Bitcoin Future Value Calculator Predict Your Investment Returns in 2025

Investing in Bitcoin can be both exciting and nerve-wracking, especially when you’re trying to predict potential returns on your investment. A bitcoin future value calculator is an essential tool that helps investors estimate what their Bitcoin holdings might be worth in the future based on various growth scenarios and market conditions.

Whether you’re a seasoned cryptocurrency trader or just starting your digital asset journey, understanding how to calculate Bitcoin’s potential future value can make the difference between making informed investment decisions and shooting in the dark.

The volatility of Bitcoin makes it challenging to predict exact future prices, but with the right bitcoin future value calculator, you can run different scenarios to understand potential outcomes. This comprehensive guide will explore everything you need to know about calculating Bitcoin’s future value, from understanding the fundamental principles to using advanced projection models that account for market cycles, adoption rates, and technological developments.

What is a Bitcoin Future Value Calculator

A bitcoin future value calculator is a sophisticated financial tool designed to project the potential worth of your Bitcoin investment over a specified time period. Unlike traditional investment calculators that deal with relatively stable assets, Bitcoin calculators must account for the cryptocurrency’s extreme volatility, market cycles, and unique factors that influence its price movements.

These calculators typically use mathematical models that incorporate historical price data, compound annual growth rates (CAGR), and various assumptions about future market conditions. The most effective bitcoin future value calculator will allow you to adjust parameters such as investment amount, time horizon, expected annual growth rate, and even factor in dollar-cost averaging strategies.

Key Components of Bitcoin Value Calculation

When using a bitcoin future value calculator, several critical components come into play. The initial investment amount serves as your baseline, while the time horizon determines how long your investment will have to grow. The expected annual return rate is perhaps the most challenging variable to estimate, as Bitcoin’s historical performance shows periods of explosive growth followed by significant corrections.

Market adoption rates, regulatory developments, and technological improvements all influence Bitcoin’s long-term trajectory. A comprehensive bitcoin future value calculator should allow users to input different scenarios, from conservative estimates based on traditional asset growth to more aggressive projections that account for Bitcoin’s potential as a store of value or medium of exchange.

How Bitcoin Future Value Calculations Work

The Mathematics Behind Bitcoin Projections

The fundamental formula used in most bitcoin future value calculators is based on compound interest principles, but with modifications to account for cryptocurrency-specific factors. The basic equation is: Future Value = Present Value × (1 + growth rate)^number of periods

However, Bitcoin’s non-linear growth patterns require more sophisticated modeling. Many calculators incorporate Monte Carlo simulations, which run thousands of scenarios with different growth rates and volatility patterns to provide a range of possible outcomes rather than a single prediction.

Factors Affecting Bitcoin’s Future Value

Several interconnected factors influence Bitcoin’s potential future value, and the best bitcoin future value calculator will account for most of these variables. Market sentiment plays a crucial role, as Bitcoin’s price often reflects investor psychology more than fundamental value metrics used in traditional finance.

Regulatory developments can dramatically impact Bitcoin’s trajectory, with positive regulation typically driving adoption and price appreciation, while restrictive policies can suppress growth. Technological improvements, such as the Lightning Network for faster transactions or improvements in energy efficiency, also affect long-term value propositions.

Institutional adoption continues to be a major driver, with companies like Tesla, MicroStrategy, and various investment funds adding Bitcoin to their balance sheets. A sophisticated bitcoin future value calculator might include adoption curves that model how increasing institutional interest could affect price over time.

Types of Bitcoin Future Value Calculators

Simple Growth Rate Calculators

The most basic bitcoin future value calculator uses a fixed annual growth rate to project future values. While these tools are easy to use and understand, they may not capture Bitcoin’s true volatility and cyclical nature. These calculators work well for quick estimates and educational purposes but should be supplemented with more sophisticated analysis for serious investment planning.

Advanced Statistical Models

More sophisticated bitcoin future value calculators employ statistical models that account for Bitcoin’s historical volatility patterns, market cycles, and correlation with other assets. These tools often use regression analysis, moving averages, and technical indicators to refine their projections.

Some advanced calculators incorporate machine learning algorithms that analyze vast amounts of market data, social sentiment, and macroeconomic factors. While these tools can provide more nuanced projections, users should remember that past performance doesn’t guarantee future results, especially in the highly unpredictable cryptocurrency market.

Dollar-Cost Averaging Calculators

A specialized type of bitcoin future value calculator focuses on dollar-cost averaging (DCA) strategies, where investors make regular purchases regardless of price. These calculators show how consistent investing over time can potentially reduce the impact of volatility and improve long-term returns.

DCA calculators typically allow users to specify investment frequency (weekly, monthly, or quarterly), investment amount, and time horizon. They then calculate the average purchase price and project future value based on various growth scenarios.

