Bitcoin Futures Market Data Complete Guide to Trading Analytics & Insights 2025

Bitcoin futures market data is becoming an essential resource for traders, institutions, and analysts worldwide. Understanding how to interpret and leverage this data can mean the difference between profitable trades and costly mistakes in today’s volatile digital asset environment.

Bitcoin futures represent derivative contracts that allow traders to speculate on Bitcoin’s future price without actually owning the underlying cryptocurrency. These financial instruments have gained tremendous popularity since their introduction on major exchanges like the Chicago Mercantile Exchange (CME) in 2017. Today, bitcoin futures market data provides crucial insights into market sentiment, institutional participation, and price discovery mechanisms that drive the broader cryptocurrency ecosystem.

The importance of accessing accurate and timely bitcoin futures market data cannot be overstated. Professional traders rely on this information to identify trends, assess market liquidity, and make informed decisions about position sizing and risk management. Whether you’re a seasoned institutional investor or an individual trader looking to expand your cryptocurrency portfolio, understanding futures data is fundamental to success in this rapidly evolving market.

Understanding Bitcoin Futures Market Data Fundamentals

Bitcoin futures contracts are standardized agreements to buy or sell Bitcoin at a predetermined price on a specific future date. Unlike spot trading, futures allow participants to take leveraged positions and hedge against price volatility. The bitcoin futures market data encompasses various metrics that provide insights into market dynamics, trader behavior, and institutional sentiment.

The most critical components of futures market data include open interest, trading volume, funding rates, and basis spreads. Open interest represents the total number of outstanding contracts that haven’t been settled or closed, indicating the level of market participation and potential for price movement. High open interest typically suggests strong market engagement and can amplify price volatility during significant market events.

Trading volume measures the total number of contracts traded within a specific timeframe, providing insights into market liquidity and trader activity. Volume spikes often precede major price movements, making this metric invaluable for technical analysis and market timing strategies.

Funding rates, particularly relevant for perpetual futures contracts, reflect the cost of maintaining leveraged positions. When funding rates are positive, long position holders pay short holders, and vice versa. These rates help maintain price alignment between futures and spot markets while indicating market sentiment bias.

Key Sources for Bitcoin Futures Market Data

Professional traders and analysts rely on multiple data sources to obtain comprehensive bitcoin futures market data. Major cryptocurrency exchanges like Binance, BitMEX, FTX (historically), and traditional financial institutions, including CME Group, provide robust data feeds and analytics platforms.

The Chicago Mercantile Exchange remains one of the most influential sources for institutional-grade bitcoin futures data. CME Bitcoin futures contracts are cash-settled and regulated, making them attractive to traditional financial institutions. The exchange provides detailed market data, including settlement prices, volume statistics, and commitment of traders reports that offer insights into institutional positioning.

Cryptocurrency-native exchanges offer additional data sources with higher trading volumes and more diverse contract types. Binance Futures, for example, provides extensive market data for both quarterly and perpetual contracts, including advanced metrics like funding rate histories and liquidation data.

Third-party data providers such as CoinGecko, CoinMarketCap, and specialized platforms like Skew (now part of Coinbase) aggregate data from multiple sources, offering comprehensive analytics and visualization tools. These platforms often provide normalized data feeds that standardize information across different exchanges, making cross-platform analysis more manageable.

For serious traders and institutions, premium data services from providers like Bloomberg Terminal, Refinitiv (formerly Thomson Reuters), and specialized cryptocurrency data companies offer real-time feeds, historical databases, and advanced analytics capabilities essential for quantitative trading strategies.

Analyzing Bitcoin Futures Market Data Trends

Effective analysis of bitcoin futures market data requires understanding both quantitative metrics and qualitative market factors. Historical trend analysis reveals patterns in institutional adoption, seasonal trading behaviors, and correlation with traditional financial markets.

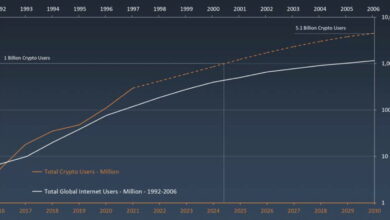

One significant trend observed in recent years is the growing institutional participation in bitcoin futures markets. Large investment funds, hedge funds, and corporate treasuries increasingly use futures contracts for portfolio hedging and speculative positioning. This institutional adoption has led to increased market maturity, improved liquidity, and reduced volatility compared to earlier cryptocurrency market cycles.

