Best Penny Cryptos: A Deep Dive into Bitcoin Sentiment Analysis

Bitcoin sentiment analysis: Investors seeking high-risk, high-reward prospects generally gravitate toward penny cryptocurrencies, which have a low price per token in the constantly changing cryptocurrency market. Understanding the underlying emotion in the crypto market, especially regarding Bitcoin, might offer significant insights into the viability of these low-cost assets despite their attraction.

The Importance of Bitcoin Sentiment Analysis

Bitcoin dramatically affects the entire cryptocurrency market because it is the first and foremost cryptocurrency. Sentiment research, which involves examining market mood using a variety of signals and data points, is essential to forecast changes in Bitcoin’s price. To know how penny cryptocurrencies are doing, you should look at Bitcoin’s emotion since it typically dictates the trend for other cryptocurrencies.

Analyzing Bitcoin Sentiment

Sentiment regarding Bitcoin can be evaluated using a variety of approaches, including the following:

- Social Media Trends: Platforms like Twitter, Reddit, and Telegram provide real-time data on investor opinions and trends. Positive mentions or hashtags related to Bitcoin can indicate bullish sentiment, while negative sentiments suggest caution.

- News and Media Coverage: whether positive or negative, media reports can sway public perception. Major news events such as regulatory changes, technological advancements, or high-profile endorsements can lead to significant shifts in sentiment.

- Market Metrics: Indicators such as trading volume, price volatility, and market capitalization can reveal investor confidence. For instance, a surge in Bitcoin’s trading volume might signal growing interest and a potential rise in price.

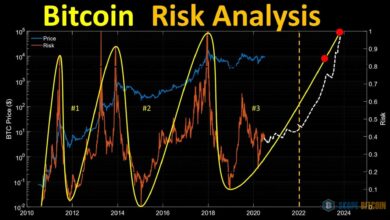

- Technical Analysis: Chart patterns and technical indicators can provide insights into potential future price movements based on historical data.

Evaluating Penny Cryptos

In the process of appraising penny cryptocurrencies, it is essential to take into account both their intrinsic value and the sentiment of the market. As viewed through the prism of the current feeling around Bitcoin, the following are some notable penny cryptocurrencies to keep an eye on:

SafeMoon (SAFEMOON)

Much attention has been paid to SafeMoon because of its one-of-a-kind tokenomics, which includes a reflection mechanism that provides holders with more tokens. The enthusiasm behind SafeMoon has been encouraged by its robust community and continual development despite its relatively cheap price structure. A positive mood toward Bitcoin may spread to SafeMoon, increasing its value.

Holo (HOT)

The decentralized hosting infrastructure that Holo provides is designed to support distributed apps. The minimal cost of entry makes Holo appealing to investors seeking creative projects. There is a correlation between a buoyant Bitcoin market and increasing investment in alternative tokens, which means that emotions towards Bitcoin can affect the performance of Holy.

Polygon (MATIC)

Polygon offers an Ethereum scaling solution that operates at the layer 2 level, known initially as Matic Network. Its price can fluctuate dramatically, making it accessible to anyone with minimal cash, even though it is not a standard penny cryptocurrency. People’s sentiment toward Bitcoin affects Ethereum and, as a result, Polygon. If Bitcoin has a positive trend, it may lead to increased investments in Ethereum-based initiatives such as Polygon.

Verasity (VRA)

Through blockchain technology, Verasity is working to enhance the quality of online video content. Because of its low price and distinctive selling concept, it is an appealing choice for investors who engage in speculation. The sentiment surrounding Bitcoin affects the cryptocurrency market as a whole, and a favorable trend about Bitcoin can result in an increased interest in other creative initiatives such as Verasity.

How Bitcoin Sentiment Influences Penny Cryptos

Bitcoin sentiment can have several different effects on penny cryptocurrencies:

- Market Correlation: As Bitcoin often drives overall market trends, a bullish sentiment towards Bitcoin can lead to increased investment in other cryptocurrencies, including penny cryptos. Conversely, negative sentiment around Bitcoin can result in a market-wide downturn, affecting penny cryptos.

- Investor Behavior: Positive Bitcoin Sentiment Analysis often boosts investor confidence, leading to higher risk tolerance and increased interest in penny cryptos. In contrast, a bearish sentiment can result in a cautious approach, reducing investments in lower-priced tokens.

- Speculative Trading: Penny cryptos are frequently subject to speculative trading, driven by broader market trends. Bitcoin’s performance can set the tone for speculative activities, influencing penny cryptos’ volatility and price movements.

Conclusion

To make a successful investment in penny cryptocurrencies, it is necessary to consider the tokens’ inherent characteristics and the market’s general emotions, particularly about Bitcoins. Investors can acquire significant insights regarding the prospective performance of penny cryptocurrencies by analyzing Bitcoin’s sentiment through social media trends, news coverage, market data, and technical analysis.

There is a lot of danger associated with penny cryptocurrencies, even though they thought of large profits with a modest investment. Therefore, to make educated judgments regarding investments, it is vital to remain updated about the sentiment of the Bitcoin market and broader developments in the cryptocurrency industry. When navigating the volatile environment of cryptocurrency investments, conducting an extensive study and approaching the situation cautiously is always helpful.

The monitoringitcoin’s mood can provide a strategic advantage to individuals interested in studying penny cryptocurrencies. This advantage can assist in identifying attractive prospects and appropriately managing risks.