Bitcoin Futures Market Shifts Institutional Interest and Market

Recent changes in Bitcoin futures markets have generated fresh enthusiasm for the whole scene of cryptocurrencies. Divergences between future and spot market trends point to a possible change in market dynamics. Some analysts speculate on whether Bitcoin bulls are subtly building positions. Bitcoin’s path is set for a critical phase with a turn toward institutional involvement and precise shifts in futures market behavior. This paper investigates these differences. The consequences of the following market moves, and whether this change indicates a rising optimistic attitude.

Decline of Bitcoin Futures

Traditionally, the Bitcoin Market has been a critical gauge of market mood and speculation. However, futures trading volumes, especially given the intense activity in the spot market, have clearly dropped recently. Though spot market transactions indicate actual demand for Bitcoin, usually reflecting longer-term investor commitment, futures contracts generally reflect short-term speculative positions.

The widening differences between future and spot market patterns point to a change in emphasis from speculative trading to more steady accumulation. Rising demand has helped Bitcoin’s spot market stay afloat; institutions and regular investors show interest in buying Bitcoin straight instead of via derivatives. Consequently, the futures market has lost importance in searching for Bitcoin prices. This change suggests that long-term buying pressure may now affect the cost of Bitcoin more than its vulnerability to short-term market swings motivated by futures speculation.

Institutional Bitcoin Futures

The growing involvement of institutional investors is one of the main causes of the noted difference in Bitcoin futures markets. To get access to the cryptocurrency market, traditional financial institutions—including family offices and hedge funds—are progressively turning to Bitcoin futures. Many of these institutions, meanwhile, are more preoccupied with long-term plans than with the fast trades sometimes linked with ordinary futures speculators. Futures markets are thus seeing more open interest concentration, but the actual trade volume has remained erratic.

In this sense, Bitcoin futures sold on controlled markets like the Chicago Mercantile Exchange (CME) are becoming dominant. Bitcoin futures contracts have surged under CME’s observation; open interest on the exchange is at fresh highs. This is noteworthy since institutional investors that appreciate the regulatory control and conventional market infrastructure CME offers generally use CME futures. Many perceive the increasing involvement of these organizations as evidence of increased faith in the long-term viability of Bitcoin, even as short-term speculative activity declines.

Bitcoin Options Surge

Besides the shifting dynamics in the futures markets, the trading of Bitcoin options has increased. Unlike futures contracts, the options market lets investors stake on the future price of Bitcoin without really holding the underlying commodity. With more intelligent investors utilizing options to hedge their positions or profit on possible volatility, Bitcoin options are progressively considered a substitute for futures.

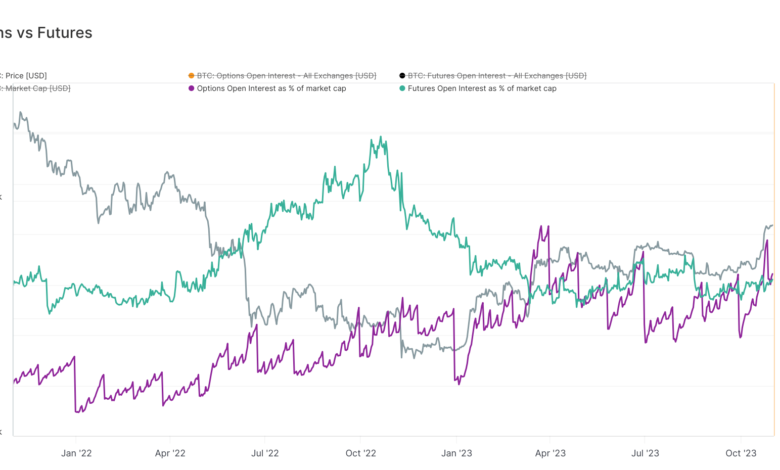

This tendency has resulted in an open interest situation when the options market outperforms the futures market. Recent studies, for instance, indicate that the options market for Bitcoin is starting to eclipse its futures market, therefore indicating a more developed and varied method of investing in Bitcoin. The change from futures to options could also point to a longer-term view from investors since institutions typically utilize options to control risk in erratic markets.

Bitcoin vs Ethereum Futures

The significant difference between Bitcoin and Ethereum futures markets is another critical element driving the more general debate on the divergence of Bitcoin futures. Whereas open interest and institutional interest in Bitcoin futures have grown, Ethereum futures have stayed somewhat quiet. This difference reflects a more significant trend whereby Ethereum is usually seen as a more speculative investment. In contrast, Bitcoin is progressively seen as a store of value or a digital asset equivalent to gold.

Institutional investors looking for exposure to the expanding digital asset class find Bitcoin appealing because it is the original cryptocurrency and shows relative stability compared to other altcoins, like Ethereum. Future markets clearly show this preference for Bitcoin over Ethereum since Bitcoin contracts far exceed Ethereum contracts in terms of open interest and trading volume. Bitcoin has confirmed its leadership among cryptocurrencies in institutional portfolios.

Bitcoin Market Evolution

Many investors wonder if these changes in the market reflect silently accumulating Bitcoin bulls. The rising institutional presence in futures and options markets, together with the higher demand in the spot market, suggests that long-term investors may be setting themselves up for a future surge. The lowering volatility of Bitcoin’s price also clearly shows this accumulating trend, which contradicts the high degrees of price swings usually connected with speculative futures trading.

The price swings of Bitcoin in the following months will probably rely on various elements, including ongoing institutional involvement, changes in regulations, and the general state of the economy. However, the shift from a futures-driven market to one stressing spot purchases and options trading points to a more mature stage for Bitcoin. Institutional investors seem to be seeing the long run, and as Bitcoin gets more ingrained in conventional financial systems, there is still a great possibility of Bitcoin Price increase.

Final thoughts

The future market divergence of Bitcoin, marked by a drop in speculative futures trading and an increase in institutional-driven interest, points to the coin’s entry into a new phase in its market development. The function of Bitcoin as a store of value is becoming more apparent as institutional investors get more involved and Bitcoin aficionados acquire positions.

Nonetheless, like with any asset class, care is advised, and investors should constantly observe market changes. The continuous change in Bitcoin’s structure could significantly affect its price and long-term survival in the financial system.