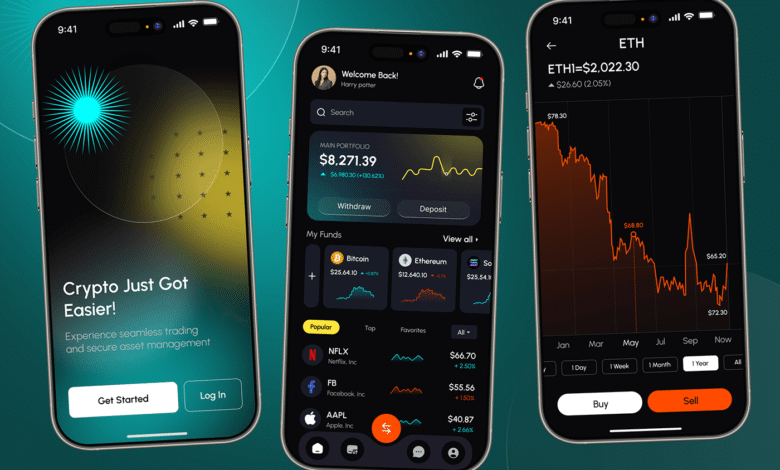

Best Crypto Trading App Your 2025 Buyer’s Guide

Discover how to choose the best crypto trading app in 2025. Compare features, fees, security, and tools—and learn pro tips to trade smarter.

The search for the best crypto trading app can feel like trying to catch lightning in a bottle. Markets move fast, exchanges change even faster, and the difference between a smooth trade and a frustrating misclick often comes down to the app you use every day. Whether you’re placing your first market order for bitcoin or scaling an advanced algorithmic strategy across multiple altcoins, your trading app shapes your experience, affects your costs, and influences your results.

This comprehensive, human-first guide explains how to evaluate crypto trading platforms in 2025, what features actually matter once you start trading, and how to match an app’s capabilities with your goals and risk tolerance.Rather than pushing a single brand, we break down the must-have features, the nice-to-haves, and the red flags. We’ll dig into security architecture, fees and spreads, order types, liquidity, charting, automation, staking, and on-ramp/off-ramp convenience.

Core Security The Non-Negotiable Foundation

Security is the first filter for the best crypto trading app. If a platform’s security posture is weak, nothing else matters. At a bare minimum, look for two-factor authentication with authenticator apps (not just SMS), biometric login on mobile, address allowlisting, and granular withdrawal controls.

Professional-grade apps add risk engines, behavioral anomaly detection, cold storage with multi-signature controls, and regular third-party security audits. The difference between marketing and real engineering shows up in details: configurable session timeouts, device management pages, and explicit alerts when permissions change.

Custody is equally important. If you intend to hold assets on-platform, look for segregated account structures and transparent policies about insurance and incident response. If you prefer self-custody, prioritize apps that integrate seamlessly with hardware wallets, allow withdraw-to-wallet with minimal friction, and provide clear network fee estimates. The best apps surface all this in plain language so you can make informed decisions every time you move funds.

