Bitcoin Could Hit $200K in 2025 If 3 Key Catalysts Align

Bitcoin has captivated investors, technologists, and speculators for over a decade. Its breathtaking price swings, narratives of disruption, and the rise of digital finance make it one of the most scrutinized assets on earth. As of mid-2025, Bitcoin has already defied skeptics by crossing six figures, and many market watchers now whisper a bold possibility: Bitcoin price set to reach $200,000 in 2025. But that claim isn’t based on blind optimism — it hinges on three interlinked conditions aligning.

In this article, we will examine those three pivotal factors that, if realized, could propel the Bitcoin price into the $200K zone. Throughout, we will weave in related phrases and LSI keywords such as BTC rally, crypto adoption, institutional inflows, and market sentiment. We’ll analyze each trigger in depth, show how they might interact, and assess the realistic upside and risks. By the end, you’ll understand not just the “if,” but the “how” and “when.”

Why $200,000 Isn’t Just a Fantasy

Before exploring the three prerequisites, we need to ground ourselves in current forecasts and market sentiment. Many analysts see Bitcoin price predictions for 2025 clustering between $145,000 and $250,000, depending on assumptions about adoption, regulation, and macro trends. Some more aggressive models even stretch toward $1 million in a longer timeframe, but such scenarios require extreme tail conditions.

Still, a $200,000 target for 2025 sits at the upper end of what’s considered plausible by many bullish analysts. It’s ambitious, but not outside the realm of possibility — provided the right catalysts converge. The next sections outline those three key elements.

Trigger 1 — Massive Institutional Inflows and Adoption

One of the most fundamental drivers of any asset’s sustained rise is demand. In the case of Bitcoin, institutional money has long been discussed as the tipping point. A flood of capital from pensions, sovereign wealth funds, asset managers, and corporate treasuries has the potential to reshape the supply-demand balance.

Why Institutions Matter for Price

Retail investors can drive short-term momentum, but only large institutions can generate prolonged upward pressure. When institutions allocate even a modest percentage of their capital base to Bitcoin, the sheer volume can be transformative. Institutions bring more credibility, better infrastructure, and stickier capital — they do not typically panic sell at the first sign of volatility.

Institutional involvement also reduces the free float effectively available for trading. More capital locked away in long-term holdings means less supply to absorb new buying interest. Over time, that dynamic can create supply constraints that drive prices higher.

Real-World Signs of Institutional Entry

We are already seeing hints of this shift. Institutional flows into Bitcoin-focused exchange-traded funds (ETFs) have grown rapidly, especially in markets like the U.S. and Canada. Some major asset managers are launching or exploring spot Bitcoin products, which dramatically open the door for institutional capital that otherwise can’t hold raw cryptocurrency.

Also, prominent corporations and balance sheet allocators (treasury allocations to BTC) may publicly disclose Bitcoin holdings, adding legitimacy to the asset. Each such public move helps drive confidence and additional inflows.

Level of Inflows Needed to Hit $200K

To push Bitcoin toward $200,000, institutional inflows would likely need to reach tens of billions of dollars over a sustained period. This would need to outpace new supply from mining and offset any selling pressure. If large institutions allocate 1%–3% of their assets under management to Bitcoin, that could represent an enormous capital injection into the BTC market.

In short, the first essential condition is an institutional wave so large that it fundamentally changes how many BTC are available to trade — shrinking effectively liquid supply while demand surges.

Trigger 2 — Favorable Regulation & Regulatory Clarity

Strong demand alone may not be enough. Without legal certainty and regulatory support, institutional capital can be reluctant to flow into Bitcoin. Thus, the second trigger is clear, favorable regulation and governmental support.

The Importance of Regulation for Bitcoin’s Legitimacy

Regulation forms the backdrop against which institutions evaluate risk. Regulatory clarity reduces uncertainty over taxation, custody rules, anti-money laundering (AML) compliance, and how Bitcoin is classified (commodity, security, property, etc.). Because large investors must manage legal, accounting, and compliance frameworks, regulatory ambiguity can act as a barrier to entry.

When governments embrace clarity instead of hostility, Bitcoin becomes easier to integrate into portfolios, retirement accounts, insurance funds, and other institutional allocations.

Political and Policy Signals Already Emerging

In 2025, various policy developments have lifted optimism in the BTC community. Some countries are taking steps toward creating strategic Bitcoin reserves or digital asset stockpiles. For example, the United States proposed a “cryptocurrency reserve” concept that might include Bitcoin and other digital assets. Such moves, if executed and backed with legal frameworks, send powerful signals.

Moreover, regulators in major economies are exploring laws to support spot ETFs, clearer custody rules, and pathways for integrating digital assets into existing financial systems. A supportive regulatory regime would lower barriers and increase confidence, helping unlock institutional capital for Bitcoin.

