A Guide to Bitcoin Halving Mechanism and Its Significance

Bitcoin Halving. There are 57,947 Bitcoin transactions recorded on the blockchain, and each “block” contains 1 MB of these entries. In a race to add the next block, “miners” use specialized hardware to solve a complicated mathematical problem; they generate a random 64-character output called a “hash,” finish the process, and lock the block to prevent modification. Cryptocurrency is distributed to those who complete blocks.

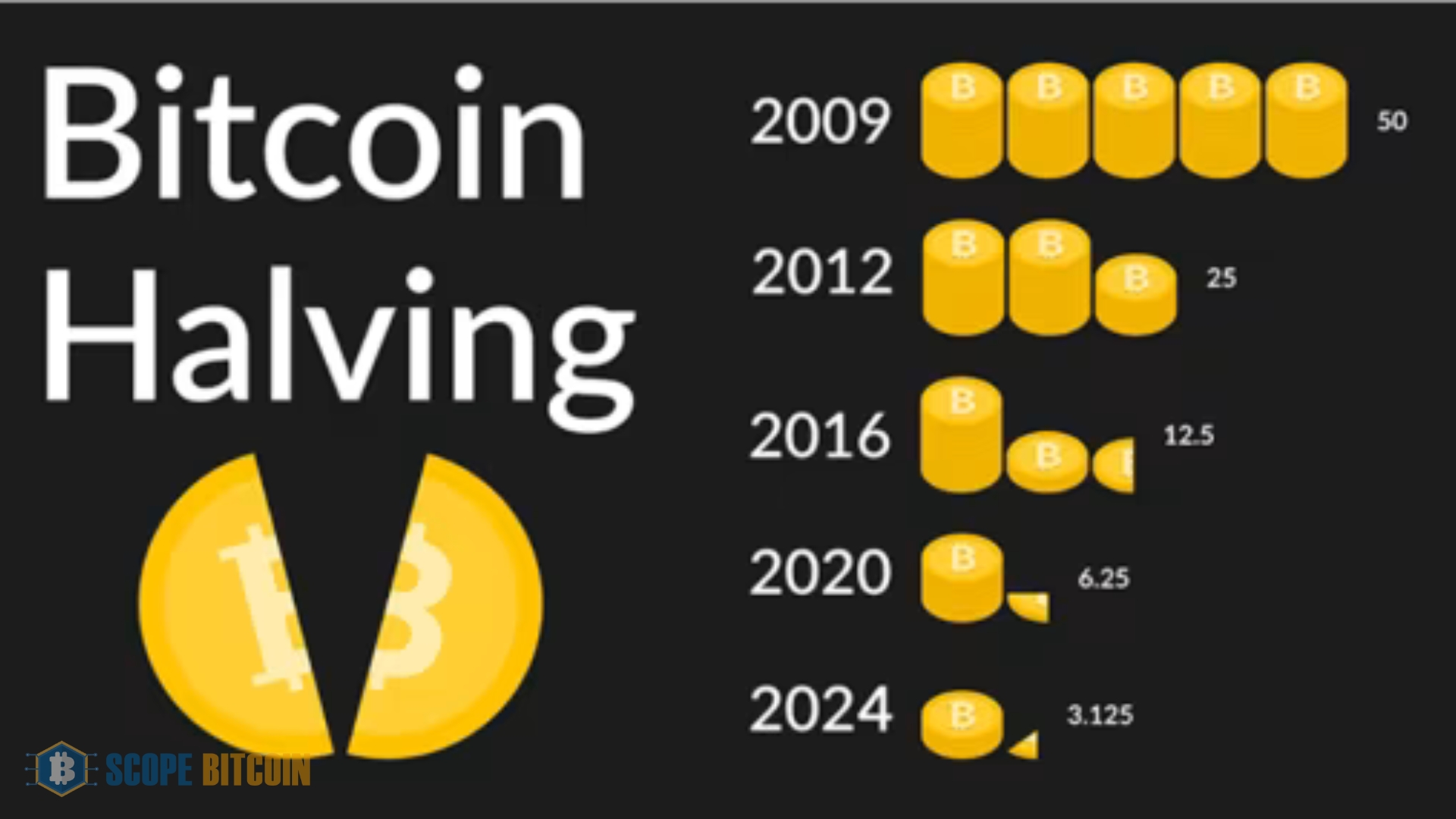

When the cryptocurrency was first created, miners were paid 50 BTC for each block. This could tempt early users to mine the network before its success was even apparent. Every 210,000 blocks mined, or around every four years, the rate of new Bitcoin creation reduces by half.

Surprisingly, Bitcoin transaction costs dropped after the much-anticipated halving on April 19, 2024. However, fees reached an average of $128 that day, according to data from mempool. Space shows they dropped to $8 to $10 for medium-priority transactions two days later. Bitcoiners’ enthusiasm for memecoins and Ordinals, which debuted with the halving event, sparked activity around block 840,000 as they tried to inscribe rare satoshis using Runes.

Before 2024, the last three halvings of Bitcoin took place in 2012, 2016, and 2020, according to the history of halving dates. In 2012, the reward for mining a block was decreased from 50 to 25 BTC, marking the first Bitcoin halving, also known as a Bitcoin split.

The block reward dropped to 12.5 BTC due to the 2016 halving. The price dropped even lower to 6.25 BTC in May 2020. After halving in 2024, the reward is now 3.125 BTC. This will continue until the last Bitcoin is mined, which is expected to happen around 2140. Why is Bitcoin halving important? We’ll get it down for you here, along with the mechanics of the halved cycle.

Why Does Bitcoin Halving Occur?

