion

The dormant Bitcoin whale’s move of $34 million after 11 years has certainly caught the attention of the cryptocurrency world. As the market reacts and analysts try to interpret the significance of the move, the event serves as a reminder of the sheer power that large holders of Bitcoin hold in shaping market trends. Whether this move marks the start of a larger shift or is just a one-time occurrence, it shows just how dynamic and unpredictable the world of Bitcoin and cryptocurrency can be.

[sp_easyaccordion id=”5468″]