Buy Bitcoin Price Dip 3 Critical Mistakes to Avoid Now

September 2025 presents a defining moment for Bitcoin investors as the cryptocurrency navigates through what historically has been its most challenging month. Bitcoin’s price action in September 2025 reflects a delicate balance between consolidation and optimism, starting the month at $108,253 after a 6.5% August decline, while BTC has held firm above the $110,000 support zone. For those looking to buy Bitcoin price dip opportunities, the current market dynamics have never been more crucial.

The question isn’t whether you should buy Bitcoin price dip scenarios—it’s how to do it without falling into the devastating traps that destroy investment portfolios. Bitcoin tends to decline in September, and having a long-term investment plan is the best way forward. However, this September appears different, with rate cut bets and institutional demand potentially helping Bitcoin beat Red September again for the third consecutive year.

What makes 2025 particularly challenging for Bitcoin investment is the evolving market structure. Bitcoin’s four-year price cycle, which has often had a predictable pattern, has shown signs of breaking or even disappearing altogether. This fundamental shift means traditional Bitcoin dip buying strategies may no longer apply, making it essential to understand new market dynamics.

Current market conditions offer both unprecedented opportunities and hidden dangers. Finance Magnates points to strong support around $100K–$105K, with extreme “buy-the-dip” targets as low as $78K–$82K if sellers really press, while Bitcoin price prediction for September 2025 points to upside targets, cautioning that if BTC fails to hold above certain bands, prices may stay range-bound between $104,000–$115,000.

The stakes have never been higher for avoiding critical mistakes in Bitcoin dip buying. One of the biggest mistakes investors make is jumping in without proper research, swayed by social media hype or influencer endorsements. With regulatory scrutiny tightening and market manipulation evolving, these three critical mistakes could mean the difference between building generational wealth and watching your portfolio evaporate.

This comprehensive guide reveals the most devastating errors investors make when attempting to buy Bitcoin price dip opportunities in September 2025, backed by real-time market data and expert analysis. Whether you’re a seasoned crypto trader or new to Bitcoin investment, mastering these insights will position you for success in the most volatile asset class of our time.

Current Market Landscape: September 2025 Reality Check

The September 2025 Bitcoin Environment

The crypto market in September 2025 operates under fundamentally different conditions than in previous years. Bitcoin dominance fell to 57.4% (down 3.12% in 24 h), while the CMC Altcoin Season Index rose to 55/100, signaling growing altcoin momentum. This shift in market dynamics affects how Bitcoin price dip opportunities develop and resolve.

Unlike previous September corrections, 2025 presents unique challenges that traditional Bitcoin dip buying strategies weren’t designed to handle. The market structure has evolved with increased institutional participation, changing the velocity and character of price movements during correction periods.

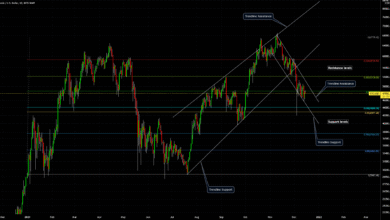

Technical Analysis of Current Support Levels

Professional analysis reveals critical levels that determine whether current Bitcoin price dip scenarios represent genuine opportunities or falling knives. BTCC sees Bitcoin in a textbook consolidation, sitting between support at $106,964 and resistance at $116,704, with MACD showing bullish divergence. These technical levels are crucial for timing Bitcoin investment decisions. The $110,000 level has emerged as a psychological and technical floor that determines market sentiment for Bitcoin dip buying opportunities.

Institutional Sentiment and Flow Patterns

The institutional landscape in September 2025 shows mixed signals that complicate Bitcoin investment timing decisions. Their call: expect more range-bound action for the next 2–4 weeks as institutions quietly keep adding, suggesting that professional investors view current levels as accumulation opportunities. This institutional behavior creates different Bitcoin price dip patterns compared to retail-dominated markets of previous years, requiring adjusted strategies for successful Bitcoin dip buying.

Mistake #1: Ignoring Market Cycle Evolution and Historical Patterns

The Dangerous Assumption of Cyclical Predictability

The first critical mistake investors make when attempting to buy Bitcoin price dip opportunities is assuming historical patterns will repeat indefinitely. Bitcoin’s four-year price cycle, which has often had a predictable pattern, has shown signs of breaking or even disappearing altogether. This fundamental shift invalidates many traditional Bitcoin investment strategies that rely on cyclical timing.

Many Bitcoin investors enter positions based on outdated assumptions about September performance, seasonal patterns, and halving-cycle behavior. These assumptions can lead to poorly timed entries and significant losses when markets behave differently from what historical precedent suggests.