Fees, Spreads, and the True Cost of a Fill

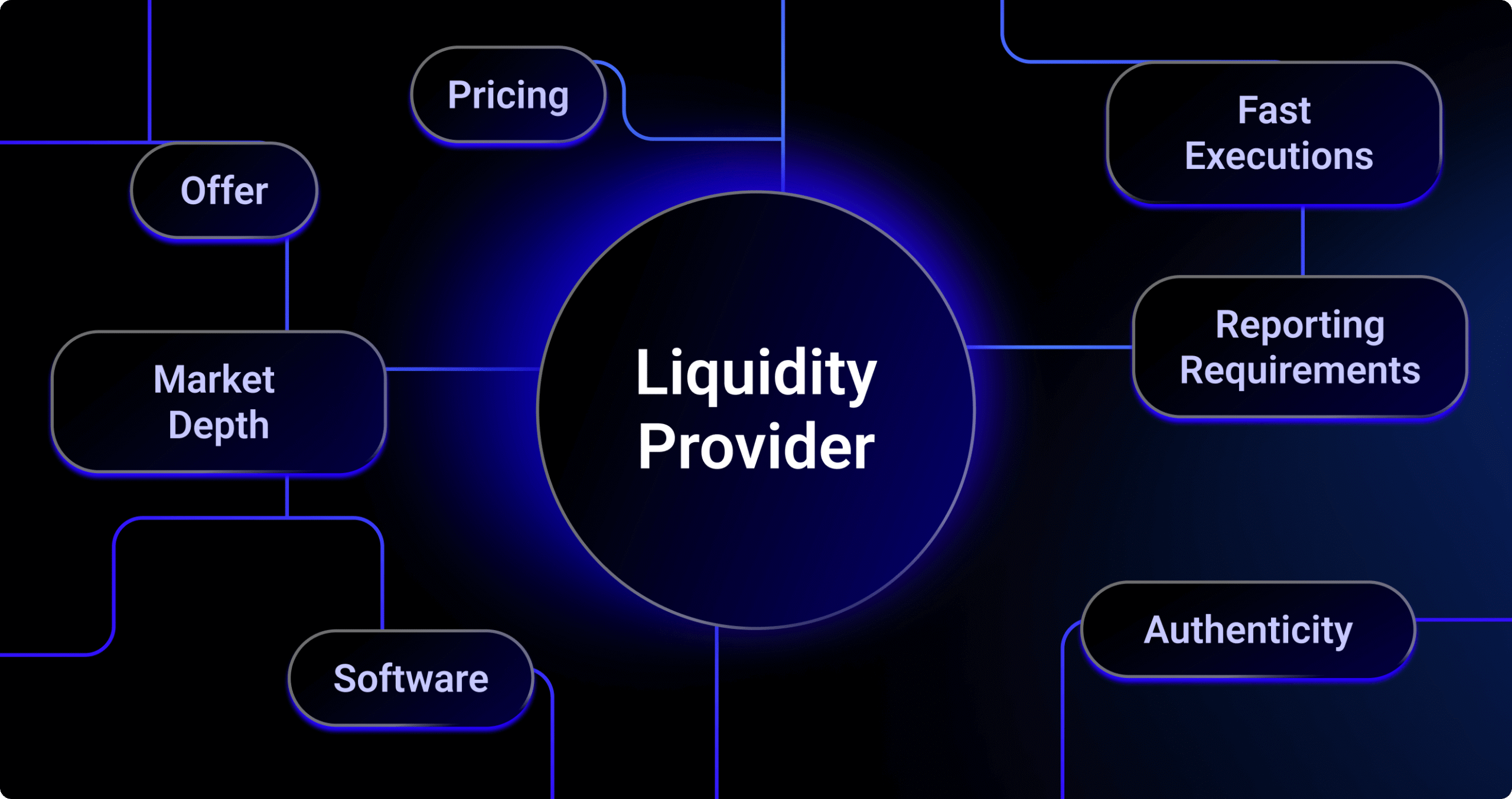

Low fees are great, but the headline price doesn’t tell the whole story. Your true trade cost blends maker/taker fees, spreads, slippage, and potential funding rates on derivatives. An app with slightly higher posted fees but deep liquidity and tight spreads can deliver a better fill than a “discount” venue with thin books.

When evaluating the best crypto trading app, run a side-by-side test with the same order size across a few pairs and compare average execution price versus the mid-market. Repeat during calm periods and high volatility. Real fills expose the truth.

Funding matters if you trade perps. Positive or negative funding can add up over days and weeks, silently eroding profits or padding losses. Transparent funding timers, projected costs, and historical charts make a big difference when you manage swing positions. The best apps show funding in the same panel where you size your order, so you can factor it in before you click.

Liquidity and Market Coverage

Breadth and depth decide whether you can act quickly without moving the market against yourself. A strong app offers deep liquidity on core pairs like BTC, ETH, and popular stablecoins, plus efficient access to vetted altcoins with healthy volume. Depth-of-book visualizations, real-time order flow, and VWAP or TWAP execution options separate pro-grade platforms from casual wallets. If you frequently trade newer narratives—AI tokens, RWA, gaming, or DePIN—ensure the app lists those sectors and that the pairs have robust activity, not just a logo on a page.

Coverage extends beyond spot. The best crypto trading app for active traders usually includes margin, perpetual futures, and optional copy trading or grid bots for those who want systematic execution. Long-term holders should look for staking and earn features with transparent APY, lock-up terms, and risk disclosures that don’t bury the lead.

Charting, Tools, and Order Types You’ll Actually Use

Good charting is more than pretty candles. You need responsive timeframes, custom indicators, and the ability to arrange layouts that match your decision process. The top apps include multi-chart views, drawing tools, price alerts, and a clean UX for flipping between spot, margin, and futures. For orders, you’ll want limit, market, stop, stop-limit, and ideally trailing stop and OCO. Advanced users appreciate post-only, reduce-only, and IOC/FOK flags that help manage slippage and avoid unintended entries.

Automation has matured too. Strategy runners, DCA schedulers, and webhook endpoints allow you to connect alerts from charting suites to orders on your favorite app. Make sure any automation shows unambiguous logs and lets you simulate before going live. The best crypto trading app treats automation as a first-class citizen rather than a bolt-on gimmick.

