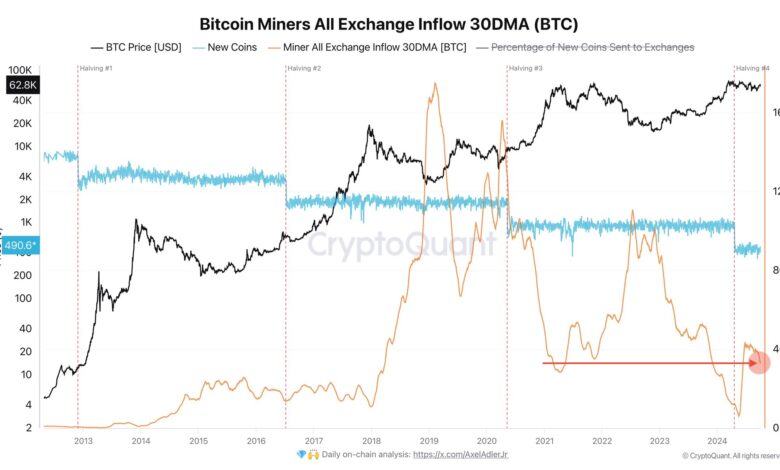

Bitcoin Miner Exchange Inflows Surge Affecting BTC Price

On-chain data shows that Bitcoin miner exchange inflows have recently shot up, which could reduce BTC’s price.

