Bitcoin Holds $107K Support as Institutions Eye $112K Breakout

As the flagship digital asset, Bitcoin keeps strong support around the $107,000 mark; hence, the Cryptocurrency Market stays lively. This tenacity has rejuvenated positive attitudes for traders and investors who now see a possible breakthrough toward the $112,000 barrier. Understanding the market dynamics, technical indications, and larger economic background is essential for players trying to profit from the developing trends as Bitcoin negotiates these critical price levels. This paper thoroughly studies Bitcoin’s price action, investigates the fundamental causes driving its path, and explains what this implies for the larger cryptocurrency ecosystem.

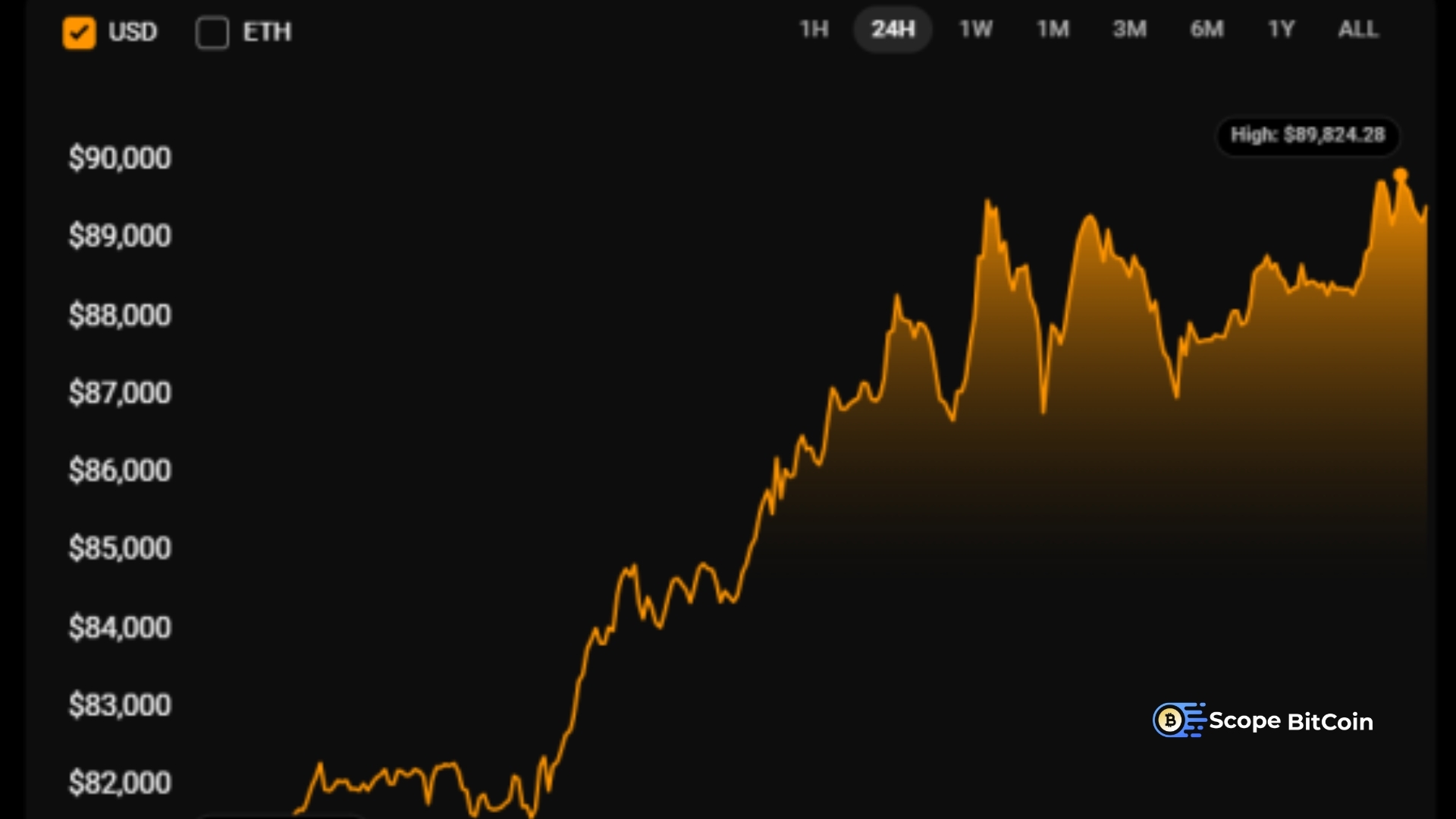

A central technical turning point that points to underlying strength is Bitcoin’s capacity to surpass $107,000. This price range is a primary support level where increasing buying activity helps prevent more significant pullbacks. Support levels like this historically represent strong demand zones where traders and institutions are ready to accumulate Bitcoin, laying a basis for upward momentum. The present state of the market shows a careful mix between fresh purchasing and profit-taking, a dynamic that is vital to keep under observation since it shapes the direction of the next price moves.

