Bitcoin Future Analysis: Bitcoin Trajectory 2024 and Beyond

Bitcoin Future Analysis: Since its launch in 2009, the pioneer of cryptocurrencies, Bitcoin, has experienced significant transformations. Institutional investors, governments, and regular people have begun to show interest in what was once a specialized digital currency. Bitcoin is always changing because of its decentralized character and the fact that blockchain technology is constantly improving. By 2024, the subject of Bitcoin Future Analysis will have captivated everyone’s attention. This study investigates Bitcoin’s future analysis in the next few years by examining important elements like legal changes, technological progress, adoption, and economic implications.

The Role of Regulation

Global Regulatory Landscape

Governments and regulators have been increasingly watching Bitcoin as its value has increased. Bitcoin allowed for exploration and innovation in an initially unregulated arena. But as the market developed and Bitcoin’s value skyrocketed, people started talking about how it could be used for illegal purposes, how the market could be manipulated, and how consumers weren’t protected.

More and more nations are trying to figure out how to regulate Bitcoin in 2024 so that innovation can coexist with oversight. Know Your Customer (KYC) and Anti-Money Laundering (AML) policies are becoming increasingly strict in countries such as China, the EU, and the US. Governments’ increasing desire to regulate the money supply and digital asset usage is mirrored in the emergence of central bank digital currencies (CBDCs).

Nevertheless, there are benefits and drawbacks to regulation. Heavy regulation, some say, might hinder innovation and go against the decentralized spirit that Bitcoin was founded upon; others see it as a way to legitimize Bitcoin and provide consumer protection. A lot will ride on the outcome of these regulations regarding Bitcoin’s future. The initial allure of Bitcoin as a decentralized asset that is resistant to censorship could be compromised if authorities are excessively stringent. Conversely, more widespread public use and adoption by conventional financial institutions may result from governments establishing a balanced regulatory environment.

The Impact of Regulation on Institutional Investment

The entrance of large-scale financial institutions has been a major factor in the pricing and potential widespread use of Bitcoin. The amount of money institutions, like hedge funds and publicly listed firms, are putting into Bitcoin has increased exponentially. This tendency will persist, particularly if authorities establish clearer regulations that make institutional investment safer.

For instance, in 2021 and 2022, Bitcoin acquisitions by Tesla and MicroStrategy were in the news. With the advent of Bitcoin ETFs (Exchange-Traded Funds), which are currently popular in many regions of the globe, this tendency is expected to grow even further in 2024. To make Bitcoin more accessible to regular investors, these financial products let them obtain exposure to the cryptocurrency without really buying it.

Technological Advancements: The Lightning Network and Beyond

Scaling Solutions for Mainstream Adoption

Scalability has been one of Bitcoin’s biggest obstacles. More efficient and quicker transaction processing is required as the network expands. To solve this problem, Bitcoin developed the Lightning Network, a layer-two solution allowing cheaper and faster blockchain transactions.

The Lightning Network is still developing in 2024, but it can still process transactions in real-time and keep Bitcoin’s decentralized protocol secure. The future of Bitcoin, particularly as a medium of exchange, depends on its performance. If Lightning Network adoption increases, Bitcoin might become a serious contender to more established payment systems like Visa and Mastercard.

Other factors besides the Lightning Network will determine Bitcoin’s scalability in the future. Alternate approaches include enhancing Bitcoin’s privacy and efficiency with protocol modifications like Taproot and Schnorr signatures and sidechains. Ultimately, these technical developments will decide whether Bitcoin remains a store of value or becomes a more popular form of payment.

Quantum Computing and the Security of Bitcoin

The advent of quantum computing is another impending technical challenge. Despite their relative youth, quantum computers may one day be able to decipher the Bitcoin and other cryptocurrency cryptography algorithms. Even though this danger is only theoretical in 2024, Bitcoin’s creators know it. Developing encryption immune to quantum attacks is an important area to watch in the coming years.

Blockchains like Bitcoin could jeopardize the security paradigm if quantum computing materializes faster than anticipated. Implementing cryptographic solutions that can withstand quantum attacks will be a significant issue for Bitcoin developers as they strive to remain ahead of the curve.

Market Dynamics: Supply, Demand, and Halvings

Bitcoin’s Fixed Supply and Halving Cycles

One of Bitcoin’s most distinctive features is its fixed supply. Only 21 million bitcoins will be created, and this scarcity is built into the protocol. This limited supply is one of the key drivers behind Bitcoin’s value proposition as “digital gold.”

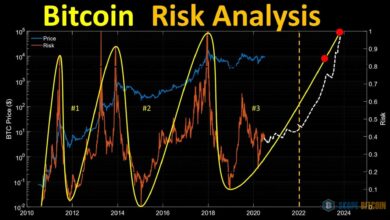

Approximately every four years, the Bitcoin network undergoes a halving event, where the reward for mining new blocks is cut in half. The most recent halving occurred in 2024, reducing the reward from 6.25 BTC to 3.125 BTC. Historically, these halvings have triggered significant price increases, as the reduction in supply against a backdrop of increasing demand leads to upward price pressure.

Many analysts believe that Bitcoin’s price will continue to rise due to this decreasing supply. However, there is also a school of thought that the halving’s impact will diminish over time as Bitcoin’s total supply nears its maximum. Additionally, the growing influence of institutional investors and the increasing utility of Bitcoin in decentralized finance (DeFi) applications could add new dynamics to the supply-demand equation.

Market Volatility and Institutional Stabilization

Bitcoin’s market volatility has long been one of its defining characteristics. While this volatility has attracted speculative investors, it has also been a barrier to wider adoption as a stable store of value or medium of exchange. However, as more institutional investors enter the space, Bitcoin’s price may stabilize.

Institutional investors tend to have longer-term investment horizons and may provide a stabilizing force in the market. Additionally, introducing Bitcoin derivatives and futures markets has allowed investors to hedge their positions, further contributing to market stability. While Bitcoin is unlikely to shed its volatility entirely, the market’s maturation may reduce the frequency of the wild price swings that have characterized its history.

Economic and Environmental Considerations

Bitcoin and Macroeconomic Trends

In 2024, the macroeconomic landscape remains uncertain, with concerns over inflation, geopolitical tensions, and shifting monetary policies. Bitcoin has been increasingly viewed as a hedge against inflation, similar to gold. As central banks continue experimenting with unconventional monetary policies, some investors see Bitcoin as a safeguard against potential currency devaluation.

However, Bitcoin’s role as an inflation hedge is still debated. While it has performed well during periods of monetary expansion, its volatility makes it a risky hedge in the short term. The future of Bitcoin as a store of value will depend on how it performs during various macroeconomic cycles.

The Environmental Debate

One of the most controversial aspects of Bitcoin is its environmental impact. The energy-intensive mining process has led to criticism from environmentalists and governments alike. In 2024, the debate continues, but there have been significant advancements in addressing these concerns.

Miners are increasingly shifting toward renewable energy sources, and there is growing interest in making Bitcoin mining more sustainable. The future of Bitcoin may see a push toward energy-efficient solutions, especially if environmental concerns become a more prominent factor in regulatory decisions.

Conclusion

Many factors, including legislative frameworks, technology developments, market forces, and macroeconomic trends, will determine Bitcoin’s future in the years to come. Bitcoin has overcome insurmountable odds to become a popular sensation while encountering several obstacles. The future of Bitcoin hinges on its ability to adapt to changing regulations, technological developments, and market dynamics. Still, we should expect to see more innovation and adoption in the future. It is impossible to ignore Bitcoin’s influence on the future of finance, regardless of whether it becomes the world’s dominant currency or stays a speculative asset.