Bitcoin ETF Price Prediction: Insights and Market Analysis

Bitcoin ETF Price Prediction: The possibility of a Bitcoin Exchange-Traded Fund (ETF) has emerged as a central topic of discussion in the cryptocurrency market. This is because Bitcoin continues to attract the attention of investors from both retail and institutional sectors. Ethereum exchange-traded funds (ETFs) might significantly impact the price of Bitcoin and the cryptocurrency market as a whole. In the following paragraphs, we will investigate the factors that influence Bitcoin ETF price forecasts and the situations that may occur.

Understanding Bitcoin ETFs

Through a Bitcoin ETF, investors can be exposed to Bitcoin without owning cryptocurrency. Instead, they put their money into an exchange-traded fund (ETF) that follows the price of Bitcoin. Due to this structure’s many benefits, traditional investors have easier access, and the market may see more liquidity. Launching a Bitcoin exchange-traded fund (ETF) can potentially encourage institutional investors to buy cryptocurrencies more widely, which might increase demand and prices.

The Current Landscape of Bitcoin ETFs

Grayscale, VanEck, and Valkyrie are just a few companies that have applied to start Bitcoin ETFs. Despite the SEC’s initial reluctance to approve such applications, the tide appears to be turning. As cryptocurrency continues to gain traction in the mainstream of finance, new developments point to a more positive attitude toward Bitcoin ETFs.

Several Bitcoin exchange-traded funds (ETFs) were authorized in Canada in 2021, and they quickly gained popularity and a lot of money. Because of this accomplishment, many wonder whether the SEC will approve Bitcoin ETFs, which has increased market expectations in the U.S.

Factors influencing.SSBitcoin ETF Price Predictions

- Regulatory Developments: The approval of Bitcoin ETFs in the U.S. could catalyze U.S. price movement. Positive regulatory developments often lead to increased investor confidence, driving up demand for Bitcoin. Conversely, negative regulatory news can have the opposite effect, creating uncertainty and volatility in the market.

- Market Demand: The overall demand for Bitcoin plays a crucial role in price predictions. Institutional investors, driven by the potential for diversification and hedging against inflation, have increasingly shown interest in Bitcoin. If a Bitcoin ETF is approved, it is expected to attract substantial capital from these investors, further driving up the price.

- Market Sentiment: Investor sentiment and market psychology are critical to predicting price movements. News events, social media trends, and general market sentiment can all influence the price of Bitcoin. A positive sentiment surrounding a Bitcoin ETF approval could create a bullish trend, while negative sentiment could lead to price corrections.

- Macroeconomic Factors: Broader economic conditions, including inflation rates, interest rates, and geopolitical events, can significantly impact the price of Bitcoin. Investors may seek alternative assets like Bitcoin in economic uncertainty, leading to price appreciation.

- Technological Developments: Advances in blockchain technology and improvements in Bitcoin infrastructure can also influence price predictions. Developments like the Lightning Network, which aims to improve transaction speeds and lower costs, could enhance Bitcoin’s usability and attractiveness as an investment.