On-Ramps, Off-Ramps, and Tax Readiness

Fiat on-ramps and off-ramps are the bridge between your bank and the market. Look for multiple methods—bank transfer, card, and local payment rails—with transparent fees and realistic estimates of settlement times. If your country has strict KYC and AML rules, the verification flow should be clear and fast, with understandable document requirements and responsive support.

When tax season arrives, you’ll thank yourself for choosing an app that exports clean transaction histories, realized PnL, and cost basis data in common formats. If you use multiple platforms, prioritize apps that integrate with third-party tax software, map symbols correctly, and annotate airdrops, forks, and staking rewards in a consistent way.

Mobile vs Desktop Where You’ll Spend Time

Most traders live on both. A powerful desktop terminal is invaluable for session planning, multi-monitor charting, and precise order management. But the mobile app is where you’ll react to a news spike, manage an open position, or adjust a stop.

The best crypto trading app delivers parity across platforms: the same core features, the same watchlists, and instant sync of alerts and layouts. On mobile, prioritize speed, ergonomic one-handed order entry, and biometric security. On desktop, look for customizable workspaces, detachable panels, and lightning-fast hotkeys.

User Experience Calm Under Pressure

In crypto, the worst moments for UX are the ones that matter most. Your app should stay stable when volatility spikes, funnels you to the right action without hunting through menus, and handles errors gracefully with clear messages.

Small touches—like allowing you to drag orders on the chart, switch from cross to isolated margin in one click, or edit leverage without closing a position—save seconds that add up. A calm, intentional interface reduces cognitive load and helps you make better decisions, especially when the market is loud.

Customer Support and Education

High-quality support is a competitive edge. When something goes wrong, you need a responsive live chat, a searchable knowledge base, and escalation paths for urgent issues. Top apps publish transparent status pages and post-mortems after incidents. They also invest in education: tutorials on order types, explainers on staking risk, and primers on wallet security. If an app helps you understand the tools you’re using, you’re less likely to make costly mistakes.

How to Test an App Before You Commit

A structured test will prevent buyer’s remorse. Start by defining a simple plan: deposit a small amount, place a few limit and market orders on liquid pairs, set alerts, and experiment with stop-loss and take-profit levels. If you trade derivatives, open a tiny perp position with conservative leverage, then modify it several times. Withdraw a portion to a hardware wallet and note the speed, fees, and communication.

During the test, log your experience. Did the order fill where expected? How quickly did balances update? Were push notifications timely? Did the mobile app and desktop view remain in sync? Could you export your trade history without manual cleanup? A few hours of disciplined testing will tell you more than a week of reading marketing pages.

Compliance, Jurisdictions, and Your Personal Risk Profile

Availability and permissions vary by region. Some apps limit derivatives to certain countries, others cap maximum leverage, and many require enhanced KYC for higher withdrawal limits. The best crypto trading app for you is one you can legally use with features that match your plan.

If you travel, check how the app behaves when your IP changes and whether your account remains fully functional. It’s also wise to review terms around account freezes, dispute resolution, and proof of reserves disclosures. A platform aligned with regulators in your jurisdiction generally offers more predictable service and less surprise downtime.

Red Flags That Disqualify an App

Deal-breakers are mercifully easy to spot if you look. A history of security breaches without transparent remediation, opaque fee schedules, unexplained withdrawal delays, or aggressive “earn” yields with vague risk descriptions are all reasons to walk away.

If the app tries to hide critical controls, bombards you with pop-ups, or refuses to publish a status page, consider it a warning. The best platforms behave like banks and brokerages in all the boring but essential ways: clear terms, steady communication, and operational maturity.

Matching Your Trading Style to the Right App

Imagine three archetypes. The active day trader lives on 1–15 minute charts, obsesses over latency, and needs precise control over orders and reduce-only closes. This trader should prioritize fee tiers, deep liquidity on core pairs, and desktop-grade charting. The swing trader holds for days to weeks, uses alerts heavily, and values convenient funding and position adjustment tools on mobile. They need robust OCO orders, accurate funding rate displays, and a clean PnL timeline.

The long-term investor accumulates over months, wants staking yields without lock-in surprises, and demands airtight security with easy recurring buys. They care about custody options, transparent APY, and simple tax exports.By identifying your archetype—or your blend—you can shortlist the best crypto trading app options that actually serve you, not a generic audience.

Pro Tips to Trade Smarter on Any App

A good app won’t save a bad process, but it can supercharge a solid one. Always predefine risk per trade and set stops the moment you enter. Use price alerts to avoid doomscrolling and to catch breakouts. Archive your set-up screenshots and execution notes so you can review what worked.