Seasonal patterns in bitcoin futures data show interesting correlations with traditional financial market cycles. For instance, institutional rebalancing at quarter-ends often creates predictable volume spikes and basis adjustments. Understanding these patterns helps traders anticipate market movements and optimize entry and exit timing.

The relationship between spot and futures prices, known as the basis, provides insights into market sentiment and arbitrage opportunities. During bull markets, futures often trade at premiums to spot prices (contango), while bear markets may see futures trading at discounts (backwardation). Monitoring basis changes helps traders gauge market sentiment shifts before they fully manifest in spot prices.

Cross-exchange analysis of bitcoin futures market data reveals important insights about market efficiency and arbitrage opportunities. Price discrepancies between different exchanges, while often short-lived, can provide profitable trading opportunities for sophisticated traders with the infrastructure to execute rapid arbitrage strategies.

Bitcoin Futures Market Data for Risk Management

Risk management represents one of the most crucial applications of bitcoin futures market data for both individual and institutional traders. Proper risk assessment requires continuous monitoring of market metrics, position sizing based on volatility measures, and hedging strategies that protect against adverse price movements.

Value at Risk (VaR) calculations for bitcoin futures positions rely heavily on historical volatility data, correlation matrices, and stress testing scenarios. Traders use this information to determine appropriate position sizes and set stop-loss levels that align with their risk tolerance and capital preservation objectives.

Liquidation data provides insights into market stress points and potential cascade effects during volatile periods. Understanding where large concentrations of leveraged positions exist helps traders anticipate potential liquidation events that could amplify price movements. This information is particularly valuable for timing market entries and exits during periods of high volatility.

Portfolio diversification strategies benefit significantly from bitcoin futures market data analysis. Correlation studies between bitcoin futures and other asset classes help portfolio managers optimize allocation decisions and hedge against systematic risks. During periods of market stress, these correlations can change rapidly, making real-time monitoring essential.

Impact of Institutional Trading on Bitcoin Futures Data

The entry of institutional players into bitcoin futures markets has fundamentally changed market dynamics and the nature of bitcoin futures market data. Large institutional orders, algorithmic trading strategies, and structured products have increased market efficiency while creating new patterns in trading data.

Institutional trading volumes have grown exponentially since the launch of regulated bitcoin futures products. This increased participation has led to improved price discovery, reduced bid-ask spreads, and more sophisticated market microstructure. However, it has also introduced new complexities in data interpretation, as institutional strategies often involve complex multi-leg trades that may not be immediately apparent in simple volume or open interest metrics.

The Commitment of Traders (COT) reports from the CFTC provide valuable insights into institutional positioning in CME bitcoin futures. These weekly reports break down holdings by trader category, helping market participants understand how large speculators, commercial hedgers, and other reporting traders are positioned. This information can provide early signals of potential market reversals or trend continuations.

Algorithmic trading has significantly impacted the frequency and patterns of bitcoin futures market data. High-frequency trading strategies create substantial trading volumes but may not necessarily indicate genuine market sentiment changes. Understanding the distinction between algorithmic noise and genuine market signals requires sophisticated filtering techniques and experience in market microstructure analysis.

Advanced Analytics and Bitcoin Futures Market Data

Modern trading strategies increasingly rely on advanced analytics applied to bitcoin futures market data. Machine learning algorithms, statistical models, and quantitative analysis techniques help traders extract actionable insights from vast amounts of market information.

Sentiment analysis tools parse news sentiment, social media mentions, and market commentary to gauge market mood and predict potential price movements. When combined with traditional futures market data, sentiment analysis can provide early warning signals for market regime changes or trend reversals.

Options flow analysis, while related to bitcoin options rather than futures directly, provides complementary insights into market positioning and expected volatility. Large options trades often indicate institutional hedging activities or speculative bets that can influence futures prices and market dynamics.

