Buy Bitcoin Future Now Top 7 Strategies That Crush Doubt

Bitcoin futures are emerging as one of the most lucrative investment vehicles for both institutional and retail investors. As Bitcoin continues its remarkable ascent toward projected targets of $135,000 and beyond, savvy investors are turning to Bitcoin futures trading to maximize their exposure and potential returns while managing risk effectively.

Buy Bitcoin future contracts represent more than just a speculative bet—they offer sophisticated investors a gateway to participate in the digital asset revolution with enhanced leverage, superior risk management capabilities, and strategic hedging opportunities. However, the complexity of futures trading can intimidate newcomers, creating doubt and hesitation that prevent many from capitalizing on this extraordinary market moment.

The current crypto futures trading landscape is experiencing a perfect storm of favorable conditions. Regulatory clarity has improved dramatically following the Department of Justice’s crypto enforcement task force shutdown, while traditional financial institutions are increasingly integrating cryptocurrency investment products into their offerings. ETF flows continue to sustain bullish momentum, and institutional whale activity suggests sustained long-term growth ahead.

Whether you’re a seasoned trader looking to optimize your Bitcoin investment strategy or a newcomer seeking to understand how to buy Bitcoin futures, this comprehensive guide delivers actionable insights that eliminate uncertainty. We’ll explore seven proven strategies that successful traders use to navigate the volatile yet profitable world of Bitcoin futures contracts, each designed to help you make informed decisions while minimizing emotional trading mistakes.

The time for hesitation has passed. With expert analysts predicting continued bullish trends through 2025 and beyond, these fundamental futures trading strategies could be the difference between missing out and securing your financial future in the digital economy.

What Are Bitcoin Futures and Why They Matter in 2025

Bitcoin futures are standardized contracts that allow traders to agree on buying or selling Bitcoin at a predetermined price on a specific future date. Unlike spot trading, which involves immediate transactions, Bitcoin futures contracts provide traders with enhanced flexibility, leverage opportunities, and sophisticated risk management tools.

The significance of Bitcoin futures trading has amplified considerably in 2025 due to several converging factors. First, institutional adoption has reached a tipping point, with major banks and investment firms incorporating crypto derivatives into their standard offerings. Second, regulatory frameworks have stabilized, providing the legal clarity that institutional investors demanded before committing substantial capital.

Crypto futures trading offers three primary advantages over traditional spot trading. Leverage allows traders to control larger positions with smaller initial investments, though this amplifies both potential gains and losses. Price discovery becomes more efficient through futures markets, as they incorporate forward-looking market sentiment and expectations. Additionally, hedging strategies become possible, allowing investors to protect existing cryptocurrency holdings against adverse price movements.