One of the most important mechanisms for controlling the amount of new Bitcoin that is put into circulation is the halving of the Bitcoin supply, which is a part of the protocol’s design. The following are the key causes behind the halving of Bitcoin:

Scarcity and controlled supply

Satoshi Nakamoto, the individual or group that pioneered the creation of Bitcoin, intended to develop digital money that would have a limited and controlled quantity. Bringing the mining rewards down by fifty percent will reduce the rate at which new Bitcoin is created. The value proposition of Bitcoin as a deflationary asset is extremely attractive because its scarcity is increasing with time.

Inflation control

In the Bitcoin ecosystem, half of the Bitcoin supply helps to contribute to the limitation of excessive inflation. The reduction in the block reward has the effect of slowing down the rate at which new Bitcoin is introduced into circulation. This limited-issue method ensures the coin maintains its value and stability over the long term.

Market forces and economics

Both Bitcoin miners and the market as a whole will see economic ramifications as a result of the scheduled halving event. Miners must adjust their operations to make a profit with a smaller block reward. This results in an increase in competitiveness and pushes away less productive miners. Consequently, this can affect the network’s overall security and its potential for decentralization.

Price impact

There have been numerous instances in the past where the price of Bitcoin has been connected to halving events. As a result of the anticipation of a fall in supply and an increase in demand, the market has exhibited a positive emotion, and prices will likely appreciate. However, it is essential to keep in mind that the success of Bitcoin in the past does not guarantee the performance of Bitcoin in the future, and that the price of Bitcoin is affected by variables other than halving events.

Why Does Bitcoin Halving Matter?

Following the halving of the Bitcoin supply, there is typically an uptick in the cryptocurrency’s volatility. The amount of Bitcoin that is now available reduces, which results in an increase in the value of Bitcoin that has not yet been mined. This makes Bitcoin a more appealing asset to investors.

On the other hand, if you believe in the significance of history, you will find that previous Bitcoin halvings have been long-term bullish drivers for the cryptocurrency’s price. On the other hand, the subsequent halving will certainly affect the Bitcoin ecosystem in various ways. There is a widespread expectation that the number of Bitcoin miners will decrease, mostly because the economic benefit of mining will become less appealing and, for miners with lower levels of efficiency, will become unprofitable.

Bitcoin Halving History and Dates

At its 2012 value of $12, half of Bitcoin’s value was halved; at its 2013 value of close to $1,000, the other half was also halved. The price of Bitcoin was cut in half again on July 9, 2016, when it reached $670. A $2,550 increase was achieved by July 2017. With a price of almost $19,700 in December 2017, Bitcoin also reached a new record high. The bitcoin price was approximately $64,000 in 2024, halving in April that year.

The deflationary nature of Bitcoin is demonstrated by its regular halving. Since its inception, this has been one of the main arguments in favor of Bitcoin. Because it is a decentralized cryptocurrency, governments and central banks cannot increase the overall number of bitcoins.

Implications of the Bitcoin Halving Event

The halving reduces Bitcoin miners’ reward, meaning they make less money by adding new transactions. The rewards of miners create new Bitcoin. This affects supply and demand because halving these payments reduces Bitcoin supply. Supply and demand cause price changes. The halving event also lowers the inflation rate of Bitcoin. Adding new coins to the supply of coins in circulation causes inflation in the cryptocurrency market. The halving is integral to Bitcoin’s design, which aims to be deflationary.

Following the 2012 halving, the inflation rate of Bitcoin dropped to 12%. Then, in 2016, it dropped to 4-5%. Inflation for Bitcoin hit 1.4% during the halving in April 2024. Every six months, the value of Bitcoin rises. Following a halving, the price of Bitcoin always goes up. The rising demand and decreasing supply of Bitcoin are driving up its price. But this upward trend usually doesn’t happen overnight.

Bitcoin would have to rise significantly for miners to earn half as many coins due to the high cost of electricity needed to operate the computers that solve mathematical riddles. Miners will struggle to compete if the price does not rise proportionally to the reward.

A new technology that can produce more hashes per second with less energy consumption and reduced overheads will be in high demand since miners must be as efficient as possible. In addition, the price of Bitcoin could be influenced by the economies of the countries that become involved with it. Above all else, the spotlight enjoying now will probably cause its price to climb. The adoption of Bitcoin by more retailers, companies, and organizations will only lead to a transaction surge.

If Most Bitcoin Miners Quit, What Would Happen?

If many miners suddenly stopped producing Bitcoin, it would affect the network’s hash rate and other metrics. The hash rate measures the computing power devoted to Bitcoin mining. The network’s overall hash rate would decrease if many miners stopped, leading to slower block formation times and worse network security.

But past data shows halving events do not cause this reaction. Bitcoin’s hash rate decreased between December 2012 and the middle of February 2013 due to the first halving in 2012. After that, the profitability of mining and the hash rate both rose. So, halving is good for the network and the miners. When everything is said and done

The situation was very similar during Bitcoin’s second halving, albeit the positive effects were slower to materialize. Despite a persistent increase in the hash rate, mining profitability did not bounce back for over a year following the halving date. Mining profitability can take a hit in the long run if this trend persists at the next event.

Next Bitcoin Halving Event

With over 19 million BTC in circulation, about 90% of the total 21 million Bitcoins that can ever exist have already been mined. Mining adds over 900 BTC to the digital supply every day. The block reward was lowered in half to 3.125 BTC in April 2024, the most recent halving of Bitcoin. The rate of new Bitcoin supply will decline as Bitcoin halvings continue. All 21 million BTC is projected to be mined by the year 2140.

After mining the 840,000th block since the last halving, the next halving will take place, however the exact date is yet uncertain. The next halving, which will reduce the mining reward per block to 3.125 BTC, is anticipated to occur around April 2028, given that new Bitcoin mined about every 10 minutes. There will be greater competition for fewer payouts, so miners must adapt to a changing Bitcoin mining environment.