Ultimate Bitcoin Price Buying Guide 7 Winning Strategies

The Bitcoin price buying guide landscape has evolved dramatically since cryptocurrency’s mainstream adoption, making strategic purchasing decisions more critical than ever for both novice and experienced investors. As Bitcoin continues to establish itself as digital gold and a hedge against inflation, understanding the optimal Bitcoin buying strategies has become essential for maximizing investment returns while minimizing risk exposure.

Today’s cryptocurrency market presents unique challenges and opportunities that require sophisticated approaches beyond simple buy-and-hold tactics. Bitcoin price analysis reveals patterns and trends that savvy investors leverage to optimize their entry points and timing strategies. Whether you’re looking to make your first Bitcoin purchase or refine your existing investment approach, mastering proven cryptocurrency investment strategies can significantly impact your long-term portfolio performance.

This comprehensive guide explores seven battle-tested Bitcoin investment methods that successful traders and investors use to navigate market volatility and build sustainable wealth. From dollar-cost averaging Bitcoin techniques to advanced technical analysis approaches, each strategy offers distinct advantages depending on your risk tolerance, investment timeline, and market conditions. We’ll examine Bitcoin market timing strategies, explore cryptocurrency portfolio management principles, and provide actionable insights for buying Bitcoin at optimal prices.

Understanding when and how to buy Bitcoin strategically requires more than just following market sentiment or relying on social media predictions. Professional investors utilize data-driven approaches that consider multiple factors, including market cycles, technical indicators, fundamental analysis, and macroeconomic trends. These Bitcoin trading techniques form the foundation of successful long-term cryptocurrency investing.

1. Dollar-Cost Averaging (DCA) Strategy

Understanding the DCA Method

Dollar-cost averaging Bitcoin represents one of the most reliable and time-tested approaches for building cryptocurrency positions over time. This Bitcoin investment strategy involves purchasing fixed dollar amounts of Bitcoin at regular intervals, regardless of current market price fluctuations. The DCA method eliminates the pressure of timing the market perfectly while reducing the impact of volatility on your overall investment cost basis.

Research indicates that Bitcoin DCA strategies have historically outperformed lump-sum investments when implemented consistently over extended periods. This approach particularly benefits investors who want to minimize emotional decision-making and avoid the common pitfalls of attempting to time volatile crypto markets. The psychological advantages of DCA include reduced stress during market downturns and increased confidence during accumulation phases.

Implementing Effective DCA Strategies

Successful cryptocurrency investment strategies using DCA require careful planning regarding frequency, amount, and duration. Weekly or monthly purchases typically provide an optimal balance between transaction costs and market exposure smoothing. Consider your cash flow patterns when establishing DCA schedules to ensure consistency and sustainability over your intended investment horizon.

Bitcoin market analysis suggests that longer DCA periods (12+ months) tend to produce superior results compared to shorter accumulation phases, particularly during bear market cycles. Many successful investors combine DCA with strategic pausing during extreme market conditions, allowing for larger allocations when Bitcoin trades significantly below historical averages.