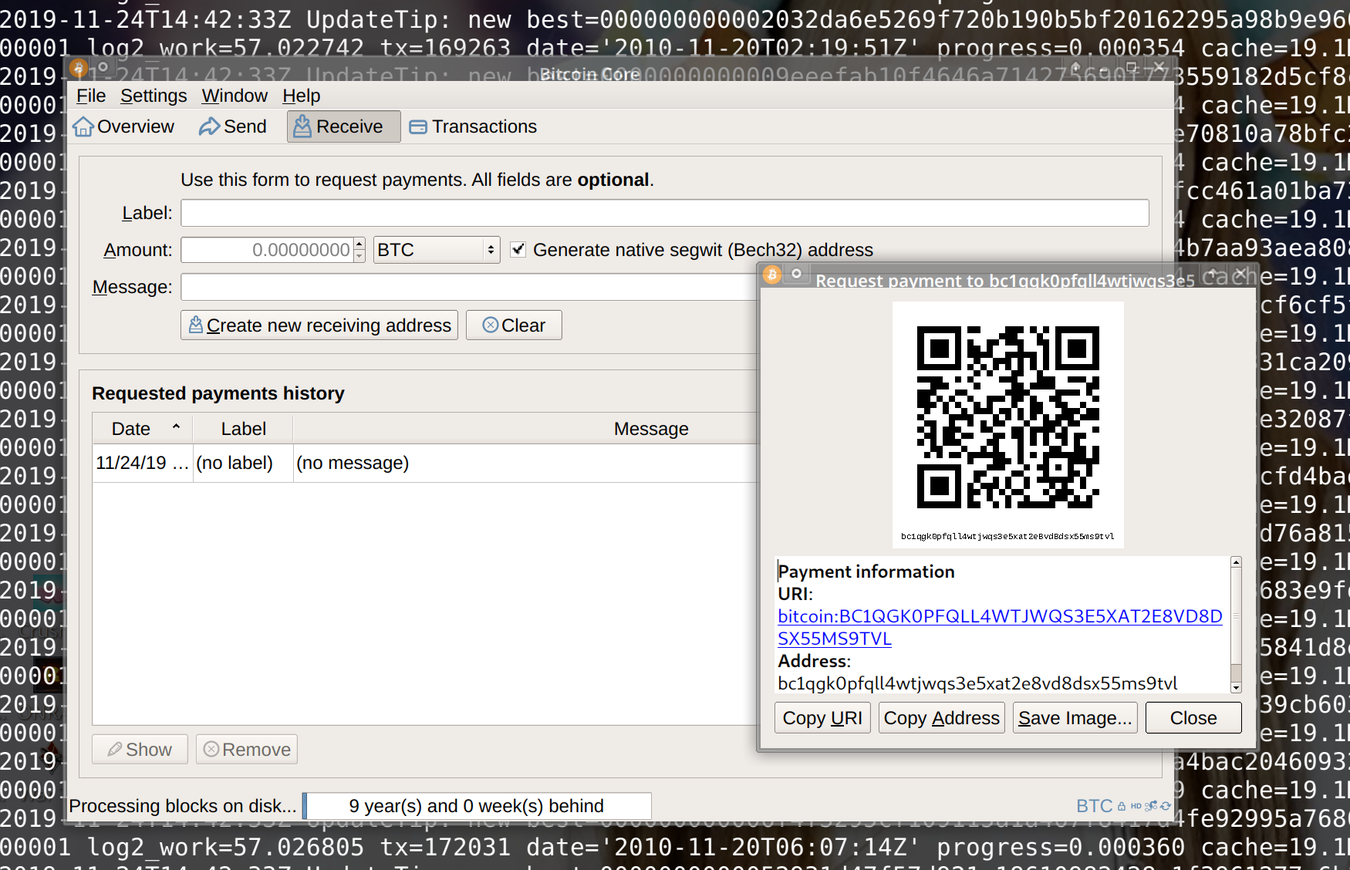

The mechanics of Bitcoin futures contracts involve margin trading, where investors deposit a fraction of the total contract value as collateral. This margin requirement varies between exchanges but typically ranges from 5% to 50% of the contract value, depending on volatility and exchange policies. Settlement can occur through either cash delivery or physical Bitcoin delivery, though most retail platforms use cash settlement for simplicity.

Strategy 1: Dollar-Cost Averaging (DCA) with Futures Contracts

Dollar-cost averaging represents one of the most psychologically comfortable approaches to buying Bitcoin future contracts, particularly for investors who want to reduce the impact of short-term volatility. This Bitcoin investment strategy involves making regular, fixed-dollar purchases regardless of price fluctuations, effectively smoothing out entry points over time.

Implementing DCA with Bitcoin futures trading requires careful consideration of contract expiration dates and rollover procedures. Rather than purchasing perpetual futures, which can accumulate funding fees over time, strategic investors often utilize quarterly contracts, rolling positions forward as expiration approaches. This approach minimizes the impact of funding rate volatility while maintaining consistent market exposure.

The psychological benefits of futures trading strategies using DCA cannot be overstated. Many investors struggle with timing the market, often buying high during euphoric phases and selling low during panic periods. DCA eliminates these emotional decisions by systematizing entry points, regardless of current market sentiment or media coverage.

Advanced DCA practitioners combine this strategy with market volatility analysis, increasing purchase frequencies during high volatility periods and reducing them during consolidation phases. This variation, known as volatility-adjusted DCA, can improve returns by taking advantage of market inefficiencies while maintaining the core principle of regular accumulation.

Risk management within DCA strategies involves setting clear position size limits and maintaining adequate margin reserves. Since Bitcoin futures contracts involve leverage, even DCA approaches require careful monitoring of margin requirements to avoid liquidation during extreme market movements.

Strategy 2: Trend Following and Technical Analysis

Trend following strategies form the backbone of successful Bitcoin futures trading for many professional traders. These approaches rely on identifying and capitalizing on sustained price movements, using technical indicators to confirm trend strength and determine optimal entry and exit points.

The most effective cryptocurrency investment trend following systems combine multiple timeframe analysis, examining short-term (1-4 hour), medium-term (daily), and long-term (weekly) charts to identify confluence zones. When all timeframes align in the same direction, the probability of successful trades increases significantly.