The New Market Dynamics

The evolution of Bitcoin from a speculative asset to institutional adoption changes how Bitcoin price dips develop and recover. Traditional retail-driven corrections occurred quickly with sharp V-shaped recoveries, while institutional involvement creates more complex, prolonged consolidation periods.

Successful Bitcoin dip buying in 2025 requires these new dynamics:

- Institutional accumulation patterns that create extended consolidation phases

- Regulatory influences that can trigger sudden sentiment shifts

- Macro-economic correlations that didn’t exist in earlier market cycles

- Derivatives market impact on spot price discovery mechanisms

The False Security of Past Performance

The most dangerous aspect of cycle-dependent thinking is the false security it provides. Bitcoin investors who rely heavily on historical patterns often increase position sizes based on the belief that “Bitcoin always recovers,” leading to catastrophic losses when market structure changes.

Bitcoin’s seasonal rhythm is one of those patterns investors love to argue over, but the historical performance data don’t actually leave much to quibble about. On average, September has been a month when the coin tends to go down. However, assuming this pattern will continue indefinitely represents a fundamental analytical error.

Developing Adaptive Investment Frameworks

Professional Bitcoin investors develop adaptive frameworks that account for market evolution rather than relying on static historical patterns. These frameworks incorporate multiple analytical approaches that remain effective regardless of changing market structure.

Mistake #2: Catastrophic Position Sizing and Risk Management Failures

The All-or-Nothing Mentality That Destroys Wealth

The second devastating mistake involves catastrophic position sizing failures when attempting to buy Bitcoin price dip opportunities. Many investors, convinced they’ve identified the perfect entry point, commit excessive capital to single Bitcoin investment decisions, risking financial ruin if markets decline further than anticipated.

This all-or-nothing approach becomes particularly dangerous during Bitcoin price dips because apparent “discounts” create psychological pressure to maximize position size. However, what appears to be a temporary correction can evolve into prolonged bear market conditions.

True Risk in Volatile Markets

Errors like failing to back up seed phrases or using exchanges for storage remain the top causes of loss, but position sizing errors cause even more widespread portfolio destruction. Proper Bitcoin investment risk management involves that even “safe” support levels can fail during extreme market conditions.

The volatility inherent in Bitcoin means that positions sized appropriately for traditional assets can become catastrophically large in crypto markets. Professional Bitcoin investors adjust position sizes based on volatility measurements rather than dollar amounts.

Professional Position Sizing Strategies

Successful Bitcoin dip buying requires sophisticated position sizing that accounts for Bitcoin’s unique risk characteristics:

- Volatility-adjusted position sizing that reduces allocation during high-volatility periods

- Staged entry strategies that deploy capital across multiple price levels

- Risk-based allocation that never exceeds predetermined loss thresholds

- Liquidity management that maintains sufficient cash for continued buying opportunities

The Psychology of Loss Escalation

Position sizing mistakes compound because loss aversion psychology drives investors to make increasingly poor decisions. As Bitcoin price dips continue beyond initial expectations, many investors add to losing positions without proper risk assessment, violating fundamental position sizing principles.

Emergency Planning and Capital Preservation

Every Bitcoin investment strategy must include comprehensive emergency planning for extreme market scenarios. This includes predetermined exit strategies, backup capital sources, and clear criteria for when to stop buying during extended Bitcoin price dip periods.

Mistake #3: Technical Analysis Over-Reliance and Timing Obsession

The Illusion of Perfect Market Timing

The third critical mistake involves obsessing over perfect timing for Bitcoin dip buying decisions while over-relying on technical analysis indicators. Factors like Fear of Missing Out (FOMO) often drive investors to make impulsive decisions without a good understanding of the fundamentals of a crypto project, but timing obsession creates equally destructive outcomes.

Technical analysis provides valuable insights for Bitcoin investment timing, but treating it as a crystal ball leads to consistently poor decision-making. Many investors spend enormous energy trying to identify perfect entry points while ignoring fundamental risk management principles.

The Limitations of Technical Indicators in Crypto Markets

Traditional technical analysis was developed for traditional markets with different liquidity, volatility, and operational characteristics. Bitcoin markets operate 24/7 with extreme volatility spikes that can invalidate technical signals within minutes.

Common technical analysis mistakes in Bitcoin dip buying include:

- Over-relying on single indicators without considering the market context

- Ignoring crypto-specific volatility patterns that differ from traditional assets

- Misapplying traditional market concepts to 24/7 crypto environments

- Failing to account for manipulation in smaller crypto markets

- Using inappropriate timeframes for volatile crypto price action

Building Multi-Dimensional Analysis Frameworks

Successful Bitcoin investment requires combining multiple analytical approaches rather than relying solely on technical timing. Professional traders integrate technical, fundamental, and sentiment analysis to identify genuine Bitcoin price dip opportunities.