Separate long-term holdings from your trading stack, ideally on different platforms or at least different wallets, to avoid accidental liquidation of investments you meant to hold. Finally, practice scaling in and out with partial orders rather than all-or-nothing bets; the best apps make partials convenient and transparent.

Also Read: Crypto Trading Platform Choose Smart, Trade Safer

How Crypto App Features Evolve Over Time

The crypto app you choose today will change. The industry iterates quickly, and the leaders push updates to improve latency, add layer-2 support, or integrate new stablecoins and fiat rails. Evaluate a platform not just on its current feature set but also on its rate of improvement. Read their product changelogs, scan community forums, and note response speed when users flag bugs. An app that ships thoughtful updates and admits flaws is safer over the long run than a stagnant app with flashy marketing.

Building Your Personal Tech Stack

Many serious traders don’t rely on one tool. You might use a brokerage-style app with low fees and deep liquidity for executions, a separate non-custodial wallet for self-custody, and a specialized portfolio tracker for analytics.

If you go multi-app, insist on clean API access, consistent webhook behavior, and reliable export formats so your data flows between systems. The best crypto trading app in your stack is the one that plays nicely with the others—without forcing you into a walled garden.

Risk Management Is the Ultimate Edge

Regardless of the platform, risk discipline determines longevity. The market will tempt you with leverage, lure you into overtrading, and pressure you to move stops “just this once.” Choose an app that makes risk management effortless.

position size calculators, visible liquidation prices, and easy toggles for isolated versus cross margin. Visual guardrails reduce errors and help you trade your plan. Over a year, avoiding a handful of preventable mistakes matters more than squeezing a fraction of a percent out of fees.

Accessibility, Inclusivity, and Learning Curve

Great apps feel welcoming. Clear language beats jargon, and tooltips beat guesswork. If you’re newer to crypto, look for contextual education woven into the interface—short explainers next to complex features, preview screens before committing funds, and sandbox modes or testnet access where you can practice without risk. If you’re advanced, make sure that “simplicity” doesn’t mean “missing levers.” The best platforms scale with you, revealing depth as you need it rather than overwhelming you on day one.

The Bottom Line Choose Deliberately, Then Commit

There’s no universal “winner,” but there is a best match for your goals. Security comes first, then true execution cost, then liquidity and tools, then experience and support. Run a structured test, review the results, and pick the platform that aligns with your style.

Once you decide, lean into it—learn every corner, set up your workspace, wire in alerts, and automate the repetitive tasks. The more fluently you operate your app, the more attention you can devote to reading the market and managing risk.

Conclusion

The best crypto trading app is the one that pairs rigorous security and fair pricing with tools that sharpen your edge rather than distract you. When you evaluate apps through the lens of your trading style—active day trading, swing trading, or long-term investing—you’ll filter hype from usefulness and choose a platform that supports your process.

Prioritize robust two-factor security, transparent fees, deep liquidity, practical order types, and reliable fiat rails. Test before you commit, automate where it helps, and treat risk management as a feature, not an afterthought. With the right app—and a deliberate workflow—you can trade more confidently, react faster, and avoid the silent killers of sloppy execution and preventable errors.

FAQs

Q: What features define the best crypto trading app for beginners?

Beginners benefit from a simple, stable interface with clear KYC steps, easy bank transfers, and guided recurring buys. Look for strong two-factor authentication, plain-language tooltips, and responsive customer support. Basic limit and market orders, reliable price alerts, and clean portfolio views help you build habits without getting lost in advanced menus.

Q: How important are fees compared to spreads and slippage?

Posted maker/taker fees matter, but total cost is what you actually pay. Tight spreads, deep order books, and low slippage often offset slightly higher fees. Test with small orders during quiet and volatile periods to see your effective execution price. Over time, better fills can outweigh a few basis points in published fees.

Q: Should I choose an app with staking and earn features?

If passive yield fits your strategy, staking can be useful, but focus on clarity. The best apps disclose APY variability, lock-up terms, and underlying risks without euphemisms. Make sure staking does not compromise withdrawal flexibility and that rewards reporting integrates with your tax workflow.

Q: Is mobile trading safe, or should I stick to desktop?

Mobile is safe when the app supports biometrics, device management, and robust session controls. Desktop remains ideal for planning and multi-chart analysis, but mobile is unmatched for quick adjustments and closing risk. The best crypto trading app offers near-parity across devices so you can switch contexts without losing control.

Q: How do I know if an app is truly secure?

Look beyond slogans. Confirm security audits, read the status page and incident reports, and check for features like address allowlisting, withdrawal confirmation, and hardware wallet integration. Transparent communication, regular updates, and clear permission logs are hallmarks of serious security engineering.