Bitcoin Ends Distribution Phase Amid Price Volatility

The broader crypto market continues to experience heightened volatility, causing a robust, sharp drop in Bitcoin Ends Distribution price below the $85,000 mark after witnessing a slight upward push in the previous week. With BTC’s price undergoing intense bearish pressure, investors’ sentiment has taken a drastic turn, which might influence the flagship asset’s trajectory shortly.

Bitcoin Holders End Distribution

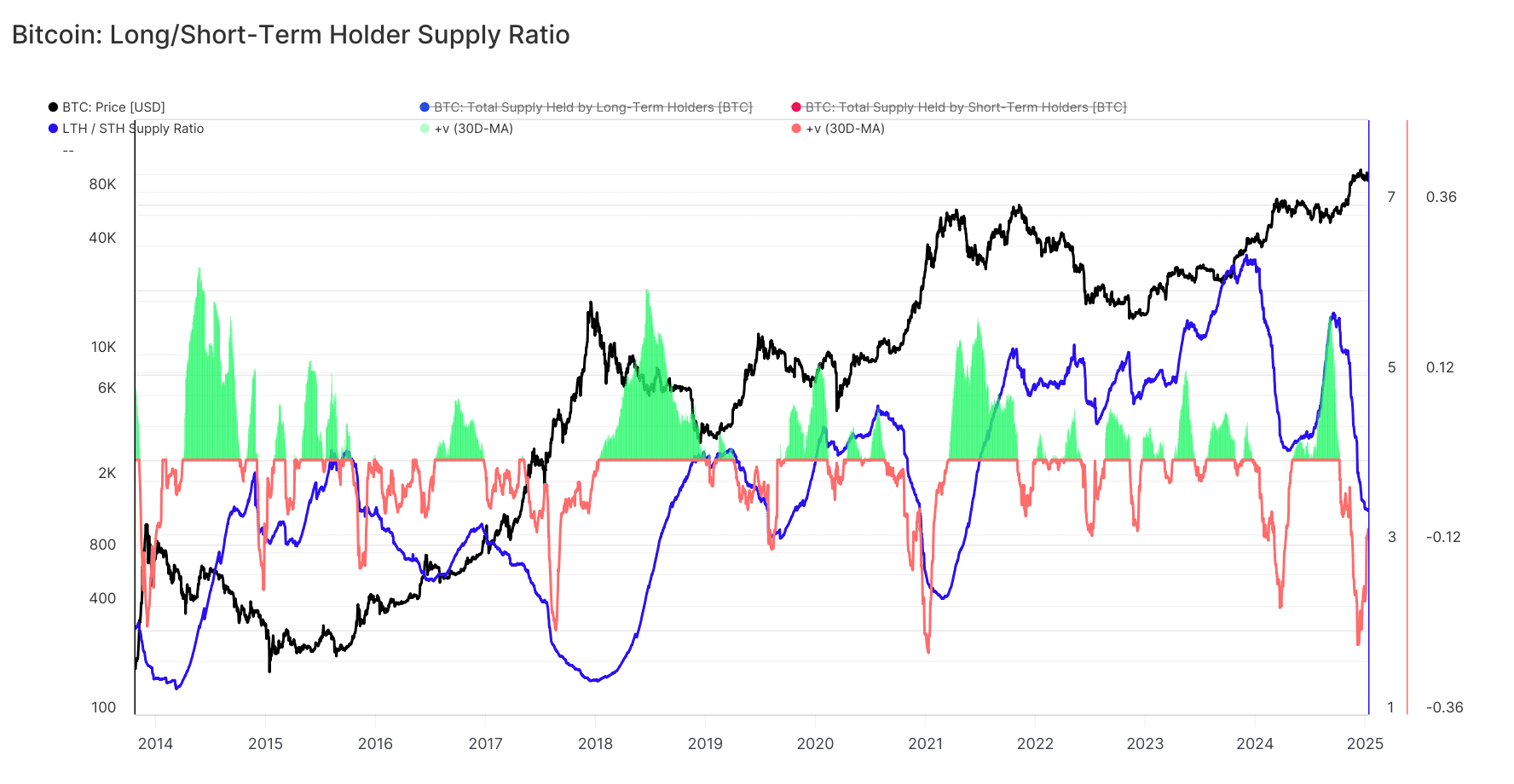

As Bitcoin struggles to reclaim key levels, a notable trend has been identified among investors, particularly long-term BTC holders. Seasoned on-chain and macro researcher Axel Adler Jr. spotted the change in sentiment among investors in his recent data research. Specifically, long-term Bitcoin holders appear to have completed their distribution phase, possibly setting the stage for renewed bullish momentum. This completion of the distribution phase suggests that selling pressure among long-term holders has subsided, limiting BTC’s supply in the market. According to the macro researcher, the distribution by long-term holders is the largest in recent years. After navigating key metrics, Axel Adler highlighted that activity metrics have shifted from high to low, mainly from selling and accumulation.

The decrease in supply is usually a sign of a new market cycle and stabilization, representing a potential positive indication of the market. Furthermore, if the demand for BTC surges, the development might lead to a supply squeeze in the upcoming weeks. In another X (formerly Twitter) post, the expert reported that long-term holders have distributed over 1.715 million BTC from the $60,000 price. After navigating the 30-day net position change of long-term bitcoin holders, Axel Adler identified the massive distribution by the long-term investors.

With the heightened distribution phase ending, the metric has almost returned to neutral levels, suggesting large-scale selling pressure has stopped. Should this trend continue, the possibility of BTC witnessing a rebound increases as long-term holders return to the accumulation phase.

Bitcoin’s Price Outlook

Despite persistent bearish performance in BTC’s price, investors and traders are becoming bullish about the asset’s prospects, reducing selling pressure. Axel Adler revealed that active selling by long-term holders reached its end on crypto exchanges. Following the halt in selling activity on exchanges is the monthly moving average inflow, which has declined from 3.8% to about 1.4%. Since it lessens the downward pressure on Bitcoin, this minimal level of long-term holders’ selling activity is an encouraging sign for prices.

At the time of writing, BTC was trading at $81,995, with a more than 5% drop in the last 24 hours. Investors seem to capitalize on the recent sharp decline, as its trading volume has increased by over 24% in the past day.

Final thoughts

The post points out the current volatility within the broader crypto market, where Bitcoin suddenly fell beneath the $85,000 price point following a temporary upward momentum in the past week. Such a decline has changed investor perceptions, which might affect Bitcoin’s future development. There is a common trend in how long-term holders of Bitcoin behave. Following an intense distribution period, with more than 1.7 million BTC sold, long-term holders also appeared to have ceased selling. This supply decline is typically an indicator of a new market cycle and can signal the stabilization of, and subsequent recovery in, Bitcoin’s price.

The reduction of selling pressure by these long-term holders, especially from exchanges, is another positive indication. Although Bitcoin’s value has been below 5% over the past 24 hours, growing trading volume means some investors are cashing in on the decline. The end of the distribution phase and the return to a neutral position of long-term holders may indicate bearishness calming down. If demand rises, Bitcoin may experience a positive price movement. As of writing, BTC was at $81,995, over a 5% decline in the past 24 hours. Investors appear to take advantage of the recent steep fall, as its trading volume has grown by over 24% in the last day.