Bitcoin Hits $103000 Milestone Story Cryptocurrency Surge

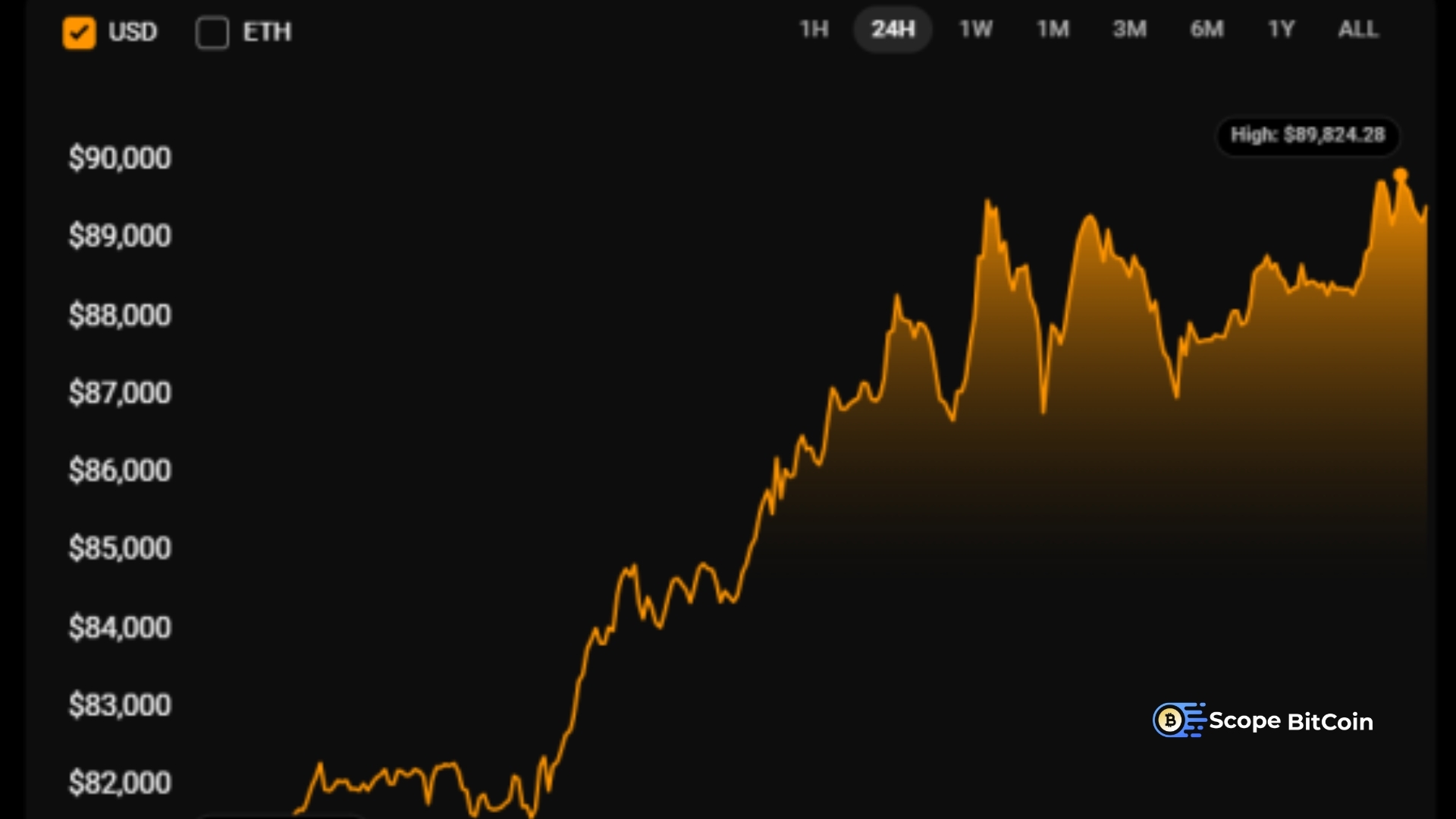

The market for cryptocurrencies saw notable change on May 16, 2025; Bitcoin led the way in an amazing increase. With many in the crypto world vibrating with enthusiasm and hope, the price of Bitcoin rocketed beyond the $103,000 level. A particularly noteworthy incident drew the attention of traders and investors all around as Bitcoin rose to new heights: Story (STORY) became the largest gainer and left many wondering whether this trend would last.

In this essay, we will examine Bitcoin’s ascent and how other altcoins, such as Story, have influenced the larger market attitude, delving deeply into the present situation of the cryptocurrency industry. We will also look at the fundamental causes of these price swings, future growth possibilities, and associated hazards.