Using Bitcoin Future Value Calculators Effectively

Setting Realistic Expectations

When using any bitcoin future value calculator, it’s crucial to set realistic expectations about Bitcoin’s potential returns. While Bitcoin has delivered extraordinary gains for early adopters, future returns may be more modest as the market matures and reaches higher valuations.

Conservative projections might assume annual growth rates similar to traditional high-growth investments (15-25%), while more aggressive scenarios could model the potential for Bitcoin to capture a significant portion of the global store-of-value market, potentially justifying higher growth assumptions.

Scenario Planning and Risk Assessment

The most effective way to use a bitcoin future value calculator is through scenario planning. Rather than relying on a single projection, create multiple scenarios with different assumptions about growth rates, time horizons, and market conditions.

Consider best-case scenarios where Bitcoin achieves widespread adoption as digital gold, moderate scenarios where it becomes a niche but stable store of value, and worst-case scenarios where regulatory pressure or technological issues limit its growth potential.

Popular Bitcoin Future Value Calculator Tools

Online Calculator Platforms

Several reputable websites offer bitcoin future value calculator tools with varying levels of sophistication. CoinGecko and CoinMarketCap provide basic calculators that focus on historical returns and simple projections, while more specialized platforms offer advanced modeling capabilities.

When selecting an online bitcoin future value calculator, look for tools that allow customization of key variables and provide transparency about their calculation methods. Be wary of calculators that promise guaranteed returns or use unrealistic growth assumptions to generate impressive-looking projections.

Mobile Applications and Software

Numerous mobile apps offer bitcoin future value calculator functionality, often integrated with portfolio tracking and market analysis features. These apps provide convenience for regular monitoring and adjustment of projections based on changing market conditions.

Some popular applications include Blockfolio (now FTX App), CoinStats, and Delta, which combine calculator functions with real-time price tracking and news aggregation. When choosing a mobile bitcoin future value calculator, consider factors like data accuracy, update frequency, and user interface design.

Advanced Calculation Strategies

Incorporating Market Cycles

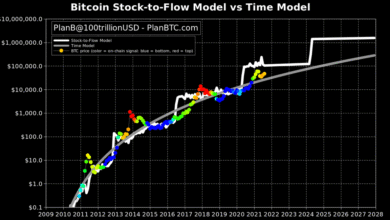

Bitcoin exhibits cyclical behavior often correlated with its halving events, which occur approximately every four years. A sophisticated approach to using a bitcoin future value calculator involves modeling these cycles and their potential impact on long-term returns.

Historical data suggests that Bitcoin experiences significant bull runs following halving events, followed by bear markets that can last 12-18 months. Incorporating these patterns into your calculations can provide more realistic projections than simple linear growth models.

Multi-Asset Portfolio Integration

Rather than calculating Bitcoin’s future value in isolation, consider how it fits within a diversified investment portfolio. A comprehensive bitcoin future value calculator should account for correlation with other assets and the potential for Bitcoin to serve as a hedge against inflation or currency debasement. Modern Portfolio Theory suggests that adding uncorrelated assets like Bitcoin to traditional portfolios can improve risk-adjusted returns, even if Bitcoin itself is more volatile than traditional investments.

Common Mistakes When Using Bitcoin Calculators

Overreliance on Historical Data

One of the most common mistakes when using a bitcoin future value calculator is assuming that past performance will perfectly predict future results. While historical data provides valuable insights into Bitcoin’s behavior patterns, the cryptocurrency market is still evolving, and future conditions may differ significantly from the past.

Bitcoin’s early years were characterized by extreme volatility and rapid adoption among tech enthusiasts. As the market matures and institutional participation increases, growth patterns may become more predictable but potentially less explosive.

Ignoring External Factors

Many users focus solely on price appreciation when using a bitcoin future value calculator, ignoring external factors that could dramatically impact outcomes. Regulatory changes, technological developments, macroeconomic conditions, and competitive cryptocurrencies all play roles in Bitcoin’s long-term trajectory.

A comprehensive approach to Bitcoin valuation should consider these factors and incorporate them into scenario planning. This might involve adjusting growth assumptions based on regulatory developments or accounting for the potential impact of central bank digital currencies (CBDCs) on Bitcoin adoption.

Bitcoin Investment Strategies and Calculator Applications

Long-Term Hold Strategy

The “HODL” strategy involves buying Bitcoin and holding it for extended periods, typically years or decades. When using a bitcoin future value calculator for this strategy, focus on long-term growth projections and consider the impact of compound returns over time.

This strategy works well with calculators that model Bitcoin’s potential role as digital gold or a store of value. Consider scenarios where Bitcoin captures a percentage of the global gold market or serves as a hedge against monetary debasement.

Dollar-Cost Averaging Implementation

Dollar-cost averaging involves making regular Bitcoin purchases regardless of price, potentially reducing the impact of volatility on your average purchase price. A bitcoin future value calculator designed for DCA strategies can help you determine optimal investment amounts and frequencies.