2. Technical Analysis-Based Buying

Key Technical Indicators for Bitcoin

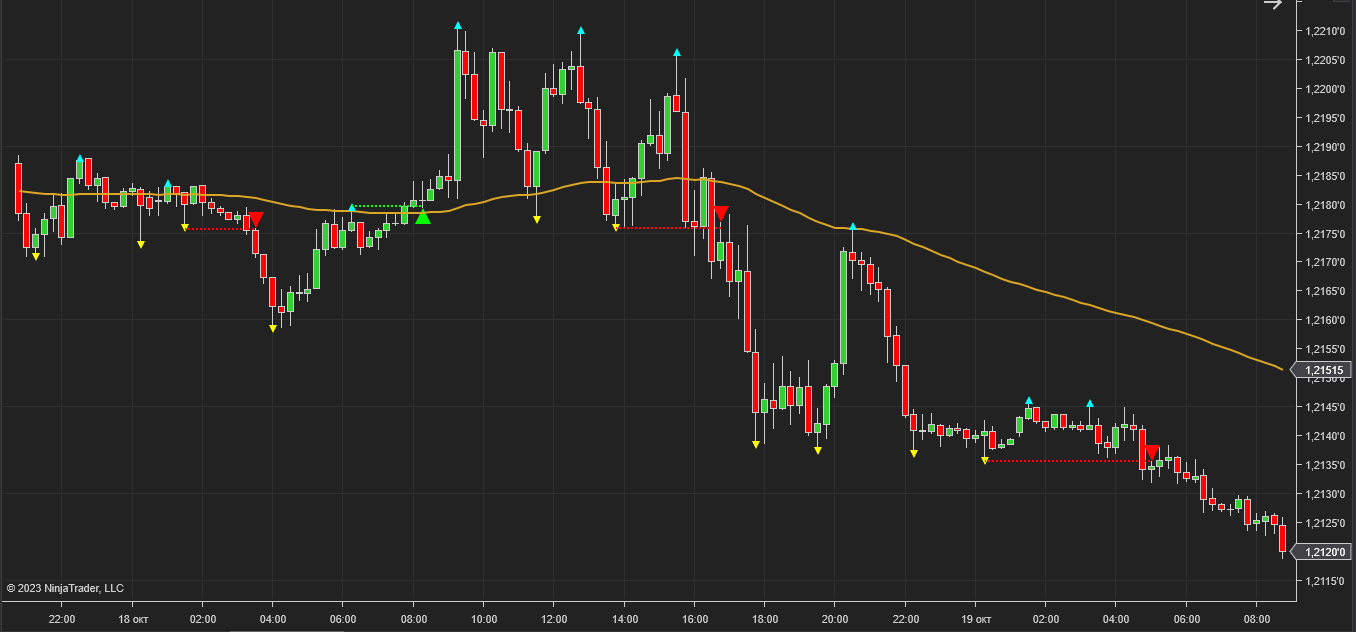

Bitcoin price analysis through technical indicators provides valuable insights into optimal entry points and market sentiment shifts. Moving averages, particularly the 50-day and 200-day periods, serve as crucial support and resistance levels that influence professional Bitcoin trading strategies. When Bitcoin price crosses above these moving averages with strong volume confirmation, it often signals favorable buying opportunities.

Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators help identify oversold conditions and momentum shifts that experienced traders use for buying Bitcoin at low prices. RSI readings below 30 typically indicate oversold conditions, while MACD bullish crossovers suggest potential upward momentum. Combining multiple indicators increases reliability and reduces false signals in volatile cryptocurrency markets.

Chart Pattern Recognition

Professional Bitcoin investment methods incorporate chart pattern analysis to identify high-probability buying opportunities. Support and resistance levels, trend lines, and breakout patterns provide structured approaches for timing Bitcoin purchases. Flag patterns, ascending triangles, and double bottom formations historically precede significant price advances in cryptocurrency markets.

Bitcoin market timing using technical analysis requires patience and discipline to wait for a confluence of multiple signals. Successful traders often combine price action analysis with volume studies to confirm pattern validity and minimize risk exposure during position entry.

3. Fundamental Analysis Strategy

Evaluating Bitcoin’s Intrinsic Value

Bitcoin investment strategies based on fundamental analysis examine underlying factors driving long-term value appreciation and adoption trends. Network hash rate, active addresses, transaction volumes, and institutional adoption metrics provide insights into Bitcoin’s fundamental strength and growth trajectory. These metrics often diverge from short-term price movements, creating opportunities for value-oriented investors.

Cryptocurrency market analysis increasingly incorporates traditional financial metrics adapted for digital assets. Network value to transactions (NVT) ratio, stock-to-flow models, and on-chain activity indicators help determine whether Bitcoin trades at a premium or a discount to intrinsic value estimates.

Macroeconomic Factors

Bitcoin buying strategies must consider broader economic conditions, including inflation rates, monetary policy changes, and geopolitical events that influence cryptocurrency demand. Central bank digital currency (CBDC) developments, regulatory clarity improvements, and institutional adoption announcements.

It often creates significant buying opportunities for prepared investors. Understanding correlation patterns between Bitcoin and traditional assets like stocks, bonds, and commodities helps optimize cryptocurrency portfolio management and timing strategies during different market regimes.

4. Market Sentiment and Fear-Greed Index

Using Sentiment Indicators

Bitcoin price buying strategies benefit significantly from contrarian approaches based on market sentiment analysis. The Crypto Fear and Greed Index, social media sentiment tracking, and Google Trends data provide valuable insights into crowd psychology and potential market turning points. Extreme fear readings often coincide with excellent buying opportunities, while extreme greed suggests caution.

Bitcoin market analysis shows that sentiment extremes typically persist longer than most investors expect, requiring patience and conviction when implementing contrarian strategies. Successful sentiment-based buying requires predetermined criteria and systematic approaches rather than subjective interpretations of market mood.

Contrarian Investment Approaches

Professional Bitcoin trading strategies leverage sentiment extremes by accumulating positions when pessimism peaks and reducing exposure during euphoric periods. This approach requires strong emotional discipline and confidence in Bitcoin’s long-term value proposition despite short-term negative sentiment. Cryptocurrency investment strategies using sentiment analysis work best when combined with technical and fundamental analysis to confirm turning point probabilities and optimize position sizing decisions.