Moving averages serve as fundamental trend identification tools in Bitcoin investment strategy development. The 20-day and 50-day exponential moving averages often act as dynamic support and resistance levels, while the 200-day simple moving average provides long-term trend context. When Bitcoin trades above these key levels with increasing volume, bullish trend continuation becomes more probable.

Futures trading strategies incorporating momentum indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) help traders identify potential trend reversals before they occur. Divergences between price action and momentum indicators often signal weakening trends, providing early warning signals for position adjustments.

Advanced trend followers implement systematic position sizing rules, increasing exposure during strong trending periods and reducing positions during consolidation phases. This dynamic approach maximizes profits during favorable market conditions while preserving capital during uncertain periods.

Strategy 3: Hedging Your Crypto Portfolio

Hedging strategies represent sophisticated Bitcoin futures trading applications that protect existing cryptocurrency investments from adverse price movements. Professional investors use Bitcoin futures contracts as insurance policies, maintaining upside participation while limiting downside risk.

The basic hedging principle involves taking opposite positions in related markets. If you own Bitcoin in spot markets, selling Bitcoin futures creates a short hedge that profits if Bitcoin prices decline. While this eliminates upside potential, it also prevents portfolio losses during market downturns.

Dynamic hedging approaches adjust hedge ratios based on market volatility and correlation analysis. During high volatility periods, investors might hedge 70-80% of their spot positions, while reducing hedge ratios to 20-30% during stable market conditions. This strategy maintains some upside participation while providing downside protection.

Cryptocurrency investment professionals often implement calendar spread hedging, simultaneously buying longer-dated futures while selling shorter-dated contracts. This approach profits from the difference in time decay between contract months while maintaining overall Bitcoin exposure.

Cross-hedging strategies involve using Bitcoin futures to hedge other cryptocurrency positions, taking advantage of the high correlation between Bitcoin and alternative cryptocurrencies. When direct futures aren’t available for smaller altcoins, Bitcoin futures can provide effective portfolio protection.

Strategy 4: Leveraged Long Positions During Bull Markets

Leveraged trading in Bitcoin futures amplifies potential returns during confirmed bull market phases, but requires disciplined risk management and clear exit strategies. Current market conditions in 2025 present compelling opportunities for leveraged long positions, with institutional flows and regulatory clarity supporting sustained upward momentum.

Identifying optimal leverage ratios depends on individual risk tolerance and market volatility. Conservative traders might use 2:1 or 3:1 leverage, while aggressive traders could employ 5:1 or higher ratios. The key principle involves using only as much leverage as allows comfortable sleep; higher leverage increases both potential gains and liquidation risks.

Bitcoin investment strategy for leveraged positions requires strict stop-loss discipline. Many successful traders risk no more than 2-3% of their total capital on any single leveraged trade, positioning stop-losses at technical support levels or volatility-based distances from entry points.

Pyramiding strategies allow traders to add to winning positions as trends develop, but require careful position sizing to avoid overexposure. Initial positions might represent 1% of total capital, with additional 0.5% allocations added at predetermined technical levels or price targets.

Futures trading strategies for bull markets often incorporate profit-taking at key resistance levels, booking partial profits while allowing remaining positions to capture extended moves. This approach locks in gains while maintaining exposure to potential breakout scenarios.

Strategy 5: Arbitrage and Spread Trading

Arbitrage opportunities in Bitcoin futures trading arise from price discrepancies between different exchanges, contract months, or related instruments. These strategies offer potentially lower-risk profits by exploiting temporary market inefficiencies rather than directional price movements.

Spatial arbitrage involves simultaneously buying and selling identical Bitcoin futures contracts on different exchanges when price discrepancies exceed transaction costs. This strategy requires rapid execution capabilities and sufficient margin deposits across multiple platforms, but can generate consistent returns with minimal directional risk.

Calendar spread trading exploits the price differences between Bitcoin futures with different expiration dates. Typically, longer-dated contracts trade at premiums to shorter-dated ones, reflecting storage costs and interest rates. When these spreads deviate from historical norms, trading opportunities emerge.

Cryptocurrency investment arbitrage strategies often involve cash-and-carry trades, where investors buy Bitcoin in spot markets while simultaneously selling futures contracts. The profit comes from the convergence of futures and spot prices at contract expiration, capturing the basis differential.

Inter-market arbitrage compares Bitcoin futures prices with Bitcoin ETF prices, Bitcoin mining stocks, or other Bitcoin-correlated instruments. When correlations temporarily break down, sophisticated traders can profit from the eventual mean reversion.