What Level of Regulatory Support Is Needed

To help push Bitcoin toward $200,000, regulation needs to be not just benign but enabling. Key elements include:

-

Legal classification of Bitcoin in major jurisdictions that avoids undue constraints

-

Licensing frameworks for custody providers and exchanges

-

Tax regimes that do not penalize long-term holders or create distortive burdens

-

Approval of spot Bitcoin ETFs or other regulated structures

-

Coordination across borders to reduce fragmentation

Once regulatory clarity becomes the norm in major markets (U.S., EU, East Asia, etc.), institutional capital becomes more comfortably deployable into Bitcoin investment vehicles with lower perceived risk.

Trigger 3 — Macro Tailwinds & Global Monetary Conditions

Even with institutional demand and regulation in place, Bitcoin must operate within the larger macroeconomic environment. The third trigger is a set of macro tailwinds that reinforce Bitcoin’s narrative as a hedge, inflation play, and growth asset.

Inflation, Currency Debasement & Safe-Haven Demand

Bitcoin is often likened to digital gold because it is perceived by some as a hedge against inflation and currency debasement. If inflation surges globally, or fiat currencies lose purchasing power, investors may turn to alternative stores of value. This macro narrative has fueled Bitcoin rallies historically.

In a world of loose monetary policy, high debt, and low yields, Bitcoin becomes more compelling as one of the few assets unbacked by any government, yet offering scarcity. This narrative gains weight especially when central banks keep printing or interest rates remain historically low.

Declining Interest Rates and Liquidity Inflows

If central banks pivot toward easing or maintain dovish policies, capital tends to flow into higher-risk, higher-return assets. Lower interest rates reduce the opportunity cost of holding non-yielding assets like Bitcoin, and increased liquidity in markets may push more money into risk assets, including crypto.

Moreover, quantitative easing programs, asset purchase programs, or infrastructural stimulus can drive capital seeking higher yields. Bitcoin, with its volatility and upside potential, could become one of the preferred destinations.

Global Dollar Weakness & Capital Flows

Because Bitcoin is globally traded and often priced relative to the U.S. dollar, macro trends like a weakening dollar can act as a tailwind. If the USD loses value, Bitcoin may rise not only relative to the dollar but attract capital from regions under stress or with weaker local currencies.

Additionally, capital flows from emerging markets — where local currencies may be under pressure — may find refuge in Bitcoin. This cross-border demand can magnify price pressure, especially if Bitcoin is perceived as a safer store of value than local alternatives.

In summary, the third trigger is a macro backdrop tilted toward inflows into assets uncorrelated to traditional markets, high liquidity, risk-seeking capital, and dollar weakness — all of which can strengthen the case for a BTC rally toward $200K.

How the Three Triggers Interact

These three triggers — institutional inflows, regulatory clarity, and macro tailwinds — are not independent. They reinforce and amplify each other. Let’s explore how this synergy can occur.

-

Regulation unlocks institutional inflows. Without legal frameworks and compliance certainty, many institutions will stay on the sidelines. Once regulation becomes supportive or neutral, institutional participation can accelerate.

-

Macro conditions sensitize investors to Bitcoin’s narrative. In a world of weak yields, inflation fears, and excess liquidity, Bitcoin’s scarcity story becomes more compelling. That draws both retail and institutional interest.

-

Institutional demand reduces supply and strengthens pricing dynamics. As more capital enters and fewer BTC remain available to trade, price pressure magnifies. This in turn attracts speculative momentum and media attention, fueling a virtuous cycle.

-

Momentum and narrative become self-reinforcing. Once the price begins to move upward strongly, sentiment gains power. New entrants rush in, fear-of-missing-out (FOMO) accelerates buying, and technical momentum can contribute to further gains.

Under that scenario, a rally that begins in late 2025 could accelerate rapidly, potentially culminating in a $200,000 target.

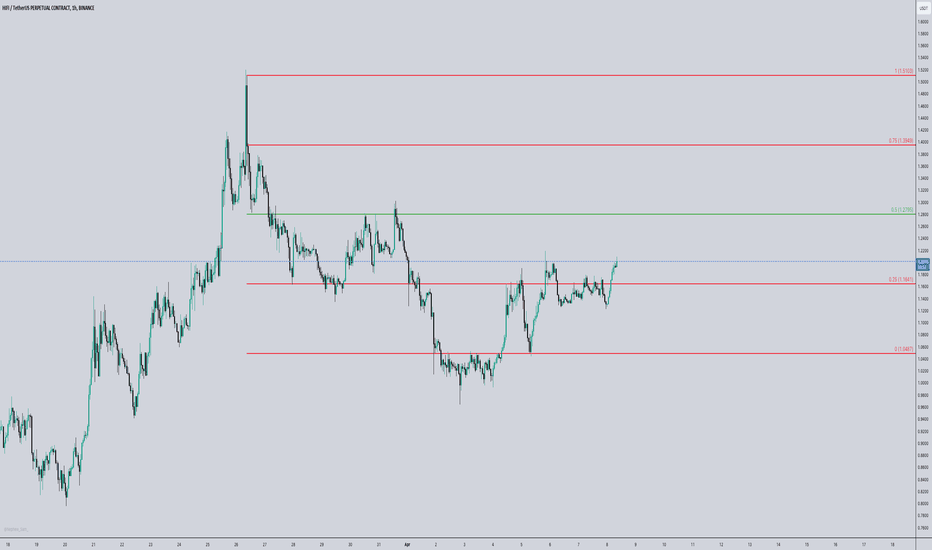

Potential Price Path & Timing

If all three triggers align, the timing of the $200K run may look something like this:

-

Mid to late 2025: Regulatory clarity emerges in key jurisdictions. Some institutions begin allocating incrementally. Macro signals (rate cuts, liquidity) favor risk assets. Bitcoin begins a sustained uptrend.