Our technical indicators signal a neutral Bullish 67% market sentiment, while the Fear & Greed Index is displaying a score of 54 (Neutral), demonstrating how multiple indicators provide a more comprehensive market signal than single technical signals.

The Time Arbitrage Advantage

Rather than obsessing over perfect timing, successful Bitcoin investors focus on time arbitrage—buying quality assets during periods of temporary dislocation regardless of short-term price movement. This approach reduces timing pressure while maintaining long-term profit potential.

Volume and Liquidity Analysis

Volume patterns during Bitcoin price dips provide crucial context that pure price-based technical analysis misses. Professional analysis incorporates order flow, institutional activity, and liquidity conditions to make more informed Bitcoin dip buying decisions.

Proven Strategies for Smart Bitcoin Dip Buying

The Power of Systematic Dollar-Cost Averaging

Dollar-cost averaging represents the most reliable approach for Bitcoin investment during volatile market conditions. Rather than attempting to time-perfect Bitcoin price dip entries, systematic buying removes emotional decision-making while ensuring participation in long-term price appreciation.

The mathematical advantage of DCA in Bitcoin markets comes from automatically purchasing more units when prices are low and fewer when prices are high. This approach works particularly well in volatile assets like Bitcoin, where timing perfect entries consistently is virtually impossible.

Advanced Layered Entry Strategies

Professional Bitcoin investors use sophisticated layered entry approaches that deploy capital systematically across multiple price levels. This strategy acknowledges that perfectly timing Bitcoin price dips is impossible while still allowing investors to benefit from volatility.

A typical professional layered approach involves:

- Initial 20% allocation at the first technical support level

- An additional 20% if Bitcoin declines another 10%

- Third 20% tranche at major psychological support levels

- The remaining 40% reserved for extreme market conditions or extended opportunities

Risk-Adjusted Return Optimization

Successful Bitcoin dip buying prioritizes risk-adjusted returns over maximum potential gains. This approach focuses on consistent profitability while minimizing catastrophic loss potential, leading to superior long-term investment outcomes.

Combining Multiple Timeframe Analysis

Professional Bitcoin investment strategies analyze multiple timeframes simultaneously before committing capital. What appears attractive on daily charts may look completely different when examined over weekly or monthly periods, providing essential context for timing decisions.

Advanced Risk Management for Bitcoin Investors

Dynamic Hedging Strategies

Sophisticated Bitcoin investors use dynamic hedging approaches that provide downside protection while maintaining upside exposure. These strategies become particularly valuable during uncertain market conditions when the Bitcoin price dip remains unclear.

Options, futures, and correlated asset positions can provide portfolio insurance that allows for more aggressive Bitcoin dip buying while limiting maximum loss potential. These instruments enable more sophisticated risk management approaches.

Volatility-Based Position Sizing

Advanced position sizing adjusts allocation based on current market volatility measurements rather than fixed dollar amounts. During high-volatility periods, position sizes decrease to account for increased uncertainty, while calmer markets allow for larger allocations. This dynamic approach ensures that Bitcoin investment risk remains consistent regardless of changing market conditions, preventing the position sizing errors that destroy portfolios during volatile periods.

Stop-Loss Implementation in Crypto Markets

While stop-losses can protect capital, they require careful implementation in Bitcoin markets due to price manipulation potential and extreme volatility spikes. When and how to use stops effectively prevents both catastrophic losses and premature exits from winning positions.

Psychology and Behavioral Finance in Bitcoin Investment

Overcoming Emotional Decision-Making Traps

Bitcoin investment success requires overcoming powerful psychological biases that cause poor decision-making during Bitcoin price dip events. Fear, greed, and loss aversion create predictable patterns that professional investors learn to recognize and counteract.

Developing emotional discipline involves creating systematic processes that remove emotion from Bitcoin dip buying decisions. Pre-determined entry criteria, position sizing rules, and exit strategies prevent impulsive decisions during high-stress market periods.

Crowd Psychology Patterns

Bitcoin price dips often result from crowd psychology effects that create temporary pricing inefficiencies. These psychological patterns help identify genuine opportunities versus continued selling pressure from emotional market participants.

Professional Bitcoin investors position themselves opposite to crowd psychology, buying when others are selling and maintaining patience when others panic. This contrarian approach requires strong psychological discipline but produces superior long-term results.

Building Systematic Decision-Making Processes

The most successful Bitcoin investment approaches rely on systematic processes rather than emotional reactions to market events. These processes include predetermined criteria for entries, exits, and position management that function regardless of short-term market conditions.

