5 Explosive Bitcoin Price Buying Opportunities You Can’t Miss

The Bitcoin price landscape in 2025 presents unprecedented opportunities for savvy investors who understand when and how to capitalize on market movements. With Bitcoin’s price in 2025 likely to grow significantly, with the potential to hit $180,000 to $200,000 according to leading analysts, identifying the right buying opportunities has never been more critical for maximizing returns.

Current market conditions reveal that Bitcoin is worth $111,187.92, positioning the cryptocurrency at a crucial juncture where strategic investments could yield substantial profits. The convergence of institutional adoption, regulatory clarity, and technological advancements creates a perfect storm for explosive growth potential.

Bitcoin investment strategies have evolved dramatically, with sophisticated investors now employing multiple approaches to capture market opportunities. From dollar-cost averaging techniques to precision market timing, successful Bitcoin investors understand that opportunity recognition is paramount to building wealth in the cryptocurrency space. 59% of crypto investors use dollar-cost averaging as their primary investment strategy, highlighting the importance of systematic approaches to Bitcoin accumulation.

The five explosive Bitcoin buying opportunities outlined in this comprehensive guide represent battle-tested strategies that have consistently delivered superior returns for investors who execute them properly. Whether you’re a seasoned cryptocurrency trader or a newcomer looking to build your first Bitcoin position, understanding these opportunities will provide the foundation for successful long-term wealth creation.

Market volatility, which many perceive as risk, actually creates the most lucrative entry points for disciplined investors. By recognizing these patterns and implementing proven strategies, investors can transform market uncertainty into profitable positions that compound over time.

1. Dollar-Cost Averaging During Market Volatility

Understanding the Power of Systematic Bitcoin Accumulation

Dollar-cost averaging (DCA) represents one of the most reliable Bitcoin investment strategies for capitalizing on market volatility. This approach involves making regular, fixed-dollar purchases regardless of Bitcoin’s current price, effectively smoothing out the impact of short-term price fluctuations on your overall investment performance.

With DCA, the investor would buy more Bitcoin during months when the price is lower and less when the price is higher. Over the year, this helps in averaging out the high and low points, providing smoother returns than investing a large sum at a single point in time. This mathematical advantage becomes particularly powerful during periods of high volatility.

Implementing Effective DCA Strategies

The key to successful Bitcoin DCA lies in consistency and strategic timing intervals. Common intervals include weekly, bi-weekly, or monthly purchases. The frequency depends on your financial situation and the level of engagement you want with the market. Weekly DCA typically captures more price variations, while monthly DCA requires less active management.

Market timing becomes less critical with DCA, as the strategy inherently captures both market highs and lows over time. This approach particularly benefits investors who lack the time or expertise to analyze daily price movements but want exposure to Bitcoin’s long-term growth potential.

Maximizing DCA Effectiveness

To optimize your Bitcoin buying opportunities through DCA, consider increasing your purchase amounts during significant market downturns. This “enhanced DCA” approach allows you to accumulate more Bitcoin when prices are depressed while maintaining your regular purchase schedule during normal market conditions.

The psychological benefits of DCA cannot be understated. By removing the pressure to time the market perfectly, investors can focus on consistent accumulation rather than emotional decision-making that often leads to buying high and selling low.

2. Strategic Market Timing Using Support and Resistance Levels

Identifying Key Price Levels for Maximum Impact

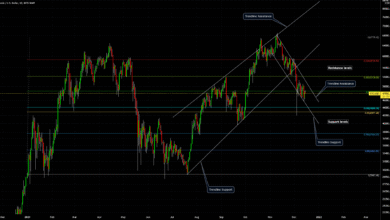

Technical analysis provides powerful tools for identifying optimal Bitcoin buying opportunities through support and resistance levels. Support and resistance levels are price zones where Bitcoin tends to reverse or consolidate before continuing on its current trajectory. Understanding these levels enables investors to time their purchases for maximum effectiveness.

Support levels represent price floors where buying interest historically emerges, creating upward pressure on Bitcoin’s price. These levels often coincide with psychological price points, previous highs that become new support, or key technical indicators like moving averages.

Advanced Support and Resistance Strategies

Professional traders combine multiple timeframes to identify the most reliable Bitcoin price entry points. Daily support levels provide short-term opportunities, while weekly and monthly levels offer longer-term accumulation zones. Effective trading strategies using these levels include range, breakout, and pullback trading.

The most explosive opportunities often occur when Bitcoin approaches major support levels during broader market uncertainty. These moments create fear-driven selling that pushes prices below fair value, presenting exceptional buying opportunities for prepared investors.

Risk Management in Technical Trading

Successful implementation of support and resistance strategies requires disciplined risk management. Set clear stop-losses below key support levels to protect capital, while maintaining position sizes that allow for multiple attempts if initial trades don’t immediately succeed.

Bitcoin investment success through technical analysis requires patience and discipline. The most profitable trades often develop over weeks or months, requiring investors to maintain their positions through short-term volatility.

3. Institutional Adoption and ETF-Driven Opportunities

Capitalizing on Institutional Money Flows

The approval and launch of Bitcoin ETFs have fundamentally altered the cryptocurrency investment landscape, creating new buying opportunities that didn’t exist in previous market cycles. The approval of Bitcoin ETFs in 2024 has set a strong foundation for institutional inflows, propelling BTC’s price to new heights while creating predictable investment patterns.