-

Q4 2025: Momentum builds. Institutional capital accelerates. Media attention and retail inflows amplify the rally. Technical breakouts push Bitcoin toward new all-time highs. Some forecasts already suggest Bitcoin may enter its historically strong quarter in Q4.

-

Year-end 2025 / early 2026: Once the momentum becomes self-sustaining, Bitcoin may cross the $200,000 threshold. At that point, further gains could be driven by continued adoption and speculative interest.

The exact trajectory could vary. The rally might stall short of $200K if any trigger falters or if external shocks intervene. But if conditions align, it becomes a credible outcome.

Risks, Counterarguments & What Could Go Wrong

No prediction is foolproof. It’s critical to examine what could derail the $200K scenario.

Regulatory Reversals or Crackdowns

Governments might pivot from supportive to restrictive. If major jurisdictions like the U.S., EU, or China reimpose bans or harsh regulations, institutional capital could exit. Regulatory risk is arguably the biggest threat to the bullish thesis.

Macro Shock or Rate Hikes

If central banks raise rates aggressively to fight inflation, or if a recession forces risk-off sentiment, capital may flee risky assets, including Bitcoin. A macro reversal would weaken the entire narrative.

Competition, Technological Failures, or Market Sentiment Shifts

New blockchain innovations, attacks on Bitcoin’s network, scaling issues, or negative media coverage could erode confidence. If sentiment turns sour, momentum can reverse rapidly.

Liquidity Traps and Sell Pressure

Some early buyers (institutions or early whales) may look to take profits along the way, exerting sell pressure. If too much BTC is liquidated, it could halt or reverse the rally.

Overvaluation & Bubble Risk

At high valuations, Bitcoin may enter bubble territory. If expectations get ahead of fundamentals, corrections can be sharp and painful. A $200K price could in itself invite scrutiny and risk. As with any high-conviction forecast, the upside must be balanced against significant tail risks.

Also Read: Bitcoin Price Today Live Levels Drivers & Outlook

Conclusion

The idea of Bitcoin price set to reach $200,000 in 2025 is bold — but not irrational — if three critical conditions align: substantial institutional inflows, regulatory clarity, and powerful macro tailwinds. Institutional capital brings scale and stickiness. Clear regulation removes barriers. Macro conditions (inflation, liquidity, dollar weakness) provide strong winds in Bitcoin’s favor. Together, they can feed a virtuous loop of demand, momentum, and narrative.

However, the path is far from smooth. Regulatory missteps, macro shocks, sentiment reversals, or liquidity mismatches could derail even the most optimistic trajectory. As always, investing in Bitcoin or any volatile asset demands caution and risk awareness.

If these three triggers coalesce in late 2025, a $200,000 Bitcoin becomes not just a headline, but a plausible reality. But for now, it remains contingent — a mountain that Bitcoin must climb under favorable skies.

FAQs

Q: How realistic is $200,000 for Bitcoin in 2025?

It’s certainly on the optimistic end of the spectrum, but many analysts already model price ranges between $145K and $250K for 2025. Provided the three triggers (institutional inflows, regulation, macro tailwinds) align, it becomes a credible scenario rather than fantasy.

Q: Which institutions are most likely to drive Bitcoin inflows?

Pension funds, sovereign wealth funds, insurance companies, hedge funds, and corporate treasuries are prime candidates. Once they are comfortable with custody, regulation, and reporting norms, their allocations — even 1–3% — can represent significant capital.

Q: What regulatory developments would accelerate Bitcoin’s adoption?

Key enablers include legal classification clarity, licensing for custodians, approval of spot Bitcoin ETFs, favorable tax treatment for long-term holders, and harmonized rules across jurisdictions. Each reduces friction and tail risk for institutional entrants.

Q: Could macro conditions alone push Bitcoin to $200K?

Macro tailwinds such as inflation, low interest rates, and dollar weakness can create favorable currents, but they are unlikely by themselves to push Bitcoin to $200K without strong demand from institutions and regulatory support.

Q: What warning signs should investors monitor?

Watch for regulatory crackdowns, central bank rate hikes, major sell-offs by whales or institutions, deteriorating market sentiment, or signs of systemic stress in the crypto ecosystem. Any one of those could interrupt the rally.