Technology Tools for Enhanced Bitcoin Investment

Professional Analysis Platforms

Successful Bitcoin dip buying requires access to professional-grade analysis tools that provide real-time market data, advanced technical indicators, and institutional flow information. These platforms enable more informed investment decisions and better timing of market entries.

Modern analysis software integrates multiple data sources, automated alerting systems, and risk management tools that help investors implement sophisticated Bitcoin investment strategies without constant manual monitoring.

Automated Strategy Implementation

Advanced investors use automated systems to implement Bitcoin dip buying strategies without emotional interference. These systems execute predetermined buying schedules, trigger purchases based on specific market conditions, and maintain discipline during volatile periods.

Risk Management Software Solutions

Professional risk management software helps Bitcoin investors monitor portfolio exposure, calculate optimal position sizes, and implement stop-loss strategies automatically. These tools are essential for managing the complex risks associated with Bitcoin price dip investments.

Regulatory Landscape and Compliance Considerations

Tax Implications of Bitcoin Trading

Bitcoin investment activities have significant tax consequences that vary by jurisdiction and trading frequency. These implications are crucial for developing profitable Bitcoin dip buying strategies that optimize after-tax returns. Professional tax planning for Bitcoin investors involves wash sale rules, capital gains treatment, and proper record-keeping requirements that ensure compliance while maximizing investment returns.

Regulatory Risk Assessment and Management

The evolving regulatory environment creates both opportunities and risks for Bitcoin investment strategies. Successful investors monitor regulatory developments and adjust their approaches to maintain compliance while maximizing profit potential.

Compliance Framework Development

Professional Bitcoin investors establish comprehensive compliance frameworks that ensure all trading activities meet relevant regulatory requirements while preserving the flexibility needed for successful Bitcoin dip buying strategies.

Future Market Evolution and Strategic Planning

Institutional Adoption Impact on Bitcoin Markets

Continued institutional adoption fundamentally changes Bitcoin market dynamics, affecting how Bitcoin price dips develop and resolve. These changes are essential for developing successful long-term Bitcoin investment strategies. The increasing presence of institutional investors creates more efficient price discovery but also different volatility patterns that require adjusted approaches to Bitcoin dip buying timing and execution.

Technological Development Influences

Ongoing technological developments in the Bitcoin network, Layer 2 solutions, and broader crypto infrastructure affect long-term Bitcoin investment prospects and create new opportunities for strategic positioning.

Global Macro-Economic Integration

Bitcoin’s increasing correlation with traditional financial markets creates new considerations for Bitcoin dip buying timing. These macro-econorelationshipstors positioned appropriately for various economic scenarios.

Building Sustainable Long-Term Bitcoin Wealth

Developing Personal Investment Philosophy

Sustainable Bitcoin investment success requires developing a clear personal philosophy that guides decision-making during market volatility. This philosophy should incorporate risk tolerance, investment timeline, financial goals, and learning from market experience.

Creating Robust Investment Processes

Rather than making emotional reactions to every Bitcoin price dip, successful investors develop comprehensive processes that guide their decision-making. These processes help maintain consistency and discipline across various market conditions.

Continuous Education and Market Adaptation

The crypto market evolves rapidly, requiring continuous learning and strategy refinement. Successful Bitcoin investors stay informed about technological developments, regulatory changes, and market structure evolution to maintain competitive advantages.

Portfolio Integration and Diversification

Bitcoin investment should integrate with broader portfolio strategies that account for correlation effects, diversification benefits, and overall risk management objectives. This integration ensures that Bitcoin dip buying contributes to rather than detracts from overall financial goals.

Also Read: Ultimate Bitcoin Price Buying Guide 7 Winning Strategies

Conclusion

Successfully navigating Bitcoin price dip opportunities in September 2025 requires avoiding three critical mistakes that have destroyed countless investment portfolios: ignoring market cycle evolution, catastrophic position sizing failures, and over-reliance on technical timing. Whale accumulation, bullish RSI divergence, and macro tailwinds suggest the dip may already be priced in, with Bitcoin potentially rebounding from its September low to target $200,000 by year-end, yet risks remain significant.

The key to profitable Bitcoin dip buying lies in developing systematic approaches that adapt to evolving market conditions while maintaining disciplined risk management and emotional control. Rather than chasing perfect timing or risking catastrophic losses through poor position sizing, successful Bitcoin investors focus on building robust frameworks that can weather extreme volatility while capitalizing on genuine opportunities.

As market cycles evolve and traditional patterns break down, only those who master these fundamental principles while avoiding common psychological traps will thrive in the rapidly changing crypto market landscape of 2025 and beyond.