Bitcoin Technical Analysis News Latest Market Trends & Expert Predictions 2025

Bitcoin technical analysis news has become crucial for traders and investors worldwide. As Bitcoin continues to dominate the digital asset landscape, understanding technical indicators, chart patterns, and market sentiment can mean the difference between profitable trades and costly mistakes.

In today’s rapidly evolving crypto environment, technical analysis provides the roadmap that helps navigate Bitcoin’s volatile price movements. Whether you’re a seasoned trader or just starting your cryptocurrency journey, accessing reliable Bitcoin technical analysis news ensures you’re making informed decisions based on data-driven insights rather than emotions or speculation.

Understanding Bitcoin Technical Analysis Fundamentals

Technical analysis forms the backbone of cryptocurrency trading strategies, combining mathematical indicators with chart pattern recognition to predict future price movements. Unlike fundamental analysis, which focuses on Bitcoin’s underlying technology and adoption metrics, technical analysis examines historical price data, trading volumes, and market psychology.

Key Technical Indicators for Bitcoin Analysis

Professional traders rely on several core indicators when analyzing Bitcoin’s price action. Moving averages, particularly the 50-day and 200-day exponential moving averages, serve as dynamic support and resistance levels. When Bitcoin trades above these averages, it typically indicates bullish momentum, while trading below suggests bearish pressure.

The Relative Strength Index (RSI) measures Bitcoin’s momentum on a scale from 0 to 100. Values above 70 often signal overbought conditions, while readings below 30 suggest oversold territory. Smart traders use RSI divergences to spot potential trend reversals before they occur.

Bollinger Bands provide another essential tool, showing Bitcoin’s volatility and potential breakout points. When the bands contract, it often precedes significant price movements, while price touching the upper or lower bands can indicate reversal zones.

Chart Patterns That Drive Bitcoin Movements

Bitcoin’s price action frequently forms recognizable patterns that experienced traders use to anticipate future movements. Head and shoulders patterns often signal trend reversals, while triangular formations typically indicate continuation patterns.

Double tops and bottoms represent significant psychological levels where Bitcoin has previously found strong support or resistance. These patterns carry extra weight due to the collective memory of market participants who remember previous price reactions at these levels.

Flag and pennant patterns usually occur after strong directional moves, representing brief consolidation periods before the trend continues. Recognizing these formations early can provide excellent risk-to-reward trading opportunities.

Current Bitcoin Technical Analysis Market Overview

Recent Price Action and Trend Analysis

Bitcoin’s recent performance has captured significant attention from technical analysts worldwide. The cryptocurrency has been trading within a defined range, creating opportunities for both swing traders and long-term investors. Current support levels have held firm despite external market pressures, suggesting underlying strength in Bitcoin’s technical structure.

Volume analysis reveals important insights about market participation. Higher volume during upward movements indicates genuine buying interest, while low-volume rallies often lack sustainability. Recent trading sessions have shown increased institutional participation, reflected in the volume profile and order flow patterns.

The daily chart structure shows Bitcoin maintaining its position above critical moving averages, a positive technical signal that suggests the overall trend remains intact. However, shorter timeframes reveal some consolidation, which is healthy for the long-term uptrend continuation.

Support and Resistance Levels Analysis

Identifying key support and resistance levels remains paramount for successful Bitcoin trading. Current technical analysis reveals several critical price zones that traders monitor closely. The primary support zone has been tested multiple times, demonstrating its reliability as a foundation for potential upward movements.

Resistance levels above current prices present obstacles that Bitcoin must overcome to continue its upward trajectory. These levels often coincide with previous high points, psychological round numbers, and Fibonacci retracement levels calculated from significant price swings.

Volume at price analysis shows where the majority of trading activity has occurred, revealing areas of value that market participants consider fair. These volume-weighted average price levels often act as magnetic points for future price action.

Expert Predictions and Market Sentiment

Institutional Analysis and Forecasts

Leading cryptocurrency analysts have provided compelling Bitcoin technical analysis news regarding institutional adoption patterns. Major financial institutions continue integrating Bitcoin into their portfolios, creating sustained demand that technical indicators reflect through consistent buying pressure at key support levels.

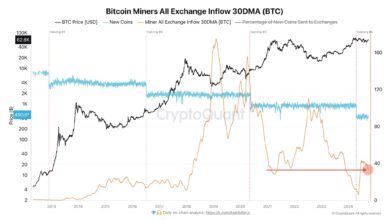

Whale activity monitoring reveals large holders’ behavior patterns, which significantly influence Bitcoin’s technical structure. When large addresses accumulate during consolidation phases, it often precedes major upward movements that technical analysts can identify through on-chain metrics combined with traditional chart analysis.

Seasonal Patterns and Historical Trends

Bitcoin exhibits certain seasonal tendencies that technical analysts incorporate into their forecasting models. Historical data shows specific months tend to produce stronger returns, while others typically experience consolidation or correction phases.

The four-year halving cycle continues influencing Bitcoin’s long-term technical structure. Past halvings have resulted in extended bull markets following initial consolidation periods, and current technical indicators suggest similar patterns may be developing.

Advanced Trading Strategies Based on Technical Analysis

Scalping and Day Trading Approaches

Short-term Bitcoin technical analysis requires different tools and timeframes compared to longer-term investing strategies. Scalpers focus on minute and hourly charts, using indicators like the Stochastic Oscillator and MACD for quick entry and exit signals.

Order book analysis provides real-time insights into market depth and potential price direction. Large buy or sell walls visible in the order book often create temporary support or resistance levels that skilled day traders can exploit.