Several elements help Bitcoin be resilient at this point. Among these is the increasing institutional acceptance of cryptocurrencies spurred on by companies like MicroStrategy and Tesla, which have recently acquired significant amounts of Bitcoin. Moreover, the participation of well-known financial organizations such as Fidelity and Coinbase has helped Bitcoin become a mainstream asset class. This institutional support improves market trust and liquidity, which supports price stability near significant support levels like $107,000.

Bitcoin’s Current Market Landscape: Holding $107K Support

The possibility of Bitcoin hitting $112,000 depends on consistent positive momentum inspired by various technical and fundamental causes. Technically, Bitcoin’s price chart is in a consolidation phase with higher lows that usually mark the end before a breakout surge. Positive movements in momentum indicators, including the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), point to rising purchasing demand.

The current macroeconomic scene is crucial. Bitcoin is becoming increasingly seen as a digital hedge against fiat currency devaluation in a setting marked by ongoing inflation worries and cautious monetary policy. This story draws individual and institutional investors looking for different value sources, hence increasing demand. Furthermore, providing long-term value to the asset and technological developments to the Bitcoin network, including adopting a root upgrade in late 2021, improves the network’s security and innovative contracts.

Regulatory Influence and Sentiment in Bitcoin Price Dynamics

The price dynamics of Bitcoin are significantly influenced by market mood. Positive news, such as rn, favorable legislative developments, or endorsements from influential people like Elon Musk and Jack Dorsey, sometimes sets off a frenzy. On the other hand, fast sell-offs might result from unfavorable occurrences, including government crackdowns, trade secrets, or nasty comments from authorities.

The attitude is still cautiously positive at the moment, while authorities worldwide are having more complex discussions on cryptocurrency policies. While the Securities and Exchange Commission (SEC) has been closely examining the crypto market in the United States, it is also pushing conversations on Bitcoin ETFs, which would open fresh capital sources. Meanwhile, in Europe, the Markets in Crypto-Assets (MiCA) rule provided guarantees that may inspire institutional involvement through better guidelines. Long-term market stability and investor trust depend on such clarity of regulations.

Bitcoin’s Market Influence and the Evolving Crypto

Influencing altcoins, including Ethereum, Binance Coin, and Solana, Bitcoin’s price swings sometimes act as a gauge for the whole cryptocurrency market. Altcoins usually follow suit when Bitcoin shows strong support and positive momentum, benefiting from more market liquidity and investor excitement.

Furthermore, advancements in non-fungible tokens (NFTs) and distributed finance (DeFi) platforms are adding further complexity to the crypto industry. Although Bitcoin mainly serves as a store of value and digital gold, Ethereum’s innovative contract features inspire creativity in other sectors. Together, they write the story of a fast-changing digital financial scene in which Bitcoin’s price patterns remain key to market mood.

Key Indicators Signal Potential Bitcoin Breakout

Before aiming at $112,000, technical traders attentively monitor Bitcoin’s Price movement near the $107,000 support level in search of confirmation. Important chart patterns include rising triangles or cup-and-handle forms that might offer indications of possible breakouts. Moving averages—especially the 50-day and 200-day lines—often confirm positive setups.

Another important consideration is volume; rising trading volumes during upward swings support breakout validity. Conversely, decreased volumes could point to a lack of conviction. Reflecting network health and user involvement, on-chain measures, including Bitcoin’s hash rate and wallet activity, can offer more insight.

Final thoughts

Readers looking for more general viewpoints on bitcoin investing methods might check related pieces such as “How Institutional Investors Are Shaping Bitcoin’s Future” and “The Impact of Regulatory Frameworks on Crypto Markets.” These publications offer a more thorough background on the factors driving the value of Bitcoin.

Real-time data and thorough analysis are provided by outside authoritative sources, including industry heavyweights such as CoinDesk, Glassnode, and the Blockchain Transparency Institute. Market reports from companies such as Fidelity Investments and JPMorgan Chase offer an insightful institutional perspective.