Bitcoin ETF Price Predictions: Scenarios

Short-Term Predictions

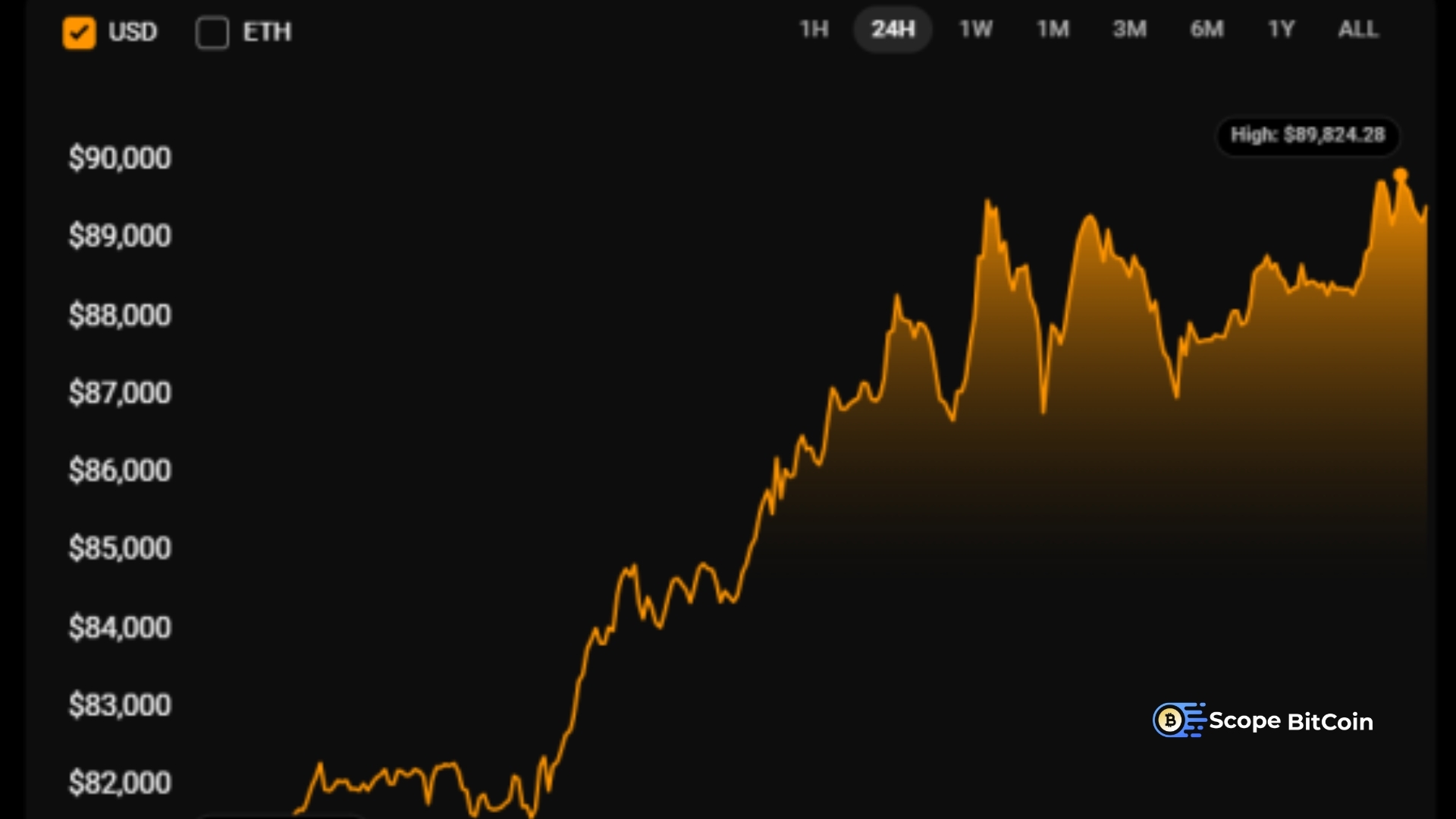

Bitcoin prices may see extreme short-term volatility as a result of the current market mood and further regulatory developments. The imminent approval of a Bitcoin ETF might cause a flood of capital into the market, driving prices higher than they are now. If Bitcoin’s upward trend continues, some experts think its value could hit $100,000 or even more in the coming year.

Conversely, Bitcoin values might fall to support levels between $30,000 and $40,000 if regulatory obstacles remain or negative sentiment becomes more widespread. The SEC’s moves and general market circumstances will continue to impact the near-term forecast significantly.

Long-Term Predictions

The outlook for Bitcoin’s price in the future, as well as a possible ETF, is bright. If Bitcoin ETFs materialize, the cryptocurrency sector as a whole might get a significant boost. Due to rising institutional use, widespread acceptance, and a lack of supply, Bitcoin might achieve a value of $200,000 to $500,000 in the next five to ten years, according to analysts.

For this hopeful scenario, Bitcoin must continue serving as a wealth and digital gold store. As demand exceeds supply and more large financial institutions include it in their investment portfolios, the price of Bitcoin will likely increase dramatically.

Risks and Considerations

Even if Bitcoin ETFs have promising future potential, it is critical to weigh the dangers. Due to the nature of the cryptocurrency market, price fluctuations can be quite large for various reasons. Changes in regulations can also affect market dynamics by sowing doubt.

Investors should also be aware of the possibility of rivalry among Bitcoin ETFs. Shifts in supply and demand when additional products hit the market could affect Bitcoin’s intrinsic value and the efficiency of specific exchange-traded funds (ETFs).

Conclusion

The future of Bitcoin ETFs is poised to significantly influence the price of Bitcoin and the broader cryptocurrency market. As regulatory landscapes evolve and institutional interest grows, the potential for substantial price appreciation becomes increasingly likely.

Investors should stay informed about market developments and remain cautious of the inherent risks associated with cryptocurrency investments. While predictions can provide insight, the dynamic nature of the market means that outcomes can vary widely. As we move forward, the interplay between regulatory approvals, market demand, and macroeconomic factors will be crucial in shaping the future of Bitcoin and its price trajectory. As always, thorough research and consideration of personal financial goals are essential for anyone looking to invest in Bitcoin or cryptocurrency-related products.