Market microstructure analysis examines how individual trades aggregate to create larger price movements. Understanding bid-ask spreads, trade sizes, and execution patterns helps day traders optimize their entry and exit timing.

Swing Trading and Position Management

Medium-term swing trading strategies rely on identifying Bitcoin’s cyclical patterns within larger trends. Weekly and daily chart analysis reveals swing highs and lows that define trading ranges and breakout opportunities. Position sizing becomes crucial when swing trading Bitcoin’s volatile price movements.

Technical analysis helps determine optimal risk-to-reward ratios by identifying potential stop-loss levels and profit targets based on previous support and resistance zones. Risk management protocols ensure capital preservation during adverse market conditions. Technical indicators like Average True Range help calculate appropriate position sizes based on Bitcoin’s current volatility levels.

Bitcoin Technical Analysis News Sources and Resources

Reliable Information Channels

Staying updated with accurate Bitcoin technical analysis news requires identifying trustworthy sources that provide unbiased, data-driven insights. Professional trading platforms offer comprehensive charting tools and real-time market analysis from certified technical analysts.

Social media channels managed by experienced traders often share valuable insights, but investors must distinguish between promotional content and genuine educational material. Following analysts with proven track records and transparent trading histories provides better decision-making information.

Tools and Platforms for Technical Analysis

Modern trading platforms provide sophisticated tools for conducting Bitcoin technical analysis. TradingView offers extensive charting capabilities with custom indicators and community-driven analysis sharing. Their platform allows traders to backtest strategies and validate technical approaches using historical data.

Professional-grade platforms like Bloomberg Terminal and Reuters provide institutional-quality market data and analysis tools. These platforms offer real-time news feeds, economic calendars, and correlation analysis that complement traditional technical indicators.

Mobile applications enable traders to monitor Bitcoin’s technical indicators while away from their computers. Apps providing push notifications for key level breaches, indicator signals, and market news help maintain awareness of developing opportunities.

Risk Management in Bitcoin Technical Trading

Setting Stop Losses and Take Profits

Effective risk management forms the foundation of successful Bitcoin technical trading. Stop-loss placement should consider Bitcoin’s volatility characteristics and avoid levels where normal price fluctuations might trigger premature exits.

Technical stop-loss levels often align with chart support levels, moving averages, or percentage-based calculations from entry points. The key lies in giving positions enough room to breathe while protecting against significant losses if the analysis proves incorrect.

Take-profit levels should reflect realistic price targets based on technical projections. Fibonacci extension levels, measured moves from chart patterns, and previous resistance zones provide logical profit-taking areas that align with market structure.

Portfolio Allocation and Diversification

Bitcoin’s correlation with traditional markets and other cryptocurrencies affects portfolio risk management decisions. Technical analysis can help identify when Bitcoin moves independently versus when it follows broader market trends.

Position sizing within a broader cryptocurrency portfolio requires understanding Bitcoin’s role as both a risk asset and a potential haven within the digital asset space. Technical indicators help determine when to increase or decrease Bitcoin allocation based on market conditions.

Market Psychology and Behavioral Analysis

Fear and Greed Indicators

Market sentiment indicators provide valuable context for Bitcoin technical analysis. The Fear and Greed Index combines multiple data points to gauge overall market emotion, helping traders identify potential contrarian opportunities.

Social sentiment analysis examines cryptocurrency community discussions, news coverage tone, and search volume trends. These metrics often lead technical price movements, providing early warning signals for potential trend changes.

Crowd Psychology and Contrarian Signals

Understanding mass psychology helps interpret technical indicators within the proper context. When everyone expects Bitcoin to move in one direction, technical analysis sometimes reveals contrary signals that prove more profitable.

Contrarian indicators include extreme RSI readings, excessive social media bullishness or bearishness, and unusual options market activity. Combining these psychological indicators with traditional technical analysis creates more robust trading strategies.

Future Outlook and Emerging Trends

Technology Integration and Analysis Evolution

Artificial intelligence and machine learning increasingly enhance Bitcoin technical analysis capabilities. These technologies can process vast amounts of market data, identify complex patterns, and generate trading signals with greater accuracy than traditional methods.

Blockchain analytics integration provides additional layers of technical analysis by examining on-chain metrics alongside price charts. This combination offers deeper insights into Bitcoin’s true supply and demand dynamics beyond simple price movements.

Regulatory Impact on Technical Patterns

Regulatory developments significantly influence Bitcoin’s technical structure and trading patterns. Major policy announcements often create volatility spikes that technical traders must navigate carefully. Understanding the relationship between regulatory news and technical levels helps traders prepare for potential breakouts or breakdowns around key policy dates. This knowledge enables better position management during uncertain regulatory periods.

Also Read: Bitcoin Technical Analysis Future Trends 2025 Expert Predictions & Chart Patterns

Conclusion

Staying informed with the latest Bitcoin technical analysis news provides the competitive edge needed to navigate cryptocurrency markets successfully. As Bitcoin continues evolving and maturing, technical analysis remains an essential tool for understanding market dynamics, identifying opportunities, and managing risk effectively.

The combination of traditional technical indicators, modern analytical tools, and market psychology insights creates a comprehensive framework for Bitcoin trading and investment decisions. Whether you’re executing short-term trades or building long-term positions, regular consumption of quality Bitcoin technical analysis news keeps you ahead of market movements.

Take action today by bookmarking reliable technical analysis sources, practicing chart reading skills, and developing your analytical approach. Remember that successful Bitcoin trading requires continuous learning, disciplined risk management, and staying updated with the latest Bitcoin technical analysis news from trusted sources. Start your journey toward more informed cryptocurrency decision-making by implementing these technical analysis principles in your trading strategy.