Institutional adoption creates sustained buying pressure that differs significantly from retail-driven price movements. These large, systematic purchases often occur regardless of short-term price volatility, providing underlying support for Bitcoin’s long-term price trajectory.

Timing ETF-Related Market Movements

Bitcoin ETF announcements, approvals, and large inflows create measurable market impacts that present timing opportunities for individual investors. Monitor ETF flow data to identify periods of heavy institutional buying, which often precede significant price movements.

The institutional adoption cycle creates multiple Bitcoin buying opportunities throughout the year. Quarterly rebalancing periods, new ETF launches, and regulatory clarifications all generate increased institutional demand that individual investors can anticipate and capitalize upon.

Positioning for Long-Term Institutional Growth

As institutional adoption accelerates, Bitcoin price appreciation becomes increasingly disconnected from short-term speculation and more tied to fundamental adoption metrics. This shift creates more predictable growth patterns that favor patient, strategic investors over short-term traders.

The transition from speculative to institutional-driven markets reduces overall volatility while increasing the importance of fundamental analysis in Bitcoin investment decisions. Understanding this evolution helps investors position themselves for sustained growth rather than boom-bust cycles.

4. Macroeconomic Events and Monetary Policy Catalysts

Federal Reserve Policy and Bitcoin Correlation

Macroeconomic factors increasingly drive Bitcoin price movements as the cryptocurrency matures and attracts institutional attention. Federal Reserve interest rate decisions, inflation reports, and monetary policy announcements create predictable volatility that presents strategic buying opportunities.

During periods of aggressive monetary expansion or currency debasement fears, Bitcoin often experiences increased demand as investors seek alternative stores of value. These macro-driven rallies typically persist longer than purely speculative price movements, offering more sustainable investment opportunities.

Global Economic Uncertainty as Investment Catalyst

Geopolitical tensions, banking crises, and currency devaluations in major economies drive capital flows into Bitcoin as a hedge against traditional financial system risks. Monitoring global economic indicators helps investors anticipate these flows and position themselves accordingly.

The Bitcoin investment thesis strengthens during periods of economic uncertainty, as the cryptocurrency’s fixed supply and decentralized nature become more attractive relative to traditional assets subject to government intervention and manipulation.

Strategic Positioning Around Economic Events

Successful macro-driven Bitcoin buying opportunities require advanced preparation and patient execution. Economic events often create initial volatility followed by sustained trends, requiring investors to maintain positions through short-term noise to capture long-term gains.

Understanding the lag between economic events and Bitcoin price reactions enables more precise timing of investment decisions. Market efficiency in cryptocurrency markets remains imperfect, creating opportunities for investors who can connect macroeconomic dots faster than consensus opinion.

5. Seasonal Patterns and Cyclical Market Behaviors

Identifying Recurring Bitcoin Price Patterns

Bitcoin price exhibits measurable seasonal patterns that create recurring buying opportunities for investors who understand and capitalize on these cycles. Historical analysis reveals specific months and quarters that consistently offer superior entry points for long-term investors.

The “Santa Claus rally” phenomenon, Q4 institutional rebalancing, and tax-loss selling in December create predictable price patterns that sophisticated investors exploit. These seasonal effects become more pronounced as Bitcoin’s market capitalization and institutional participation increase.

Halving Cycles and Supply Reduction Impact

Bitcoin’s four-year halving cycle creates the most powerful and predictable buying opportunities in cryptocurrency markets. The systematic reduction in new Bitcoin supply creates supply-demand imbalances that drive multi-year bull markets following each halving event.

Strategic accumulation in the 12-18 months following each halving provides optimal risk-adjusted returns based on historical performance. Bitcoin price prediction for August 2025 points to a possible rebound toward $125K if the $112K–$115K support holds, suggesting continued strength in the current halving cycle.

Market Cycle Psychology and Contrarian Opportunities

Understanding market psychology cycles enables investors to identify the most explosive Bitcoin buying opportunities when sentiment reaches extreme pessimism. Maximum opportunity often coincides with maximum fear, requiring emotional discipline to execute contrarian investment strategies.

The most successful Bitcoin investment approaches combine technical cycle analysis with contrarian sentiment indicators. When long-term fundamentals remain strong but short-term sentiment turns extremely negative, exceptional accumulation opportunities emerge.

Long-Term Wealth Building Through Cycle Recognition

Bitcoin price cycles create generational wealth-building opportunities for investors who can maintain long-term perspectives through market volatility. Each complete cycle typically delivers returns that far exceed traditional asset classes, justifying the increased volatility for patient investors.

Recognition that current market conditions represent specific phases within larger cycles helps investors maintain appropriate risk levels and investment time horizons. The ability to zoom out and view temporary setbacks within the context of multi-year trends prevents emotional decision-making that destroys long-term returns.

Also Read: Purchase Bitcoin Price Today Ultimate 2025 Buying Guide

Conclusion

The five explosive Bitcoin buying opportunities detailed in this analysis provide a comprehensive framework for maximizing investment returns in 2025 and beyond. From systematic dollar-cost averaging strategies that smooth volatility to sophisticated technical analysis using support and resistance levels, each approach offers unique advantages for different investor profiles and market conditions.

The convergence of institutional adoption through Bitcoin ETFs, macroeconomic uncertainty driving hedge demand, and predictable cyclical patterns creates an unprecedented environment for strategic Bitcoin accumulation. With venture capitalists projecting Bitcoin could reach $500,000 by October 2025 and over $1 million by 2035, investors.