Risk management in arbitrage strategies focuses on execution risk and correlation breakdown. Position sizes should account for potential slippage and margin requirements across all legs of the trade, with clear exit plans if expected convergence fails to materialize.

Strategy 6: Momentum Trading and Breakout Strategies

Momentum trading in Bitcoin futures capitalizes on strong directional moves following periods of consolidation or significant news events. These futures trading strategies require quick decision-making and efficient execution, but can generate substantial profits during high-volatility periods.

Breakout strategies identify key technical levels where Bitcoin futures contracts are likely to experience significant price acceleration. These levels include previous highs and lows, trend line intersections, and chart pattern boundaries. When prices break through these levels with increased volume, momentum traders enter positions in the breakout direction.

Bitcoin investment strategy for momentum trading often incorporates volatility filters, focusing on periods when the average true range or other volatility measures exceed historical norms. High volatility environments provide the price movement necessary for successful momentum trades.

News-based momentum trading requires constant monitoring of cryptocurrency developments, regulatory announcements, and institutional adoption news. Buy Bitcoin future decisions based on fundamental catalysts can generate exceptional returns when combined with proper technical analysis confirmation.

Momentum position management involves trailing stop-loss orders that adjust as prices move favorably, locking in profits while allowing positions to capture extended moves. Many momentum traders use percentage-based or volatility-based trailing stops to optimize exit timing.

Crypto futures trading momentum strategies benefit from market microstructure and order flow dynamics. Large buy or sell orders can indicate institutional activity, providing early signals for potential momentum moves.

Strategy 7: Risk Management and Position Sizing

Risk management forms the foundation of sustainable Bitcoin futures trading success, determining the difference between long-term profitability and account destruction. Professional traders prioritize capital preservation over individual trade profits, as consistent application of risk principles generates superior long-term returns.

Position sizing calculations should account for volatility, leverage, and individual trade risk tolerance. The Kelly Criterion provides a mathematical framework for optimal position sizing based on win rate and average win/loss ratios, though most traders use more conservative approaches to account for estimation errors.

Bitcoin investment strategy risk management involves diversification across time frames, technical approaches, and market conditions. Traders might allocate 40% of capital to trend-following strategies, 30% to mean reversion approaches, and 30% to arbitrage opportunities, reducing dependence on any single market condition.

Maximum drawdown limits prevent catastrophic losses during unfavorable market periods. Many professional traders implement maximum daily, weekly, and monthly loss limits, suspending trading when these thresholds are reached. This approach preserves capital for more favorable market conditions.

Futures trading strategies require continuous monitoring of margin requirements and liquidation levels. Automated alerts should notify traders when positions approach dangerous margin levels, allowing for position adjustments or additional margin deposits before automatic liquidation occurs.

Correlation analysis helps identify hidden risks in seemingly diversified portfolios. During market stress, correlations often increase dramatically, causing previously uncorrelated strategies to move in tandem. These dynamics help traders adjust position sizes during high-stress periods.

Advanced Tips for Bitcoin Futures Success

Cryptocurrency investment success in futures markets requires continuous education and adaptation to evolving market conditions. Professional traders maintain detailed trading journals, documenting entry and exit reasons, market conditions, and emotional states to identify patterns and improvement opportunities.

Market timing strategies benefit from seasonal patterns and cyclical behaviors in Bitcoin futures trading. Historical analysis reveals certain months or weeks tend to produce stronger returns, though these patterns evolve as market structure matures and institutional participation increases.

Bitcoin futures contracts’ pricing incorporates interest rates, storage costs, and convenience yields that affect basis relationships. These factors help traders identify mispricing opportunities and optimize contract selection for different strategic approaches.

Advanced order types like iceberg orders, time-weighted average price (TWAP) orders, and volume-weighted average price (VWAP) orders help large traders execute positions without significant market impact. These tools become crucial as position sizes increase beyond typical retail trading levels.

Buy Bitcoin future decisions should incorporate macroeconomic analysis, including inflation expectations, central bank policies, and global liquidity conditions. Bitcoin increasingly responds to traditional financial market drivers as institutional adoption accelerates.

Technology infrastructure plays a critical role in futures trading strategies execution. Reliable internet connections, backup systems, and low-latency trading platforms can determine success or failure during high-volatility periods when rapid execution becomes essential.

Common Mistakes to Avoid When Trading Bitcoin Futures

Overleverage represents the most common and dangerous mistake in Bitcoin futures trading. New traders often use excessive leverage, seeking quick profits, but instead face rapid liquidation during normal market volatility. Conservative leverage ratios provide more sustainable long-term results.