Bitcoin Hits $103,000 Milestone

The world’s leading cryptocurrency has long been a barometer for the entire market. Its volatility and price fluctuations often dictate the movement of other Cryptocurrency markets. Today, as Bitcoin climbs above $103,000, it marks another key milestone in its remarkable journey toward mainstream adoption.

Over the past few years, Bitcoin has consistently gained attention from institutional investors, large corporations, and even governments. In May 2025, Bitcoin’s rally was primarily driven by an influx of institutional capital, which has been increasingly recognizing Bitcoin as a hedge against inflation and a store of value akin to gold. This institutional shift has been further amplified by the growing demand for decentralized finance (DeFi) platforms and the increasing awareness of digital assets’ long-term potential.

The surge also follows the broader market trend that began in 2025, fueled by positive regulatory developments, global economic uncertainty, and growing interest in digital currencies. Many experts believe that Bitcoin’s rise above $103,000 signals a renewed trust in the cryptocurrency market, especially as traditional financial institutions like JPMorgan, Goldman Sachs, and others are beginning to embrace Bitcoin as part of their asset portfolios.

Story Cryptocurrency Surge

Although the price surge of Bitcoin has dominated the news, another, purposeful narrative has surfaced in the altcoin field. The somewhat recent cryptocurrency Story (STORY) has turned out to be the biggest gainer of the day. With its tremendous increase in value, Stohas drew traders seeking high-risk, high-reward trades.

Rising knowledge of its underlying technology, the expansion of its ecosystem, and developing relationships inside the entertainment and media industries help to explain Story’s price explosion. Focusing on distributed and created decentralized content, the Story platform has been popular as more creators search for other income sources outside conventional centralized platforms.

Like many altcoins, Story’s price is erratic; hence, this quick surge could be a transient phenomenon resulting from market speculation. But the rising demand for Web3 technologies and the ongoing expansion of distributed apps (dApps) point to Story’s price maybe continuing to show notable swings, drawing both long-term investors and speculative traders.

Bitcoin Surge Factors

Finding the reason Bitcoin has surged above $103,000 calls for investigating several market variables. First of all, institutional adoption plays an always-present part. Bitcoin became respectable when significant hedge funds, businesses, and financial institutions started to enter the picture. Companies like Tesla, MicroStrategy, and Square have invested in Bitcoin, demonstrating that digital assets are here to stay.

The increasing support of international regulatory authorities also helps Bitcoin rise. Although governments have lately realized the need to control digital currencies to guarantee consumer safety, lower fraud, and stop illicit activity, cryptocurrencies have faced major regulatory obstacles in many countries. Knowing that a legislative framework is under development to direct the future market’s course gives investors peace of mind.

Altcoins and Innovation

Although Bitcoin Price still rules the cryptocurrency market, altcoins have started to carve out their niches; some coins and tokens show impressive expansion. For example, the emergence of Story draws attention to a significant cryptocurrency industry trend: the increasing relevance of niche use cases, especially in domains including distributed content creation, gaming, and entertainment.

The cryptocurrency market is still rather speculative, driven in great part by the promise of invention and the possibility of huge rewards. Although several altcoins—such as Ethereum, Solana, and Cardano—have become recognized as fundamental venues for distributed applications and smart contracts, others are still under development. Though they present interesting opportunities, these new altcoins—Story among others—also carry more risk.

Bitcoin Market Outlook

The current market sentiment is overwhelmingly positive, particularly after Bitcoin’s surge past $103,000. Investors increasingly see digital assets as viable long-term investments, leading to growing interest in Bitcoin and altcoins. The question is whether this trend will continue or if a market correction is imminent.

In the short term, the potential for continued growth is significant, as institutional adoption shows no signs of slowing down, and the global economic climate remains uncertain. However, with this optimism comes caution. The cryptocurrency market is inherently volatile, and while prices can rise dramatically, they can also fall just as quickly.

For Bitcoin, the next key price level to watch is $110,000. A sustained rally past this level could signal a new phase in the bull market, attracting more mainstream investors and potentially leading to a more widespread adoption of cryptocurrencies across various sectors.

Final thoughts

Rising above $103,000, Bitcoin confirms its leadership in cryptocurrency. Expandings such as Story marks eamarkmarket variety and the possibility of fofh usefor-profitenew cases, new stimulus One thing is certain: cryptocurrencies are becoming increasingly significant on the global financial sceneven e,n if tfuturen e is yet unknown.

For investors, the major lessons are to be careful and stay current. Though they come with great risk, cryptocurrencies provide amazing development potential. Success in the always-changing realm of digital assets depends on an awareness of the market dynamics, monitoring legislative developments, and closely assessing every initiative.