Trading and Speculation Considerations

While most bitcoin future value calculators focus on long-term investing, some tools cater to active traders and speculators. These calculators might incorporate technical analysis indicators, market sentiment metrics, and short-term volatility patterns. However, remember that active trading is inherently riskier and requires significantly more time and expertise than long-term investing strategies.

Regulatory Impact on Bitcoin Future Value

Global Regulatory Landscape

Regulatory developments significantly impact Bitcoin’s future value potential, and savvy investors should consider these factors when using any bitcoin future value calculator. Positive regulatory developments, such as Bitcoin ETF approvals or legal tender adoption, can drive substantial price appreciation.

Conversely, restrictive regulations or outright bans can suppress Bitcoin’s growth potential in affected markets. A comprehensive approach to Bitcoin valuation should account for various regulatory scenarios and their potential impact on adoption and price.

Institutional Adoption Trends

The growing acceptance of Bitcoin among institutional investors represents a significant factor in future value calculations. As more corporations add Bitcoin to their treasury reserves and investment funds offer Bitcoin exposure, demand dynamics may shift substantially.

When using a bitcoin future value calculator, consider scenarios that model increasing institutional adoption and its potential impact on supply and demand dynamics. This might involve estimating what percentage of corporate treasuries or pension funds might allocate to Bitcoin over time.

Technical Analysis Integration

On-Chain Metrics

Advanced bitcoin future value calculators increasingly incorporate on-chain metrics that provide insights into network health and user behavior. Metrics such as active addresses, transaction volume, and holder distribution can provide valuable context for long-term projections. The Network Value to Transactions (NVT) ratio, often called Bitcoin’s price-to-earnings ratio, can help assess whether Bitcoin is overvalued or undervalued relative to its utility as a payment network.

Market Sentiment Indicators

Social media sentiment, Google search trends, and other behavioral indicators can provide early signals about changing market conditions. Some sophisticated bitcoin future value calculators incorporate these metrics to refine their projections. However, sentiment indicators should be used cautiously, as they can be manipulated and may not always correlate with long-term value creation.

Risk Management and Bitcoin Calculations

Volatility Considerations

Bitcoin’s extreme volatility presents both opportunities and risks that should be factored into any bitcoin future value calculator. While volatility can generate substantial returns during bull markets, it can also lead to significant losses during corrections. Consider using calculators that provide confidence intervals or probability distributions rather than single-point estimates. This approach can help you understand the range of possible outcomes and plan accordingly.

Portfolio Allocation Guidelines

Most financial advisors recommend limiting Bitcoin exposure to a small percentage of your total investment portfolio, typically 1-5%. When using a bitcoin future value calculator, consider how different allocation percentages might impact your overall portfolio returns and risk profile. A small allocation to Bitcoin can potentially enhance portfolio returns without dramatically increasing overall risk, while larger allocations may be appropriate for investors with higher risk tolerance and longer time horizons.

Future Developments in Bitcoin Valuation

Technology Improvements

Ongoing developments in Bitcoin technology, such as the Lightning Network, Taproot upgrade, and potential future scaling solutions, may impact its utility and value proposition. When using a bitcoin future value calculator, consider how these technological improvements might affect adoption and price over time. The Lightning Network, in particular, could significantly improve Bitcoin’s utility as a medium of exchange, potentially expanding its addressable market beyond store-of-value applications.

Macroeconomic Factors

Bitcoin’s relationship with macroeconomic factors continues to evolve, and future value calculations should account for various economic scenarios. Consider how factors such as inflation rates, currency debasement, and global economic instability might affect Bitcoin demand.

Some analysts view Bitcoin as a hedge against monetary inflation, while others see it as a risk asset that may decline during economic downturns. A comprehensive bitcoin future value calculator should allow users to model different macroeconomic scenarios.

Also Read: Bitcoin Future Price Prediction 2025 Expert Analysis & Forecasts

Conclusion

A bitcoin future value calculator serves as an invaluable tool for anyone considering cryptocurrency investments, providing structured approaches to estimate potential returns while accounting for Bitcoin’s unique characteristics and volatility patterns. Throughout this comprehensive guide, we’ve explored various types of calculators, from simple growth models to sophisticated statistical projections that incorporate market cycles, regulatory factors, and technological developments.

The key to successfully using any bitcoin future value calculator lies in understanding its limitations while leveraging its insights for informed decision-making. Rather than seeking precise predictions, focus on scenario planning that considers multiple potential outcomes, from conservative growth assumptions to more aggressive adoption-driven projections.

Whether you’re implementing a long-term HODL strategy, exploring dollar-cost averaging techniques, or integrating Bitcoin into a diversified portfolio, the right bitcoin future value calculator can help you model different approaches and understand their potential implications. However, always remember that these tools provide estimates, not guarantees, and should be combined with thorough research, risk assessment, and professional financial advice when making significant investment decisions.