Emotional trading destroys more cryptocurrency investment accounts than any technical factor. Fear of missing out (FOMO) drives traders to chase price movements, while fear of losses causes premature position exits. Systematic approaches eliminate emotional decision-making from trading processes.

Ignoring Bitcoin futures contracts specifications leads to unexpected costs and execution problems. Contract sizes, margin requirements, settlement procedures, and expiration dates vary significantly between exchanges and contract types. These details prevent costly surprises.

Poor risk management includes inadequate stop-loss placement, position sizing errors, and correlation oversight. Many traders focus exclusively on potential profits while ignoring potential losses, leading to account destruction during inevitable losing streaks.

Futures trading strategies’ failure often results from insufficient backtesting and optimization. Strategies that work in trending markets might fail during consolidation periods, and vice versa. Comprehensive testing across various market conditions improves strategy robustness.

Information overload causes analysis paralysis and contradictory signals. Successful traders focus on a limited number of reliable indicators and information sources rather than attempting to analyze every available data point.

Choosing the Right Exchange for Bitcoin Futures

Exchange selection significantly impacts Bitcoin futures trading success through factors including liquidity, fees, security, and available features. Major exchanges like CME, Binance, and FTX offer different advantages depending on trader requirements and geographic location.

Liquidity considerations affect execution quality and slippage costs, particularly important for larger position sizes. Bitcoin futures contracts on high-volume exchanges typically offer tighter bid-ask spreads and more efficient price discovery than smaller platforms.

Fee structures vary dramatically between exchanges, including maker/taker fees, funding rates for perpetual contracts, and settlement costs. Cryptocurrency investment professionals calculate total trading costs across all fee types to determine the most economical platform for their trading style.

Security features, including cold storage, insurance coverage, and regulatory compliance, provide essential protection for trading capital. Recent exchange failures highlight the importance of choosing platforms with robust security measures and transparent financial practices.

Bitcoin investment strategy implementation benefits from advanced order types, charting tools, and API access for automated trading. Professional-grade platforms offer sophisticated features that enhance execution quality and strategic flexibility.

Customer support quality becomes crucial during technical problems or market disruptions. Exchanges with responsive, knowledgeable support teams help resolve issues quickly, preventing potential trading losses from platform problems.

Future Outlook: Bitcoin Futures in 2025 and Beyond

The Bitcoin futures trading landscape continues evolving rapidly as institutional adoption accelerates and regulatory frameworks solidify. Analysts expect Bitcoin prices to reach $135,000 by the end of 2025, with some projections suggesting $150,000 in 2026, creating unprecedented opportunities for futures traders.

Regulatory developments favor continued growth in cryptocurrency investment products, with the Department of Justice’s crypto enforcement task force shutdown and relaxed banking regulations providing clearer operational frameworks. These changes encourage institutional participation and product innovation.

Bitcoin futures contracts are likely to expand beyond traditional monthly and quarterly expirations to include more granular time periods, options combinations, and structured products. This expansion provides traders with more precise tools for implementing sophisticated strategies.

Central bank digital currency (CBDC) developments and potential government Bitcoin reserves could dramatically impact futures trading strategies by reducing volatility while increasing overall adoption. These macro trends suggest the continued maturation of Bitcoin as an institutional asset class.

Buy Bitcoin future opportunities may extend beyond price speculation to include yield-bearing products, inflation-protected instruments, and cross-currency applications as the ecosystem matures. Innovation in derivative products continues to expand available strategies for professional traders.

Also Read: Bitcoin Futures Trading Course 7 Proven Strategies to Win

Conclusion

Bitcoin futures trading represents a sophisticated investment approach that, when executed properly, offers exceptional opportunities for portfolio growth and risk management in 2025’s bullish cryptocurrency environment. The seven strategies outlined—from conservative dollar-cost averaging and defensive hedging to aggressive momentum trading and complex arbitrage—provide frameworks for investors across all experience levels to participate in Bitcoin’s continued ascent while managing downside risks effectively.

Success requires disciplined risk management, continuous education, and careful selection of trading platforms, but the potential rewards justify the effort as Bitcoin approaches analyst targets of $135,000 and beyond. Whether you’re seeking to hedge existing cryptocurrency holdings, amplify returns through leverage, or capture arbitrage opportunities, these proven strategies eliminate doubt and provide actionable pathways to capitalize on one of the most significant investment opportunities of our generation.