Bitcoin Miner to Exchange Flow

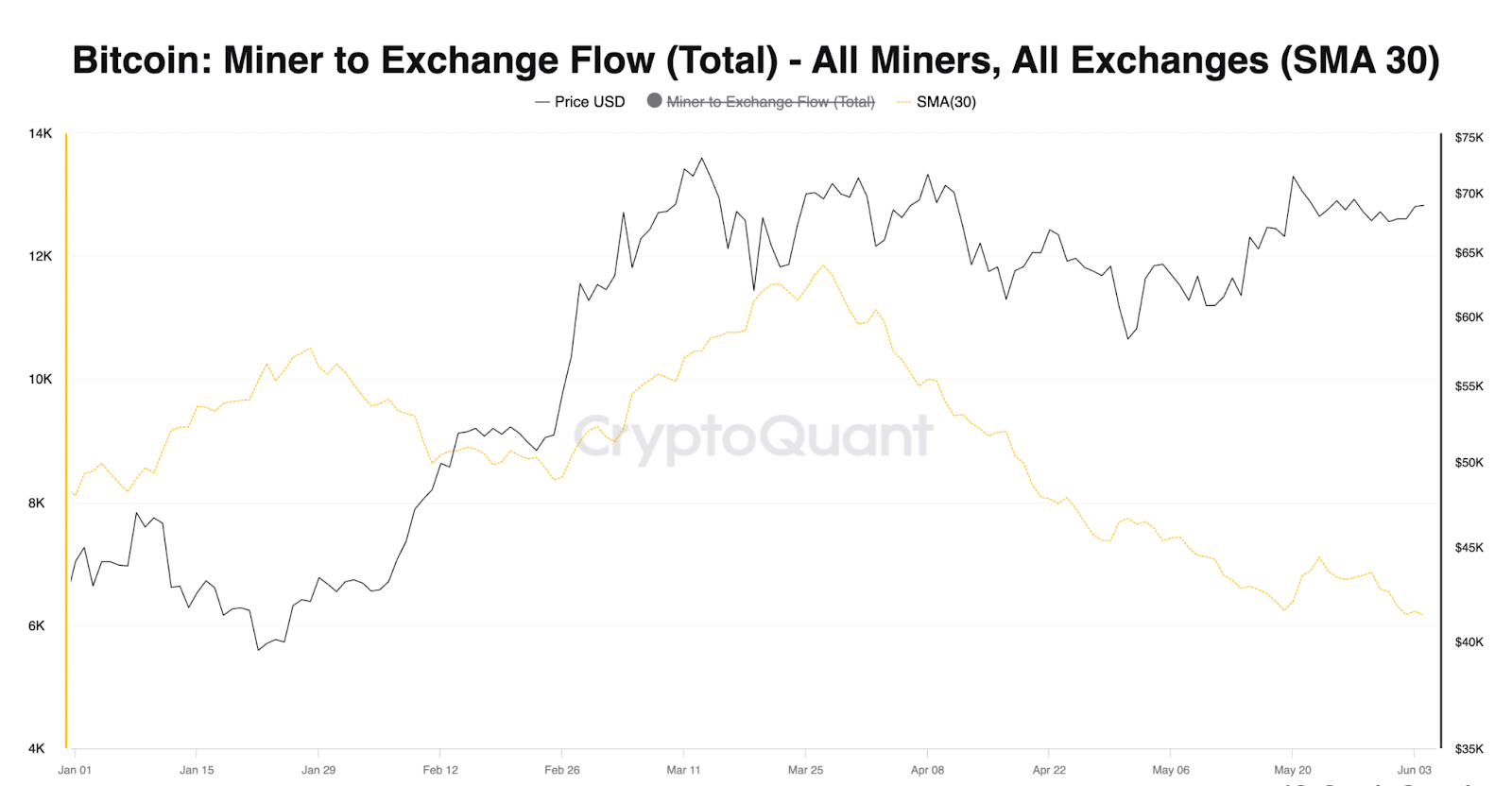

As an analyst in a CryptoQuant Quicktake post pointed out, miners are upping their selling pressure. The on-chain indicator of relevance here is the “Miner to Exchange Flow,” which, “as its name implies, keeps track of the total amount of Bitcoin moving from the miner entities to exchange-associated wallets. When the value of this metric is high, it means the miners are transferring a large number of coins to these central platforms. Generally, these chain validators deposit to exchanges when they want to sell so that this trend can be a bearish sign for the asset’s price.

On the other hand, the low indicator implies the miners may not be interested in selling as they only make a low amount of exchange inflows. Such a trend can naturally be bullish for the cryptocurrency. Now, here is a chart that shows the trend in the Bitcoin Miner to Exchange Flow over the last few months: As displayed in the above graph, the Bitcoin Miner to Exchange Flow has observed a spike in the past day, which suggests the miners have made a hefty deposit to the exchanges.

Miner Sell-offs and Bitcoin Price Impact

In the last couple of weeks, there have also been other large spikes in the metric, with an interesting commonality between most of them being that they all came after plunges in the asset’s price. The latest spike has followed this pattern. Thus, it would appear that the chain validators have been panic-selling during this phase of bearish momentum. Miners have to participate in regular sales to sustain their operations, as they have constant running costs in the form of electricity bills. Most of the time, the market readily absorbs the selling pressure from the cohort, so the BTC price tends not to see a bearish effect from it.

In cases where the selloff is of a particularly notable scale, however, Bitcoin can indeed feel an impact. “Sustain” selling from miners can slow recovery unless absorbed by strong demand,” notes the quant. It now remains to be seen whether BTC Miner to Exchange Flow would see a cooldown or if miners would continue to part with their holdings, potentially causing the price downtrend to extend.

Bitcoin Rebounds to $80,700 After Dip

Bitcoin briefly fell below the $77,000 mark yesterday, but the coin has since rebounded, and its price is now back at $80,700. As of March 12, 2025, 1 Bitcoin (BTC) is approximately equal to 22,934,281.22 Pakistani Rupees (PKR). In U.S. dollars (USD), Bitcoin is currently priced at $81,410.00, reflecting a 1.24% increase from the previous close. Bitcoin’s high is $83,745.00, and the intraday low is $79,107.00.

Please note that cryptocurrency prices are highly volatile and can fluctuate rapidly. For the most current rates, it’s advisable to consult reputable financial sources or cryptocurrency exchanges.

Final thoughts

The article highlights the recent spike in the Bitcoin Miner to Exchange Flow metric, which tracks the movement of Bitcoin from miners to exchanges. This is a key indicator of selling pressure from miners, who typically send Bitcoin to exchanges when liquidating assets for operational costs, such as electricity. The increase in miner exchange inflows suggests that miners are selling more Bitcoin, potentially contributing to downward pressure on Bitcoin’s

The article notes that this surge in miner sales often follows price declines, with miners potentially panic-selling to mitigate losses. However, while the market has historically absorbed miner selling pressure without significantly impacting Bitcoin’s price, the article emphasizes that sustained, large-scale selling can hinder price recovery unless strong demand exists to absorb it.