Network analysis of on-chain Bitcoin data combined with futures market information creates a comprehensive view of market conditions. Metrics like exchange inflows/outflows, whale movements, and network activity provide context for interpreting futures market data and anticipating potential market movements.

Machine learning models trained on historical bitcoin futures market data can identify patterns and relationships that may not be immediately apparent to human analysts. These models can process vast amounts of information quickly and identify trading opportunities or risk factors that traditional analysis might miss.

Global Regulatory Impact on Bitcoin Futures Market Data

Regulatory developments worldwide significantly influence bitcoin futures market data patterns and market structure. Understanding regulatory trends and their implications helps traders anticipate market changes and adapt their strategies accordingly.

The approval of bitcoin ETFs in various jurisdictions has created new demand patterns for bitcoin futures, as many ETFs use futures contracts rather than holding physical bitcoin. This institutional demand creates predictable patterns in futures market data, particularly around ETF rebalancing dates and creation/redemption activities.

Regulatory clarity in different jurisdictions affects where institutional trading occurs and how market data is distributed. Changes in regulations can cause trading volume migration between exchanges, affecting data interpretation and market analysis. Staying informed about regulatory developments is essential for understanding long-term trends in futures market data.

Cross-border regulatory arbitrage opportunities sometimes manifest in bitcoin futures market data as price discrepancies between exchanges operating under different regulatory regimes. These opportunities, while often short-lived, can provide insights into regulatory premium valuations and market efficiency.

Technology Infrastructure for Bitcoin Futures Market Data

Accessing and processing bitcoin futures market data effectively requires robust technology infrastructure capable of handling high-frequency data streams, complex calculations, and real-time analysis requirements. API connectivity to multiple exchanges and data providers ensures comprehensive market coverage and reduces the risk of missing critical market information.

Professional trading operations typically maintain redundant data feeds and backup systems to ensure continuous market access even during periods of high volatility or technical difficulties. Data storage and processing capabilities must handle the volume and velocity of modern bitcoin futures market data. Time-series databases, distributed computing systems, and cloud infrastructure enable traders to store historical data, perform complex analyses, and generate real-time alerts based on predefined criteria.

Latency considerations become crucial for strategies that rely on rapid execution based on Bitcoin futures market data signals. Co-location services, optimized network routing, and high-performance computing systems help minimize the time between data reception and trade execution, which can be critical for certain trading strategies.

Future Developments in Bitcoin Futures Market Data

The evolution of bitcoin futures market data continues as markets mature and technology advances. Several trends are likely to shape the future landscape of bitcoin futures trading and data analysis. Integration with traditional financial data systems is increasing as bitcoin futures become more widely accepted by institutional investors.

This integration will likely lead to more standardized data formats, improved analytics tools, and better risk management systems that can handle both traditional and cryptocurrency derivatives simultaneously. Real-time settlement systems and blockchain integration may eventually revolutionize how bitcoin futures contracts are cleared and settled.

These technological advances could provide more granular data about position transfers, margin requirements, and settlement flows, creating new opportunities for market analysis and risk management. Artificial intelligence and machine learning applications will likely become more sophisticated, enabling more accurate prediction models and automated trading strategies based on bitcoin futures market data. These advances may also help democratize access to institutional-grade analytics tools for individual traders.

Also Read: Bitcoin Futures Basis Trading Complete Guide to Profitable Strategies 2025

Conclusion

The world of bitcoin futures market data offers immense opportunities for traders, investors, and analysts who understand how to effectively interpret and utilize this information. As the cryptocurrency market continues to mature and institutional adoption grows, the importance of sophisticated data analysis becomes increasingly critical for achieving consistent trading success.

Success in bitcoin futures trading requires a comprehensive approach that combines technical analysis, fundamental research, and risk management principles. By leveraging the wealth of information available in bitcoin futures market data, traders can make more informed decisions, optimize their strategies, and better manage their exposure to cryptocurrency market volatility.

The future of bitcoin futures trading looks promising, with continued technological innovation, regulatory clarity, and institutional adoption driving market growth and sophistication. Staying informed about market developments, maintaining access to high-quality data sources, and continuously improving analytical capabilities will be essential for long-term success in this dynamic market.