5. Buy-the-Dip Strategy

Identifying Quality Dips

Strategic Bitcoin buying during market corrections requires distinguishing between temporary pullbacks and fundamental trend changes. Quality dips typically occur in the context of overall uptrends, maintain above key support levels, and show signs of buyer interest at lower prices. Volume patterns during dips provide crucial information about institutional participation and accumulation activity.

Bitcoin investment methods for dip buying include predetermined price targets based on Fibonacci retracements, previous support levels, and percentage corrections from recent highs. Many successful investors allocate specific portions of their investment capital exclusively for dip-buying opportunities.

Risk Management for Dip Buying

Bitcoin buying strategies for corrections must incorporate proper risk management, including position sizing, stop-loss levels, and maximum allocation limits. Not every dip represents a buying opportunity, particularly during bear market phases when lower lows remain likely.

Successful dip buying requires patience to wait for optimal entry points rather than catching falling knives during panic-selling episodes. Cryptocurrency portfolio management principles suggest limiting individual dip purchases to small percentages of total allocation until trend confirmation emerges.

6. Breakout Trading Strategy

Identifying Breakout Patterns

Bitcoin trading techniques focused on breakout patterns offer opportunities to enter positions during the early stages of new trending moves. Breakouts from consolidation ranges, triangle patterns, and resistance level violations often lead to sustained price movements in breakthrough directions.

Bitcoin market timing using breakout strategies requires confirmation through volume analysis and momentum indicators to distinguish genuine breakouts from false signals. Successful breakout trading demands quick decision-making and strict adherence to predetermined entry and exit criteria.

Volume Confirmation Methods

Professional Bitcoin investment strategies emphasize volume confirmation as an essential component of valid breakout signals. Breakouts accompanied by above-average volume suggest institutional participation and increase the probability of sustained moves.

Volume profile analysis helps identify key accumulation and distribution zones that influence breakout probability and target levels. Bitcoin price analysis through volume-weighted average price (VWAP) and volume spread analysis provides additional confirmation tools for breakout validity assessment and position sizing decisions.

7. Long-Term HODLing Strategy

Strategic Accumulation Planning

Long-term Bitcoin investment through HODLing (Hold On for Dear Life) requires systematic accumulation planning and unwavering conviction in Bitcoin’s long-term value proposition. This cryptocurrency investment strategy performs best when combined with regular accumulation schedules and strategic rebalancing during major market cycles.

Bitcoin investment methods for long-term holders include cold storage security practices, estate planning considerations, and tax-efficient structuring of cryptocurrency positions. Successful HODLers often combine their core positions with smaller trading allocations for shorter-term opportunities.

Portfolio Allocation Strategies

Cryptocurrency portfolio management for long-term success requires appropriate Bitcoin allocation relative to traditional assets and overall risk tolerance. Many financial advisors suggest Bitcoin allocations between 1-10% of total investment portfolios, depending on individual circumstances and risk capacity. Bitcoin buying strategies for long-term holders benefit from systematic rebalancing approaches that maintain target allocation percentages while taking advantage of market volatility for optimization opportunities.

Risk Management and Security Considerations

Position Sizing and Risk Control

Effective Bitcoin investment strategies incorporate systematic risk management, including position sizing rules, maximum loss limits, and portfolio correlation monitoring. Never invest more in Bitcoin than you can afford to lose completely, as cryptocurrency markets remain highly volatile and unpredictable.

Cryptocurrency investment strategies require robust security practicess including hardware wallet usage, private key backup procedures, and protection against phishing and fraud attempts. Security breaches can result in permanent loss of cryptocurrency holdings without recourse.

Regulatory and Tax Implications

Bitcoin buying strategies must consider regulatory developments and tax implications in relevant jurisdictions. Cryptocurrency tax reporting requirements vary significantly between countries and continue evolving as governments develop comprehensive regulatory frameworks. Professional tax planning becomes essential for substantial Bitcoin holdings, particularly regarding the timing of sales, loss harvesting opportunities, and estate planning considerations for cryptocurrency assets.

Also Read: Purchase Bitcoin Price Today Ultimate 2025 Buying Guide

Conclusion

Mastering Bitcoin price buying strategies requires combining multiple approaches tailored to your investment goals, risk tolerance, and market conditions. The seven strategies outlined—dollar-cost averaging, technical analysis, fundamental analysis, sentiment-based buying, dip purchasing, breakout trading, and long-term HODLing—each offer distinct advantages when properly implemented with appropriate risk management.

Success in cryptocurrency investment depends on developing systematic approaches, maintaining discipline during volatile periods, and continuously educating yourself about evolving market dynamics. Whether you’re implementing Bitcoin DCA strategies for steady accumulation or using Bitcoin market analysis for optimal timing, the key lies in consistency, patience, and adherence to predetermined investment criteria rather than emotional decision-making during market extremes.